Goldman pays $750M for wealth platform United Capital, Jefferies gives blockchain-lender Figure $1B, plus 14 short takes on top developments

Hi Fintech futurists --

Today, a longer take on understanding how incumbents like Goldman Sachs, Jefferies and WSFS Bank are finding new ways to serve the middle class with blockchain and roboadvice, and why they are spending billions on chasing a customer-centric strategy. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

Thanks for reading and let me know your thoughts by email or in the comments!

Long Take:

Two things are on my mind: (1) the acquisition of United Capital by Goldman Sachs, and (2) Mike Cagney's Figure securing a $1 billion funding line from Jefferies and WSFS for blockchain-tracked home equity loans. Both are outcomes of complex, interesting, somewhat unexpected processes -- and both are examples of demand-driven market expansion. Let me highlight that again. Both of these are consumer-centric developments, and not product-driven developments, which goes to the core of the problem in the financial services industry.

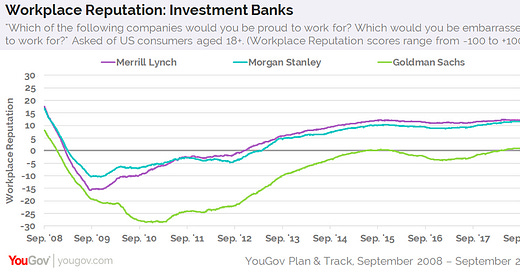

First, Goldman. I founded a roboadvisor in 2009, and spent 7 years pitching large financial institutions on using the software for their wealth management divisions. I pitched Goldman's asset management and wealth management businesses several times, to no avail. Many others (SigFig, Jemstep, et al), I imagine, had done the same. These are not sour grapes, just simple numbers in a sales funnel (which ended up being fruitful). The takeaway was straight forward. The firm's incumbent businesses -- ultra high-net-worth money management, capital markets for ginormous funds, investment banking the biggest corporations -- saw down-market clients with derision and hostility. This is not unique to Goldman, but a cultural tenet of all investment banks without a retail branch footprint.

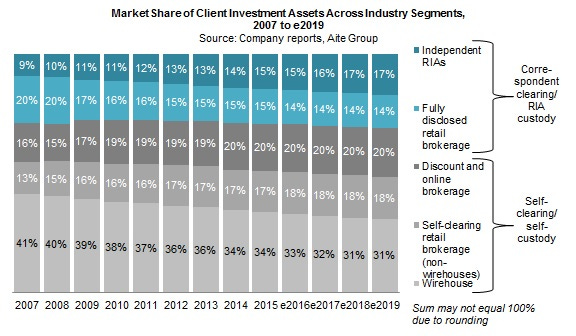

And yet, here we are. Goldman built one of the leading digital lenders in Marcus (thanks for the idea, Lending Club), acquired Adam Dell's personal finance app Clarity Money, partnered with Apple on their foray into credit cards for the mass market, and has now spent $750 million on a mass-affluent financial planning RIA platform United Capital. As a reminder, companies like United Capital are built to help the many millions of upper middle class people in the US with financial planning, fiduciary advice, and retirement. They provide a platform (middle, back office, technology) to independent financial advisors to leave the large "wire-houses" like Merrill Lynch and Smith Barney. Companies like United, Dynasty Financial, and others are the antidote to Wall Street broker culture, which spent 30 years selling proprietary products to captive customers until burning it all down in 2008.

So why is Goldman putting all these pieces together at such high price tags? I do not think it is about helping existing wealth and asset management businesses be more productive. Put another way, I cannot imagine any of the incumbent divisions paying 3% on AUM for a business making around 25 bps in revenue (i.e., a 10-15x revenue Fintech multiple). Instead, it is about building a full fintech bundle for the American mass-affluent consumer in the smartphone. Before, your sales funnel began by targeting HNW investors with narrow products features (e.g., the best investment) using expensive sales people (i.e., the advisor). This is the playbook for a product company. Now, your marketing funnel starts with $1,000 accounts across financial products -- from banking to lending to investing -- and aggregates untold millions of mobile platform customers. Some will convert, through sheer probabilistic volume, into very wealthy clients. The rest of the customers will be your free (or break-even) sales force. This is what the Internet implies -- what's the point of luxury if nobody knows about it on Instagram?

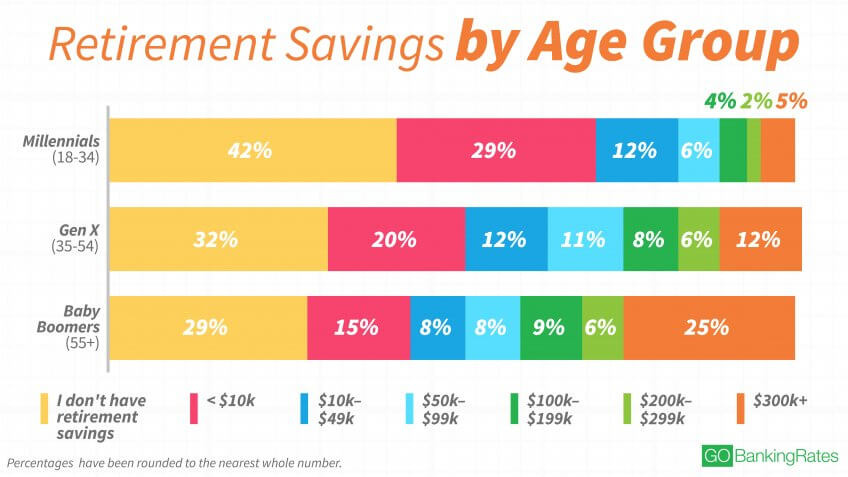

The developments with home equity lender Figure echo these themes. For context, Figure's founder used to run SoFi, a lender focused on re-financing the student debt of Millennials. SoFi has raised over $1 billion and is now in the wealth management, investment management, insurance, and mortgage business. They are focused on the demographic, not the product. Figure, on the other hand, helps the older mass-affluent unlock cash from an asset they most likely own -- their homes. I do not know if it is financially healthy to take these loans out, but I do know that most middle class American have a real tough time ahead of them in retirement, because they do not have any savings. And the US does not provide meaningful social safety nets. Therefore, Figure is a demographic bet on people struggling to retire and needing financial help. Further, unlike wealth managers, digital lenders make money immediately -- losing it later in defaults. Those optics help raise unreasonably large venture rounds.

The latest news is that the investment bank Jefferies and regional bank WSFS are providing Figure with a $1 billion credit line, which it can then lend out to consumers in this segment. The loans are recorded on a proprietary blockchain, called Provenance.io, which enables for shared workflows across asset originators and investors. It does not make the loans or the homes into real digital assets, but it certainly approximates the experience of holding Crypto, and introduces it to an entirely new demographic. The demographic analogy here would be the same target as a retirement-oriented roboadvisor, like Vestwell, which provides digital wealth technology focused on older clients (i.e., not Millennials). Guess who invested $30 million into Vestwell? Goldman Sachs.

While there's a good chance that many Fintech operators are using words like "blockchain", "artificial intelligence" and "big data" to create a high-multiple veneer on their straightforward banking business, this trend should still not be ignored. The $1 billion of capital from Jefferies and WSFS would never, in a million years, touch Bitcoin -- but they trust an entrepreneur that knows lending and has already minted enterprise value. And a relentless marketing machine from Figure or Goldman, who excel at getting people to adopt product, will bring "Crypto" to the masses and define what it means in the process. The chance of spontaneous adoption of open source solutions, unfortunately, remains a longer term moon shot. One lesson, then, is to find ways to chase new audiences in new channels with the capital of old finance.

Featured

Excited to be a guest on Accenture’s latest podcast, #InsuranceInfluencers. We talked disruption, AI and the future of insurance. Check out the three parts here.

Short Takes

Fintech Raisin Receives Backing of Orange Digital Ventures in €100m Series D. A Telecom is investing into a fintech that aggregates the long tail of small bank capital into a web platform, alongside PayPal, and B2C venture investors. Reminds me of NBC and Acorns.

Robo Adds Direct Indexing SMA Platform for Advisors. Some broker/dealers are choosing to build ETF-like baskets (think Motif, Fidelity, Wealthfront) rather than use the financial instrument. OpenInvest is interesting in creating a tool for thematic separately managed accounts, though not the first nor the last. Applications for crypto also could exist.

SoftBank Makes $800 Million Bet on U.K. Financier Greensill. Ok, so this isn't a consumer bundle, but instead a supply-chain financing company focused on business debt ($50B of credit to 2 million clients). I include it both for the check size, as well as to indicate how previously consumer-first investors like the Vision fund are switching to the SME market to try and create venture-backed monopolies.

Determining Lemonade Investors’ Likely Exit Strategy. Lemonade raised $500mm, and people are starting to talk about exit. Hard for me to see who would acquire them at the needed price with the current revenue, but raising more and doing an IPO would not be unexpected.

CME Group’s $1 Billion Record Volume of Bitcoin Futures Shows Full Institutional Involvement. While the lead is too strong, the increase in Bitcoin's price and volatility, as well as spurts of speculation are notable. Fidelity trading and liquidity from recent IPOs could play a role, or (as some speculate) perhaps it is related to the Bitfinex IEO trying to shore up capital.

The ICO market is down around 97% in Q1 2019 (YoY), based on the amount of capital raised. On the other hand, ICOs are dead! I spent so much time collating that data, and it is disappointing to see that this attempt at crowdfunding has fizzled. The mental gymnastics of differentiating IEOs from ICOs from STOs, however, are a deception.

Inside Moloch: A new DAO aims to fix Ethereum and Two Blockchain Players Fund Ethereum Project MolochDAO. An investment DAO gained backing from Joe Lubin and Vitalik Buterin, coming after the decentralized decision-making / governance issue yet again. There will be thousands of these DAOs, distributed according to power laws.

Ethereum Consortium Launches New Enterprise Tools With Input From Microsoft, Intel. I hear about your DFinity, Cardano, Hashgraph, and EOS. I hear about them. But Ethereum is still the one doing the primary heavy lifting as a public, core programmable infrastructure.

Using AI to Produce “Impossible" Tulips and AI: More than Human. Truly spectacular art exhibit on at the Barbican in London right now focused on how creative AI is being used to generate novel art. Would recommend to anyone that think machines are not capable of qualities resembling human empathy or creativity.

US forms task forces on fintech and artificial intelligence. The American legislative body is starting to think about the impact of the transformation of the financial sector. While the executive gets to regulate and enforce, the legislature can write new laws which the executive has to enforce.

Robots That Learn Are the Hottest Weapon in the Investing Arms Race. Interesting treatment of quantamental and machine-learning based investment management product track-record. The short answer is that everyone is hyped, but alpha has not been stable.

Chinese phone cradle for boosting your phone's daily step count. Chinese technology expert Matt Brennan shows a video of a device meant to trick a phone into counting fake steps for its daily step count in order to get a discount on health insurance.

Mastercard Brings AI Voice Assistants To QSRs. Mastercard is working on digital drive-through ordering systems, powered by display company Zivelo. Payments rails are the key to augmented commerce.

Minecraft Earth Is An All-New AR Game For Mobile. This could be a big one. Minecraft is one of the largest young communities in the world, and bringing it into the physical world has very interesting implications on the scale of a PokemonGo. How will digital assets from the game be attributed, valued, and traded, for example.

Looking for more?

Get this writing directly in your Inbox by subscribing here

Fully updated website here, and LinkedIn over here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.