Hi Fintech Architects —

Welcome to our new report format, the Greatest Hits!

This content curates and aggregates the most relevant Blueprint articles, across form factors, focusing on a key concept. We start with stablecoins and central bank digital currencies.

Full access to the Greatest Hits reports is available only to premium subscribers. The full Premium Fintech Blueprint newsletter experience now includes:

3 industry newsletters per week, including short takes covering the latest Fintech, Web3, and Digital Wealth news via expert curation and in-depth analysis, with full archive access

Weekly flagship Long Takes on Fintech and DeFi topics, providing deep, comprehensive, and insightful analysis without shilling or marketing narratives

Our ugdraded weekly industry insider Podcasts with value-added data-driven, annotated transcripts

Hope you enjoy, and don’t hesitate to let us know your thoughts here.

Overview

Stablecoins are digital cash equivalents, whose value is typically pegged fiat currencies. They evolved to allow investors to reduce volatility in their crypto portfolios, and preserve value without having to offramp from the crypto capital markets entirely. An example would be selling more volatile cryptocurrencies, like Bitcoin, and purchasing onchain stablecoins during bear markets. Additionally, there are commercial use cases, for purchasing USD denominated goods and services.

The most popular stablecoins are USDT and USDC, designed to be pegged 1-to-1 with the U.S dollar (e.g., 1 USDC = $1.00). These are both examples of collateralized stablecoins, though their collateral can differ. A centralised entity will issue a token, such as Circle issuing USDC via Centre. Each USDC is redeemable for one dollar, and to ensure there is 1-to-1 backing, reserves assets like cash are held for every 1 USDC in circulation. The USDT stablecoin has more controversial reserves, intermediated by affiliates of Bitfinex, but has stood the test of time to date.

Other types of stablecoin design include over-collateralised and algorithmic stablecoins. Over-collateralized stablecoins, like Maker’s DAI, generate a synthetically pegged asset after a certain level of collateral is locked into a smart contract onchain. Algorithmic stablecoins are a misnomer, but they generally refer to pegged currencies which attempt to tranche risk and function like a structured product, where the top tranche is pegged and the other tranches work like equity buffers.

Lastly, another form of fixed-value digital currency is a Central Bank Digital Currency (CBDC). As the name suggests, these are issued by a country’s central bank, whereas stablecoins are normally issued by private entities. You can think of them as national moneys vs. money market funds in traditional capital markets. Another useful distinction is in the use case. Stablecoins are mainly used to facilitate investments and portfolio functions, whereas CBDCs are planned to be used to facilitate payments whether in retail or wholesale designs.

Below you will find our coverage of these topics. It is intertwined, opinionated, and sometimes hard to unwind. We encourage you to dive into the material, see the progression over time, identify how we came to our conclusions, and find ways to build your own mental blueprint. The sections are separated into (1) Key Concepts, (2) Long Takes, (3) Conversations, and (4) Short Takes and Related Topics.

Key Concepts

2021, April — Building the foundational money DAO (Decentralized Autonomous Organization) in DeFi, with Rune Christensen of Maker Foundation

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput. 👉 Read more here.

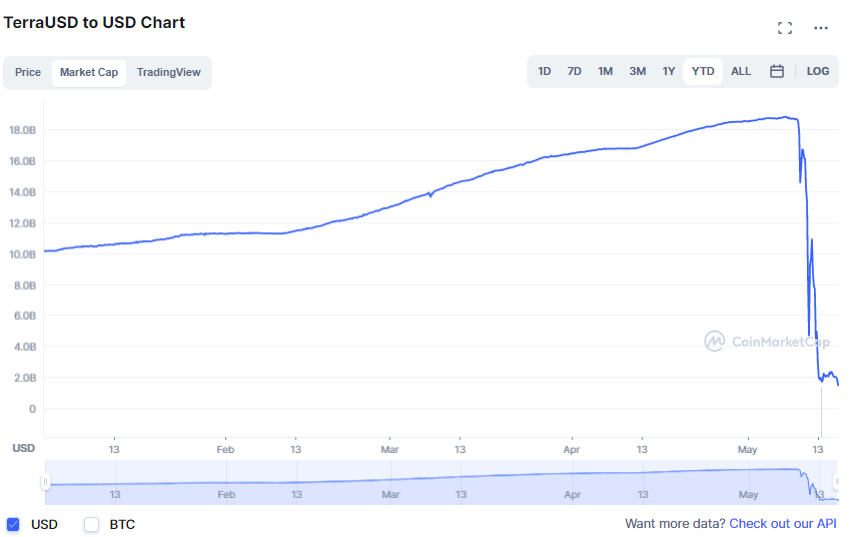

2022, May — The right lessons from Terra's $40B collapse

We discuss the collapse of the Terra ecosystem and the destruction of the UST stablecoin. Of particular interest to us are (1) understanding what happened, (2) comparisons to bank structures and bank runs, as well as their systemic solutions, (3) comparisons to international macroeconomics and countries attempting to defend currency pegs, and established solutions. If Soros could break the Bank of England, why do we believe that private pegged currencies would be immune, especially with weaker reserves? We take this moment not to gloat or stare into the fire, but to learn. 👉 Read more here.