Have Facebook Messenger Chatbots failed for Finance? +16 key Fintech developments

Hi Fintech futurists --

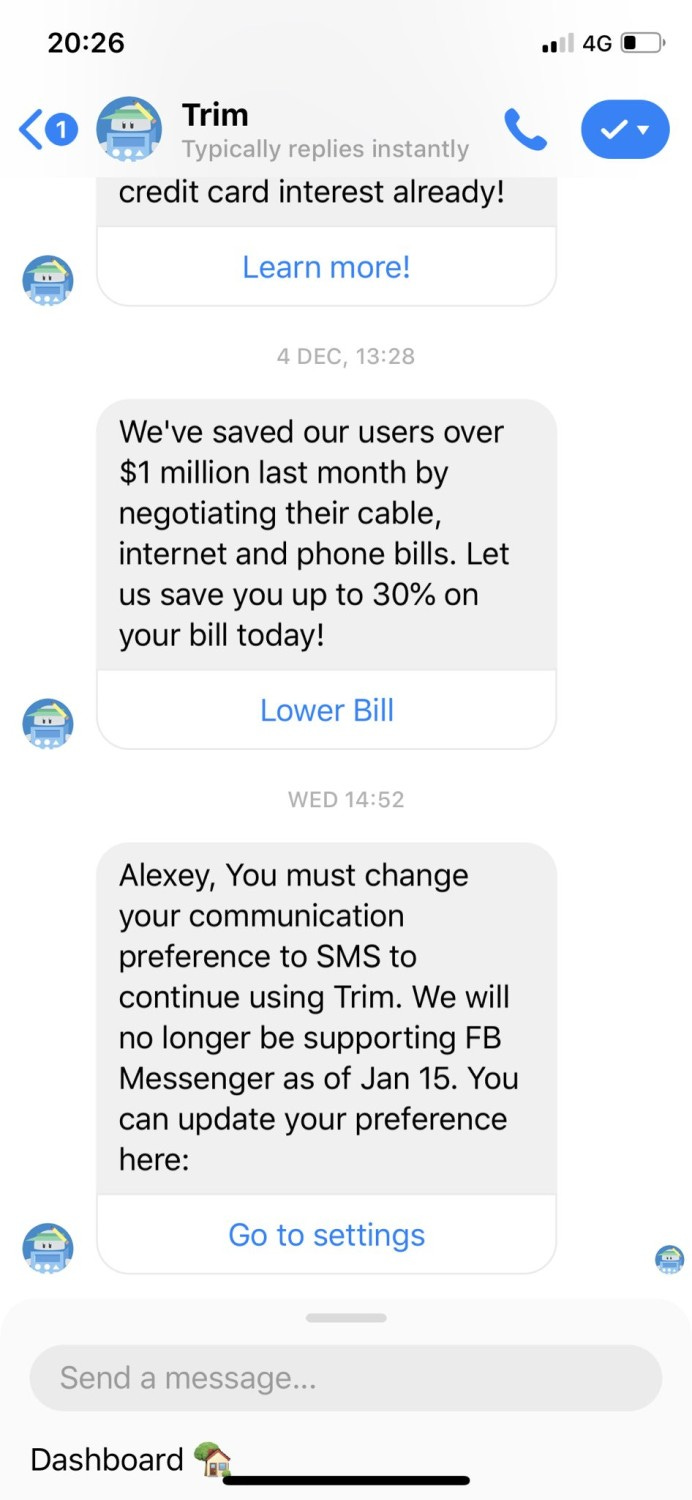

In the long take this week, I try out a contrarian point of view on personal finance chatbots. Trim, a savings chatbot, just withdrew support from Facebook Messenger. While lots of other chatbots are still invested in conversational banking, what could we take away from the counterfactual of chatbots failing to get B2C traction? What is the impact on the rest of the platform wars waged by Amazon, Google, and Tesla for connected homes, cars, and the Internet of Things?

The latest key updates on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

It's important to know when you are wrong. And when it comes to things like technology platform shifts, what we are really talking about are Black Swan events. Such events are by definition not within the set of likelihoods that come out of a normal distribution. They are not the type of pattern our monkey brains are used to extracting from daily life. They are abrupt, alien, and surprising. They are the unknown unknowns.

For example, who knew that training a machine learning algorithm on images of cats and dogs for a decade would lead to Deep Dream, the second picture in the row above? Once you teach a machine how to see, you can teach it how to hallucinate the things it sees into everything else. And once you teach a machine how to hallucinate, it is not that hard to hallucinate fake people by the millions, as in the last picture. And once you can have fake people, tech companies inevitably do things like this: Snapchat and TikTok Embrace ‘Deepfake’ Video Technology Even As Facebook Shuns It and Snap reportedly acquires a deepfake startup. Are the people on Tinder real?

Anyway, one of the things I try to do is apply analogies from prior platform shifts to current ones. But it is easy to miss, or get irrationally optimistic. The only antidote to wrong thinking is measurement and data, especially data that contradicts your point of view. Which is why I was startled to see this in my Facebook Messenger last week:

Trim is a chatbot software focused on personal finance. In the evolution of the sector, the mental model is first to (1) aggregate data through PFM software like Mint.com or Plaid, (2) analyze the information to understand someone's financial sitation at the current time, (3) generate a recommendation to improve the financial situation, and (4) implement the recommendation as an advisor. Trim implements savings improvements and subscription cancellations based on your transaction history, and it started out doing so through third party messaging services -- in particular Facebook Messenger.

Now lots of things grew up on Facebook, only to move away into independent companies. This is the story of the social investing / trade following network called Kaching, now called Wealthfront. But I had thought Messenger to be different -- not just a starting channel, but the actual paradigm. The core argument is that the chatbot and voice channels are platform shifts, they are the place where customers are going to be in the next decade as interaction preferences change. Devices like Amazon Alexa and Google Home will be the aggregators of user attention, and power conversational banking. Therefore, the banks themselves become subsumed to the platform into which they are integrated.

There still remains lots of data that proves out the decline in bank branches, human customer suppport, and an increase in Millennial and Gen Z preference for mobile apps and interaction.

There still remain multiple conversational banking companies that are trying to build out direct to consumer services, like Plum, Cleo and various other primarily-European Fintechs. And the Trim data point is just one of the few symptoms that the current generation of messaging-integrated chatbots are not having meaningful B2C impact. Perhaps they are not easier to use than mobile apps. Perhaps the conversations are too frustrating and the technology is too early. Perhaps Facebook has ruined its reputation, between the election cycle and the crypto-currency launch.

But we need to consider the negative data points seriously to pierce our reality distortion bubbles. If chat and voice are not sufficient architectures for platform shifts, what impact does that have on the large tech companies which are battling each other over AR/VR hardware and smart car operating systems? In the Mixed Reality and IOT link sections below, I highlight a few industry bets that are dependent on consumer behavior changing to adopt conversational banking. Embedding Amazon Alexa into gas stations so that people can pay for fuel with their voice, or creating e-Commerce dashboards in smart cars, may end up being quite a waste of time if our basic assumptions about platform shifts are wrong.

I am not arguing that we are wrong already -- but that the probability-weighted chance of being right has decreased at least a smidgeon. Stay vigilant!

And let me know if you think conversational banking is here to stay, or just innovation theater.

Key Fintech Developments

Banks Elevate SMB Lending With FinTech Tie-Ups and Why 64 Pct Of Merchant Services Providers Want A Payments Overhaul

Monetary Authority of Singapore Has 21 Aspiring Fintechs Apply for 5 Digital Bank Licenses -- and in particular, Mapping the Singapore digital banking contenders by their experience (sent to me and written by one of the reader's of last weeks' edition)

Court order slows down SEC bid to obtain Telegram banking records tied to token sale and Ripple Labs’ Real Business Model: Selling XRP to Retail Investors

Head of Russian central bank lets companies test stablecoins

Bitcoin.com wants to raise $50 million through an exchange token sale and Europe’s first bitcoin bank has expanded its service to offer ether trading directly from users' current accounts. (some good Ethereum features over here)

PWC report on How VR and AR will transform business and the economy globally and in the UAE and 5 Million PlayStation VR Units Sold, Sony Announces

Elon Musk heads to Shanghai for first deliveries of made-in-China Teslas to public

Alexa Payments Coming For ExxonMobil Customers and Visa: Road-Tripping Into Connected Commerce’s Future

Featured Interviews, Podcasts, and Conferences

Experts Share: What Are the Biggest Crypto and Blockchain Topics to Follow in 2020. A CoinTelegraph collection of views on the future, featuring yours truly.

We Made No Progress, Other Than All the Progress We Made. An op-ed for CoinDesk about the 2019 year in review.

Xtiva WEALTHTECH TRENDS 2020. Check out this deep report across wealth tech about what the next year can look like -- my contribution was to discuss how digital assets will start making their way into more traditional portfolois.

Fintech used to be a back-office support function, now it's defining an industry. Check out my Op-Ed in Investopedia about the history and future of financial technology.

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.