How are Central Bank Digital Currencies like Lithium-ion Batteries, and how do you build a CBDC today? +20 key Fintech developments

Hi Fintech futurists --

In the long take this week, I examine the rising relevance of Central Bank Digital Currencies. We look at the World Economic Forum policy guide to understand different versions of CBDCs and their relative systemic scale, and the ConsenSys technical architecture guide to understand how one could be implemented today. For context, we also dive into a very different topic -- Lithium ion batteries -- and show how a change in the cost of a fundamental component part (e.g, 85% cost reduction in energy, or financial infrastructure) opens up a massive creative space for entrepreneurs.

Long Take

Look, it's 2020 and I guess things are really moving. The biggest Fintech meme of the year appears to be the return of Central Bank Digital Currency ("CBDC"). I've covered the idea before, but always with this skeptical lens of -- a sort of presumption that some masked *they* will never allow it. At the same time, water beats rock in the repeated game of wave and tide. What Bitcoin accomplished 2009 is now really, truly, and actually being considered as a type of infrastructure for all of our global money.

There are many analogies we can make. Often, my favorite is how Spotify ate both Napster (principled open source pirates, i.e., BTC) and the music labels (DRM enforcing manufacturers, i.e., Wall Street) to build a thin layer on top of free digitized music. But there's another analogy I'd like to explore -- the Lithium ion battery.

I'm not an energy guy, so reader beware of ignorance and naivete. Maybe if I link McKinsey's view on energy storage, that will give me more credibility! Regardless, this isn't about batteries -- it's about money.

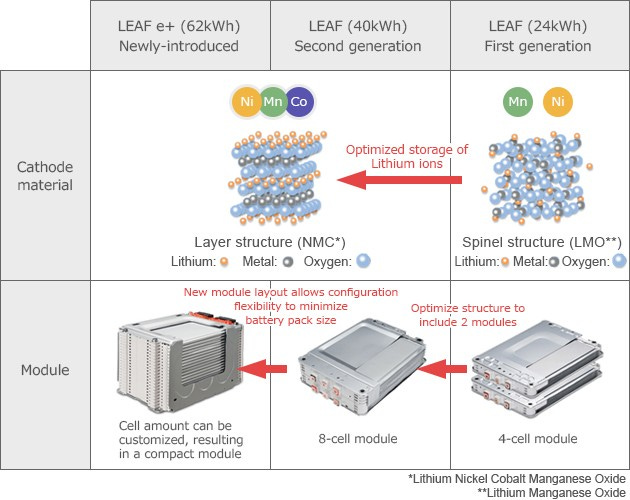

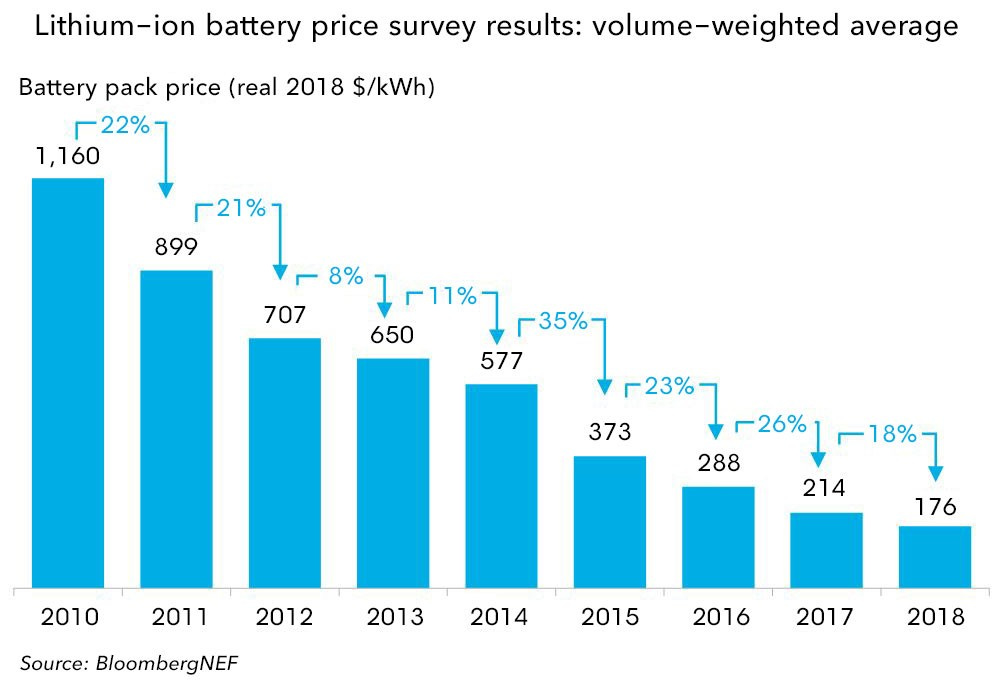

But here's the deal. There is no Moore's law, or personal electronics, or electric cars, or Amazon drone deliveries without the chemical discoveries powering the Lithium ion battery pictured above. You probably only think about your device battery when it starts breaking down. But let's pause to recognize just how recent the commercialization of this invention was (1991), and just how drastically prices changed over the last decade. That we can carry around increasingly performant computers the size of a notebook, or ride around in an electric car for 300 miles, can be partly traced to this small miracle.

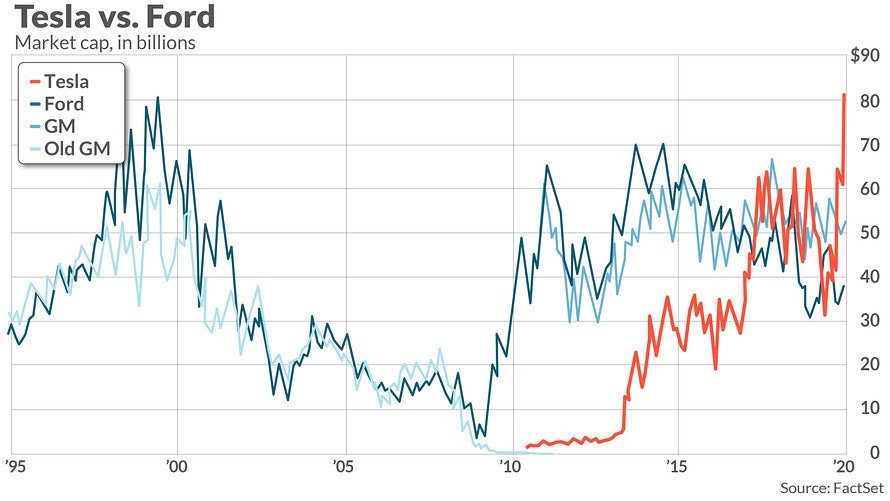

Between 2010 and 2018, the price of a stored kilowatt hour collapsed by 85%. You could flip the math, and say that in 2018 you get 7 times more energy in devices for the same cost. The battery itself has also changed form factor, and became increasingly minitiarized. Imagine trying to motivate investment into building out this infrastructure in 2008, and using the rationale that it will be 80% cheaper to power a drone or an electric car in 2020. Some of these markets at the time (e.g., Tesla's electric cars or their chargers) were not well developed, and were not subject to reasonable modeling in a spreadsheet.

Your argument would be that (1) some future functionality, combined with (2) some future demand by consumers and/or organizations will (3) depend on more electric energy consumption by an order of magnitude. Forget that non-electric infrastructure is just fine, and consumers haven't adopted the requisite behaviors yet. You would still argue that cutting storage cost now will unlock incredible value in ten years.

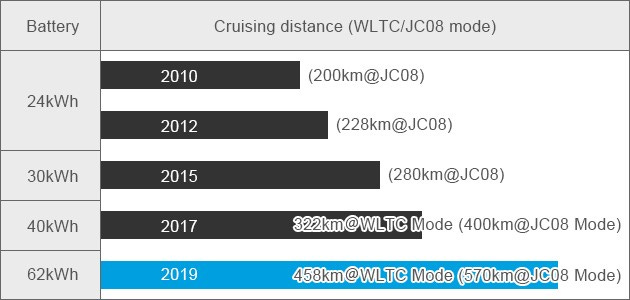

Take a look below at the impact of battery improvements on an electric car's cruising distance between charges (Nissan in this case). Or the market capitalization performance of Tesla, a battery-operated mobile AI computer. Or the absolutely incredible projected demand for electric power, stored into these batteries (or their next generation leap-frogging versions) to power our Homo Sapien hive.

With that preamble, let us get back to Central Bank Digital Currencies. For now, we can put to the side all questions of sovereignty and actual power to issue the currency used in an economy. We don't need to debate philosophy when looking at electric batteries.

Is there anything wrong with the wiring behind money today? There are so many ways to interact with value. You can hold it in paper. You can write out checks. You can send a wire transfer. You can swipe a card at a merchant terminal. You can check out from Amazon using PayPal. You can hold your phone close to the NFC chip and trigger ApplePay. You can scan a QR code. All these things are the movement of money, and they all travel on radically different infrastructure. Why should we consider adding anything else?

Simple -- you can cut the costs 85% within a decade. Not today, and not all at the same time. But we see the symptoms.

It is not about what you can do with that savings today. Such a framing is the worst way to approach the problem. Rather, it is a deeper question -- what can we do with our society and economy if we remove 85% of the friction behind the movement of money? The immediate corollary is to expand beyond money supply, and understand that a programmable blockchain-based infrastructure impacts every single vertical of financial services. Whether we are talking about payments, or savings, or lending, or investing, or insurance -- you get to remove the same frictions in each of those industries. These industries will spring up along whichever road the money travels; it brings life like water in a desert.

Don't take my word for it. See what the Guardian says here:

The Bank of England will examine how Britain could adopt a bitcoin-style digital currency as part of a global group of central banks that have joined together to examine the possible pitfalls of relying on electronic money. Bank officials will meet with the Bank of Japan, the European Central Bank (ECB), the Sveriges Riksbank, the Bank of Canada, the Swiss National Bank and the Bank for International Settlements (BIS) to pool research and experiences of the potential for a central bank digital currency (CBDC).

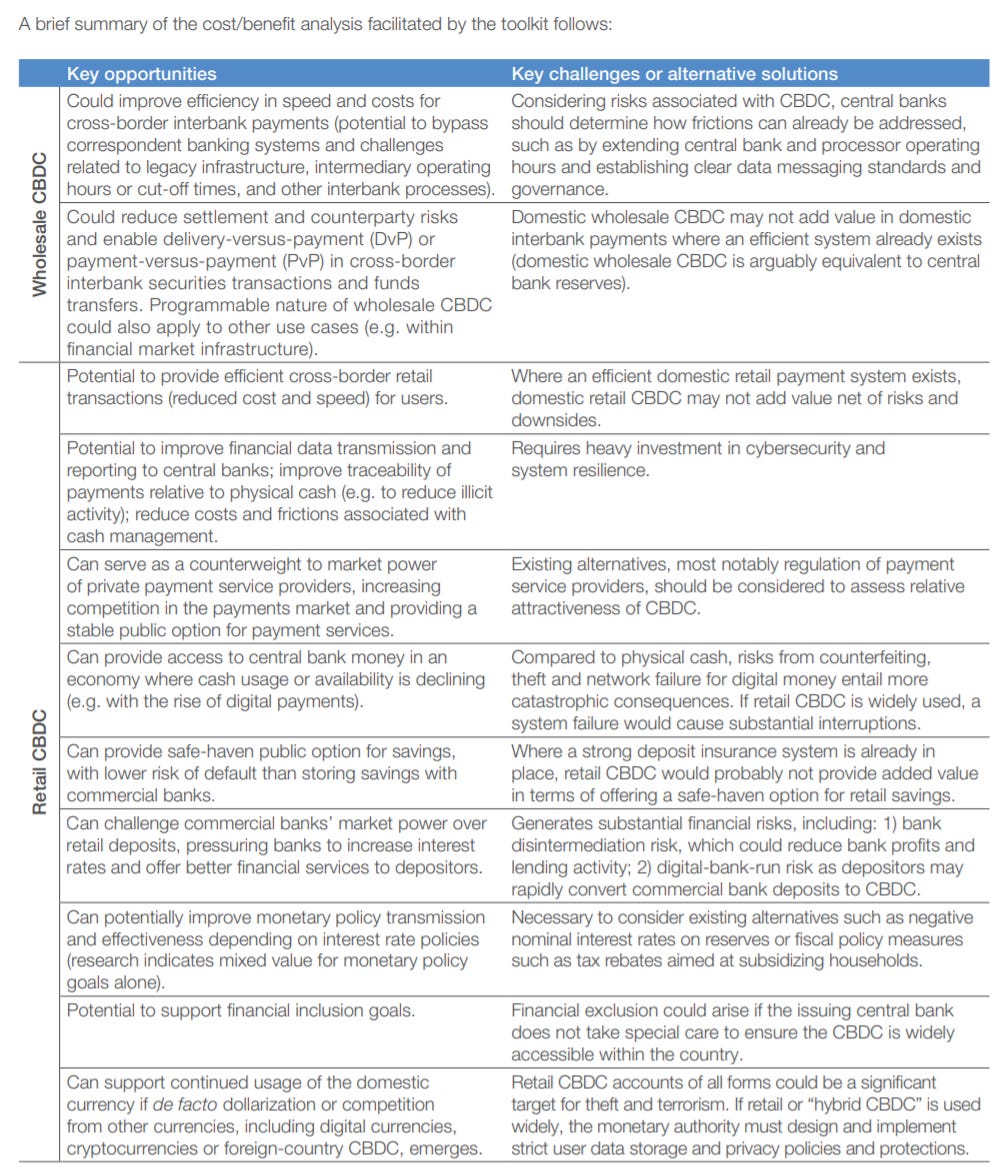

Or perhaps we can refer to the newly published World Economic Forum guide for Central Bank policy makers trying to design a CBDC (definitely worth a download).

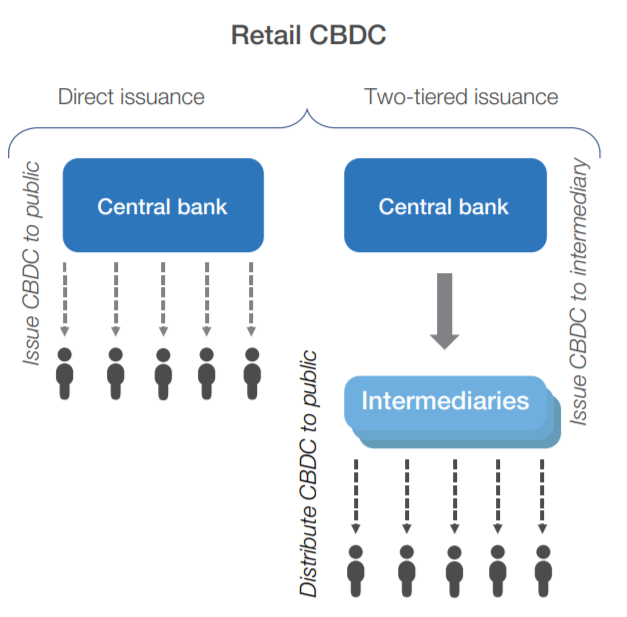

It's not appropriate for me to copy/paste all of the WEF report, but let's identify some key concepts. The first is to acknowledge the split between (1) retail and (2) wholesale money movement (see for example, Australia's new initiative). The institutional payments market is about about 3-8x the size of the retail one, depending on your source. In terms of the feature set, retail payments require very many small simultaneous transactions, while institutional payments are generally not as high-volume, but much larger in size. This also has implications for scalability and privacy, both of which require additional solutions if using blockchain-based systems. These solutions exist, but must be chosen and adopted.

Second, there is a difference between national and cross-border CBDCs. Moving into the international arena creates exponential complexity, and certainly fuels the Fintech regulation and reserve currency wars being waged by the US, UK, China, and continental Europe. Lastly, the launch and technological support of direct money issuance by Central Banks to individuals creates a financial industry risk. Money would take a step closer to regular human beings, making banks less useful. How exactly reserve banking, interest rate policy, and other traditional macro-economic levers continue to work becomes an open question. Similar questions arise for the technology providers of core banking systems, payment networks and processing, and portfolio management.

Let's also look at the recently published ConsenSys whitepaper on CBDCs, and how they can be implemented on Ethereum. I am of course conflicted in telling the story here. That said, I am conflicted for a reason -- which is that I believe strongly that a programmable, open source, public blockchain with the options for private deployment, and add-on privacy and scalability, is the best shot we have at actually re-building financial infrastructure. Being open-source at the core (vs. partially open-source) implies the largest community of developers and the most cumulative innovation. You can look at the consumer surplus created by Linux, and its conquering of the world in the guise of Android for proof.

Further, a public chain that can be flexed into private institutional use-cases but still retains the native ability for tokenization and digital asset interoperability is more powerful than those built only for financial corporates. You don't need to choose the crypto Wild West today. But why would you permanently kill the option of inter-operating with one of the most innovative Fintech ecosystems in the world? And programmability is key -- otherwise, you are just stuck with a single financial product. There are hundreds of financial permutations that people need, each interacting with the next (e.g., a payment and a loan).

But I digress. The core graphic for a CBDC on Ethereum is below, with a discussion of the architecture quoted directly from the paper. The resulting product can be built out of modular software like ConsenSys Codefi (which I co-lead) and deployed via infrastructure like Infura and PegaSys. Other solutions, like those from PwC or JPMorgan are also on the market.

Base settlement layer (dark blue). There is one base settlement layer on a permissioned Ethereum blockchain.

Layer 2 (light blue). The next layer is comprised of a network of state channels between intermediaries that would enable fast payments.

Layer 3 (green). In this layer each intermediary operates its own side chain, where the central bank or regulator is a participant and can ensure that the supply of money remains consistent with the supply of CBDC allocated to the intermediary in the base settlement layer

Layer 4 (tan). At the top we find many different end user interfaces, offered by banks, telecom operators, mobile phone manufacturers, fintechs and other providers, each in competition with each other and with their own special functionalities, in order to provide the best possible end user experience via competition between these private providers.

Going back to the beginning of this essay, it is fantastic that the world's Central Banks are actually engaging with these concepts and trying to make operating decisions about the economies which they have a duty to grow and maintain. Notably, this is not innovation for innovation's sake. Private solutions are already far ahead, attempting to generate profit through the maintenance of private moneys. It is not that algorithmic stablecoins and collateralized digital dollars will somehow lead to capital appreciation. They won't, because they are pegged to fiat. Deviating from the peg is a fundamental failure, and maintaining the peg is expensive (just ask the Bank of England about Soros). Rather, owning the rails and wiring around those stablecoins is what is profitable.

For example, Facebook's Libra may generate billions of dollars of interest income from its projected massive reserves. While some companies like Vodafone have pulled out of the Libra consortium, technical and business development is still moving forward, and is now governed by an explicit Steering committee. It consists of Diogo Monica (founder of crypto-custodian Anchorage), George Cabrera III (product lead at Calibra), Joe Lallouz (CEO at Bison Trails), Nick Grossman (Union Square Ventures), and Ric Shreves (Mercy Corps, an aid organization). These may be strong entrepreneurial, investment, and humanitarian leaders -- but they are not servants of any elected body.

There is a whole plethora of other private approaches to try and benefit from digital currency scaffolding. See Jack Dorsey’s Square Wins Patent for Fiat-to-Crypto Payments Network, trying to solve how people move money between digital and blockchain-based payment systems. On-ramps generate fees and profits! Or see WisdomTree, an asset manager with $60 billion in assets under management working on a regulated stablecoin. If you can create a money market fund on a digital asset chassis, maybe you can package up the allure of Bitcoin into an ETF, which is then allocated into the $30 trillion of American investment portfolios. Certainly blockchain financial technology providers like IBM, R3, ConsenSys, and others are waiting with baited breath.

For me, the important takeaway is that money is a public good. It is the blood of the political body in which we live -- wherever your body may actually be. In some cases, we may wish to switch political bodies, for example escaping Venezuela's socioeconomics for the promise of the decentralized web and its financial ecosystem. Yet for nearly everyone in the world, we are rooted in our countries. And if our contries build out a new commons for digital money, the next 10 years will see more than just 85% cost reductions in payment costs.

Remember, the Lithium ion battery opened up the creative space of AI-powered electric cars, consumer drones, and powerful smart-phones. Fintech and financial services is yet to see such changes -- but CBDCs could open up entirely new frontiers for innovation, and remove regulatory and technological barriers. Such innovation will spread to billions of people, and gently put into the dustbin of history our baroque era of finance.

Key Fintech Developments

Google Pay co-founders raise $13.2m from 3 top VC firms to build neo-banking platform

Citi and Yieldstreet, the Bank Partnership No One Saw Coming

Swedish Open Banking / Data Aggregation Startup Tink Closes €90M Funding Deal

Vietnam-based Binance users can now directly purchase and sell major cryptocurrencies using Vietnam’s fiat currency through the latest versions of the Binance P2P mobile app on iOS and Android and Binance appears to have taken in $194 million in the most recent quarter, according to an analysis of the company's most recent token burn

Skylo raises $103 million to affordably connect the Internet of Things to satellite networks

Available now on iOS, Octi is a new social platform that uses augmented reality technology to basically turn you into a walking talking social media profile and AR apps are bringing added layers of interactivity to creative writing workshops and descriptive language sessions as they begin to be used for writing prompts

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.