How the SEC is wrong about the Internet and the Bitcoin ETF, plus 14 short takes on top developments

Hi Fintech futurists --

Today, a longer take on understanding why the SEC postponed its decision on the VanEck Bitcoin product, and why its concerns betray a misunderstanding of the culture of the 21st century. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

Quickly, let me tackle the first issue around financial damages. Low cost, no-transaction fee ETFs are the core instrument of financial planning in America. If the investment product is not packaged in this way, then it is not part of the asset allocations of most financial advisor professionals serving the mass-affluent and retail markets. This creates inequity. Wealthier, accredited investors can buy the Grayscale Bitcoin Trust, invest in one of 500 crypto hedge funds, or pay a custodian to manage an on-chain position on their behalf. As a result, retail investors will either buy public market proxies, or invest in self-directed brokerage of non-SEC regulated commodities. In other words, they will buy Bitcoin via Coinbase, Binance, and ICO websites. Or they will buy stock in Long Island Blockchain (now in trouble) or Overstock, and lose their money that way. Making something inaccessible just makes people pirate it. If you can't get Game of Thrones via HBO Go in your country, you will use BitTorrent and Popcorn Time. Much of the janky speculation could have been removed by making a boring vanilla product legal and easily available.

Let's get to the real meat. A fund traded on regulated capital markets exchanges would become available to all investors. In regards to stocks, there is a shared cultural myth that "fundamental" data about a company determines its price. This is not entirely true -- most of the trading of stocks these days is done by robots working for various financial organisms. Nor is price in fact determined by financial information, as much of it is swung to and fro by human sentiment and anxieties. But at least there is a shared myth to underpin the illusion! With an ETF, the underlying components are what matter. And the SEC has a problem with the single component of a Bitcoin ETF -- exposure to Bitcoin, whether in the shape of regulated Futures, or the public crypto asset itself. The reason for this problem is that the pricing of Bitcoin is not just volatile, but easily moved and manipulated. Until an asset manager can show a kosher market for Bitcoin, where the price reflects some sort of truth and is not the plaything of white collar criminals who can move one lever and profit on the others side, an ETF is unlikely.

But this is wrong.

It is not wrong because the motivation is wrong. There are very good reasons to stomp out insider trading and market manipulation -- those are theft, pure and simple. While some crypto libertarians may claim that unrestricted markets and "free" trading are the utopian goals of anti-sovereign money, this reveals an uneducated view of economics, asymmetric information, and externalities. If you have insider information and are trading on it, you are deceiving your counterparty into a trade you know is destructive for them (they don't know they are buying a lemon, but you do). If you manipulate the markets by creating false volume or cancelled orders, you are generating false information on which your counterparties rely, and therefore again you are stealing money from their pocket like a street urchin that distracts the eye with a magic trick. So I fully endorse and support making financial theft illegal, because at the least it may re-focus value-destroying financial effort (e.g., market manipulation) into some economic purpose (e.g., market making).

However, it is pure ignorance to look at the Bitcoin markets and suggest that there is something unique about how they are manipulated. The falsehoods around promoting offerings of crypto assets and the manufactured lies about crypto financial statistics are the norm, not the exception. They are the water in which we swim, part and parcel of the global Internet, and the DNA of social media and our current politics. Let's review.

When looking at the entirety of Internet traffic, more than 50% is fake traffic manufactured by bots. That's everything from Google's crawlers (good bots) to Chinese click farms on fake blogs (bad bots). And guess what! There is no worse industry than Financial Services when it comes to fake bot traffic. Software machines are clicking on your neobank Google ads to make money for your marketing consultant.

When you look at the walled gardens of Facebook, Twitter and the rest of social media, the landscape is identical. People buy followers left and right -- followers built algorithmically through Russian botnets, or farmed across the developing world in Internet cafes by 15 year olds. For instance, Twitter has been trying to stomp out 10 million fake accounts per month since the election. Such "growth hacking" techniques are not an exception. They are a new professional field that will give you a high-powered business position in any number of Silicon Valley's favorite startups with $100,000+ base salary.

Generating propaganda at scale on the Internet is the norm. The latest artificial intelligence technology is perfecting the ability to manufacture not just traffic from automatons, but to take an image from a still photo and use it to create video. Deep fakes, which required hundreds of hours of video footage, are a rough first draft of the current technology. Generative adversarial networks can take any image, use an abstracted face motion algorithm, and transplant Elon Musk or Warren Buffet to visually support an investment thesis using any words you choose. Chinese news anchors are already made from neural artifacts, so that they most efficiently deliver the State's message while being under full control.

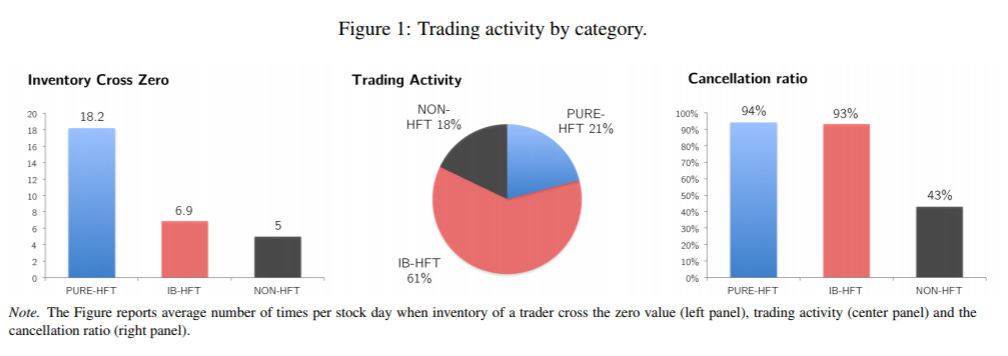

You may say that it is only information, and its immediate derivatives (e.g., traffic, engagement), that are being manipulated. Are bots only surfing the web? The answer is -- of course not! Bots are part and parcel of the traditional equity markets. They are one of the reasons why retail investors have no business buying individual stocks, and why Robinhood can get a $10 billion valuation selling consumer data and flow to high frequency trading firms. HFT firms are the epitome of financial bots -- they make decisions, take action, do it faster than a human ever could, are on all the time, and function at a massive, industry-wide scale.

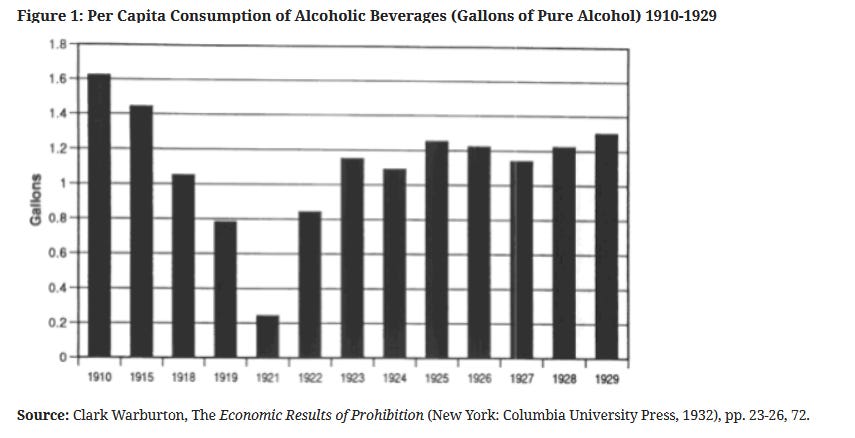

The core argument in favor of HFT bots is that they create liquidity and price transparency. But many create merely figments, hallucinations of volume. A recent paper suggest that HFTs cancelled 94% of the trading orders they put into the market, kicking up a sand-cloud of misinformation as a defense against other software. On top of that, they generate over 50% of trading volumes on US equity exchanges. I am not suggesting all HFT trading is deceptive or a theft. But I am suggesting that even the most regulated markets are full of false information, robots trying to out-do each other fake signals, and fundamentals disconnected from any ground truth.

Now, let's look at Crypto. There is no better document on crypto capital markets than the Bitwise ETF submission to the SEC, so read that if you haven't yet right now. The shocking figures are that 95% of the reported volumes on Coinmarkecap are simply false. They are a result of software creating trades between itself. Unlike the case of equity exchanges, however, this fake trading is being manufactured by the exchanges themselves in order to look important on the Internet. Looking important matters, because it can attract brokerage investors that pay commissions on trades. It can also attract venture-stage projects that ask the exchange to do an Initial Exchange Offering -- an equivalent to an investment bank shopping around an equity offering to its investor base. So lying about volumes is big business.

That said, it is not impossible to get to the truth. Messari has done this with the "Real 10 Volume" metric, looking only at the exchanges in the graphic above -- the venues that the industry insiders know are closest to truth, and are trying to build an honest business. You can create diligence, standards, and transparency. Private legal systems, like the ones in the cotton industry, can be used to layer on top of local sovereign jurisdictions to create a global, international layer of conflict resolution. This is hard where a potential injured counterparty is an uneducated consumer -- but the "HTTPS" protocol has been rolled out to the benefit of users, without any technical knowledge on their behalf. This starts with the crypto capital markets industry acknowledging that conflicts of interests and financial crime are a harm that we do not want around.

To be good is not the same as to be imprisoned.

As for the SEC, I wish the regulator would recognize that you cannot hope for a world of truth in a world of lies. Holding young, honest businesses accountable to a standard that everyone around them has failed -- from every single investment bank, to the President of the United States -- seems patently absurd. The high quality players have made a best-efforts show of where the fundamental truth lies, and why it is important and beneficial to move forward instead of backward. Inaction continues to be harmful to the consumer, incentivizing reckless investment, and leaving America in the dust.

Short Takes

Robinhood Nears Funding at Valuation Over $7 Billion. Giving drugs away for free is a great business model! Finding a way to make financial products into free drugs is the key to get there. Chime did it with banking, and Robinhood rocked it with trading. Their massive user base is enviable to every other Fintech. Expect a UK neobank, maybe some student lending, crypto, and wealth management soon enough.

North Capital Builds Free Direct-to-Consumer Financial Planning Platform. Now that automation of asset allocation and portfolio management is commonplace, financial planning and the resulting investment structuring is next. No surprise then that Vanguard plans to roll out robo technology to advisors, and that Canadian digital wealth leader WealthSimple raised $100 million from Allianz.

Google Pay, Assistant will help you ride the New York subway system. The NY subway is finally modernizing, and you will be able to tap a smartphone to an NFC sensor. Contactless credit and debit cards are also included. This incrementally helps people adopt Google or Apple Pay as a method of payment, with the subway turnstiles as inadvertent marketing.

ConsenSys Legal and Latham & Watkins collaborated to create the Automated Convertible Note for startups and investors in the blockchain ecosystem and beyond. Moving a widely used legal document into a smart contract instrument may be a better way to power fund-raising with Ethereum than by flipping token offerings. But this effort seems instead to have focused on the question of how to deal with token offering rights for early stage companies.

Cornell Uni’s Emin Gun Sirer Debuts Ava Blockchain Following $6 Million Investment. Emin has one of the world's best technical understandings of blockchain, and is now backed by one of the best venture teams in the business. Still, I can't help but be tired of yet another DLT solution trying to be a monopoly protocol.

CryptoCompare’s April 2019 Exchange Review. Fun graphs in this one, like volume of Bitcoin trading into fiat currencies by month (USD rising) and stablecoins (USDT going strong).

How Exactly Will SAT Test Takers’ “Adversity Score” Be Calculated? In addition to performance on tests, students will now get a score that measures the challenge of their upbringing. If it is adopted at the college level and flows into quota, we could expect to see the same in professional recruiting.

Clinc has announced a $52m Series B round; bringing its total funding to date to $60m. This is a conversational AI company focused on financial services, like Finn.ai and Kasisto. While chatbots and voice are having a bit of a quiet time in Fintech, the leading companies are maturing and entering meaningful valuation territory.

How Artificial Intelligence is helping the unbanked. News to me -- a company called Oriente last year raised $100MM+ as a Seed round to build an AI digital lender for people without a credit history in Asia. It's probably common place in the geography to see such big moves, but is completely nuts from a Western perspective.

Standard Chartered launches Trade AI engine with IBM. A natural application of enterprise AI is to convert paper documents into a structured database. This is about taking 36 million pages of trading information into digital bits.

Ways to monetize AR/VR technology in large and medium businesses. Some nice visual examples of how marketing and customer engagement can be enhanced with emerging media.

Magic Leap announced that they’ve agreed to acquire Belgian startup Mimesys. The target was working on holographic teleconferencing -- think Star Wars but more boring. If you don't succeed, then buy buy buy!

PartnerRe Launches Wearables Pilot with Dacadoo. Interesting experiment in using wearables, generating health data, and having that flow into pricing and underwriting. Of course, last week we showed an example of how putting a smartphone into a pendulum machine tricks it into thinking the user is walking, increasing daily steps, and thereby tricking the insurance company.

A car that negotiates with charging stations and pays its own parking fees. An interesting press release from Bosch about the 52 million connected devices they sell per year, and their plans for dominating IoT.

Looking for more?

Get this writing directly in your Inbox by subscribing here

Fully updated website here, and LinkedIn over here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.