Investing 101: DeFi Fixed Income Yields

Three Low-Risk DeFi Strategies Yielding Above Fed Rates

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we explore how crypto has matured to support capital preservation strategies akin to fixed income, focusing on conservative yield generation rather than high-risk speculation. Protocols like Spark, Aave, and Ethena now offer APRs ranging from 0% to 20%, depending on market demand for leverage and protocol mechanics. Spark (by MakerDAO) manages $4.3B and currently yields ~4.5%, Aave supports a $3B USDC lending market with historical APRs up to 15%, and Ethena uses complex derivatives to offer yields up to 100% while maintaining a dollar peg. These strategies can serve as a cash management layer, outperforming traditional money market funds in risk-on environments while maintaining capital safety.

Topics: Generative Ventures, Spark, MakerDAO, USDS, Aave, Compound, Ethena, MZero, Morpho, Usual, BlackRock, Securitize, Pendle, OlympusDAO, Terra, Luna, Fidelity

To support this writing and access our full archive of newsletters, analyses, and guides to building in the Fintech & DeFi industries, see subscription options below.

Analysis

Capital Preservation

DeFi investing, and crypto more broadly, is associated with very high-risk assets. The boom and bust of the sector is constantly in the news.

However, the asset class has matured significantly. It is possible to think about it not just as a subsector within the Alternatives slice of an asset allocation, but as a component of Fixed Income or even Cash Equivalents. As we think about investment strategy at Generative Ventures, one of the research areas has been to highlight the absolute safest onchain investment opportunities.

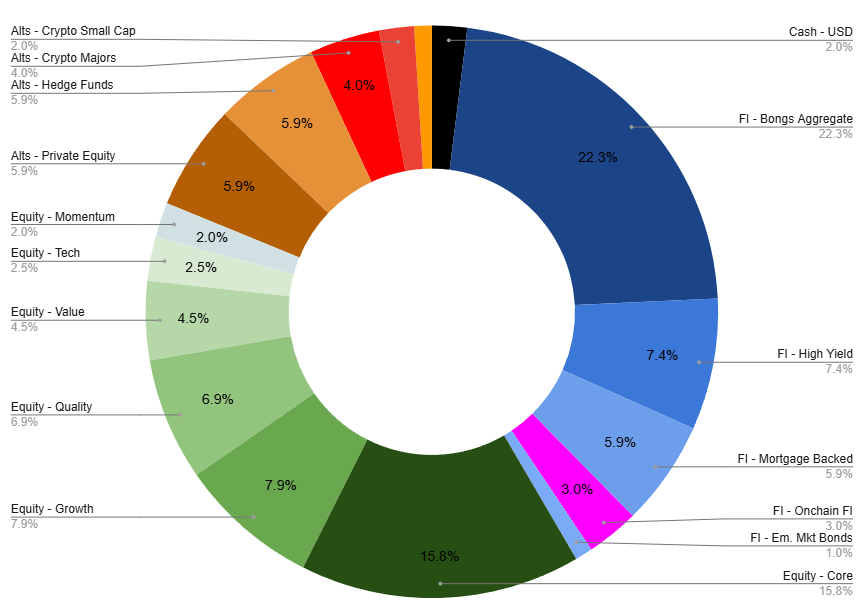

Take this asset allocation:

It is adapted from BlackRock’s 60/40 portfolio and made to look like an endowment model. We start with Cash, then Fixed Income, then Equity, then Alternatives. Within Alts, maybe 2-8% is allocated to crypto. Of that, probably 5% is in Bitcoin and ETH (or Solana) to reflect exposure to large cap tokens. And then another few points sit in small caps and venture-capital like speculative projects.

ICOs, memecoins, even NFTs — all that stuff is like investing in an early-stage project that gets immediate liquidity. You get the usual market structure issues with investors manipulating prices and influencing charts.

The DeFi sector had also been quite speculative, but for another reason. Whereas most tokens float as phantom equity exposure, DeFi yields provide interest rates on money deposited or staked into pool or vaults — which in the old tongue would be separately managed accounts, SPVs, Trusts, or fund structures.

Speculators chased DeFi yields because they could reach 100%+ APRs. The reason for this was (1) leverage loops and rehypothecation of assets, (2) exposure to short-term rewards that made the numbers appear higher, or (3) other hidden tokenomics dangers. For example, the rewards you received would be priced in the currency of a project that was very quickly falling in price.

But we are now in a new era where US Treasuries are pretty much onchain with the introduction of multiple protocols that tokenize Real World Assets. And that gives us conservative Crypto Yield.

On the above efficient frontier, we now have an option between Money Market Funds and below corporate bonds on a risk spectrum. And this is powered by several high-quality protocols.

Note that what we are describing here is the usage of a protocol for its intended function, not the ownership of that protocol’s tokens. For example, Apple stock and Apple’s iPhone are different things. Using the iPhone is fantastic. We are talking about usage. So here are the contenders.

Criteria

Our goal is to find the least risky things to do during a bear market. A simple filter would be to look for the following:

$1B+ in assets

Publicly known and trusted teams

Well-understood mechanism for source of yield

Minimal leverage and rehypothecation loops

Available on major chains without too many hops and bridge risk

Here are a few that fit the bill.

Spark

Spark is a $4.3 billion product from the folks at MakerDAO. The product yields between 0% and 12% in APR, currently sitting at around 4.5%.

Maker issues a collateral-backed stablecoin, this is their core business. This stablecoin used to be called DAI, now it is called USDS. It is over-collateralized by ETH and other onchain assets. It can also be traded directly 1-1 for USDC. In order to attract holders of the stablecoin, the DAO decides on an interest rate to pay to users — this is the “savings rate” that we show above. It is akin to various rates that banks may decide to distribute in order to attract deposits.

Why can the rate get higher than the fed funds rate?

The answer is that only a portion of the holders of USDS stake it, availing themselves to the savings rate. It is the same thing as if you were using a checking and savings account. If you take the collateral and get interest on it of 5%, but only 50% of people are using the savings account, then the product can pay out 10% maximally. The logic here is analogous.

There is some small risk on de-pegging in an extreme market downdrift, and there is a chance that the DAO will vote for a 0% interest rate if the rest of the market has similar yields. But we think that Spark will stay competitive with the Fed Funds rate for the foreseeable future.

Listen to our podcast breaking this down:

Aave

Aave is a lending protocol that has a $3 billion market around USDC, Circle’s stablecoin. This market has generated between 2% and 15% APR over the last year.

How does it work and where does the yield come from?

Think about a margin account in a regular brokerage. Normally, you only have the assets in your account. But if you want to get a loan from the broker, it is called margin, and you pledge your portfolio as collateral. This gives you leverage — usually 50% of assets or so — to take more positions.

In DeFi, this functionality is pooled and automated across assets. So if you want to borrow USDC, for example, you would not borrow it from a custodial broker (who can default on your assets from a credit risk). But rather, you would borrow it from the entire market venue. You can offer up some appropriate collateral to the pool, and get USDC in return. Similarly, being on the other side of this trade means you are allowing someone to borrow USDC from you in return for collateral and an interest rate.

Thus Aave is a proxy for demand for leverage. When the market is risk-on, lots of people will want to borrow and get leverage, and will pay an interest rate to do so. Worst case, the interest rate is 0% as demand for leverage goes away, and there is no principal loss.

We haven’t talked with Aave, but an early player called Compound had a very similar mechanism.

Ethena

Ethena is a $6 Billion project that has yielded anywhere between 0% and 100% APR depending on market conditions. Of the stablecoins so far, it is the more complex and looks closer to a structured derivative product than a deposit-backed or treasuries-backed investment.

Lots of ink has been spilled discussing the mechanism. The short version is that Ethena takes advantage of the basis trade in crypto around Ethereum. It both goes short and long ETH in order to generate a stable value asset. It does this across centralized exchanges of large size, such that it gets rewards with the perpetual funding rate from its positions. Because there is a long bias in crypto, people will be willing to pay for leverage. Some do that on Aave and the DeFi protocols, and others do this using perpetual derivatives on exchanges.

Ethena captures this long bias as an interest rate, and also avails itself to staking rewards from ETH. This creates a synthetic dollar that so far has been able to keep its peg. The investment is sensitive to overall leverage demand, operating risk of exchanges, and has some limits to scale. Our conversation with the team is here:

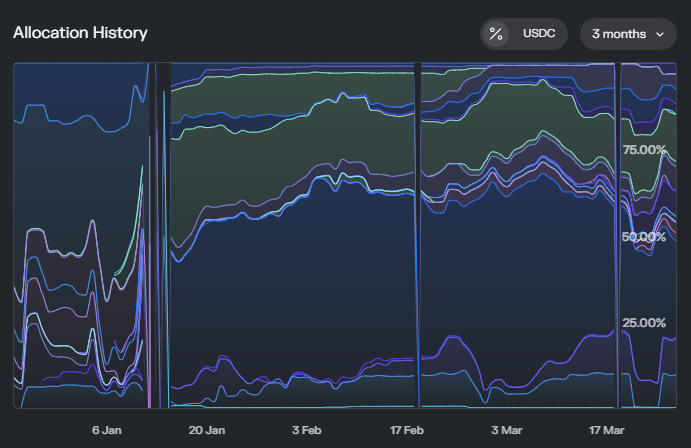

In terms of large capital preservation strategies, these three are the most likely contenders. If you were to equally weight these strategies and apply them to cash management, performance could look something like this.

The floor of the strategy would be around the Fed Funds rate, and the ceiling would be around 10-20%, leading to fairly persistent outperformance that largely correlates to demand for leverage during risk-on bull markets. This is not an investment you would make in your high-risk alternatives portfolio as it does not compete with high-volatility tokens. But it is not a bad way to preserve capital — something we are thinking about building at Generative Ventures.

Other Options

As runners up, we would point to a few other more exotic protocols we like. However, they are more complex.

MZero is an institutional stablecoin issuance platform that has just passed

$150 Million of assets. Companies can use the protocol to issue stables backed by treasuries, and then have a common platform across which they are all managed. This is a 4-5% APR strategy underneath assets like Usual, and we expect steady positive growth.

Morpho is a strong competitor to Aave in that various people can set up lending pools with fairly complex allocations. The MEV Capital pool forcused around Usual has about $300 Million of assets. This yields 5-25% APR as an actively managed onchain fixed-income vault.

We like the investment profile, but there are complexities in the ongoing rebalancing and some controversy has surrounded Usual as of late relating to the redemption of its tokens.

BlackRock BUIDL Fund is a $1.7B tokenized money market fund. It will track treasury rates closely and provide a risk-free rate onchain. The tokenization is done by Securitize, into which BlackRock invested. You are welcome to invest in it, but the minimum is a $5MM check and there is somewhat heavy onboarding since you are touching the regulated financial world.

Pendle is a $4.5B fixed income protocol and has been a fantastic innovation after the initial DeFi cycle. It allows users to take a floating interest rate asset and transform it into a fixed interest rate asset. This, in our view, is a bit too complex for the average user. However, for people that want to dive in with spreadsheets, Pendle offers quite a bit of financial engineering firepower.

That said, there are clear things to avoid.

First, yield farming and rotating through high-risk chains and forks of various smart contracts is a bad trade-off these days. The chance to lose your principal for an extra 5% of return by selling airdrops is not worth it.

Second, extremely high-leverage and rebasing inflation games lead to tears. We have seen this happen with OlympusDAO, where the mathematics were so convoluted as to make it impossible to tell what was actually happening with the numbers. Thus, forget the financially engineered pyramid schemes.

And finally, stay away from algorithmic stablecoins backed by low-quality collateral, as was the case with the protocol token of Terra / Luna and its recursive logic. We are entering the phase of markets where stablecoins and bank accounts are going to be indistinguishable. Everyone, including Fidelity, wants to launch one.

There is no reason to expose yourself to unreasonable risk. Stay safe out there.

🚀 Postscript

Sponsor the Fintech Blueprint and reach over 200,000 professionals.

👉 Reach out here.Check out our AI newsletter, the Future Blueprint, 👉 here.

Read our Disclaimer here — this newsletter does not provide investment advice

Fantastic one. Would love more protocol deep dives like this. Maybe one on active trading strategies by LPs on various DEXes?