Is Plaid cheap at $5.3 billion for $500 billion Visa? +20 key Fintech developments

Hi Fintech futurists --

In the long take this week, I dig deeply into the $5.3 billion acquisition of data aggregator Plaid by $500 billion payments network Visa. We examine why this deal is worth 25-50x revenue, while Yodlee's sale to Envestnet was priced much lower. We also look at how Plaid could be an existential threat to Visa, and why paying 1% of marketcap to protect 200 million accounts may be a good bet. Broader implications for product manufacturers across payments, investments, and banking also emerge -- the middle is getting carved out, and infrastructure providers like Visa or BlackRock are moving closer to the consumer.

The latest key updates on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

Most of you have heard by now of the $5 billion monumental deal in Fintech between Visa and Plaid. Unlike the Fiserv and First Data deals last year, this is a much more forward-looking bet that requires a large incumbent (Visa) to buy into the story of one of the more expensive Fintech plays out there (Plaid). And yet, it is possible for this to soon become a real market comparable and reference transaction for years to come. Just as the Mint.com $170 million exit to Intuit became mana for entrepreneurs in 2009, a $5.3 billion exit will have similar repercussions for the decade to come. So let's get the basics out of the way.

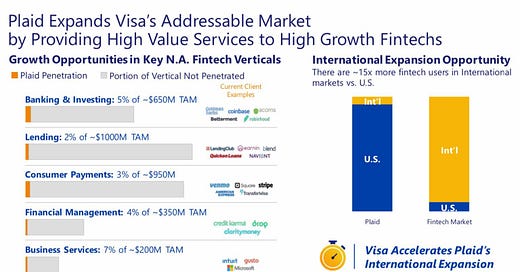

Plaid was founded in 2013, has revenue of $100 to 200 million, and about 400 employees. That's about $12 million of total enterprise value per employee! The firm also powers 200 million connected accounts -- give or take -- for a $25 value per account. I've written before about the $1,000 per-account values of the challenger banks, and the lead-generation value of companies like Credit Karma or Lending Tree. Just note the number of users and the valuations of the companies below, and you start to get a sense for what kind of user footprint a company like Plaid provides infrastructure (more in the FT Partners report).

Visa is looking to pay $5 billion in cash, plus $400 million in employee retention and performance in the form of RSUs. That is about 2x on their most recent private valuation (hats off to Mary Meeker). Given Uber, AirBnB, WeWork and other Silicon Valley unicorn bets are losing their shine, it is still somewhat surprising that Plaid's narrative has persuaded Visa. So what can we learn? Why is this company selling for 25-50x revenue, and not 5-10x as the Yodlee/Envestnet acquisition for essentially the same bet? What is the real product, and product strategy? Who are the customers? And most importantly, what motivates the acquirer?

Plaid provides use cases built on data aggregation, delivered through APIs. It sees nearly every bank and investment account in the US, and being the leader in the industry gives you 80% of that industry's value (i.e., it is good to be the best Justin Bieber, not the 53rd version of Justin Bieber). Plaid also used venture funding to design its revenue growth to look correct to an investor. It raised around $300 million, and spent it to generate several hundred millions of revenue back. Not to say that this is easy to do -- quite the opposite. But spending your war-chest on user acquisition in the correct way is pivotal. There are no years that are failing to perform on a revenue growth basis, which creates the impression that the team is executing on an exponential opporunity.

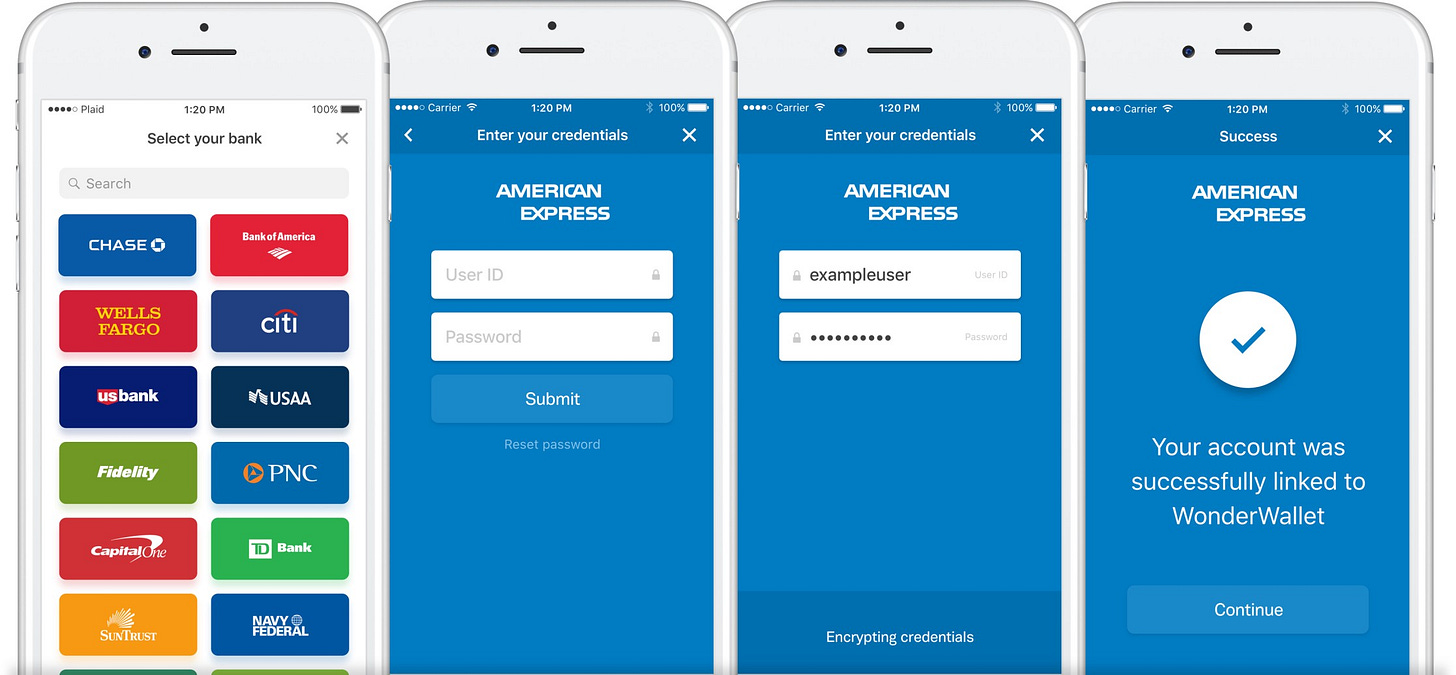

Second -- unlike Yodlee, Plaid leans into authentication and payments use cases. If you sign up for an account on a FinTech app, you likely link your bank accounts with Plaid. The company did not invent the tech, nor build the full stack originally — in fact they were 13 years late to the theme. Now, they also have personal finance management data, especially after acquiring Quovo. But the display of PFM information is absolutely secondary to the use-case of onboarding clients for Fintech customers. It's nice to be able to show your customers their networth statement, but your customers won't pay for this while costing you money. It's much better to use data aggregation to generate revenue through onboarding customers. This is a core takeaway. Attach yourself to the growth of others, and take a small piece.

Further, payments and lending are the most revenue-generating and optically venture-backable asset classes. It is easier to give people money than to take it from them. Thus lending can balloon to millions of retail customers lining up for free services -- with an unidentified default event several years out. It is harder to build a business where you get people to give you money to manage or bank. It is even harder to sell a venture story around a large institutional finance business, where you only have a few chunky customers that trust you.

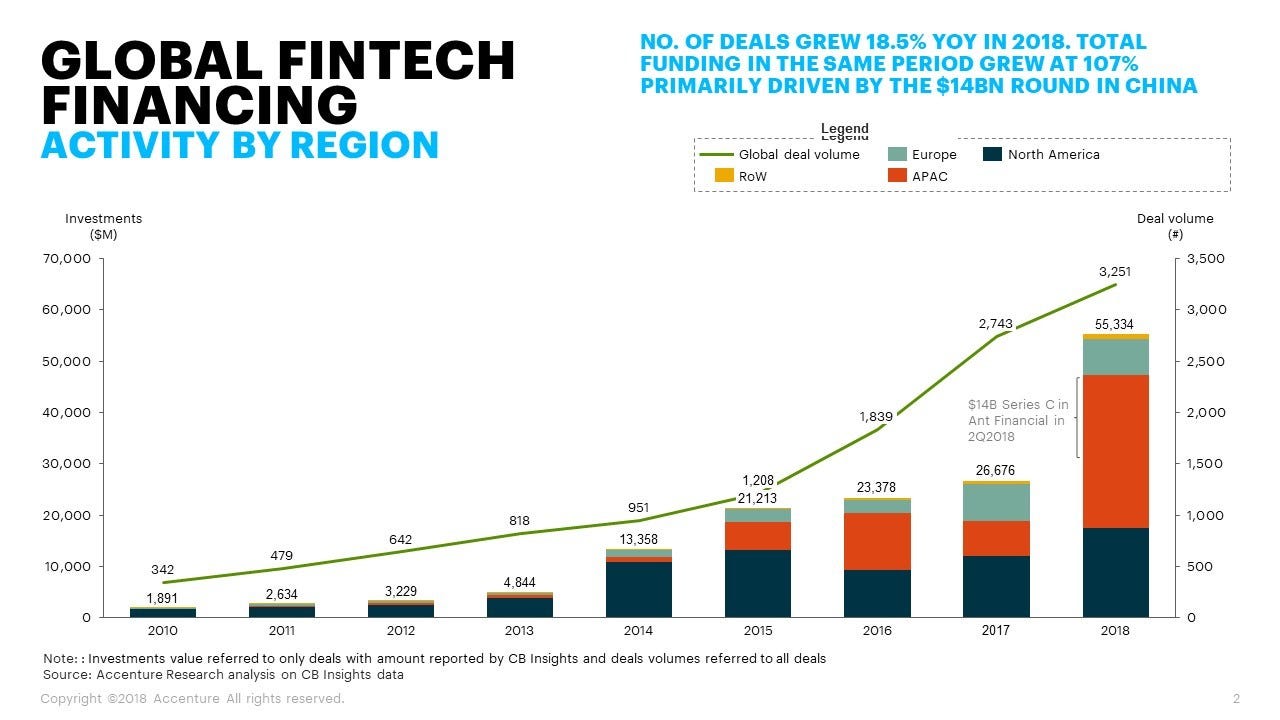

Given that Plaid aggregates consumers across payments, lending, banking and wealth, it was able to ride the wave of FinTech venture finding as a derivative. You likely have heard that the biggest beneficiaries of venture capital investment generally are Google and Facebook, where most young start-ups go to spend advertising dollars. For Fintech, the same can be said for the onramps into growing disruptors. This is also why companies like ComplyAdvantage are growing like crazy.

You can't just generically provide on-ramps, however. You have to provide them for the growth engines of each vertical. Plaid did this with customers like Venmo, Goldman Sachs (assuming Marcus), Credit Karma, Robinhood, Lending Club. As a result, they owned a small critical piece in the largest finance venture bets that exist. They got a free ride as usage of any of these particular clients picked up — and it is the industry’s imperative to not fail (not Plaid’s). Would you want to be exposed to the Goldman Sachs digital transformation program? Would you bet that every other bank will also undergo digital transformations, diversifying away idiosyncratic risk? The CAPM beta in this case is (1) Fintech venture funding, and (2) incumbent bank digitization.

Finally, let's talk about Visa. Visa is a $500 billion market capitalization company -- rivaling the size of JP Morgan and Bank of America. They understand network businesses, and why those are better than pure software-as-a-service businesses. Building a multi-sided network, which includes merchants, consumers, banks, regulators, and global complexity creates an incredible barrier to entry and a profoundly defensible revenue generator. All you need to do is for users to generate economic activity between themselves, and take a tiny cut. The Visa model relies on human nature, not the quota of your sales people.

Unlike Yodlee, Plaid was adjacent to payments. Once you have aggregated 200 million logins and can cause money movement between bank accounts, you become a de facto payments network. In Europe, the PSD2 directive mandates that all banks open up their APIs to allow both information aggregation and money movement by licensed third parties. In the US, we are still trying to crowbar information out of the banks through screen-scraping. But the direction of travel is clear -- data is money, and the bots will move it around.

With naive math, 200 million Plaid accounts divided into 3 billion Visa cards is 7%. Individuals might have several cards, so let's say 10% of Visa's payments relationships are at risk. Paying $5 billion out of a $500 billion marketcap to get rid of this competitive threat means putting up 1% of your value. Therefore, if Plaid had a 10% chance to pull away a Visa payments relationship into a "Pay with Plaid" relationship, then the deal makes financial sense.

Do you think this Visa user experience will last very long against the Plaid user experience below?

In short, Visa removed an existential threat. Whether or not Plaid could have grown into the existential threat, or whether it really is worth 25-50x its venture-fueled revenues, is certainly debatable. But we have good takeaways regardless.

More generally, we can observe that it is the financial product manufacturers that are moving closer to the consumer experience. In this case, Visa is the payments product itself. With Plaid, it can disintermediate its distributors -- the merchant acquirers, the consumer banks, the payment processors -- by getting closer to clients. Paying for something is the value, not who brokers you to payment. Similarly, in roboadvice, it is the asset managers like BlackRock that found the B2C technology valuable, not the brokers who intermediate the consumer to the investment product. Increasingly, we will see the middle getting squeezed and automated away. Perhaps the neobanks will get acquired by the core banking processors, or Facebook's Libra. The digital lenders could be bought by the hedge funds and private equity firms that invest the underlying capital. At least until everything falls apart and unbundles again.

Key Fintech Developments

Fantastic Challenger Banking research report from FT Partners -- must read. I would paste in all the charts if I could.

Google Pay co-founders raise $13.2m to build neo-banking platform and Neobank Tonik Is Planning to Launch an All-Digital Bank in the Philippines After Acquiring License

ThinCats Milestone: Online Lender’s New Loan Number Doubles Almost to £200 Million

More Than Half of Financial Advisors Want Better Regulation Before Investing in Crypto, an article summarizing the fantastic Bitwise research report. Simiarly, all the charts.

Major Spanish Bank, CaixaBank, Added The Blockchain-Powered Finance Platform We.trade To Its List Of Services and Thai Bank, SCB, Launches App For Instant Cross-Border Payments Powered By Ripple

Sacramento Kings Launch League's First Live Blockchain-Powered Auction Platform for Authentic Memorabilia with Consensys and Treum and DeFi10 Part 1: Lessons in Building a DeFi Portfolio

Quants like boasting that sophisticated models power their trading strategies, not humans. But the models, it turns out, can be as varied as humanity and David Vogel, a pioneer in using machine learning to trade, is seeking $1.5 billion for a new fund that will analyze big data to find investments linked to climate change.

Customer Support Chatbots Improve Sales and How Intelligent Virtual Assistants Help Brands

Procurement AI Tackles The Drawbacks Of Sluggish ePayments Adoption

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime