Lessons from Uber's JUMP bikes on evolution in capitalism, Facebook's crypto money monopoly, plus 13 short takes on top developments

Hi Fintech futurists --

Today the long take focuses on a local discovery I made walking along the street in London. Uber's bright JUMP bikes are in, and I see two fintech implications as a results -- online marketing strategies spilling into the urban environment, and the impact on payments from Facebook's Libra crypto currency club. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

A neon red bike pulsated at me this weekend with its color. It yelled at me with its branding. Its metallic cartoon body splayed across the sidewalk, proudly beaming the letters JUMP into my retinas. So I had to look -- good luck not seeing this thing! The object is designed in ALL-CAPS.

What is this contraption? Simple -- Jump is an electric bike that is being distributed by Uber, and it just happened to be launching 350 of them in the London borough of Islington. You can rent a bike for 5 minutes at £1, and pay £0.12 per minute thereafter. That's generally cheaper than a taxi, on average more expensive than a public bike subscription. So why am I going on an on about these bikes? Two things come to mind as jumping off points for deeper discussion: (1) the incentives and tactics of economic organisms under capitalism to gather and retain attention, and (2) the monopoly powers of Uber and Facebook, leading to the impact of Libra's cryptocurrency on open competition, as well as the public responsibilities of supra national corporations.

Let's take the former easier point. Evolution is a law of nature. It creates constraints on the biological organisms populating planet Earth, discarding those that fail to reproduce and sustaining those that pass on their genes to the next generation. There is no normative judgment in this process -- it can create amoral teeth-stacked monsters built for dominating environments (e.g. sharks, tigers), and it can also create high intelligence poets that make art as a byproduct of reproductive display (e.g., bowerbirds, humans). Capitalism is a similar economic constraint, discarding companies without traction and sustaining those that generate cashflow engines with more clients. But when there are so many organisms, it is important to stand out. One simple tactic is to become garish -- brighter, louder, unmissable.

You think your designer discovered that loud colors are effective? Ask peacocks and flowers what marketing firm they hired! Humans have copied these strategies ad-nauseum. See for example, the signage of a Brooklyn bodega or Las Vegas at night. Unstructured visual noise meant to capture attention is a sign of bad systemic design -- nothing fits in, everything sticks out, there is no public interest but for yelling loudest.

JUMP's visual identity is the equivalent of a Facebook notification on a crowded grey cityscape. Check out the pictures below for the illustration -- it is a truly ingenious and sneaky approach to behavioral design. First, because the frame of the bike is much larger than normal due to the basket and the electrical wiring, the bike has a bigger advertising footprint than something like a Santander or Citi bike. Talk about getting value for sponsorship dollars! Second, the color sticks out like the red alarms we all associate with a dopamine kick from our social media and smartphone interactions. Sneaky, sneaky, sneaky! The object cannot remain unnoticed.

So one shallow comment is that there are rules against this kind of thing -- people do not want to live in a garish jungle. Urban planning comes with zoning and design guidelines, built through open political process, to make sure that things fit into the built environment and do not aggravate locals. Breaking such rules creates a minor, but persistent advantage to the rule breaker. Otherwise, there is good chance that locals will take scooters, bikes, and other neon-colored venture-backed objects and toss them in the river.

Public transportation is the counterpoint. When you optimize for maximum customer gathering and shareholder value, you get advertising all over your city. When you optimize for broad, public provision of transportation, you get drab, unhappy, clunky services available to all. The stereotype is that since public services do not need to compete in capitalism, they are poorly managed and not innovative. I wonder what set of incentives could tone down the customer acquisition peacocking, while retaining positive unit economics!

Let's focus now on the more difficult discussion -- how JUMP interacts with financial products. If you walk up to the bike and look at its handles, you'll see an embedded computer unit (I assume that's what it is) that performs a couple of functions. First, it has a screen and GPS, allowing the bikes to be self-locating Internet of Things objects on a fold-out electronic map. Second, the activating lock and power button are connected to the Internet. As a user, you scan the QR code that identifies the bike in your Uber app, and agree to start the payment cycle. The usage measurement is carried out by the bike itself, which is associated with your Uber account, plugged into multiple payment channels.

Today, those payment rails are going to be connected to the debit or credit card entered into your account. And surely, Uber and the rest of the Silicon Valley machine care very strongly about user adoption and reducing conversion friction. But I can imagine how Facebook-backed global crypto stablecoin Libra could quickly become a default payment method in the app, especially if it makes the onboarding process faster. Perhaps scanning the QR code on the bike not only associates the bike to my app, but also immediately triggers the payment transactions from some particular wallet. Already, similar consumer behaviors are practiced by users of the Asian super apps, WeChat and Alipay.

I hate getting stuck on Facebook, as it makes much of the Fintech and Crypto industry reactive rather than innovative. But it is important to say -- this is what monopoly looks like. No matter where you are in the world, no matter what product you touch or purchase, the answer will always be the same -- Facebook. I will select you as my Facebook contact, call you on my Facebook app, using my Facebook phone, paying for it with Facebook currency, recording it on Facebook cloud, watching Facebook advertising, etc, etc. While that's a rhetorical flourish, you could make the argument that all the companies in the crypto circle below are winners of the Web 2.0 generation and their investor set. Sprinkle in the words Google, Uber, and Apple, and the approximations becomes accurate.

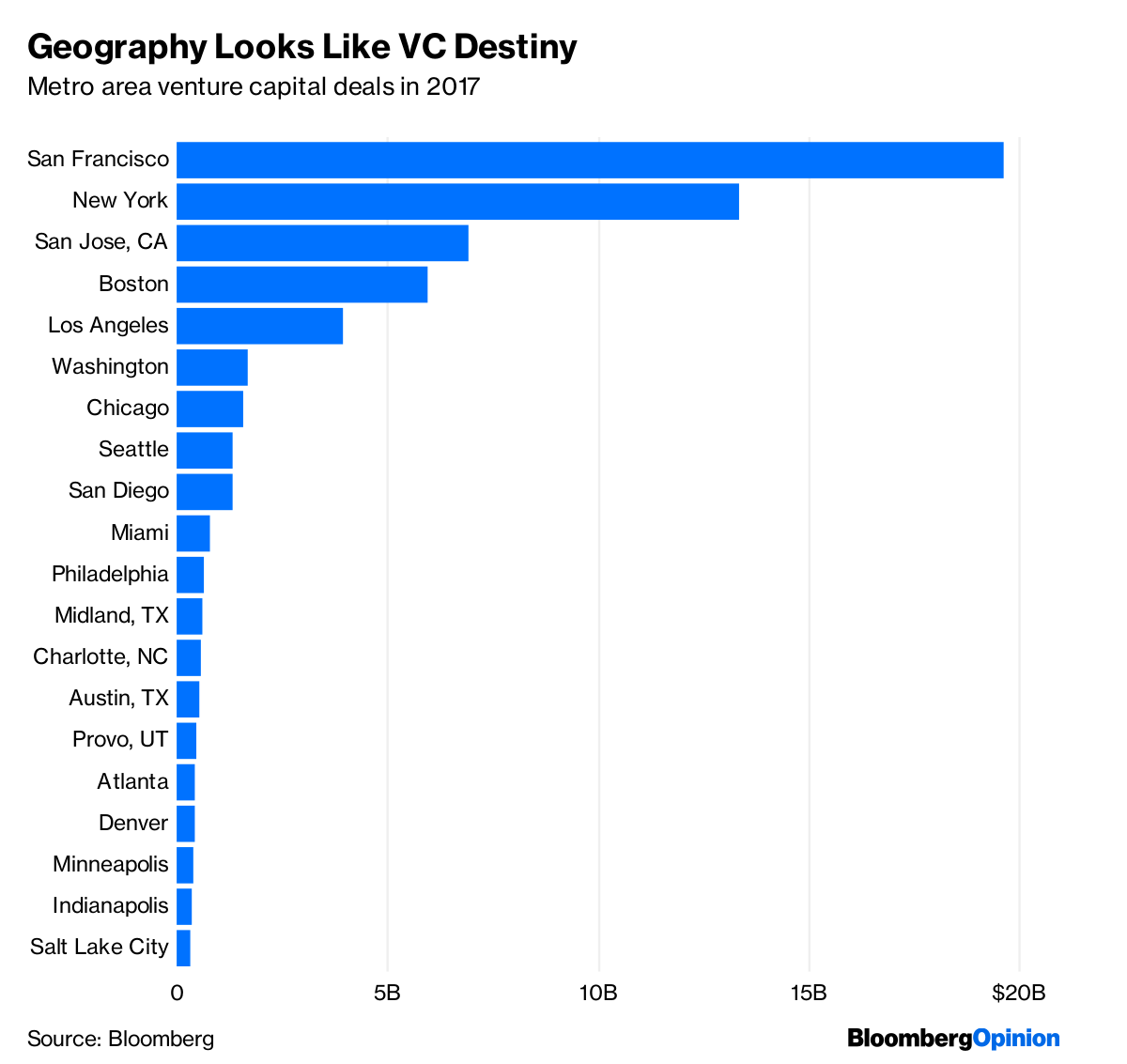

It doesn't take a genius to figure out how the club works. But that's all natural, in the sense of economic competition leading to asymmetric gains to the winners. Power laws and compounding interest are the two building blocks of why our world looks the way it does. Power laws suggest that 80% of the value is generated by 20% of the players, and in the world of the Web, that is only increasingly so. Pewdiepie has an order of magnitude more Youtube/Twitch subscribers than his 1000th best clone. And compounding interest repeats this game over multiple periods, such that winners keep getting ahead of the losers. The Internet investing game is 30 years old -- a lot of time to build unfair advantages for USV, Sequoia, and Andreessen. Yet unlike in biological evolution, the economic organism does not die. Perhaps if you look at this as intra-species competition, the picture starts to come together.

In the abstract, I have no issue with good companies making great solutions. But take, for example, something like Ripple. You don't have to be a fan of Ripple or XRP to recognize the following. First, Ripple was the first to fully think through how blockchain applies to the $250 billion revenue world of international business-to-business payments. They built an enterprise solution, RippleNet, to take on SWIFT and champion new payments rails. They developed a separate liquidity pool, XRP, to maybe one-day be the slush fund that connects the enterprise solution with global crypto capital markets. While the confusing link between the two in their messaging, their abusive Twitter presence, and various legal issues are all black eyes for the company, you have to admit they've done some pioneering work.

Facebook's Libra is the worst thing that can happen to Ripple on the consumer front. Unlike XRP, Libra will be collateralized with mountains of fiat. Nobody has to formulate a memetic belief in the currency for it to hold value (as they do in XRP). Instead of waiting for a pool of money to float on the capital markets to multi-billion marketcap value, Facebook can solicit and coordinate the funding of a multi-billion dollar financial asset. Worst case, Zuck can do it himself. And on the other side, JPM Coin (and separately Finality) is the worst thing that can happen to Ripple on the enterprise side. The banks have learned from their various consortia, and moved to support their industry position with proprietary solutions. This is what coordinated oligopoly looks like. The pioneers are pushed out by incumbents, thank you very much.

This is not new ground, and we live in a world full of highly functional, useful monopolies. These monopolies do not look like the JUMP bike, nor can they. They have learned to be invisible, boring, and cheap. Visa and MasterCard do not need to declare themselves to the world; they already have us in their pocket. The rents we pay them are too small to create revolt, but large enough in the aggregate to maintain strategic position. Peacocking is the worst strategy for the monopolist, as it goads the political power of the sovereign. Liz Warren's presidential campaign, and its desire to break up Big Tech, illustrates exactly why it may be better to be invisible. Facebook's entry into money -- a key pillar and enabler of the Nation State for centuries -- puts a target on their head in neon red colors.

I do want to end on a higher note, and that is that I think there is an aspirational solution. Today, Facebook is the world's largest social collection of people across its properties. Yet it behaves according the natural laws of the stock market. It is playing within the constraints of maximizing shareholder value, which leads it on profit maximization adventures across industry and the world. But it doesn't have to be governed according to these rules. We all need electricity. We all need telecommunications. We all need social identity and digital lives.

A utopian borderless nation with its own currency could be successful -- but it needs to be run like a society, not a dictatorial corporation. It needs to have participatory governance by its people, a clear social policy goal that advances the well-being of its citizens, and the provision of services and security within its borders. It needs to worry about life, liberty, and the pursuit of happiness for those poor, huddled masses yearning to breathe free, the wretched refuse of the teeming shore. Not about the legacy of its oligarchs. Can Zuck get us there?

Short Take

New neobank to list on the ASX and challenge the Big 4 ASX banks and Revolut launches in Australia. The approaches that Fintech is taking banking and investments is global, and you can see this with Australia becoming the next battleground after UK/Europe, US, and South America. Asia is messaging and payments first, but Facebook is getting there.

U.S. Bancorp aims to catch first-time investors with changes to robo advisor. The changes include cutting price from 50 bps to 24 bps, and the minimum from $10,000 to $5,000. The traditional business has $9 billion in AUM from 36,000 clients, which to me means they have no idea how to go after mobile-first Millennials. Same as JPM shutting down Finn, because the app is no compelling vs. fintechs, and no value proposition other than channel marketing exits.

When is a fintech too big to be bought by a bank? Haha, you thought you were going to sell your multi-million user finance mobile app for billions! Look first at how much cash your acquirer has on their balance sheet.

Digital Asset Partners With Amazon AWS Aurora on Smart Contract Language Interoperability. DAML is a programming language for smart contracts that was acquired by Digital Asset a few years back (see Elevance), and it has a stricter coding approach than Ethereum's Solidity to building financial instruments. Broader adoption implies more digital manufacturing, and an increasing number of entrants in the space will be launching security offerings.

Roll Wants to Take Power From YouTube With Cryptos for Content Creators. A $1.7 million round in a company that I've spent time advising, with the core thesis that influencers will be underwriters of their own social currency, and that the fundamental value of that currency is tied to things the influencers will do. It's a more narrow, and perhaps focused, play of what Voice and DLive are trying to accomplish.

Circle to sunset payment app, continue advancing vision of crypto-based payment solutions using fiat tokens. This is the first of the fallen as a result of Facebook's Libra strategy. Watch as crypto payments becomes all about stablecoins.

Ubisoft May Soon Have Ethereum In-Game Items and Blockchain Games. Super important. There are lots of startups trying to do this, but a big existing gaming footprint is a better strategy. And if you tokenize game items, you create raw digital finance and associated virtual exchanges.

AI Can Now Detect Deepfakes by Looking for Weird Facial Movements. Machines can fake videos of people saying and doing things they have not done. Compliance teams will need software that is able to detect whether such visual information is falsely created by a neural network -- and this is a start.

Teaching artificial intelligence to connect senses like vision and touch. Now that some machine senses are as good as human ones, connecting them into a more holistic whole is the next step. It creeps me out, but so do a lot of things these days!

MTN Group launches Africa’s first artificial intelligence service for mobile money. MTN has 230 million subscribers in over 20 countries, and Africa is famous for leveraging Telecom infrastructure for mobile money. Chatbots have been mere curiosities in the West, but it will be interesting how this approach performs given a new geography.

London-based insurtech start-up Zego raises $42m to fund European expansion. This is a 3-year old company hitting the product-market fit sweetspot in emerging Fintech. Zego offers commercial car, bike, and scotter insurance to Deliveroo and Uber employees, tracked by the minute -- a combination of insurtech, mobile-first IoT, and the future of work.

CSAA offers digital cameras to clients to boost claims experience. You've got a video camera on your car. If you get into an accident, the camera sends video to your phone, which is prepared to upload that into a claims management app. Another interesting take on how real time data can change the nature of risk, and the workflows around it.

Harry Potter: Wizards Unite bests Pokemon Go every way but one. The folks that brought us Pokemon Go have launched their latest augmented reality game. If this one replicates the success of its predecessor, we can start seeing more digital commerce flow through mixed reality channels. That's a big *if*.

Looking for more?

Fresh website here, and LinkedIn over here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.