Long Take: Acquisition arbitrage between public and private fintech revenues, highlighted by Figure and Starling

Hi Fintech futurists --

This week, we cover the following:

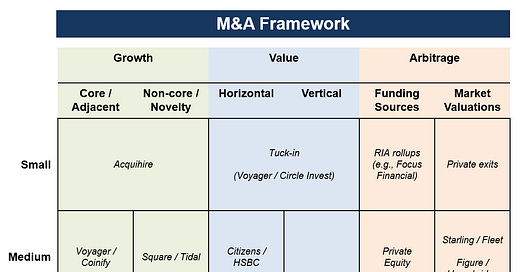

Thesis: In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, …