Long Take: Amazon/Goldman partnership, TikTok banking license, and Ethereum fintech through the lens of Aggregation Theory & Super Apps

Hi Fintech futurists --

If you are in finance and only looking at banks, you are missing out on the real change agents. Here's some cross-industry action that we will unpack this week.

Amazon selected Goldman Sachs to be the lender of choice for small business loans. TikTok maker ByteDance is working with a Singaporean business family to get a financial license. And small business bank Starling is integrating Slack, energy switching service Bionic, and health insurance provider Equipsme into their marketplace. And we might as well talk about the Plaid Exchange launch, and end on the computational economy of Ethereum.

You can get more content like this in your Inbox for $3 per week -- the humble price of a delicious Fintech coffee. For exclusive analysis parsing over a dozen frontier technology developments every week, become a Blueprint member below.

Long Take

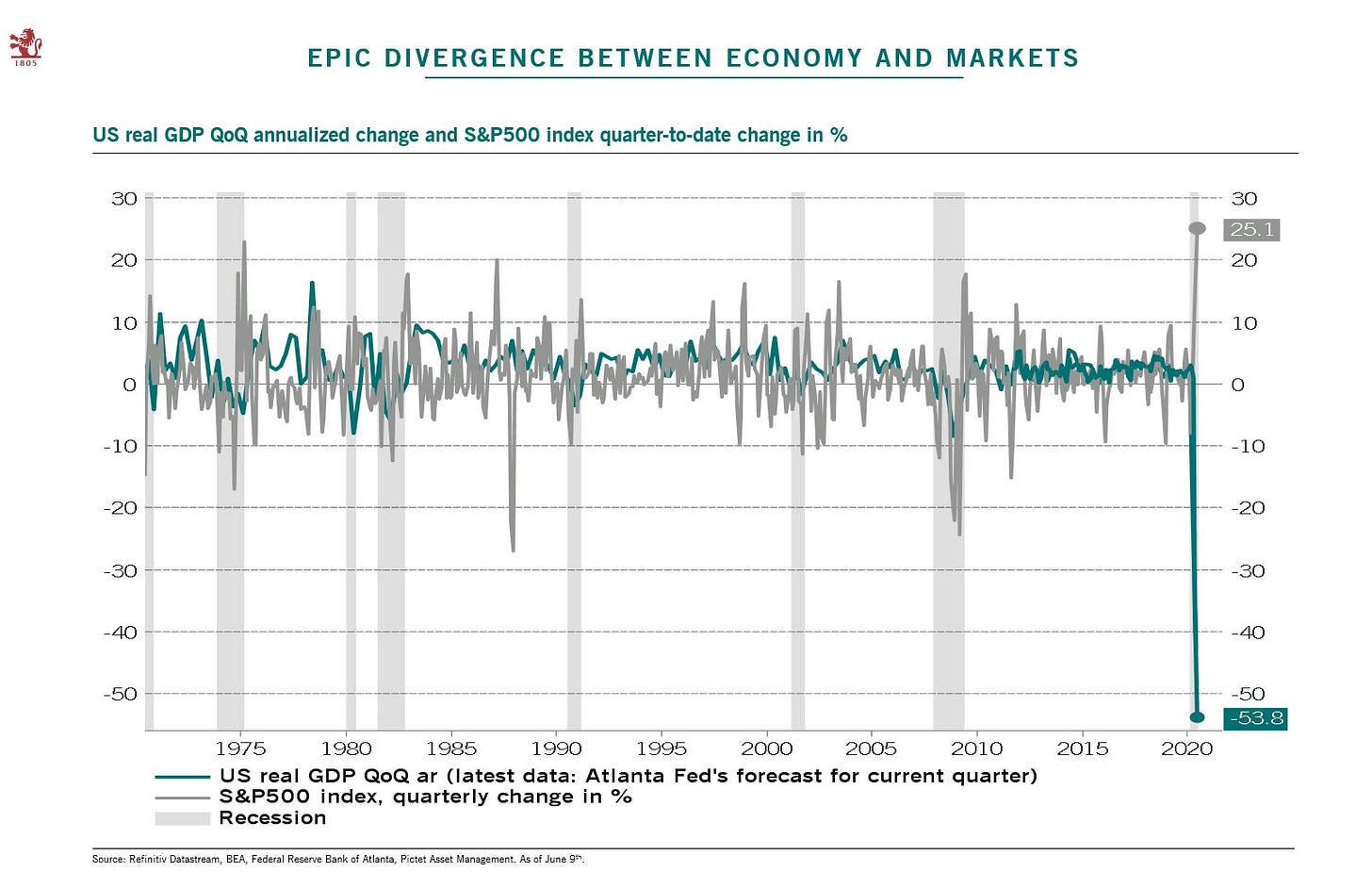

Let's start off acknowledging the truly bizarre Wizard of Oz world we inhabit. Take a look at these charts:

GDP down 50%, US monetary base up to $7 trillion, M1 velocity way down (i.e., not being spent), stock markets rallying, Shiller PE ratio (i.e., price to earnings for the whole market) still in crazy territory.

I mean, maybe I don't know how the money machine works. Maybe nothing matters. Maybe there aren't protests and riots in the streets signifying systemic change. Maybe everything will always stay the same in beautiful Oceania. When our financial systems are trying so hard to stay the course and pretend everything is gonna be OK, where are we going to find the change agents? It won't be the government, and it won't be the banks. Pay attention to the outcasts, the revolutionaries, and the philosophers. Our mountain will crack.

Super Apps, Financial Features, and Aggregation Theory

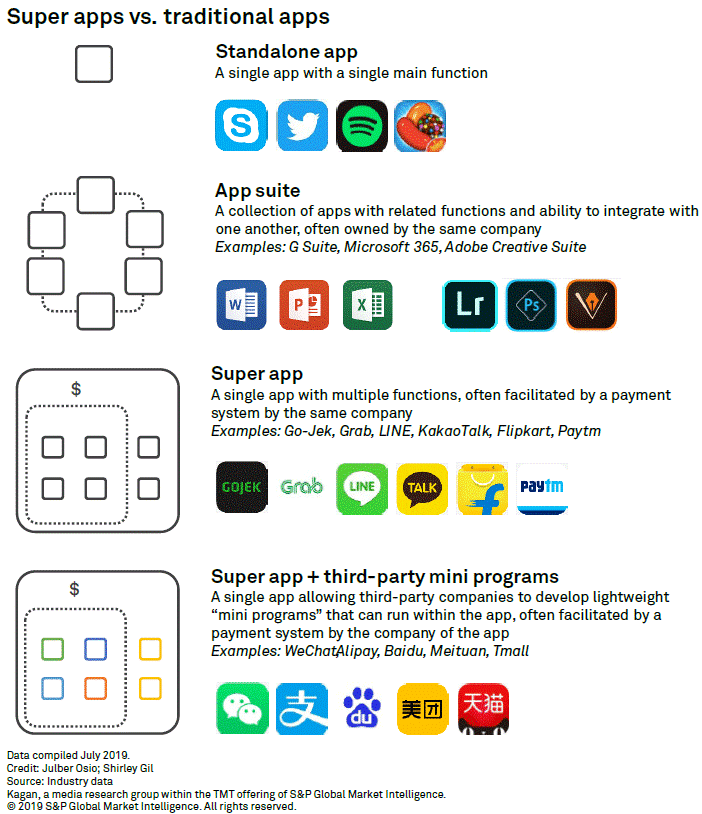

I've framed this in many different ways before, all dancing around some version of Ben Thompson's aggregation theory. The core insight is that value chains in a digital world transform from being vertically packaged conveyor belts into a particular niche or use-case, and instead become attention wormholes that pull in users and customers into AI-moderated platform, that then selects which underlying products are presented and implemented for the user. This maps well onto things like Amazon, Facebook, and Netflix.

Another way to say the same thing is to highlight again the Eastern super-apps of Paytm, AliPay, and WeChat. Instead of being the best application for chatting or for payments, the application becomes an operating system that subsumes the other functionality. Like some Fintech octopus, the app throws its tentacles into travel, meals, movies, and transportation, and pulls in their capabilities internal to the core.

What's interesting to me is not that some center of gravity is able to pull other developers into its orbit. Facebook had a marketplace for integrated apps. Windows had a marketplace for integrated apps. That now Amazon, and Baidu, and Uber, and Starling all want to have a marketplace for integrated apps is not the key. What is more fundamental is the center of gravity -- *what* exactly is the core service around which everything else rotates?

We humans are lazy. Give us a quick button to install Farmville using an AI scan of our face, uploaded immediately to Cambridge Analytica and the US government databases, and we take the deal 100% of the time.

Apple and its hardware are, without any debate, one such core center of gravity. Not only has Apple solved the impossibly difficult question of building a mobile operating system, but it has solved the friction points of identity and payments. The phone is important, because it correlates with a human user that can participate in economic activity. The marketplace succeeds, because developers can authenticate and charge users, and have an enormous target audience with unlimited digital demand.

Facebook has done this too, but with weaker advantages. A social network is not, by default, a commercial marketplace. Still, Facebook built out developer tools, including payments and identity, as well as a variety of venues for trading and exchange. I would argue that identity is any social graph's strongest advantage, because it de-risks the transaction and makes the adoption of economic activity easier. Buying and selling within a walled garden feels safe, and is an easier problem to solve than the stranger-to-stranger challenge of contactless proximity payments, or the adversarial presumption in crypto-native system of Bitcoin or Ethereum.

If we look at Amazon, the core gravitational object is E-commerce. It always feels weird to type out that word, with its Web 1.0 history, surviving into a multi-trillion dollar behemoth. E-Commerce. People and merchants come to Amazon for shopping, and get its integrated robot warehouses, value chains, cloud infrastructure, and financial products as a corollary. Similar to how Spotify packages (essentially) all music in the world for just $10 per month, Amazon's Prime members get an all-you-can-eat subscription package of online shopping. We can talk about Shopify and Stripe as iteration on the same theme, but let's stick with Amazon.

Amazon has aggregated demand. It has built a super-app of everything that touches small business along their entire lifecycle. They feed, clothe, and shelter the small business in a massive marketplace. And to this diety, even Goldman Sachs will bow to gain access. In recent news, Goldman's Marcus won a coveted spot to provide a credit line to the businesses in Amazon's ecosystem. The loans will have a rate between 6.99% to 20.99% and extend up to $1 million. Note that Marcus is growing very well -- even refusing new customers in the UK after hitting a regulatory speed bump of £25 billion. But what Goldman understands is the role of capital in an ecosystem, in a super app. That role is to be the oil and to flow around the core center of gravity, rather than try to define it.

Notice that so far in our discussion of Western packaging, the core value around which things orbit is not finance. It is also not transportation or food -- no matter what Uber or Deliveroo or WeWork want you to think. Marketplaces have not accrued to those players in a way that transformed the other industries. Instead, the crown is with media, entertainment, and consumption, and the hardware on which those run.

When is Finance the Core?

I mentioned earlier that ByteDance, the $75 billion company behind social media sensation TikTok, is working on getting a banking license in Singapore according to the FT.

Why should this company be a bank? What is the underlying motive?

Let's take another look at the interface for Alipay --

It's just a set of links to other services, isn't it? This payments experience is not about activating a payment (e.g., Venmo, Cash App), but about the deployment of a payment to get a real world outcome. It is one step further on the ladder of commercial intent, and it removes friction from the transaction by bringing along with it authentication, identity, and money movement.

Is a super-app an operating system like iOS? Or is it a browser, like Chrome? Or is it a social identity like Facebook? Or is it a digital wallet like MetaMask for Ethereum?

Yes. It is all of those, because they are all the same.

TikTok wants a bank license to deploy capital into its gravitational core. Maybe it will make it easier for consumers to shop on credit from the brands in the TikTok network. Or maybe it will power payments between creators. Or maybe memes are the currency of the 21st century, and they will accrue earnings and interest through digital assets. Regardless, adding finance into the media business shifts that business from a video site to a commercial wormhole with modern barriers to entry. Barriers to entry that make even Goldman Sachs ask for permission to participate.

Financial Aggregation Way Forward

Often, however, this reasoning by analogy gets people into trouble. Take for example the UK neobanks -- Monzo, Starling, or pick another Fintech unicorn. One of the arguments for continued loss making is that bank accounts can be distributed at a marginal loss, but when the app reaches a sufficiently large scale, then monetization will come from rent-taking from a bolted-on marketplace. This did work for Ant and Tencent, but they started with profitable, in-demand payment businesses for a daily need, rather than a venture-backed customer acquisition game.

Starling just announced adding Slack and a slew of other business-oriented tools on its own marketplace. The benefits of being included are a well-connected set of APIs to the technology providers, so for example, your bank data is seamlessly connected and updated in the associated app. Will developers make things *only* for Starling customers as a result of these APIs and a 150,000 SME audience? Maybe in the very, very long run.

Note that Amazon selected Goldman as a partner, rather than power a lending marketplace of multiple partners. Amazon has a marketplace for its core value proposition -- shopping. The embedded finance features can be proprietary or managed through a designated partner. Alipay's core value proposition of paying for some value-add (vs. paying in the abstract) also suggests a marketplace of services to be purchased. This logic would imply that neobanks should power a marketplace that is competitive with their own capital provision, in order to build a customer-centric financial attention destination. They don't, other than perhaps Curve.

Another example is the Plaid API exchange. I found it a fascinating short take previously. While in the past, data aggregators would try to "break in" into bank data by screen scraping based on a user's name and password, there has been a reversal of fortunes. Plaid is offering a structured API service to banks, which essentially will upload bank data into Plaid and then download it into other banks that sign up. When your network reaches a certain critical scale, the power dynamic flips.

Alternately, we can look at the VISA network (Plaid's owner) as the core of a particular banking operating system. A large portion of the banks in question issue cards that use the VISA network for money movement, which means that they develop and distribute financial product using VISA's tooling. VISA also supports corporate identity, the way Starling is capturing the identity of the small business, and your iPhone scans your face with AI before installing Candy Crush.

Is there such a thing as decentralized aggregation?

Let's say Plaid is trying to reformat and standardize the existing financial industry. But we also now have Ethereum, which is a computational architecture for financial transactions, property rights management, and digital economic activity. Let's pull on all of our previously discussed strings. The core gravitational pull of Ethereum is some combination of crypto-native economic exchange (i.e., Amazon, Ant) and a hardware/software combination to run applications (i.e., iPhone).

Unlike iPhone software, Ethereum nodes can run on many different type of devices, and therefore are harder for the average person to use than a tightly packaged consumer device with an embedded OS. Interacting with crypto-native software requires a particular type of wallet/browser hybrid (e.g., MetaMask, Brave), but this software is also kind of like AliPay or Apple Pay. It comes with a built-in ability to pay and a pseudonymous identity. It also comes with a financial economy of users: 100 million accounts, 300,000 developers, and 200,000 decentralized finance investors. No surprise people keep writing software to reach this audience.

I am still a bit fuzzy though in trying to develop the right intuitions. Is Ethereum's killer feature the ability to pay for things with native currency ETH (or in a USD equivalent, collateralized by ETH)? Then the marketplace of competing financial service providers makes a lot of sense, deepening the capability of the platform. Media, entertainment, and social networks would all be a distraction at this moment of development.

Or, is Ethereum primarily a computational platform across use-cases, and therefore needs the broadest application stores available? Perhaps, but then technical requirements differ by industry and could slow development to a crawl. Text messaging and high frequency trading are quite different from wholesale payments and insurance underwriting in throughput and privacy considerations.

And further, much of the crypto-economy is designed to resist aggregation theory. Value is not intended to accrue to the consumer access point, but rather to the asset holders within particular networks. If you are interacting with a decentralized trading app, for example, access should in theory be free, perhaps incentivized through some token reward incentives.

One could argue that the whole thing is an open marketplace, with identity, payments, data standards, and APIs available out of the box. Are the tools of modern tech companies sufficient without comparable customer footprints? While we don't yet have the final answers to these questions, we do know to avoid the failure modes. We need crytpo-native economic activity to blossom in these networks, and an unassailable core human need to be solved by the beating of their digital heart.

Looking for More?

Get more content like this in your Inbox for $3 per week

Want to pay back another way? Share this write-up on social media!