Long Take: Apple's augmented reality leak, and what Fintech should do for the coming Multiverse

Hi Fintech futurists --

There's lot of good stuff happening. Some great Fintech progress, with social impact neobank Aspiration raising $135 million, the DTCC moving forward with a large blockchain project, the French central bank working with SocGen on a EUR 40 million bond issuance on a blockchain, and Silicon Valley credit card issue Brex raising $150 million. But it's a bank holiday, so let's leave the work stuff for the Wednesday short takes. If you're not yet subscribed to that distribution, check it out here.

This week, let's dive into the Apple augmented reality glasses leak, the Magic Leap $350 million financing, and the uncanny imagery created by Epic Games' Unreal Engine. We summarize and pull apart the thesis of the Metaverse -- a virtual world as realistic and economically important as our own -- and how media and financial companies should think about the opportunity.

Long Take

Reality is shifting.

As we build more performant machines, polish our computational engines, and deepen our mathematics, human imagination is conjuring new worlds into existence. These worlds are more beautiful, realistic, and engaging than ever before. Take a moment to watch the video below (from about the 1 minute mark).

If you don't have the time, just look at this screenshot of real-time rendered gameplay.

That's not a photograph. It is a simulated world built in the latest version of the Unreal engine. The Unreal engine powers thousands of video game worlds with its physics, light, character models, and other infrastructure. But not only does it power video games like Fortnite, with its 80 million Gen Z players, it also increasingly powers Hollywood and the rendering of special effects.

Did you watch the show Star Wars: The Mandalorian? It kicked off Disney's Netflix competitor and drove hundreds of millions of views. But for the actors, it was also entirely rendered in the Unreal Engine. That's right -- the whole set was modeled on a computer. With a little bit of handwaving, we can say that the entire show happened in what-used-to-be just a video game environment.

There should be no difference in the future between interactive (games) and scripted (movies) rendered worlds -- they are just places where we can experience story. Imagine taking a virtual reality stroll through any of your favorite films and interacting with the characters from The Avengers or Harry Potter. Not like, a simple copy of those movies, but literally the exact worlds that these characters inhabit. And it's not just the fantasy shlock we are talking about. The next Godfather and Citizen Kane are made in the same way.

As a reminder, here is what these reality "engines" looked like 30-40 years ago. The first screen below is a selection of 1980s arcade games. The second screen is from Who Framed Roger Rabbit, a 1988 movie that combined animation with film. As you can see, we've come a long way to merging reality to better visual models.

I would argue, we have actually come to the point that the human mind is not able to distinguish the difference between modeled visual information and actual visual information. It is possible that, at least for environments, we are on the other side of the Uncanny Valley. But we are getting there for faces too, using some combination of artistic direction, 3D scanning, and neural networks. These technologies will continue to merge to the point of us being completely unable to tell reality apart from fiction.

Here is a set of faces rendered by the next generation of Unreal.

Here is an artificial news anchor rendered for a Chinese news agency. Some room for visual improvement, but already a committed worker.

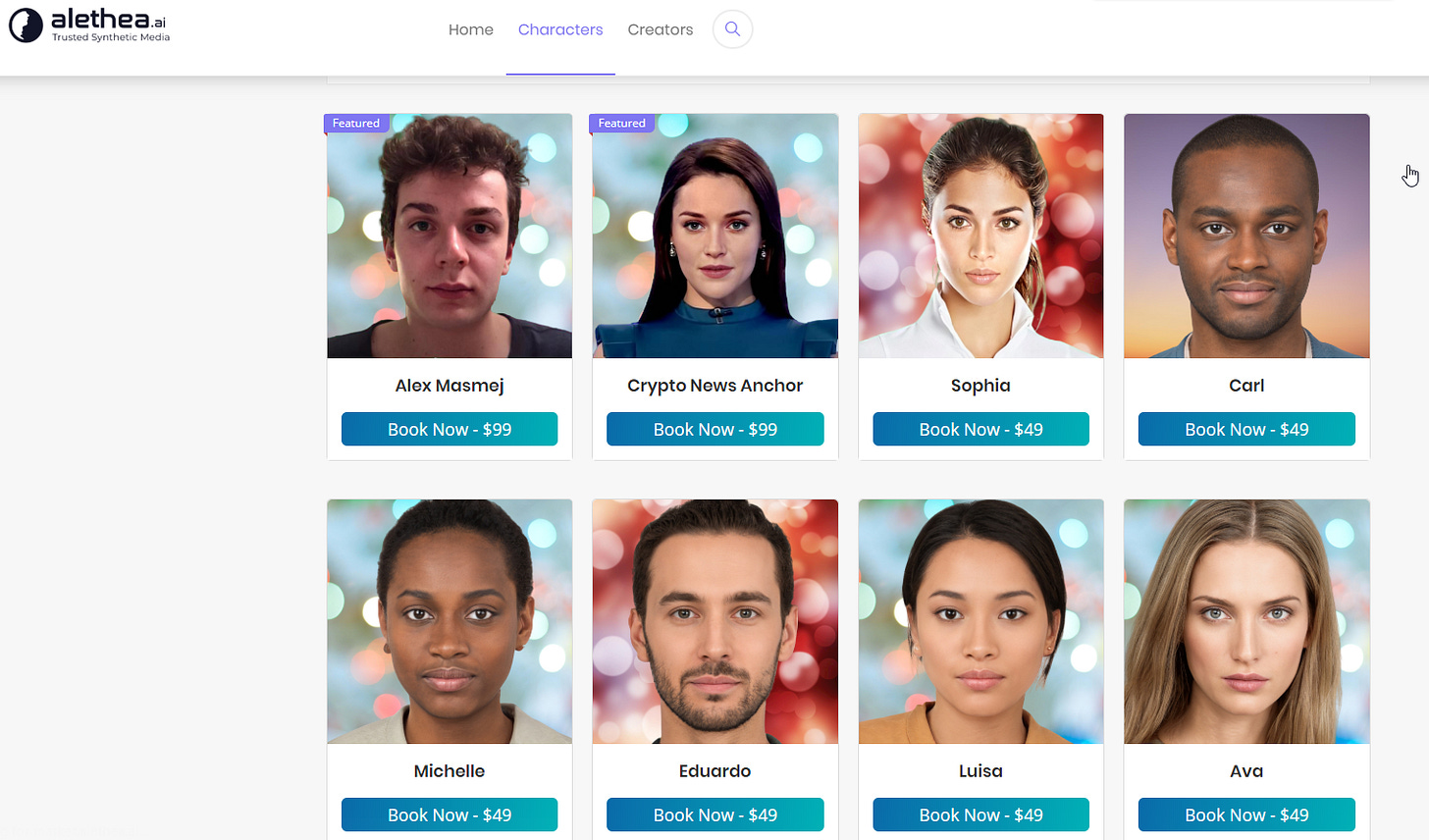

And here's a set of rentable neural-network generated faces, that largely are hallucinated from the mathematical spaces between real people. The AI company Alethea will gladly rent you a synthetic replicant.

The Virtual Media Empires

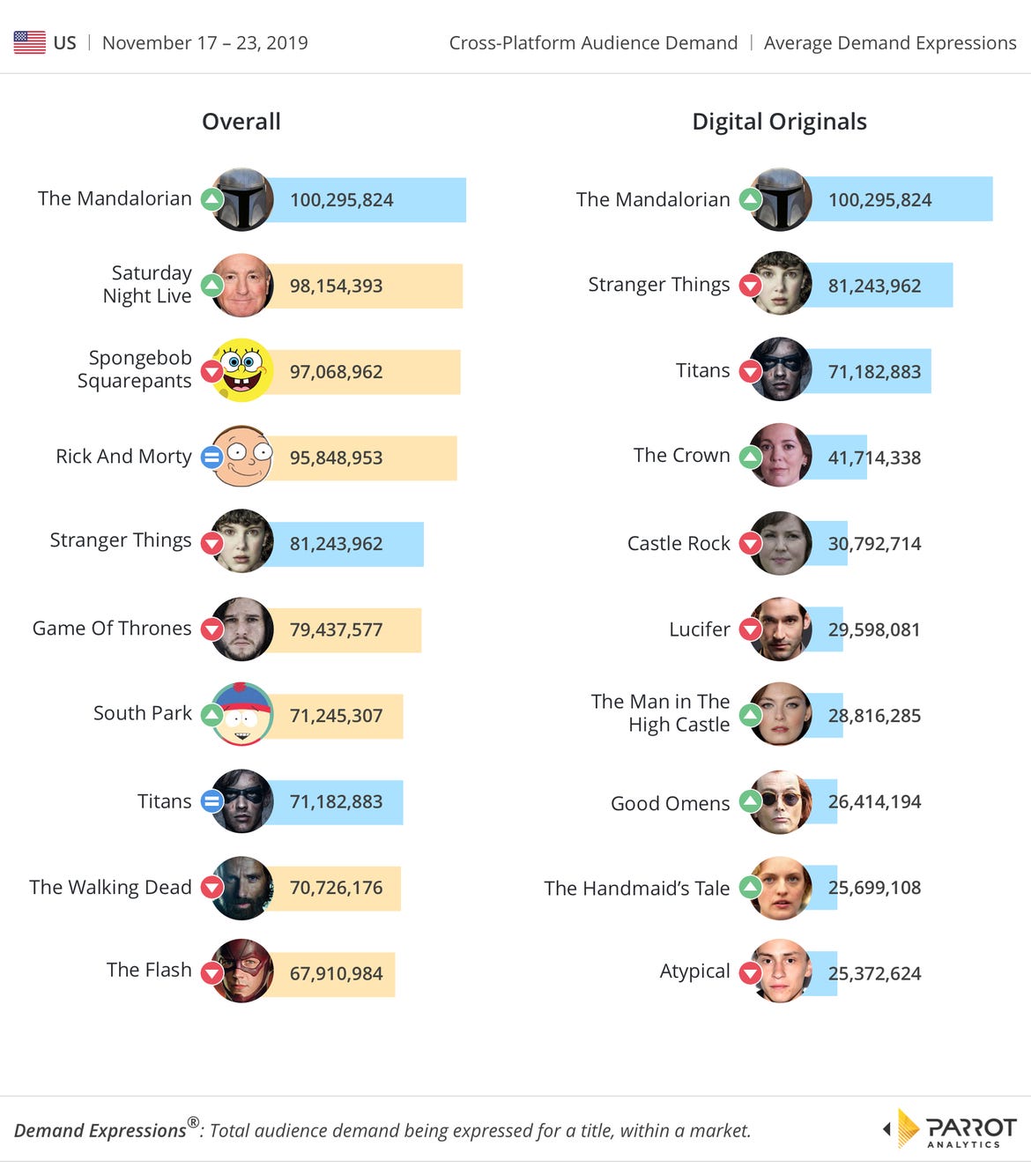

Look at the outside world. Inequality, bankruptcy, government aid, a new Cold War, technology monopolism, pandemic. To deal with the surreal, many of us will plug into fiction as a deep drug. Now is the age of Tiger King.

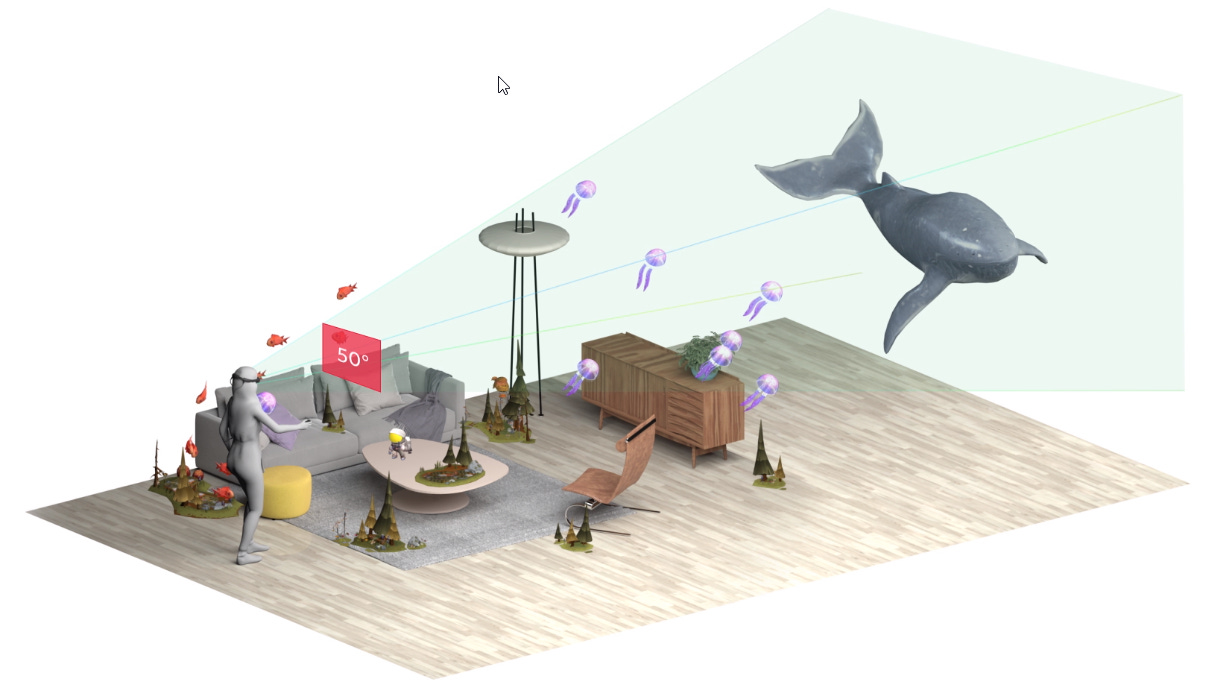

And who will give us the drug but Apple, Facebook, Netflix! Maybe even Microsoft and Magic Leap. Consider two data points. The first is the leak about Apple's augmented reality glasses, called Apple Glass. The device is expected to cost $499 and hit the consumer market in late 2021. While the glasses will display visual information overlaid on top of the physical world, data processing will occur on a nearby paired iPhone. Apple has been laying the groundwork for this stuff for years, putting specialized AI chips into its hardware, building out ARKit for developer to create AR software, and growing the ecosystem of relevant applications.

The second data point is that Magic Leap, an augmented reality hardware builder, managed to raise $350 million despite burning through $2 billion in venture to date, mortgaging all of its patents to JP Morgan, and announcing layoffs for 1,000 people. The start-up attacked several vectors of innovation at once and needing to create the hardware, software, and operating system for its bet. The latest pivot has been from consumer to enterprise, out of competing with Facebook's Oculus and into competing with Microsoft's HoloLens. Despite the money sink, it is a beautiful idea.

So AR isn't dead. And with the COVID quarantine, people are experimenting with virtual conferencing in a way that just wouldn't have happened before (e.g., Cryptovoxels).

But what has been particularly interesting to me instead is the gradual shift of technology companies to becoming media companies. Not satisfied with delivering only search, social connection, and hardware, technology platforms are looking at subscription media as a growth vector. Facebook has been a media company for over a decade, curating information consumption and delivery across billions of people and various properties. Apple is now lagging Spotify in the music game, and perhaps AR is a platform where it can still be early and dominant. Google is also in this race with cloud gaming provider Stadia, while Microsoft owns Xbox, and everyone is syndicating news, films, and podcasts.

While the banks are yelling from the mountain tops how much they are all technology companies, the technology companies have moved on to media.

Financial and Economic Implications

I borrow many of the concepts above from Matthew Ball's overview of Epic Games: Epic's Flywheel & Unreal Engine, Fortnite & How It Built the Epic Flywheel and Epic's Philosophy and Unprecedented Aspirations. His core thesis is that Epic is trying to go after the Metaverse -- a trillion dollar digital world economy, interconnected through the Unreal Engine and various open technologies. This fight is primarily about platforms. Will distribution continue through something like Steam, which takes 30% of all game economics, or will happen in a decentralized way using Epic's developer tools to create inter-connected universes. Notably, Epic has waived all fees to developer for the first $1 million of revenue they generate using these tools.

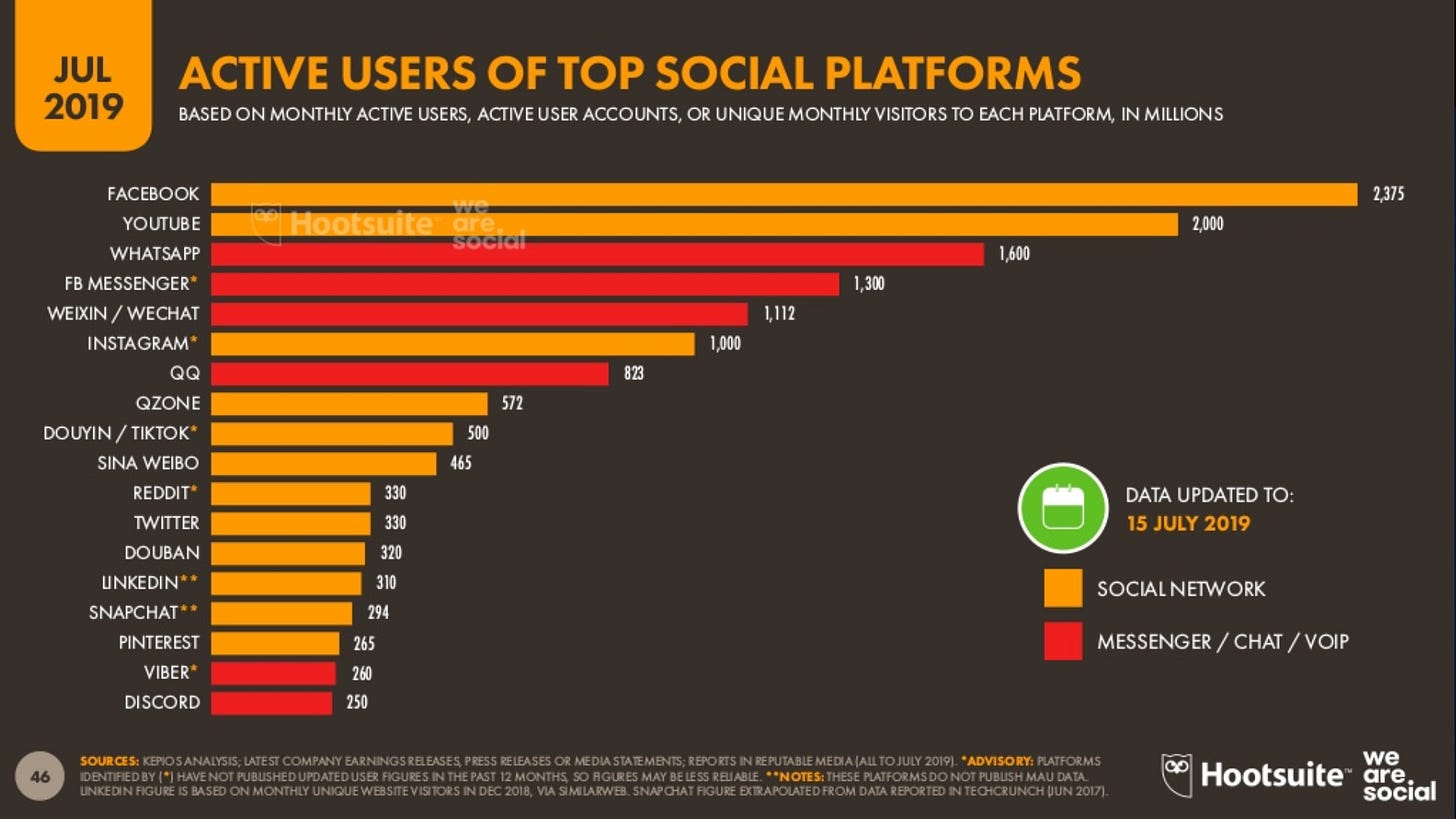

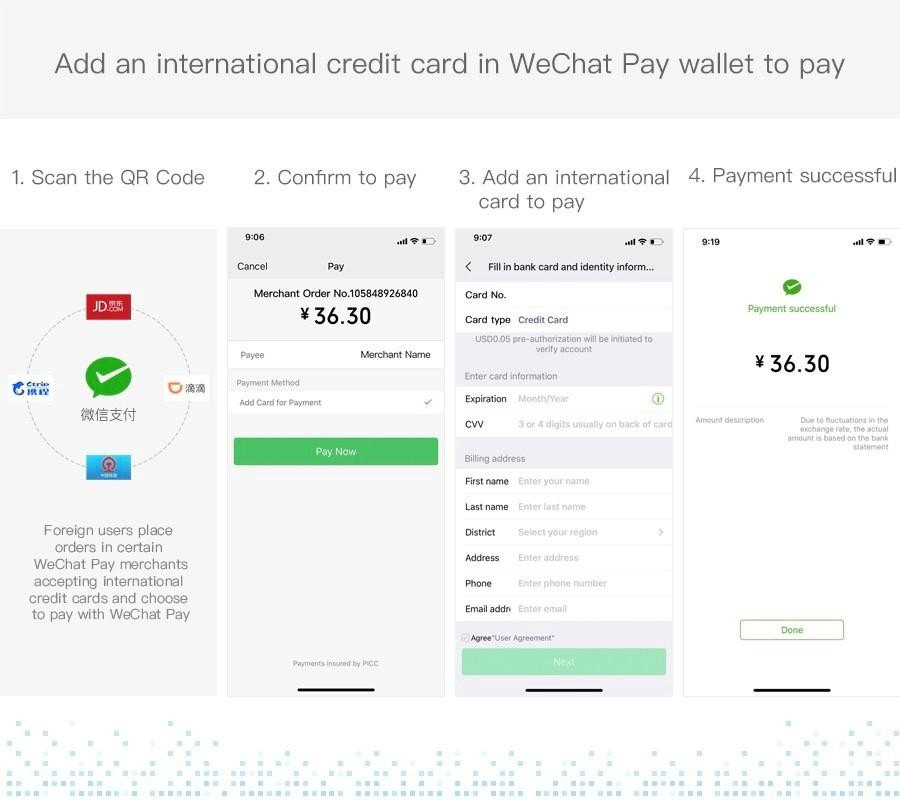

Also notable is that Epic is owned privately by its founder Tim Sweeney and the Chinese technology conglomerate, Tencent. You might recognize Tencent as the maker of WeChat, the most popular messaging service in the East, and a strong provider of payment services (competing with Alipay). You might also remember that Tencent was part of the $160 million round of investment into German leading neobank, N26. Last but not least, they are a large blockchain player in the Chinese national chain efforts. So you could say Tencent is as good a Fintech company as any of the Silicon Valley aspirants.

Let's pick up the thread about banking. For a while now, I have held the thesis that the killer use case for AR/VR finance will be payments processors. Increasingly, I believe it will be blockchain-anchored payment processors.

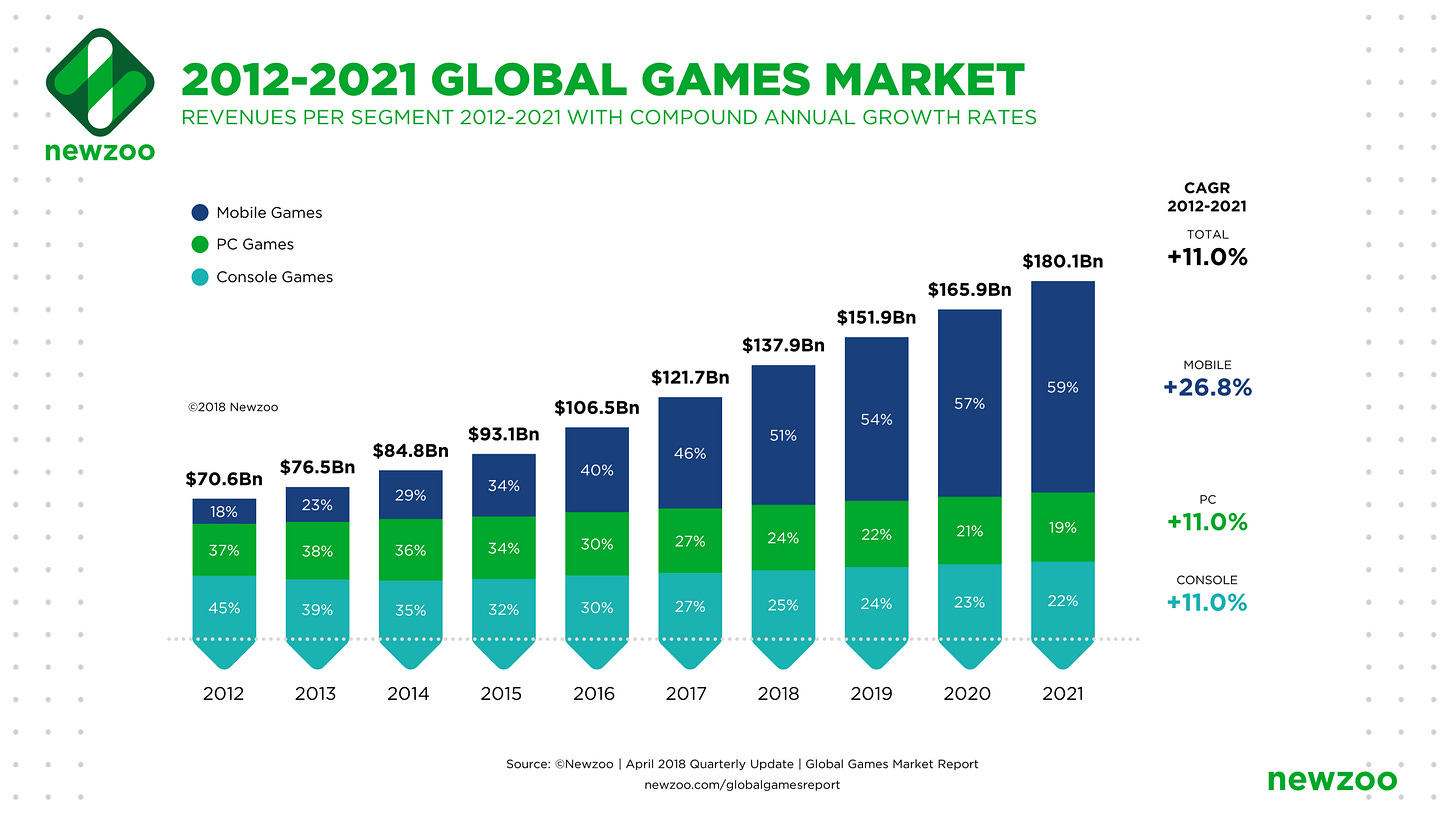

The magic of something like the Metaverse is that it is an emotionally real place for the people that inhabit it. A large number of games today, like Fortnite and League of Legends, are already free-to-play while generating billions of dollars in revenue. They do this in part through personalization and customization. If you spend months of time in an imagined place, you will pay to make that place yours -- from customizing appearance with unique outfits, to signaling your social status to others with scarce resources. These are mere human impulses.

To make these customizations collectible, and actually scarce while being digital, they have to be anchored into common, interoperable infrastructure. I would expect Epic Games to pick a fundamental blockchain partner for Unreal (at least as a close integration) within the next few years. Rumors are swirling already. Once anchored, the entire financial infrastructure of payments, banking, lending, and investing become available.

If we take the maximalist finance view as it relates to the Metamerse vision outlined above, the bold move for a financial company would be to leapfrog from "technology" company to "media" company today. How could a bank underwrite the creation of all these worlds on a common visual engine, and then use smart contracts and APIs to integrate its products across available financial activities.

Some parting food for thought:

Why do gaming companies have to design in-game economies, rather than picking them up off the shelf from an financial modeler?

What would the world look like if JPMorgan bolted on a video game studio, and every player got a JPMorgan bank account, interoperable between the US dollar and Bitcoin in the virtual world?

Is Tencent already doing it?

Looking for more?

Want to send me a note? Reach out here anytime.

Like this analysis? Tell the world!

Interested in a premium subscription for just $3 per week?