Long Take: Can balanced regulation for the crypto markets emerge after crash?

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We look into the regulatory torrents swirling around the current market cycle, and how it has created opportunities for regulators to focus on stablecoins, yields, KYC/AML, and related topics. We spend some time understanding the words of “democratization” and “decentralization” to establish the values of the space as something to preserve, memetic value aside. We then try to parse some elements of MiCA against what we see as priorities in making the markets better.

Topics: regulation, stablecoins, decentralization, democratization, KYC/AML

Tags: Celsius, SEC, 3AC, MiCA, BIS

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

The French Future of Democratized, Decentralized, Distributed of Finance

We need a reality check.

People used to say “democratising financial services”, until that turned into a meme. Then we all started saying “decentralizing financial services”, until that turned into a mess.

You used to be able to say “Future of Finance”, and in fact this newsletter was titled as such, with a straight face. Now, even the sarcastic “Future of France” is cliche, and you are better off striking the word “future” from your vocabulary.

Let’s live in the present and understand the words we use. “Democratising” finance has a simple meaning, and that meaning is financial inclusion. Financial inclusion isn’t a SoftBank blitzscaling investment thesis, but the actual access by actual people to actual financial services. You can check out this 200+ page analysis from the World Bank on financial account penetration and access to credit.

This access is a problem of human dignity, human creative potential, and building better operating economies that serve the people who do productive labor. So in this way, we can look at the low cost of distribution technologies — mobile payments, roboadvisor, neobank, digital lender, digital broker or insurer, various embedded finance features in social or commerce apps — and see how there is now *more* distribution of financial services. And it was good!

Even if you lost money on the SPAC, it was good, just like if you lost money on the Uber stock, it probably is still pretty sweet that there’s Uber in the world.

The democracy we talk about is the idea that even poor people deserve high quality financial services. Because, obviously! And tech-enabled distribution cost structures *allow us* business models where some form of that works.

Now look, it’s hard to make fashion trends last long, and so it’s understandable that this meme was replaced by the decentralization meme. Crypto was making so many people, of which many are quite young and haven’t had their face bashed in by 90% down markets for 15 years at that time, very confidently rich.

In our view, “decentralization” as a word should safely be used for the openness, trustlessness, and permisionlessness of the technical aspects of joining and running economic computational networks. You want to validate Ethereum? Go on! You want to mine Bitcoin! God bless! The network architecture is such as to allow anyone to joing and earn rewards for maintaining a blockchain, mediated by token economics.

Notice how decentralization doesn’t obviously mean (1) that the economic rewards will be distributed in a communist utopian fashion equally to everyone, or (2) that human organizations should be decentralized in a manner identical or even similar to that of software machines. Those ideas are the juice spilling over as part of creative destruction.

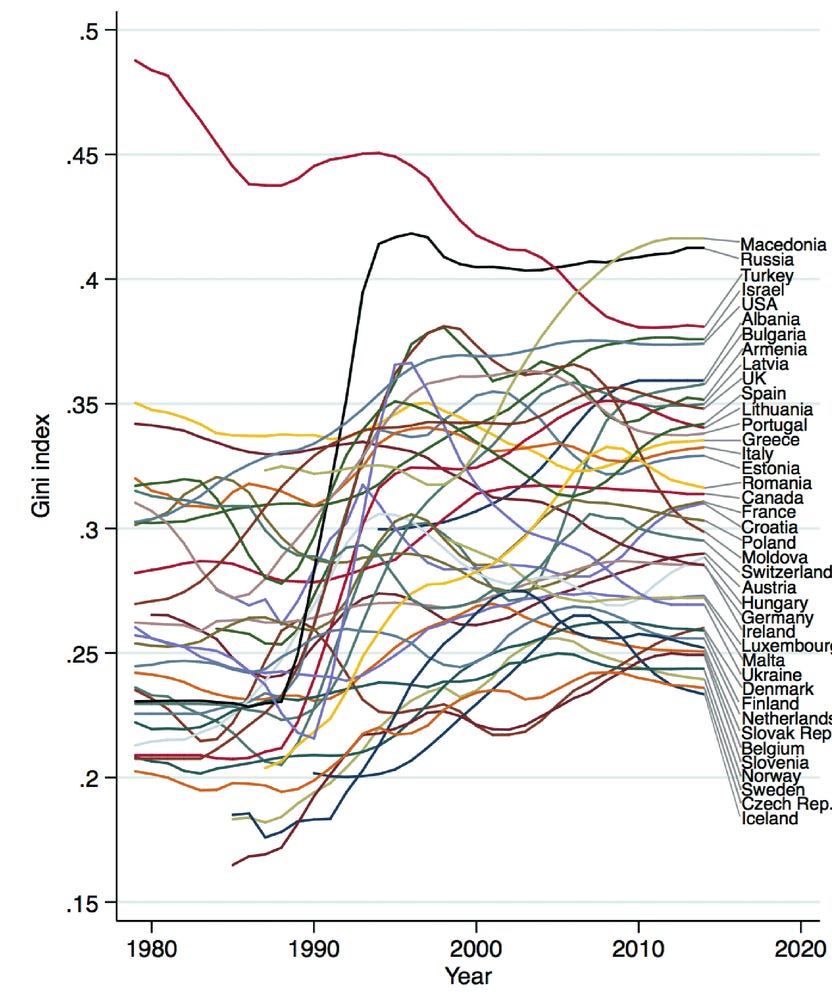

Just to bring home this point, here are the Gini coefficients for national economies and the main crypto assets.

It is not the outcome that is decentralized, but the access to participation and creativity. We think of blockchain networks as the factories for financial products, or alternately as the operating systems where economic application accrue, in the way that videos accrue to YouTube.

But just because anyone can post videos to YouTube, where access to consume media is democratized, and manufacturing of videos is decentralized, doesn’t mean that returns are equally distributed. No matter how many deep feelings we at the Fintech Blueprint have about wanting to be popular, we are not — nor should we be — Mr. Beast.