Long Take: Can the SEC take down Uniswap, and all of DeFi with it?

And a closer look at Uniswap's $2 Trillion in volume

Gm Fintech Architects —

Today we are diving into the following topics:

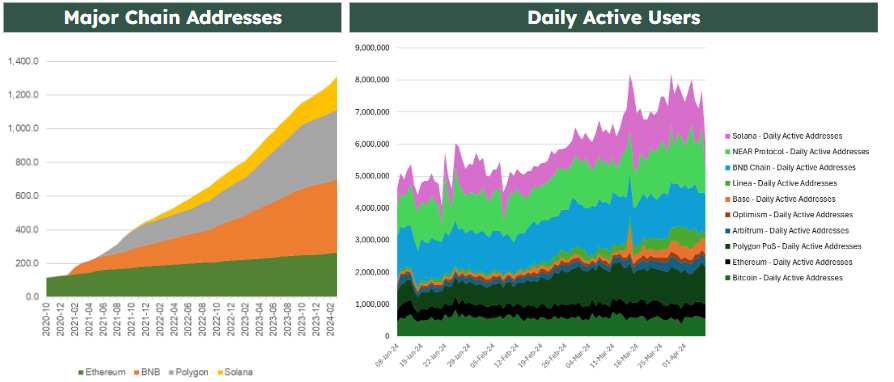

Summary: In this article, we discuss the recent regulatory actions faced by Uniswap from the SEC. Despite these challenges, the DeFi ecosystem continues to grow, with over 1.3 billion addresses and daily active users increasing from 5 million to nearly 8 million. Financial activity in DeFi has also seen a resurgence, with cash equivalents growing to $150 billion and DeFi assets topping $100 billion, partly due to significant staking activities. Uniswap, a cornerstone of the DeFi infrastructure facilitating over $2 trillion in cumulative volume and generating $500-$1B in annual fees for users, exemplifies the sector's potential for innovation and disruption. The article also touches on legal arguments surrounding the SEC's attempts to regulate DeFi, as well as providing comparisons to the performance of Coinbase and Virtu.

Topics: Uniswap, SEC, Ethereum, Binance Chain, Polygon, Solana, Lido, EigenLayer, Coinbase, VIRTU, Robinhood

To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below (if you haven’t yet). We just adjusted the price to $12/mo.

In Partnership

Generative Ventures invests in the machine economy — the financial activity settled on blockchain protocols and accelerated by the machine labor of generative AI.

Long Take

Not so Wells

Just when it looks like the DeFi sector has recovered, with near all-time highs across asset prices and usage, the SEC has come in to save us all from having a good time.

It has just been revealed that the regulator has sent a Wells Notice to Uniswap, the leading decentralized exchange in Web3. The notice is the last step before an enforcement action, and — probably — a very public lawsuit. The SEC will try to sink Uniswap and shatter DeFi in its decentralized robot core.

Let’s take a moment to take stock of where things are.

There are now over 1.3 billion addresses across Ethereum, Binance Chain, Polygon, and Solana. A few hundred million more are spread across a variety of other chains. Daily active users across the major ecosystems have risen from 5 million to nearly 8 million this year, as people participate across various campaigns and chase meme coins. Whether regulators like the activity or not, there is certainly more of it — and it comes from every country in the world, not just from American users.

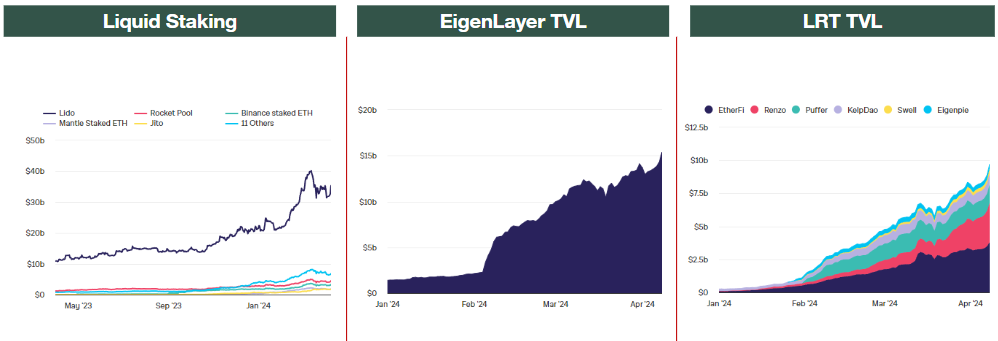

We are also finally seeing an uptick in financial activity. Cash equivalents have grown to $150 billion, and assets in DeFi have risen to over $100 billion again. A meaningful portion of this is driven by staking and re-staking protocols, with nearly $35 billion in Lido, $15 billion in EigenLayer and another $10 billion in various other derivative products. Over 25% of Ether is now staked, which has given DeFi a new lease on life.

At the heart of capital issuance and exchange are the automated market maker protocols like Uniswap. To participate in any new thing, one has to buy an initial currency, trade (or swap) into another currency, likely commit that in some way, and then trade out of the position in the end. Unlike brokers and exchanges in the regular world of finance, these activities can be done in a permissionless way.

In the case of Coinbase, for example, the company has to choose to list some particular asset on its platform for consumption. In the case of open Web3, market participants can come together to create trading pairs between any assets they like. This is profoundly disruptive to how finance used to work.

Here’s an analogy. Before the Internet, you could only read books, magazines, and newspapers that you chose and bought from a store. A publisher would platform content creators and act as a “responsible” filter and censor of what the audience could access. Now, your browser — which is software you run for yourself — uses a number of open source protocols to communicate with the Web and renders for you any website you desire based on an infinite amount of content supplied from every corner of the world.

Before DeFi, you could only access financial products that you chose and bought from a bank. A licensed financial firm would platform the financial products and act as a “responsible” filter and censor of what consumers could access. Now, your crypto wallet — which is software you run for yourself — uses a number of open source protocols to communicate with computational blockchains and delivers to you any financial product you desire based on an infinite amount of capital supplied from every corner of the world.

We hope there will be no more need for analogies soon.

Uniswap

The project is a major *platform shift* success story.

Its massive traction came from a need for asset exchange within the Web3 ecosystem. To do so, the protocol built smart contracts that allowed certain parties to become (1) providers of liquidity and other parties to (2) make trades against those assets while paying fees for the privilege. The design used an elegant algorithm so that liquidity providers could be passive participants, only stocking the vending machine with money for distribution. No order-books, or live bids and offers are involved.

We discuss the mechanics in more detail here:

The details have since evolved and professionalized, but the core design philosophy remains. Uniswap contributes code into a protocol used by anyone that wants to set up a market or participate in exchange. As a result, countless projects are able to bootstrap their own tokens and come into existence, with their token used as currencies for the goods and services they provide.

Let’s look at Uniswap in numbers.

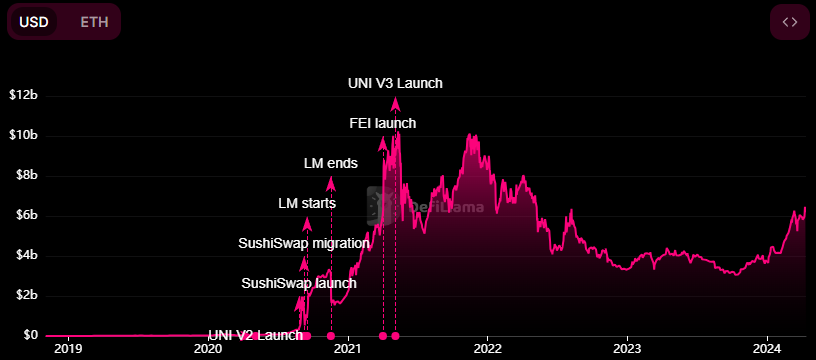

The Labs entity, which works on building the protocol and user interfaces has about 150 employees on LinkedIn. A lot can get done with a small team leveraged against a huge problem. Below you can see that capital committed to providing liquidity had at one point reached $10B, and has now rebounded to $6B.

Of particular interest are the volume numbers. Recently, it was announced that Uniswap passed $2 trillion in cumulative volume. Between its three software versions, we can see around $40-80 billion of monthly volume, which would annualize to around $500 billion per year today.

The fees generated by the protocol include a 30 bps fee (or a broader range in the more recent versions) going to liquidity providers, not the Uniswap Labs entity. There is a placeholder protocol fee that would share revenue with the token holders. However, this mechanism is not yet turned on — likely in the shadow of the SEC threat. There is an additional 15 bps fee that is levied on certain token transactions for users of the Uniswap user interface, though it was many years before this fee was turned on to benefit the Lab.

As a result, Uniswap generates around $50-$150MM in fees per month for its users, which is equivalent to $500-$1B per year. This comes from around 400,000 daily active users. Many of those users were also the lucky recipients of Uniswap’s original airdrop — worth several thousand dollars at the time and constituing 15% of the available supply. Today, the market capitalization sits between $5 and $10 billion. This is an absolutely Blockbuster outcome.

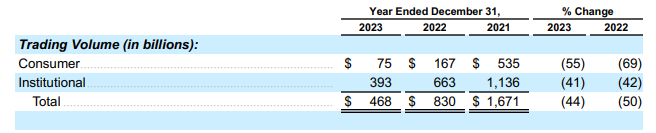

Let’s quickly compare this asset to Coinbase, the centralized exchange, and VIRTU, the market maker. Coinbase is the leading US exchange, doing — you guessed it — $500B of volume in 2023.

We expect this number to be closer to $1.5 trillion in 2024 as the markets recovered. Coinbase generates around $3-5 billion of revenue, or around 60 basis points on its volumes, and trades at a $60 billion marketcap. Whereas Uniswap has accomplished its metrics with 150 people, Coinbase employs about 5,000 people. Even though Coinbase has other fantastic business lines, from commerce to custody and protocols, in our view, this is still a very competitive outcome for Uniswap.

Our second comparison VIRTU is one of the market makers underpinning Robinhood, paying the neobroker for trading volume. It is not a broker itself, but it does create the liquidity that brokers can use for routing trades. In that sense, it is analogous to Uniswap. Here are its volume metrics.

Virtu is facilitating $500 billion of volume per day, which yields it around $1-2B of revenue per year. The take rate is substantially lower — around 0.1 bps on the $125 trillion of volume per year. For this privilege, Virtu trades at a $3B marketcap, a meaningful discount to the $17B still held by Robinhood.

So while Uniswap is a big fish in the Web3 pond, it is tiny compared to traditional market participants. However, it is also a foundational piece of Web3 infrastructure. It plugs into liquidity aggregators across various ecosystems, and has been the inspiration for countless projects forking its code and launching multiple competitors with new innovative features.

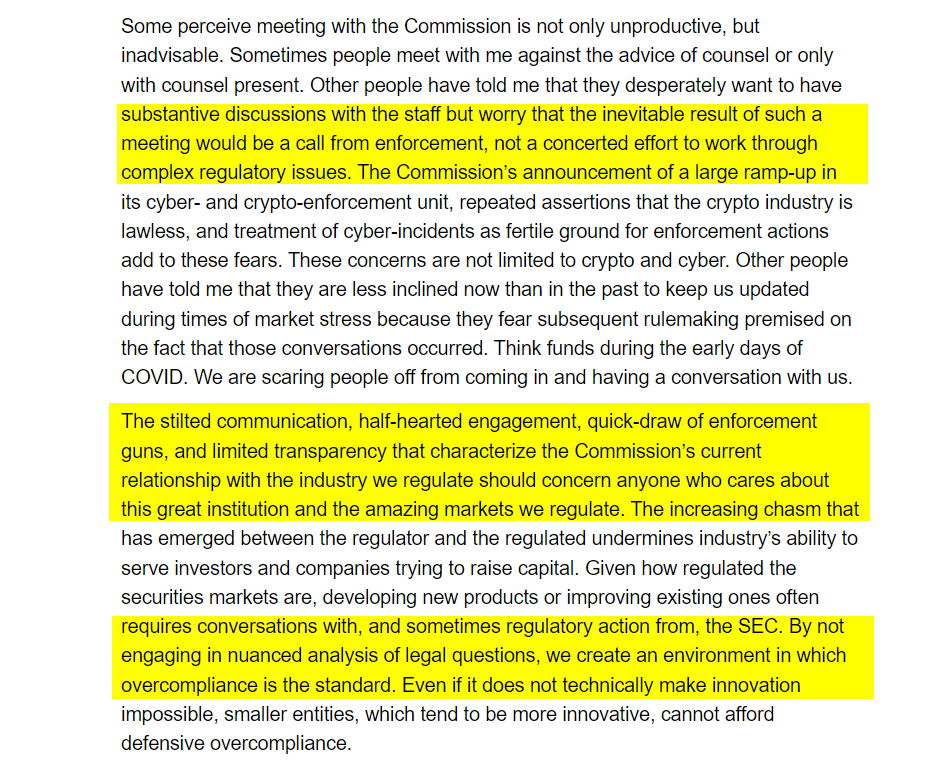

This is the thing that Gary Gensler’s SEC wants to break, control, and wrap in American jurisdiction. We’ll quote for you another SEC Commissioner, Hester Pierce for contrast.

The Legal Argument

It is beyond the scope of the Blueprint to offer any sort of legal analysis, but we will quote liberally from the following Coin Center article published in 2022. At the time, the SEC attempted to ensnare DeFi in a new definition of what it means to be an “exchange”. It had done this by altering the definition from this:

a person who “brings together orders” and “uses established, non-discretionary methods” to effectuate a trade

to this:

a person who “brings together buyers and sellers” and “makes available” various methods for those persons to trade including “communication protocols.”

The main thrust of the argument from Coin Center is that the new definition attempts to move from regulating *conduct* to regulating *speech*. A party that brings together orders using its methods to effectuate trading is literally in the process of facilitating the trading. A specific activity is performed in the middle of the trading by the exchange.

In the latter case, however, bringing together buyers and sellers is put in a completely open way. Does Instagram bring together buyers and sellers? Networking and assembly of the parties is not the same things as moving orders around. Further, making available communication protocols is very different from effecting an exchange. Developers write software all the time, and as Coin Center argues, software is speech and Congress cannot abridge it.

Especially in the case of DeFi, these protocols are deployed onchain in an open source manner, and then left to their own devices to be used (or not) by independent actors making independent decisions. People are not coming to Uniswap Labs to be listed as an asset on an exchange. Rather, Labs publishes frameworks and code, and other developers engage on their own terms.

It is fascinating to see the SEC in court over its various enforcement actions, from XRP to Coinbase and others. It is also encouraging that occasionally the regulator is warned about over-reach, and does not get what it wants. As advocates of innovation, we want to see Uniswap survive and triumph through this period. Hopefully the system of American checks and balances against its own executive power will allow the rest of the world to benefit from DeFi and open software.

Postscript

Read our Disclaimer here — this newsletter does not provide investment advice

Another friendly reminder to share this post so that others can learn: