Long Take: Custodia rejected from Federal Reserve membership, Silvergate & Signature borrow billions to survive

Did you know about the Federal Home Loan Banks system?

Hi Fintech Architects —

We are constantly looking for ways to improve and create content that you love.

We’d love your unfiltered feedback on how you find Fintech Blueprint.

Please fill out a brief survey here — It takes only 2 minutes.

As a token of our appreciation for participating in the survey, we'll mention your brand, company, startup, or job position in our next newsletter (if you're interested). Or whatever other symbol of love and devotion you desire.

Today we are diving into the following topics:

Summary: We noticed two pieces of news that seem to rhyme — Custodia Bank failing to become a member of the Federal Reserve system, despite its Wyoming charter, and Silvergate Capital and Signature Bank borrowing billions from the Federal Home Loan Bank system. Both of these news items show the importance of nation-scale insurance against bank runs, and the challenges that digital asset-exposed companies continue to have relative to their more traditional counterparts. But should we be surprised?

Topics: payments, regulation, politics, money, economics, digital lending, embedded finance

Tags: Silvergate, Signature Bank, Custodia, Federal Reserve, Federal Home Loan Banks, OCC

Long Take

Getting Chartered

Custodia Bank, formerly Avanti, is a Wyoming bank with a state charter founded and run by Caitlin Long. Long is an admirable operator — in the weeds of banking and regulation with strong traditional experience, but interested in digital assets as an early adopter and champion. Custodia was built to handle digital assets while also being a bank, something that, you know, people still like.

There are state-chartered banks, and federally-chartered banks, and industrial loan companies in Utah. The US has a history of banking experimentation and political tumult over whether central banking should even exist. There were periods of free banking, where banks could issue private moneys, and there were periods of great consolidation and too-big-to-fail. There is no one brush to paint the American banking history, other than to say it is dynamic.

Fintechs, as would-be disruptors and re-distributors of depository products, also wanted to be banks in their offerings. Meaning, here’s an app for your money.

But it is onerous to get a license, and therefore it is no surprise that they tried to flow around the regulation, either looking for a bank-like license to hold, or figuring out how to “rent a charter”, or looked at buying a bank footprint, or gave up and just paid for a cash account via embedded finance. If you look at Europe, you might recognize the role that Lithuanian bank licenses in being passported across the continent, and how attractive a UK bank license is to a player like Revolut as a result.

In the US, A bank license gets you access to the sovereign power of printing money — (1) FDIC insurance, covering deposit accounts in the event of bank collapse and runs, and (2) access to the Fed window, which allows commercial banks to borrow from the Fed as a last resort. You get to be solvent, instead of dead.

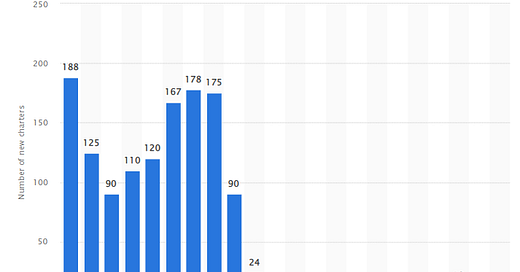

But, you know, after 2008 there weren’t that many new charters to be given out. The financial crisis showed what happened to banks, who, let’s say, relied on being able to socialize their losses from underwriting all those silly mortgages. It showed how public funds absorb the private losses that result from market exuberance.

So Fintechs, and of course now Crypto, are seen as the irresponsible barbarians at the gate. Instead of emphasizing risk management and controls, Fintechs emphasize growth and million-user account bases, powered by over-eager venture funding. Crypto companies emphasize the disruption of currency and payment systems themselves, with their own politics and governance.

Custodia Bank and The Fed

Do you really give them the keys to depository insurance and government lending? Or do you shut the door and pretend you’re not at home?

Do you really give Custodia Bank, a Wyoming Special Purpose Depository Institution, which can custody but not lend, access to the Federal Reserve System?

No, no you do not. If you’re the Fed, that is. And so Custodia was denied access.

We point you to the statement from the Fed, and the longer associated Policy Statement. We excerpt the relevant parts:

What we glean from the read is that the state-chartered status is a necessary but insufficient condition for access to the Fed system, and that essentially meeting the sufficiency requirement is entirely in the judgment of the OCC. We can have debates about what appropriate systems are, or are not, and it is hard to imagine for us that Caitlin Long built insufficient controls.

Instead, what it looks like is that a continuation of the OCC turning away from crypto, which it had sort of supported under Brian P. Brooks laying the groundwork for banking of stablecoins after his role as Chief Legal Officer at Coinbase (now CEO of Bitfury), and is now reverting to a more conservative position under Michael J. Hsu.

Here is our previous relevant take on the issue — you can see the first one is very positive.

And here, a year later, embedded finance and stablecoins are enemies of the OCC.