Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this analysis, we review the $4.5B valuation of Binance.US, the $14B valuation of Blockchain.com, and Meta’s old/new Zuck Bucks plans with the intention to understand progressive decentralization for centralized companies. What does it do for a well organized, profitable entity to launch a token? What does it for it to “engage” with DAO and Web3 organizational structure. We explore a few approaches to think about answering such questions in terms of economics and incentives.

Topics: DAOs, decentralized finance, exchanges, capital markets, tokenization

Tags: Meta, Blockchain.com, Binance, Uniswap, SushiSwap, ShapeShift, ENS, Deep DAO

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

The Question

We are going to grapple with the idea of Web2 (i.e., Facebook) or CeFi (i.e., centralized financial) companies launching tokens. Will they do it? Should they do it? If they do it, what will that mean? Why do we believe that every crypto-adjacent company will have a Cryptoeconomics team, the way that Web2 needed “growth hacking” and “user experience”?

One approach is to assume philosophy. Because the world is becoming Populist, and Institutionalism is a badge of intergenerational shame, therefore, Populist tactics are what will win in the next round of macroeconomic Prisoner’s Dilemma.

Decentralized, communalist, hyper-capitalist digital city states will defeat the cathedrals of sovereign corporations. We can *say this* as a proclamation, as a waving of the flag. But we can — and perhaps should — also try to reason one step further.

The Factual

Let’s start grounded in some recent progress. First, big tech. This headline from the Financial Times seems like it comes from 2018, with Facebook’s attempt to launch a supranational digital money. The rationale then was that Facebook was maxed out as an attention economy play and wanted to replicate Ant Financial and Tencent as a global financial rail as well.

That rationale has gotten beaten into submission, as the Chinese CP put its superapp fintechs into time-out, composed largely of regulatory purgatory. Diem is dead, sold to Silvergate, or relaunched as open source code. Circle has raised another $400MM from BlackRock and friends, after delaying its public float with a SPAC. Meanwhile, Facebook has been humbled by Apple, who showed the tech company how weak software can be when the customer is owned by hardware, and monopoly laws don’t apply.

And so Facebook, now Meta, is trying to back into the Metaverse with new media money.

It will render a VR universe, monetize it through digital asset sales, and put the stuff into Novi — a sort of corporate MetaMask, bootstrapped with AR/VR avatars and Instagram’s NFTs. Should there be a Meta token that pays for this digital real imaginarium? What should its cryptoeconomics be?

On the other side of the coin (!), are the crypto exchanges. Whereas Meta is coming to this digital world with attention and assets, exchanges are the gates through which financial value flows. Here’s a brief illustration of the business model.

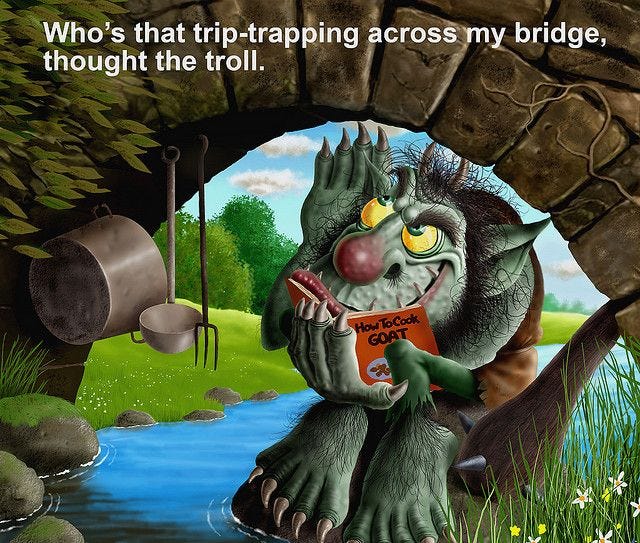

We kid! We kid!