Long Take: Despite Ethereum ETF approval, 🦄unicorn projects are in trouble

Comparing crypto token launches to traditional IPOs reveals potential solutions

Gm Fintech Architects —

Today we are diving into the following topics:

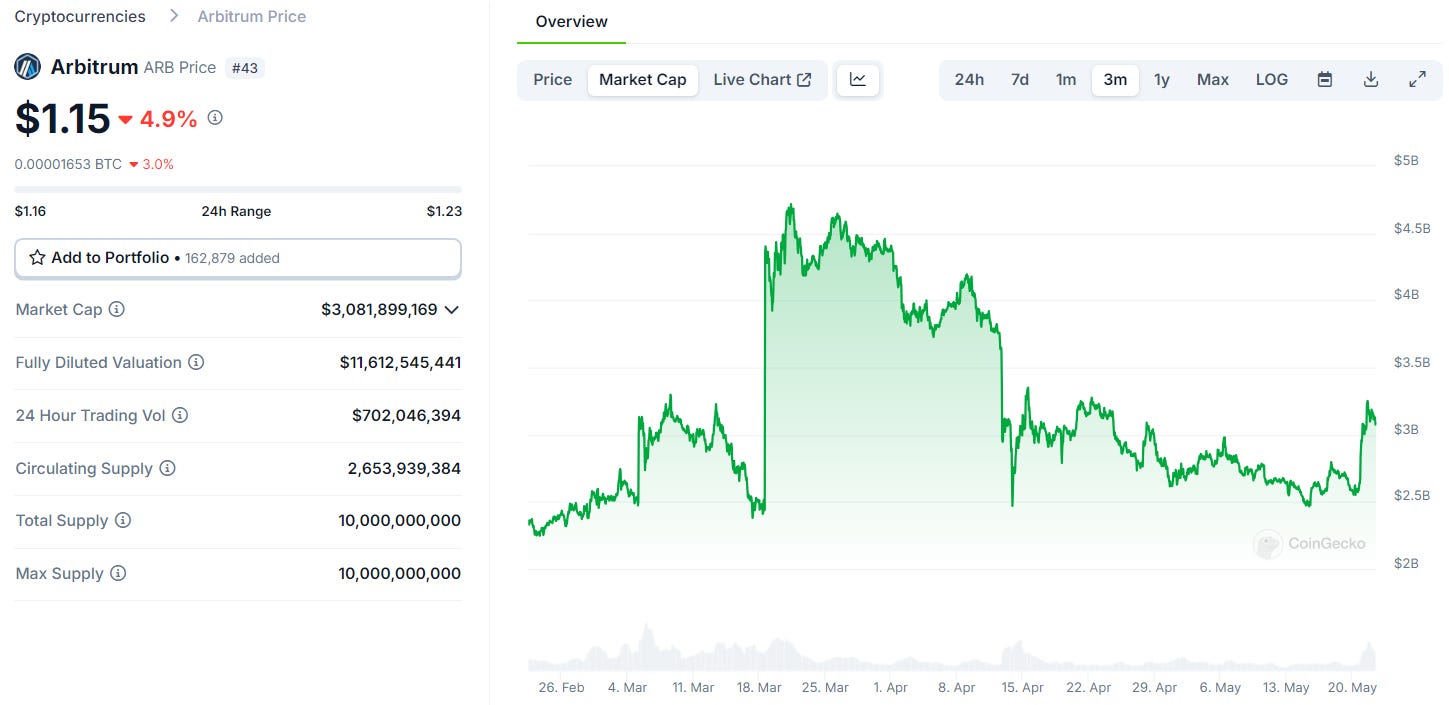

Summary: In this article, we discuss the financial challenges of unicorn Web3 projects in the context of the recent approval of the ETH ETF. Despite a $2.5 trillion overall market valuation, many new crypto projects, such as Arbitrum, face poor price performance, with token prices dropping 50% over three months even as usage increases. This disparity is attributed to a low float, high valuation issue where only a small percentage of tokens are trading, leading to market inefficiencies. We compare this to traditional IPO processes, suggesting that crypto could benefit from programmatic vesting schedules and professional pricing strategies. Implementing mechanisms like bonding curves and on-chain vesting could help stabilize token prices and improve market dynamics.

Topics: ETH ETF, BlackRock, Fidelity, Arbitrum, Binance, Coinbase, Ambient Finance, SoftBank, Dragonfly, Arca, Hedgey, Open Libra (0L Network).

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

In Partnership

Generative Ventures invests in the machine economy — the financial activity settled on blockchain protocols and accelerated by the machine labor of generative AI.

Long Take

The Problem

We have just crossed the line into approval for the ETH ETF, driving prices up to new highs, as well as a political step change in the treatment of crypto in Washington.

In an unlikely turn of events, the winds have shifted towards innovation and digital assets are now a bi-partisan consensus. BlackRock and Fidelity will be the champions of mega-cap crypto assets, continuing to push forward this bull market. There is $2.5 trillion of digital assets — on par with the last cycle high — but a market with decreasing regulatory overhang, and many bad actors weeded out.

And yet, many market participants are frustrated with the financial performance of new projects launching their tokens.

Take for example something as respected as Arbitrum, one of the first EVM roll-ups to add millions of transactions and users to Ethereum. This is a real product, with a technological advantage. Let’s assume that the fundamentals are sound. Then why does the token price look like this?

Over the last 3 months, token price has fallen almost 50%. Meanwhile, the market capitalization has risen from $2.25B to $3B, with a high of $4.5B. If we look at activity onchain, transaction are steadily increasing, which suggests more usage and adoption. So what is going on?