Long Take: Dissecting the 2023 Macroeconomy, from personal savings to global politics

Revisiting our macroeconomic framework for the year to date

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Economic analysis indicates we might be at the peak of the interest rate environment with rates surpassing inflation, but banks show vulnerabilities with massive unrealized losses. Personal financial health is concerning, with savings at an all-time low and escalating debt. Corporate debt maturing in the coming years poses significant threats in the high borrowing cost scenario, coupled with the growth of unprofitable public companies. Amidst these challenges, global political instability is rising, evidenced by U.S. governance issues and increased geopolitical risks. The 2023 growth forecast presents a modest outlook, marked by potential geopolitical and debt-related downturns.

Topics: macroeconomics, interest rates, investment management, consumers

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Turning Point

There is gossip in the air.

BlackRock and other asset managers are marching their way to a Bitcoin ETF. The SEC is losing ground in the courts. SBF and FTX have been exposed and defanged. Generative AI is a new platform for innovation, and NVIDIA is flying. Early stage companies continue to be born, chasing dreams. Despite profound displacement, risk-on assets have survived.

Interest rates have potentially peaked and inflation has abated. There is hope that the central banks have stopped raising, and that the next leg of the exercise is to land softly without too much unemployment. While there is plenty to be concerned about over the next year — housing markets, valuations relative to earnings, China, lobal war, the deficit, Binance — are there things we can relax about?

There is a danger in making a two-sided, intellectually dishonest argument. If crypto is the apocalypse hedge, it performs well when inflation rises and countries lose economic discipline. But if crypto is a high-tech equity asset, then it performs well when money is cheap and there is plenty liquidity. These things seem contradictory. Similarly, if Web3 is the antidote to the excesses of the Web2 business model, then Big Tech has to shrink for decentralized networks to rise. Or, is it that we want attention from Big Tech, such that they integrate Web3 into existing networks? Do we want big banks to use DeFi or to be supplanted by DeFi?

We want it all. In the fog of ignorance, let’s search for an exit.

Today we check where things are in the cycle of macroeconomics.

Macroeconomic Cycle

We are going to leverage a Generative Ventures analysis for discussion.

This chart tells us two things. First, the Consumer Price index is in blue, falling to below 4% in year over year inflation. You can see inflation peak around mid 2022, thereafter coming down. Second, the blue line shows the 3-month treasury bill rate, which tells you roughly the interest rate level. Forgive the chart crime of different percentage axes, and focus on the fact that interest rates are now higher than inflation. That is a signal that we are perhaps at the top.

Another signal that we are at the top is this:

Bank balance sheets now have something like $600B of unrealized losses on their held to maturity and available for sale securities. Remember, this is what brought down Silicon Valley Bank. To the extent that banks lock in long-dated bonds at low interest rates, and then interest rates increase, the value of those bonds goes down. Bank of America alone is sitting with over $130B in losses. Now, these securities have a US government back-stop as precedent, but certainly increasing rates will generate more fragility in the banking sector.

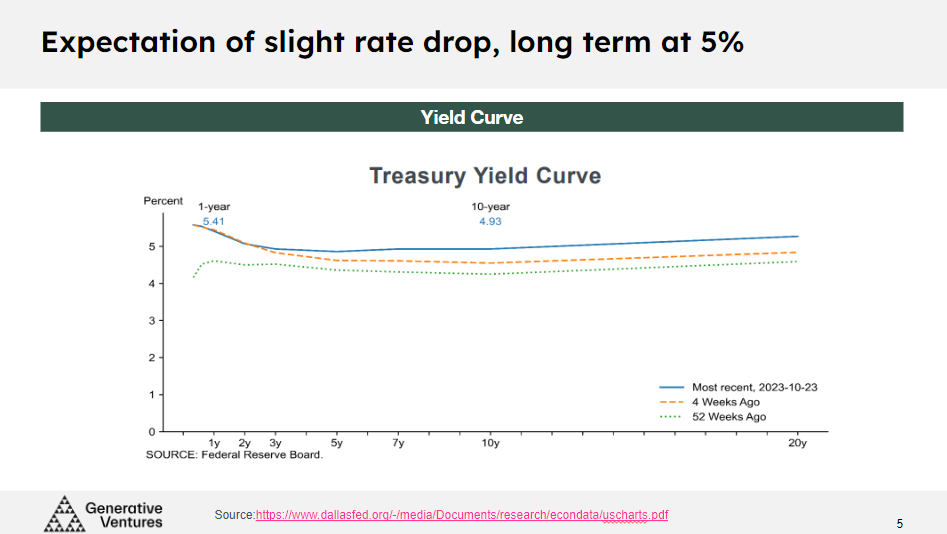

The yield curve has flattened out as well, showing an expectation for a slight decline in short-term rates, but a steady 5% or so for longer term durations. This tells us that there is unlikely to be a surprise shock to the upside on rates, which in turn is good for the equity and crypto markets.

If we look a bit deeper, there are conflicting messages in regards to whether the rate hikes “worked” or were merely at the same time as some deeper structural changes. For example, much of the movement in inflation came from energy, which is weighted at 7% of the overall index but had moved as much as 40%+ inflation year over year.

Does raising rates increase and decrease the cost of energy, because people and businesses feel poorer and consume less? Or is that an independent variable, which moves from supply chain shocks like Covid and the Russian invasion of Ukraine?

Or alternately, let’s look back at money supply expansion.

In 2020, M1 surged from $4 trillion to $16 trillion in a Covid minute. That pace was not reflected in M2, and more recently overnight repo activity by the Fed has also slowed down. Still, the simple story that money supply increased through government policy during the pandemic and was correlated with temporary wealth effects, increased consumer spending, and resulting inflation checks out. Notably, the government deficit has continued to grow, which implies increased issuance of debt by the government — continued money printing.

Unfortunately, those savings and wealth effects were indeed temporary.