Long Take: Down from $6B to $500MM, better for Better Mortgage to stay private

Understanding the SPAC collapse of the mortgage fintech champion

Gm Fintech Architects —

Here we are, still enjoying the revolutions of August. Today we do a relaxed take, there will be time for more complexity later —

Summary: Better Mortgage, initially a promising digital finance target known as BETR or Aurora Acquisition Corp., saw a 90% drop in stock value despite previously raising $500MM at a $6B valuation from major investors like SoftBank. Founded around 2014, the company aimed to digitize the mortgage market, which had significant potential. However, issues arose with financial projections, dubious management decisions, and changes in the macro environment. This culminated in massive layoffs, revenue shortfalls, and a declining stock, highlighting the pitfalls of rapid scaling and market unpredictability.

Topics: Better Mortgage, Lending Club, SoFi, digital lending, SPACs, capital markets

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

The Collapse

One story telling tactic is to start from the end, Memento style and move backwards to the beginning.

Watch this disaster, and ask — how did it all start?

This is BETR, also known as Aurora Acquisition Corp., or Better Mortgage. Aurora was a SPAC, which had gathered its requisite financing in the middle of the Covid crisis, and went looking for attractive, digital finance targets.

A SPAC raises something like $200-500MM, and then floats around trading at a $10 share price. The blue line shows the SPAC holding that value, the value it raised, for months and years prior. Then, it surges up as Better Mortgage starts getting through the de-SPAC process and generating public financials.

Except for Better Mortgage, those financials aren’t very good, the management is deeply controversial, and the macro environment is brutal. And so, we see a 90% drop in stock value pretty much immediately.

According to Google Finance, this is a company with a $500MM trading market cap. Just a few years back, it was raising $500MM at a $6B valuation from the price insensitive and market-distorting venture investor, SoftBank. How did the company burn so much value?

The Obvious B2C Digitization Thesis

The answer is both straightforward and multi-factored. We don’t need to create a villain out of the CEO or complain about capitalism. Let’s just look at the conflicting parts.

Better Mortgage was founded around 2014, and launched its flagship products in 2016. If you rewind back to this time in fintech, the game was about racing to build B2C fintech champions for each particular vertical. In investing, you had the roboadvisors Betterment and Schwab. In trading, you were looking at Robinhood. For banking, we were still watching Simple and Moven, and the neobanks Monzo and Revolut were around the corner. Payments saw Venmo take on Paypal. In lending, Lending Club and SoFi were growing fast.

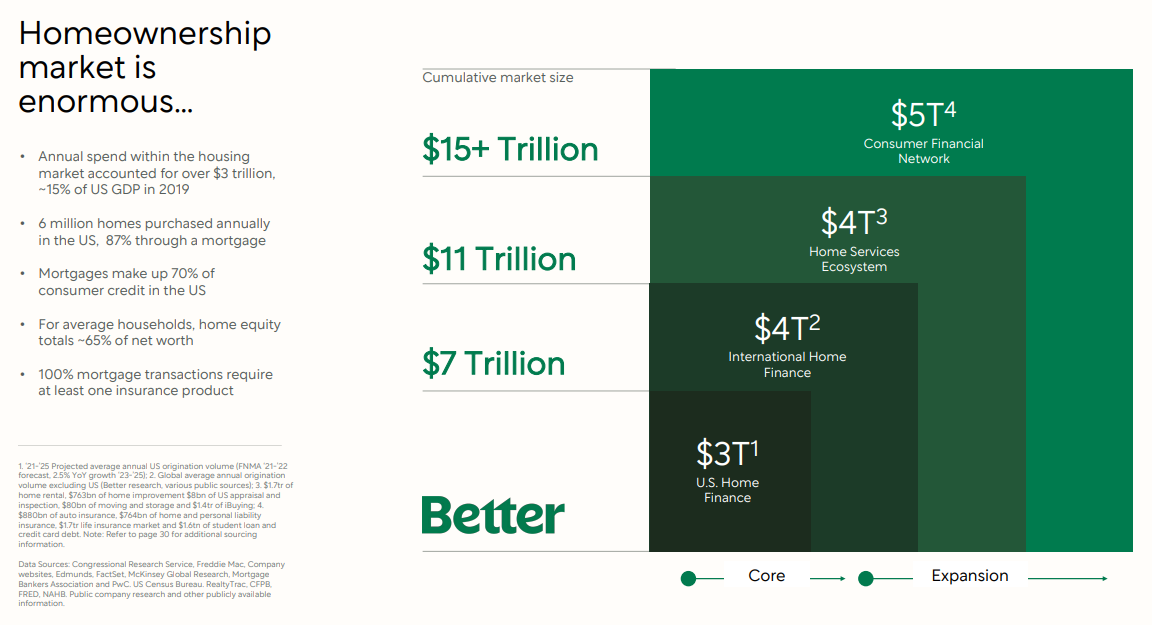

Investors like Ribbit were making a killing finding digital first companies who knew how to acquire customers at $10 per customer, 10x cheaper than their traditional brick and mortar competitors. Most fintech pitches used the word “democratization” and showed charts of market sizes. If only we could get 5% of all loans, they said.

We give you these pages from Better’s SPAC investor presentation in 2021, but we are sure the same pages were repeatedly used in earlier fundraising decks by the company. Obviously, mortgages are a big market, and SoFi had proven out student loans while Lending Club had done so for personal credit. Mortgages needed a digital champion, and it found one in Better.

One thing we have learned is to doubt lender who magically find ways to get new customers that banks don’t like. They are probably bad risks, and will blow up the balance sheet after you book the underwriting revenue. But look, Better Mortgage wasn’t taking on balance sheet risk supposedly. It was cranking up origination, charging 150 bps less than market due to a “technology first” approach, and selling off the loans down stream in the value chain. It was an arbitrage on people not caring about branches and human sales people.