Long Take: Finance is a Joke, 500,000 tokens launched on Solana last month

Iggy Azalea's $MOTHER memecoin is worth about $200MM and up 1,000% since inception

Gm Fintech Architects —

Quick take for you. Robinhood is buying crypto exchange Bitstamp for $200MM. Is it a fair price?

We’ll cover this next week, let us know your thoughts in the comments.

Today we are diving into the following topics:

Summary: In this article, we explore the evolving nature of finance and its integration with the Internet's populist and capitalist logic. Once a highly institutionalized domain, finance has been democratized, allowing anyone to issue tokens, akin to user-generated content. The rise of platforms like Solana and the proliferation of tokens exemplify this shift, presenting challenges for traditional regulatory approaches. This trend is also seen in the creation of memecoins by celebrities like Iggy Azalea, highlighting a blend of entertainment and finance. Ultimately, this shift signifies a broader movement towards financial democratization and user-generated financial products.

Topics: Bitcoin, Solana, Base, Coinbase, Binance, SEC, Pump.fun, DeviantArt, Goldman Sachs, Iggy Azalea, Roaring Kitty, GameStop, Farcaster

This is a premium article that is freely available. To support this writing and access our full archive of newsletters, analyses, and guides to building in Fintech & DeFi, subscribe below. We just adjusted the price to $12/mo.

Conversation Highlight

Generative Ventures co-founder Lex Sokolin interviews Venice.ai CEO Erik Voorhees at Consensus Austin.

Long Take

The Point of it All

Finance is serious business, right?

Of course, since it determines people’s livelihoods! Access to bank accounts can determine the trajectory of a person’s financial health and the health of an entire economy.

Money is important, stately, and should be respected.

Of course, because it makes the world go around! Money is the accurate accounting of labor and intermediates the exchange of goods and services. It is the glue holding society together, enforcing the social contract between the government and the governed.

But maybe? Maybe it’s all just fake, and a collective hallucination that we decide to treat however we all want — with reverence, with laughter, with violence, or with disrespect.

Maybe it is just one of our many human creative expressions, a neuron in the superorganism that is a country, and the hyperstructure that is the global community.

In the past, the issuing of money — strictly speaking — was a narrow institutional endeavor. Very few people in the world got to do it. Now, broadly speaking, issuing money and capital has been democratized. From the sovereign approval of the very first venture companies, like the East India Company, to the proliferation of Corporations and their liability shields, to the evolution of equities and the stock markets, the issuance of capital has been the preferred human modality of the last several centuries.

This is what we do in the age of money abstraction — we exude value.

Over the last 15 years, since the launch of Bitcoin to be precise, something magical happened. It is the same thing that happens to everything on the Internet. Professionalization and institutionalism give way to hobbyism and prosumerism. The esteemed craftsman, decorated with a black suit and tie or other fancy dress, educated at Harvard and Stanford, and seated in a glass tower on the top floor is replaced with the teenage hacker, genius, and anarchist in one.

The Internet’s populist logic — anyone can do anything on any platform for free — is also deeply capitalist. Attention aggregates to the very best, annihilating the middle class and the aspiring artist. Only Snoop Dogg and Damien Hirst reign supreme. Or, as is relevant to today’s note, Iggy Azalea. If you are a marketer trying to make it on the Internet, remember that you are competing with the Rock for attention and likeability.

Atomic Units of Value

Anyway, the earlier waves of platform shifts on the Internet all had their atomic units — the thing in which they were measured, or in which the Internet provided value. It is not enough to just talk about users or visit.

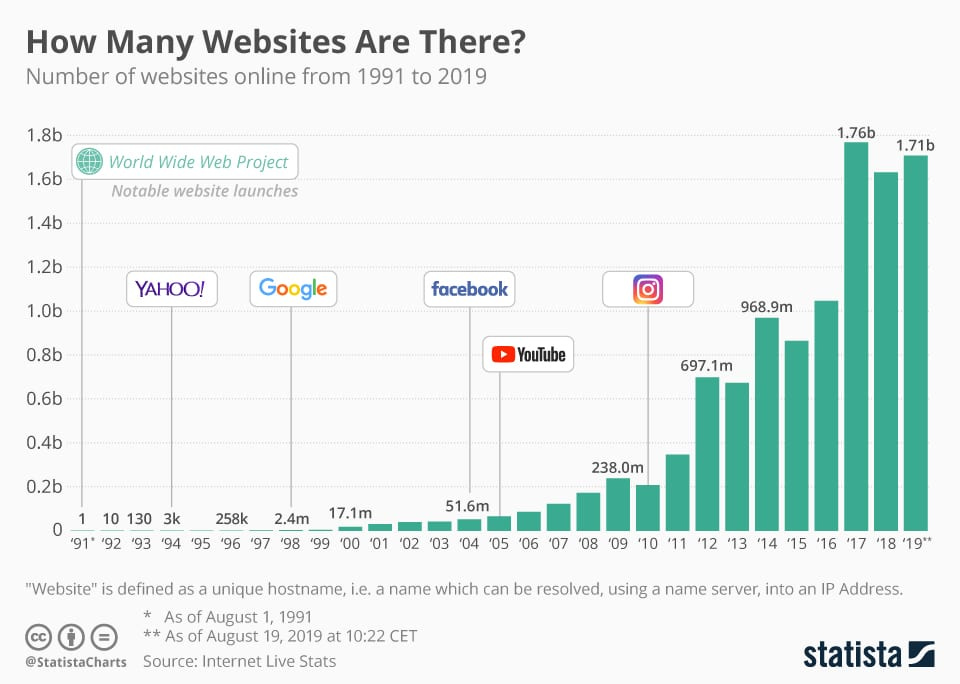

Let’s consider the number of websites.

Given the early focus on media content and its disintermediation, websites were the core product of the Internet, its atomic unit. If we fast-forward a bit to YouTube, we can think of its user-generated content in the context of the number of videos created.

According to a recent research paper, there are nearly 10 billion videos on YouTube today. The exponential growth curve suggests a profound change in consumer and creator behavior. All our favorite buzzwords, from the attention economy to the creator economy, can be plotted right on this graph. Video content is the atomic unit of this particular platform, and it exhibits Internet-scale properties.

Now, we come to Finance. For dear reader, this is a humble Fintech newsletter, not just an epic philosophical treatise. Since we are now in the era of user-generated finance, what is our atomic unit of value?

Super obviously, it is tokens. Tokens are the ultimate reduction of the corporate form into digital nothingness, the essence of abstraction and industry. They represent it all without representing anything in particular — or at least until the SEC allows us to finally attach cashflows into their intended container.

If you need guidance on reaching that chart above, it says that in the last month alone, there were 500,000 tokens launched on Solana and 200,000 tokens launched on Base, the Coinbase optimistic Ethereum roll-up. The last time things looked this way was in 2021, when the Binance chain saw the issuance of 250,000 tokens across its multi-million user footprint.

A few years back now, we told the following hypothetical in response to questions about financial regulation and the inevitable hand-wringing that finance professionals had about crypto. Isn’t it going to be a problem, people said, that anyone can issue securities? Or, you know, things that sort-of-look like securities, but aren’t, like digital sports collectibles that you can trade on exchanges.

And we said, imagine this.

There are 8 billion people, and maybe 1 billion of them are young. And maybe 100 million of them are willing to play around with financial products. Some of them will be consumers. But let’s say there are 10 million of them that want to be creators. And now, all it takes is one press of a button to issue a token.

Imagine 10 million people issuing their own capital. And some of these people will be repeat customers. They will issue more than one token — maybe a token every month. Others will be even more enthusiastic. Imagine a person on TikTok with 10 million followers. That person posts a lot of videos, don’t they? More videos than one every month. So there will be people who are issuing tokens and drawing new capital every single day. Thousands of tokens per person per year.

How do you regulate that? How do you regulate billions of new issuances every single day using a human task force of 4,000 people?

You do not, it is a fool’s errand.

To work with robots, you need robots. And that’s another thing. Of the million enthusiastic token issuers, half will be robots — simple trading bots, high-frequency trading algorithms, market makers, AI agents, generative labor workers, DAO treasury solvers, and other software machines.

It is like telling Facebook to find and censor specific politically-charged posts. Obviously, this cannot be done. A group of human employees cannot keep up with machine speed and scale. Only software rules — natively written in the language of machine finance — can be implemented and observed as protocols.

This is why our regulatory agencies need to learn how to code and write their compliance manuals in Python and Solidity.

Meme Economy

There is no moral content in what we have just written.

It is not that we think it is a strict good that financial engineering is available to the masses, or it is wonderful that the holiness of money has been completely debased and debunked. Rather, we are describing the thing as it is.

Financial issuance is completely open and available to all and there are no barriers to entry of any kind.

Pump.fun, the platform which has allowed Solana to become home to an enormous ocean of useless meme tokens, is not Goldman Sachs. Just like DeviantArt is not the Metropolitan Museum of Art and is unlikely to house the Mona Lisa. Both are home to the mass product of digital goods. DeviantArt was the home to millions of digital JPEGs in the mid-2000s. Pump.fun is the token maker of choice on the casino chain of Solana.

Don’t complain. Welcome to the Internet. This is what it is like.

As a specific example of what is happening this cycle, Iggy Azalea, the rapper and music personality has just launched a memecoin called $MOTHER. The coin is worth about $200MM and is up 1,000% since its inception a week ago. Here is the performance chart for it, and the … marketing collateral.

If you are thinking about how long it takes a VC-backed fintech startup to reach a $200MM valuation, or that it needs $50MM in revenue and $25MM in EBITDA, you are in the wrong mental space.

The product here is entertainment. The memecoin captures attention and popularity, and provides an experience to the consumer.

In fact, it may be the experience itself — of maybe winning the 100x lottery, or maybe losing all of your money — that is on sale here. Celebrities have been offering these experiences to you for decades, punctuated by the start of reality television. Once you gave the Kardashians your time and attention, you have invested a meaningful portion of your life and mind to their commercial engine. They benefit, and you lose. But in your losing — of your time and sanity — you gain something else.

And that something is community, belonging, and adventure. Meaning in a meaningless, nihilistic world.

It is not a surprise that “creators”, “celebrities” and other attention economy workers are trying to figure out how to capture this cycle’s financial mechanism for their own benefit. Everyone from Trump to Caitlyn Jenner is on the gravy train.

Of course this is horrible, in a high-minded aesthetic sense.

Welcome to the Internet. It’s too late.

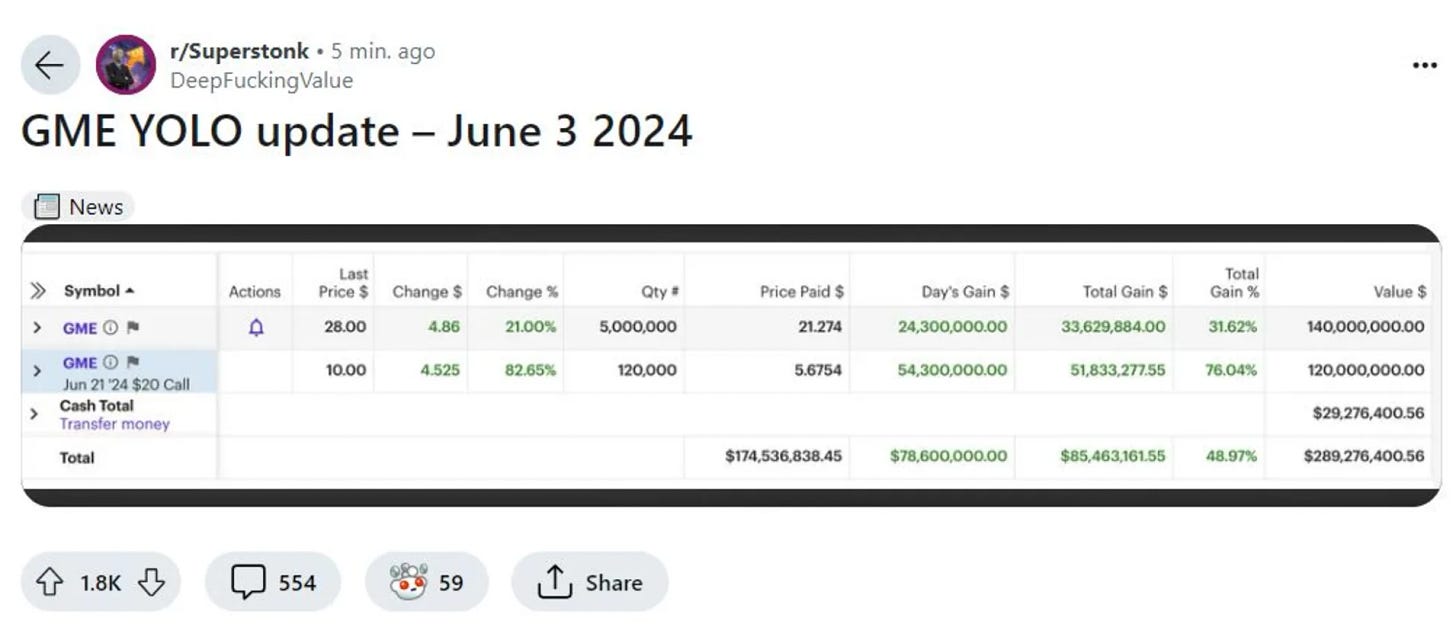

Things are spreading much further than crypto memes. You can look at Roaring Kitty, the retail champion trading GameStop, back in action after a brief fall from Reddit grace. Below, he is seen holding a $290MM position.

Why? How? Doesn’t matter. The Internet provides for its own entertainment.

From our seat, it looks like we will see only more of this type of activity going forward. The parable of teenagers issuing thousands of tokens a year has come to pass. The robots are around the corner, as AI agents infiltrate blockchains and begin to transact. Financialized social media platform Farcaster has just raised $150MM, introducing NFT and meme coin primitives into social media.

The best you can do is mark to market. You are here.

Postscript

Read our Disclaimer here — this newsletter does not provide investment advice

Subscribe for more premium content