Long Take: Fixing our innovation blindspots, with Apple identity and DALL-E AI art

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: It is easy to fall into the trap of ignoring certain information, or expecting breakthroughs only from your favorite sources. After a while, we confirm too much of what we believe, and ignore too much of what we don’t understand. In this take, we focus on our own blindspots around innovation from incumbents, and revisit developments from Apple in iOS 16 around BNPL and identity. We also check in on AI-based art, and reconnect to earlier themes around machine generated creativity.

Topics: BNPL, payments, big tech, identity, artificial intelligence, machine vision

Tags: Apple, Dall-E, Midjourney, Stable Diffusion

Thanks for your time and attention. Share this Long Take with others so they can benefit.

Long Take

Blindspots

We see what we want to see. Whether you call it a blind spot, or confirmation bias, it is unavoidable for humans to miss evidence that challenges their thinking, and amplify evidence that confirms their thinking.

This behavioral pitfall is a natural function of how the brain works. We form connections and intuitions not as some constructed machine of reasoned logic, but as a big network of associations between facts and ideas. Then, we attach confirmations to that clump of neural probabilities, and call it a mental model. The mental model becomes our reality, and inputs filter through it, chiseling it further like some Green statue of the world.

For us here at the Fintech Blueprint, our blindspot is the middle path between novelty and establishment. Let’s describe what we mean.

On the one end, you’ve got things that are very clearly new and strange — the heart of innovation. This is what the artist, the entrepreneur, the creator snags on. This is what inspires us and drives us. It’s core is curiousity, and its measure is product market fit.

Look! Here are all the strange weird things! How new and strange they are. Wouldn’t it be amazing if we lived in a world where strange news things defeated the old orthodoxy? In this way, we gaze at Web3, at artificial intelligence, at augmented reality, and wish for it to be true. The newness represents the future, and we seek its utopian nectar.

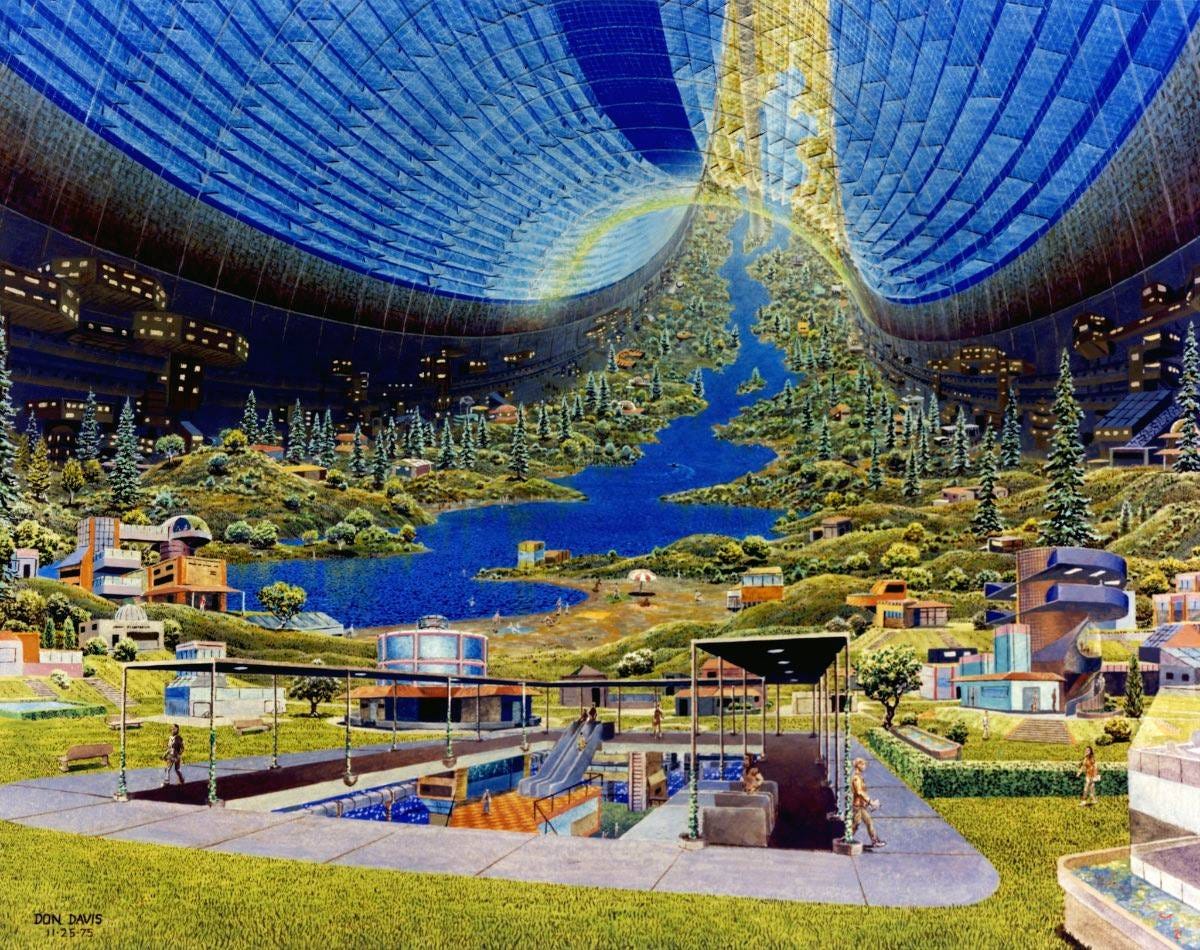

We, collectively as an avatar of progress, want to live here …

… and you can see how startups and technology model themselves around that science fiction.

The new things are built by eccentrics, who are willing to take the risk and fail out to follow their own conviction and curiosity. Some, however, break through and hit a product or feature that is a real improvement, which then scales to product-market fit. We see Robinhood or Coinbase get in the millions of users and cheer them on! They are *still* in the innovator corner, waving our flag, the flag of disruption.

Energy overcomes stasis.

But something funny happens. At some point, the innovators win and become incumbents. They become too big to be credible as artists anymore. And at that point, we here just … sort of … lose interest. Those companies that reach escape velocity and become incumbent, well to us they just become part of the furniture. Their employee headcount goes from 50 to 5,000 (e.g., see Binance) and their market power becomes the market itself. At that stage, there is not struggle and gamble for the stars. It’s just growth, profitability, and EBITDA.

Just another factory making financial widgets for the general public.

If we think about this model, it has a major blindspot.

We are missing the magic done by large incumbents that have woven innovation into their DNA. We scoff at the $12 billion in tech spend that JP Morgan outlays every year, while celebrating $12 million raises for yet another B2C Gen Z bank. We are not seeing the wild things enterprises and governments, and therefore communities, can accomplish through their duly created institutional structure. We are blind to all the public goods and the actual history of human progress, which relied on collective action beyond capitalist optimization.

Let’s plot this —

Can we marvel at the novelty built by the Orthodoxy? Or do we assume it is obvious and boring, because it comes pre-installed on your operating system, or is issued by your government? We may want David to best Goliath so much that we do not care if the battle has a meaning beyond damage. Perhaps by pointing to this error, we can polish our thinking for the better.

The Apple Wallet

Apple announced the next version of its operating system, which has in turn generated lots of tech and blog coverage. This stuff has stopped floating up into our attention, because of how we caricature the space. It goes something like this — big tech companies own attention, financial companies own manufacturing of capital-based products, the two will fight over distribution alongside fintech, and eventually those with better technology will win by compressing the margins of the manufacturer and driving distribution costs to free.