Long Take: How can Farcaster avoid the death trap of decentralized social media?

The Pitfalls of Prioritizing Finance in Social Media Platforms

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we explore the rise of social media as a recent phenomenon reshaping business and financial landscapes. The discussion transitions to the challenges and missteps in creating decentralized social media (DeSo) platforms that prioritize financial features over improving the core social media experience. We examine several attempts at integrating blockchain and financialization into social media, such as Steemit, EOS's Voice, BitClout, and Friend.tech, noting their initial promise but ultimate decline in user engagement and value. Farcaster is introduced as a new contender aiming to blend the social media experience with Web3 capabilities without compromising on the social aspect. Its architecture, which allows for ownership of one's social graph and the integration of Web3 apps within posts, suggests a potential for a more engaging and innovative platform. The success of Farcaster and similar platforms hinges on delivering a superior social experience and meaningful community presence, moving beyond mere financial incentives.

Topics: Decentralized Social Media, Steemit, EOS, Voice, BitClout, Friend.tech, Farcaster, Warpcast, Lens protocol, Aave

If you got value from this article, let us know your thoughts!

Also, if you are interested in checking out Farcaster, follow us here and join the Fintech channel.

Long Take

Build It Better

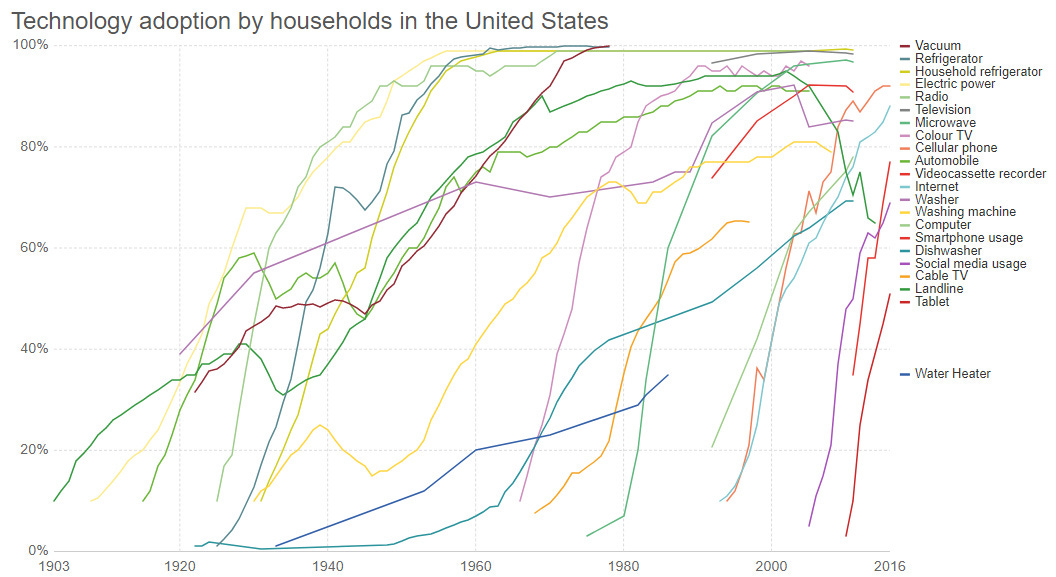

Technology platform shifts are rare, coming around once every few decades in recent history.

They change how people behave and what they take for granted. As a result, platform shifts are deeply disruptive for business models that are designed around the particular shape of existing value chains.

You can have an extremely competitive and well defended business, like K-Mart (retail shopping) or Borders (books) or Kodak (photos) or Tower Records (music CDs), that has entrenched a position in the incumbent value chain. But when a platform shift is introduced, the entire sequence of how people buy good and services changes. Consider — the switch from malls to Amazon, or from physical music to digital streaming media.

One might look at an industry structure and see a tightly woven, geared machine.

There is nowhere to go, no oxygen for a new entrant. And yet, technology is like water. It will flow around the machine, the great mountain of industry, and find a new path.

Social media is a recent phenomenon, and we are still processing the behavioral and economic changes it has brought forth. The norms of the attention economy, and its resulting business models are just getting to scale. From a finance perspective, think about the payment processors, eCommerce enablers, lending underwriters, and other adjacent fintech software providers that have grown up in the last decade. Or, alternately, think about the B2C fintechs that have built billion-dollar brands using digital client acquisition through these channels. All of that is the re-shuffling of value chains in response to new platforms.

Networking and community is one of the core pillars of the Internet, and one could argue, is the main pillar of Web2.0 — turning attention into a product to be collected, mined, and attached to a giant machine-learning algorithm. So it is extremely tenacious for Web3 — an adjacent Internet defined by ownership, self-custody, and financialization — to go after this sector and try to build new competitors. As a comparison, imagine if JP Morgan decided to launch a social network with its $15B of tech spend per year.

And here lies the existential problem.

JP Morgan’s version of Facebook might have cool financial features, but it wouldn’t be better at being Facebook than Facebook (how meta!).

This is precisely the mistake that the financial engineers of blockchain protocols make when considering social media. Instead of building *better social media*, they prioritize the financial features enabled by crypto assets. While that can lead to an initial speculative rush, it also usually ends in a speculative bust. People do not stay and engage with each other, because the core social media experience is not better than the Web2 alternatives. It is a rush for the exits.

The only answer is to build it better.

To do so, you have to use the native capabilities of the platform shift to accomplish something new, without compromising the core experience of the previous thing. People are still buying toilet paper, but getting it delivered by Amazon is easier than driving to a mall. People are still reading books, but downloading it to an iPad is faster than browsing a bookstore. You get the picture.

The Mistakes

Decentralized social media (DeSo) has been a target of crypto builders for a while.

See Steemit, once worth $1.5B, a Reddit clone that had a coin-type cryptocurrency underneath its points system.

The project surged in popularity as an early demonstration of the financialization of content — creators can be paid for their work by things other than advertising! It has been a long grind down since.

Another time we covered the DeSo sector was when EOS, the scammy $4B ICO, decided to spend $150MM on Voice, a Facebook clone in 2019. Tokenomics was meant to solve the bot problem, and again reward creators for content.

But people don’t come to social media to grind out digital coins — they go there to connect with their community and build an audience. Some people go further and further to feel important and influential. Content is an emergent property of humans getting together to tell stories around a camp fire at night.

Our takeaway was that Facebook had far more to fear from TikTok than Voice. The latter is no more.

The next evolution came in the form of BitClout, founded by the clever financial engineer Nader al-Naji, previously known for raising $130MM to create the algorithmic stablecoin Basis and returning the money after regulatory pushback. Nader has an eye for mechanism design — in another universe, he would be running some giant MBS trading desk at Goldman.

BitClout stole Twitter’s tech influencer social graph, and re-created it on its own protocol. Each profile was granted an amount of currency proportional to the number of followers those profiles had on Twitter, and the value at which these coins could be redeemed were determined by a bonding curve — a one-side version of a decentralized exchange. This was an amazing marketing gimmick, gifting the most famous people most of the funny money. It led to a speculative moment of large proportion, bootstrapping the fundraise for the native DeSo token.

There was profound friction in the experience — developers remained anonymous at the time, there were only Bitcoin on-ramps, and the user experience was unusual. But the idea of capitalizing your followers — rather than underwriting content production with digital money — was novel and clever. The project raised over $1.5B in Bitcoin if we recall correctly, but was not able to build real sustainable value and puttered out.