Long Take: How Decentralized Physical Infrastructure (DePIN) impacts finance and the machine economy

When do the robots take over, we are ready already

Gm Fintech Architects —

Today we are diving into the following topics:

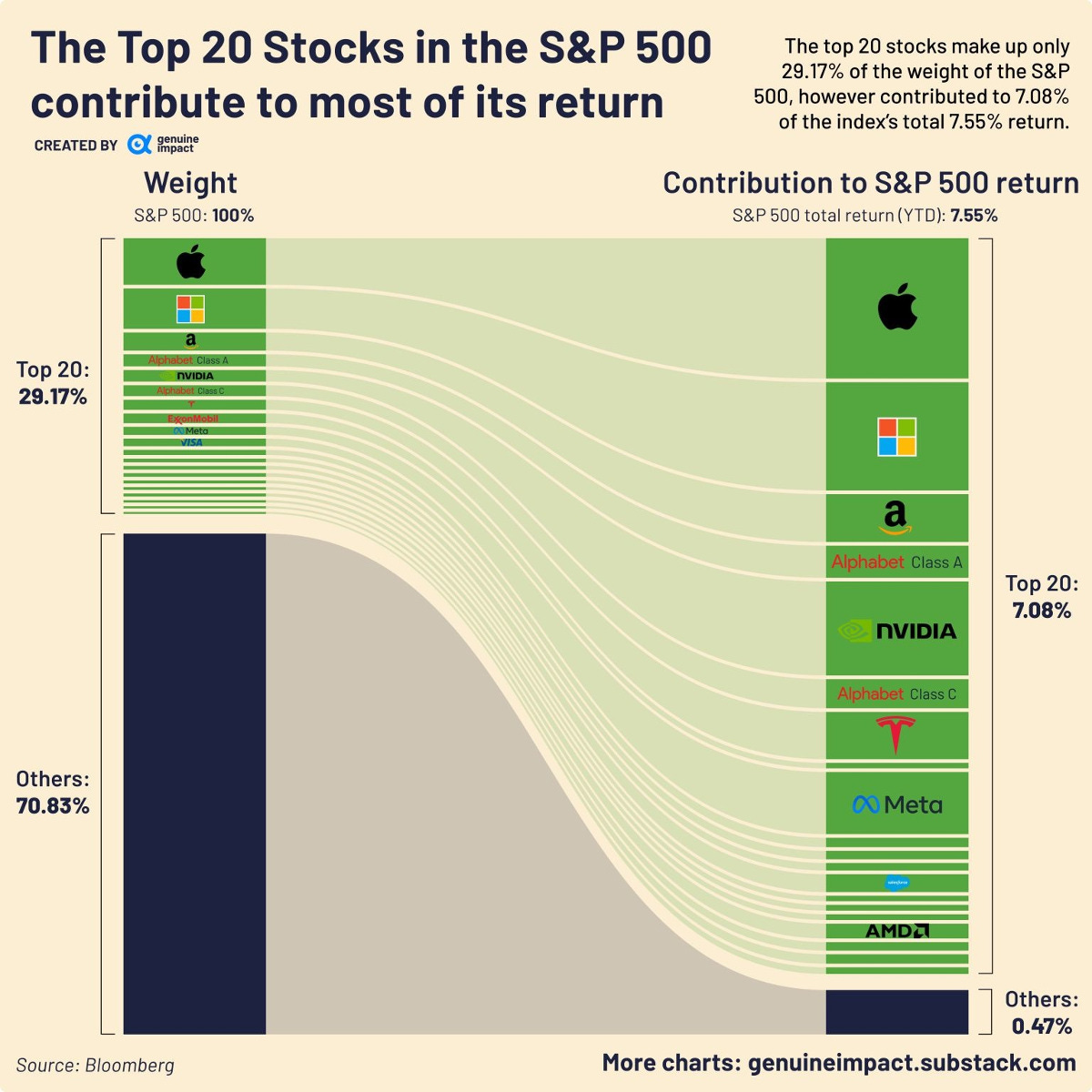

Summary: We dive further into the concept of a machine economy, and how it intertwines the Internet of Things (IoT), the Metaverse's economic structure, and visionary sci-fi narratives. Current data from Goldman reveals a shift in the S&P 500, where top tech companies dominate, indicating their increasing influence in the digital realm. The DePIN (Decentralized Physical Infrastructure Networks) sector is emerging in Web3, aiming to anchor digital twins and commerce avatars into decentralized platforms. As finance evolves, we're not just observing hardware devices interacting financially; we're witnessing the birth of self-driving money, where software representations of real-world entities play pivotal roles in our digital economic future.

Tags: DePIN, Internet of Things, DeFi, Helium, Peaq, IOTA, machine economy

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Machine Motivation

A few weeks back, we talked about the idea of a machine economy in the context of Generative Ventures.

This idea is a tangle of different threads, from the grounded devices of the Internet of Things, to the economic architecture of the Metaverse, to the science fiction stories of Neuromancer and the Diamond Age. We don’t all have to be robots to be robots, you know.

One way to tell this story is with the following chart.

Though a few months old, this Goldman analysis of S&P 500 value concentration tells an useful point. The largest companies in the equity index are comprising a historic high of the entire index market capitalization. That suggests that all the other companies are sort of just hanging out, while the top ones are rallying back with a vengeance this year. And that shouldn’t be a surprised — tech was punished during the risk-off deleveraging, and has now regained some of its shine. And we can validate that in the second chart above, which splits 2023 returns by their company drivers.

So who is involved? Robots, or people?

Our expert illustration above (watch out BCG!) tells the story.

The world’s most valuable companies are hardware and software manufacturers. Apple and Microsoft and Google do all of these, responsible for the majority of the world’s smart devices. Their software forms the large neural brain sitting on top of the digital body of human knowledge, i.e., the Internet, and augments human capabilities with software productivity. By using an iPhone or Alexa, you are already a cyborg.

NVIDIA and Tesla are both machine companies. NVIDIA makes the brains, the GPU processors to create the computational power that reasons from big data. Tesla makes the physical chassis for the travel net, and mines the data into large scale machine learning patterns until we have self-driving cars. And Facebook has the Oculus, open sourcing any AI they can on the way to last place.

As a result of all this technological work, we have something called the Internet of Things — all of the computing devices and sensors strewn across the physical world generating a parallel digital universe. A few years back, we would be excited to talk about digital twins of cities and phygital commerce.

You see, the meatspace object and its digital analog are merging together, and software can be used to impact the real world. Today, IoT and edge computing (i.e., the capabilities of hardware at the edge with the user, rather than a centralized cloud) are both more established and less exciting.

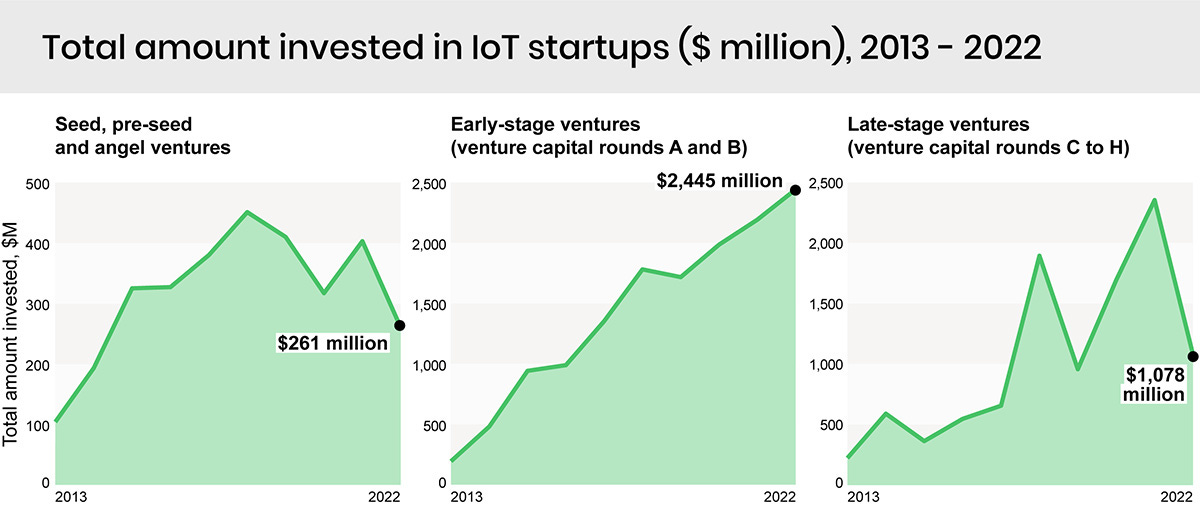

IoT funding has reached about $2 billion per year, and the number of devices outnumbers the number of humans by a few billion. But yet in many ways, this remains an infrastructure telecom story. Large capital outlays are spent by big companies in order to install thousands of hardware things across the world. The building of the railroads is an endeavor for a natural monopolist. Just ask Carnegie.

We think there is a tension here. So far, IoT has been an enterprise theme. Just like IBM’s early computers were for work, and not for the home. It took Microsoft and Apple to bring the personal computer to us all.

We believe there will be more sensors, more biometrics, more data, and more merging with the digital world. But something is missing in the mechanics of the market structure.