Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Elon is talking about turning his $44B Twitter purchase, with its 400MM monthly active users, into a fintech with a payments and banking offering. We take apart the underlying strategy, and discuss the value chain that starts in social media, moves into commerce and payments, and then ends in banking and investments. There certainly are ways this could work, if it’s not an experly executed troll plan. We consider how Goldman could power the financial aspects of the platform, and highlight the importance of identity to the whole scheme, which explains the speed to build verified accounts.

Topics: embedded finance, social media, M&A, payments, commerce

Tags: Twitter, PayPal, Elon Musk, Goldman Sachs

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Payments Entrepreneur Adds Payments to Website

Twitter is a website.

It is a website of user generated content, constantly expanding and contracting with the chaotic waves of the universe. But still, just a website where you scroll and click things.

Elon Musk is a payments entrepreneur.

And Elon Musk just bought a $44 billion website with about 400 million monthly active users and $4B in revenue. That’s about $10 in ARR per MAU, primarily driven by monetizing attention via advertising, which naturally erodes the quality of the actual product and is counter to Musk’s Atlas Shrugged ubermensch ethos. The enterprise value, on the other hand, is about $100 per MAU — a 10x revenue multiple that’s a bit harder to defend in a bear market focused on value investing.

So naturally, one place that Musk is thinking about is invoking the payments Fintech bundle. You may remember it as the chart from ARK Invest, or the motivating logic of the value behind SoFi, Revolut, and the neobank SPACs that were trying to take user ARR from $10 pre year to over $100, justifying their $1000 per user enterprise value. Here’s that chart, unfortunately looking much more like hopium these days.

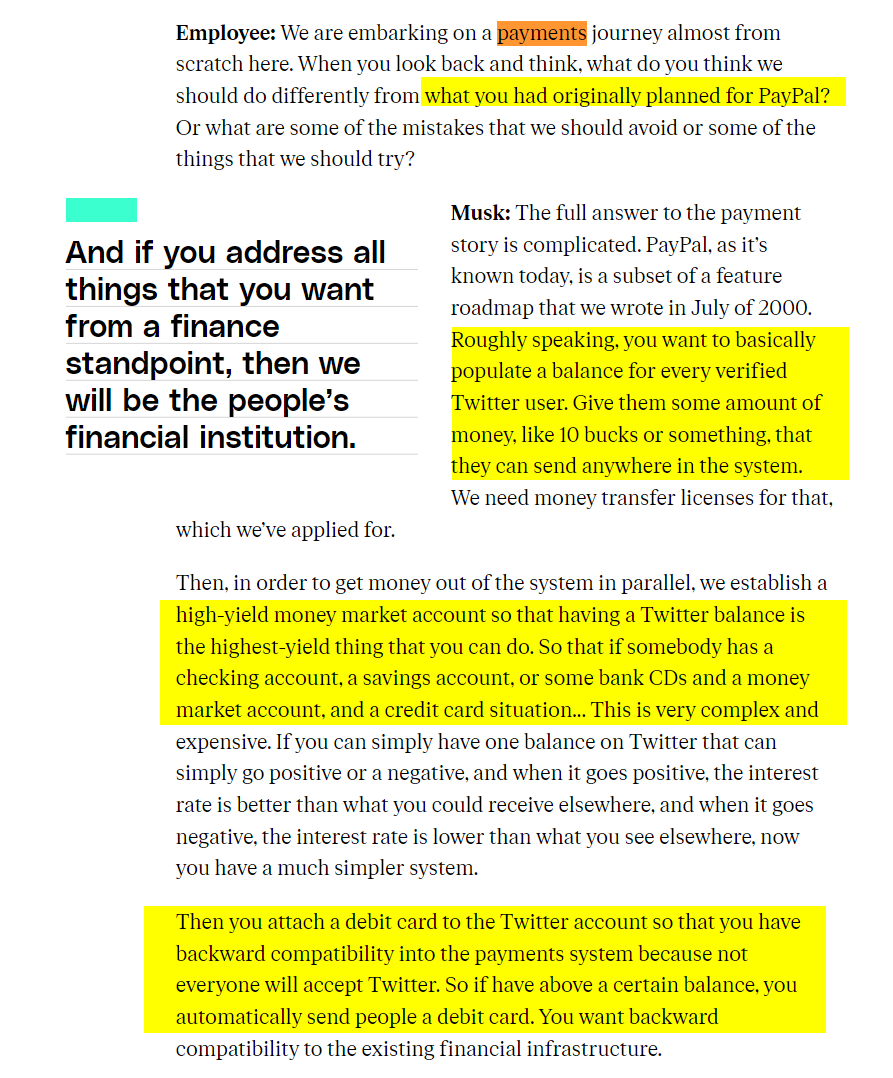

So here’s what Musk is saying to his poor, stressed out, almost fired Twitter staff:

The conversation points to a couple of things every Fintech entrepreneur discovers over their journey. First, attention, commerce, and financial products are deeply connected. How closely you tie them together is a function of vertical integration and regulatory barriers.

You could own a media company, a traditional one like Forbes or a new media one like Twitter, and simply algorithmically farm attention. Farming attention is maximized through outrage and dopamine addiction, and then monetized through advertising.

What is advertising? Advertising is the lead generation funnel for commerce. What is commerce? It is the economic exchange of goods and services, creating value in every transaction and contributing to GDP. If you are eBay, which bought PayPal and then spun it out, you are providing a platform for commerce. Relative to eBay, PayPal became much more valuable due to failure to really execute. Relative to Amazon, however, PayPal is a simple payment processor. Similarly, if you are Alibaba, you are providing a platform for commerce. Relative to Alibaba, Ant Financial is the payment processor.

Anyway, once you have commerce, you can intermediate the money flows with such a payment processor and capture fees not just on being the store, but also on the money in motion. And once you have ways to tap into money in motion, you start building out services for money at rest, such as the high yield bank account that Musk is talking about above.