Building Company Playbook #1: How to design your Fintech business model

This is the first part of a series on building companies from the Fintech Blueprint

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We start 2023 with a series on how to build companies in Fintech and DeFi. The first entry explores the topic of business models, and in particular, how to identify various shapes of demand, parse between different approaches to business model, and respect the economic and financial flows that drive your potential company. We highlight common mistakes and suggest approaches to navigating uncertainty and risk.

Topics: start-ups, fintech, DeFi, innovation, disruption, tokenomics

Tags: Betterment, Coinbase, MetaMask, Second Market, Robinhood, Lemonade

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

A year to do the work

Welcome back to the world everyone, grinding forward as it does with each minute. We draw lines — between here and there, then and now — to make sense of it. So be it then, 2023, you are new, fresh, and open. What is your theme, baby new year?

We’ve got through quite a bit of self-reflection, looking for where to go next.

And the thing that sticks out is being honest with ourselves, and cultivating the practice. It is the doing of the work.

What is the work, you might say? What is its shape! When you push as hard as you can forward, but the water takes you back all the way to the beginning and more, what work is worth doing? Why not give up, and float away along with the rest of the bankrupt start-ups, disgraced founders, and failed influencers? Because it is in the actual doing that you go on the adventure and discover yourself by discovering the world around you. It is in the mundane that you form together the patterns of the grand and the majestic.

So let’s get back to the basics. We are humans and our superpower is to make things anew. It is to build. And if you are here with us, it is probably because you want to build something meaningful in financial services or in technology — of whatever flavor. In this series, we will lay out some of the basic lessons for building Fintech companies and DeFi projects, re-teaching ourselves the foundations of what makes things work. Because that’s what you are going to do with us together.

The Shape of Demand

In this series overall, we want to think about the various functions of a fintech company. How do you build a good Marketing team, for example?

But before we get there, we need to figure out when Marketing actually matters. Are you trying to build a brand? Create leads? Convert into product? Or do you not need marketing for more than decorating the activities of an enterprise Sales team? Each strategy is congruent to the shape of some company or project. That leads us to the question about that particular shape.

In some of our past work, we had talked about this as a “negative space” — see here Who are the customers of Embedded Finance, and what do they reveal about Stripe, Affirm, DriveWealth, and Green Dot? The shape a company — let’s just use this word for all sorts of entrepreneurial permutations — is determined by multiple factors. The wrong factor is to be merely a mirror of leadership personalities and their prior experience. Stubborn, opinionated management comes with pre-built assumptions about markets and value chains. This can be both an asset and a liability to a young company.

If, for example, you had run the UBS wealth management business, you might assume an entire industry structure of custodians, tech providers, and broker-dealers, as well as their prices, sales strategy, and other integrations. Alternately, if you had run a digital payday lending business, you might have very strong assumptions about what your previous customers need and their spending habits, as well as the value chains of underwriting and payment processing. Taking these different experiences as fact about some new problem, and applying that as dictate from the management team leads to a mismatch between the hypotheses of experienced people (i.e., your stubborn and expensive management teams), and what really matters.

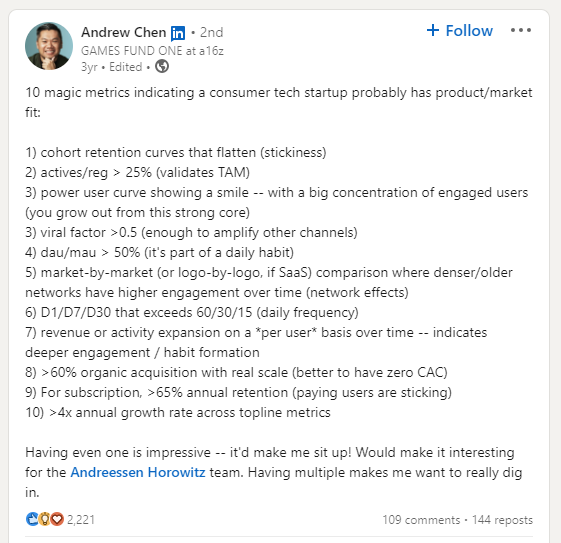

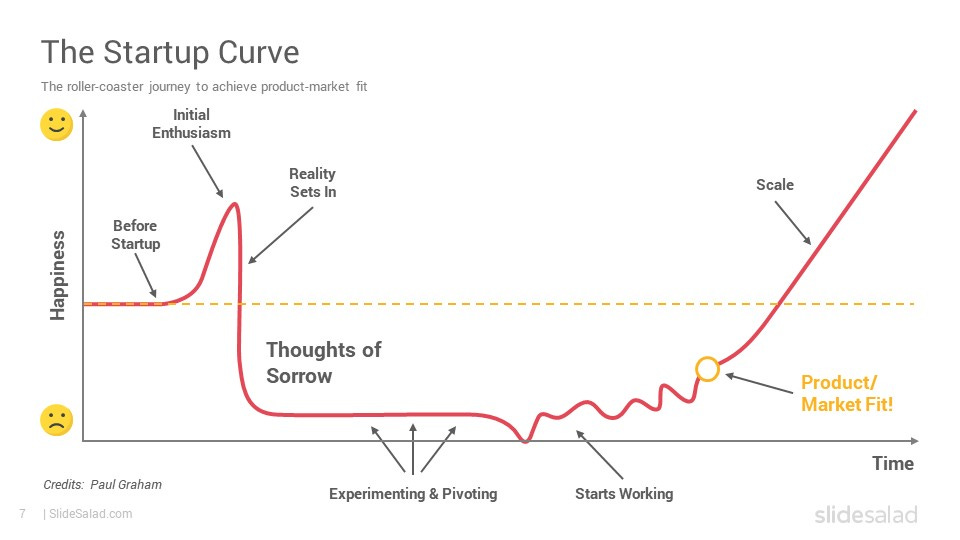

And what really matters is the shape of demand, and the ability of a company to wrap itself around that demand in all sorts of ways — from product strategy, to brand positioning, to customer support, to the execution of marketing programs. Some people call this product-market fit, and talk about pivoting a start-up until such a state is achieved. Venture investors will have specific metrics that qualify as product-market fit for their investment thesis, of needing to get viral unicorn hits in an otherwise doomed private portfolio.

So let’s say you are looking for that negative space, which is the set of problems that other people experience, and trying to run experiments to validate whether there is enough economic value for a company to be built sustainably.

There are lots of other places you can learn about how to run a product discovery and development process, so we won’t belabor it here. Whether it is the lean startup method, or some version of Agile, or just lots of conversations with prospective customers, the most important thing is that you get out there and actually learn what those prospects could want. Look for things that people would be happy to spend on, without hesitation.

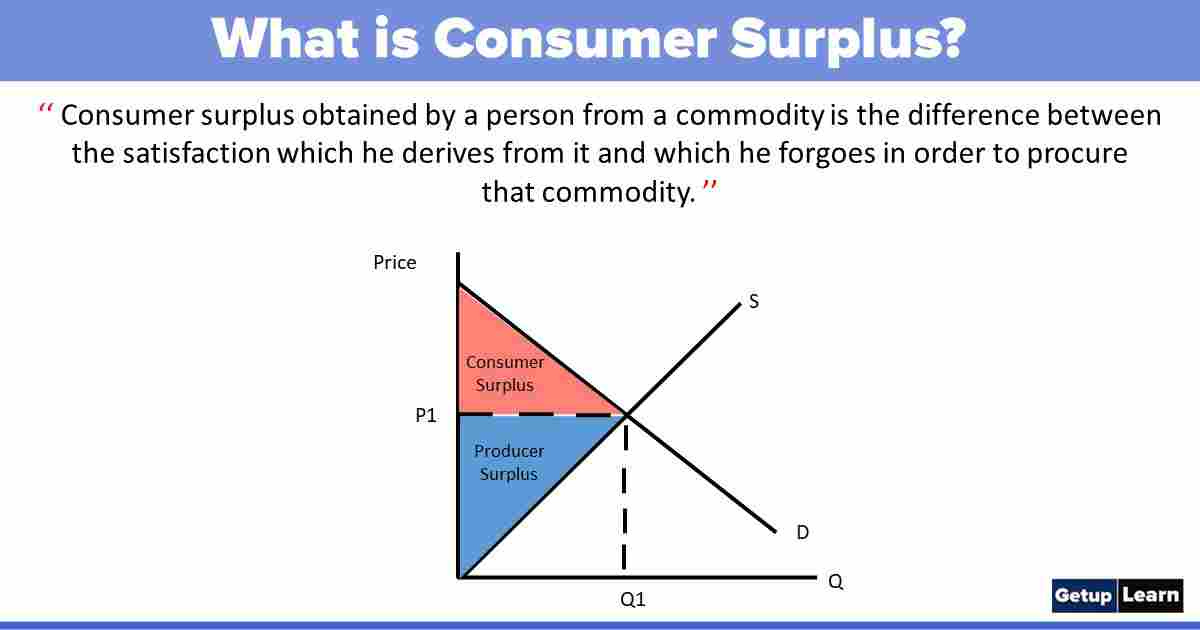

Economic value is oxygen. You want to find and target places with meaningful consumer surplus, where the price you charge to your customer is still lower than their willingness to pay. You want to leave value on the table for your customer, who will then recommend your business to others, and engage with it more fruitfully.

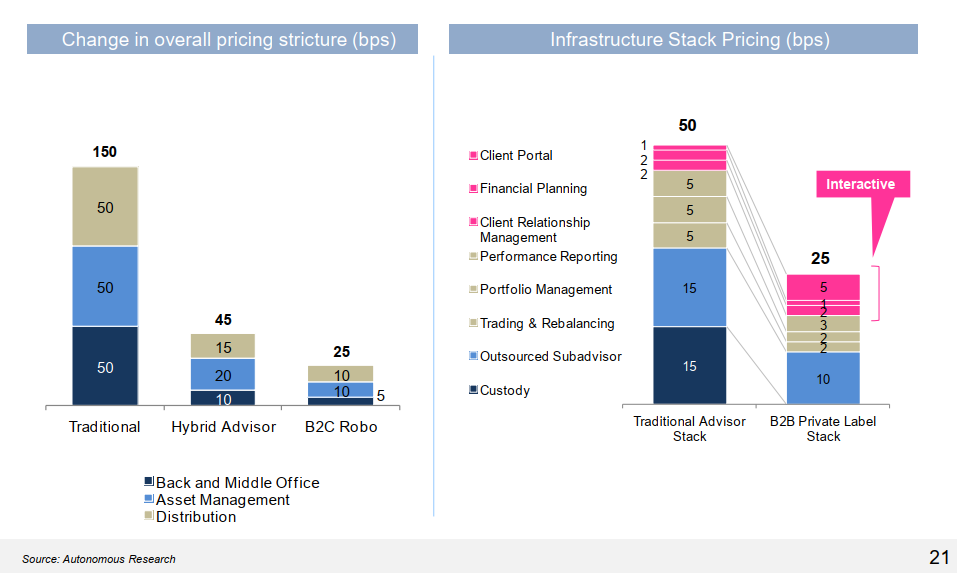

If you want examples of this, look at the value that roboadvisors offered in automating wealth management and reducing cost from 1.5% of assets under management to 0.25% of assets under management. Or look at Transferwise, cutting the cost of moving money from 3% in foreign transaction fees to below 1%.

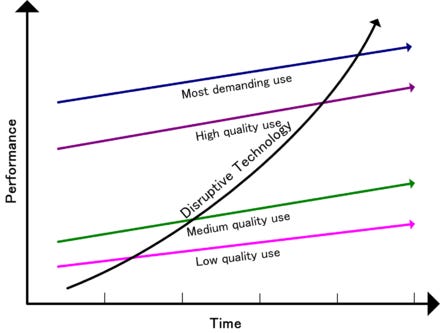

If we look at the digital fintech tools — neobanks, roboadvisors, digital investing, payments wallets — as an investment analyst does, just cells in a spreadsheet with a lower cost base, we will miss the substance of what is actually going on. Financial analysis misses the important qualitative shifts that drive industry transformation. Isolated financial analysis is incredibly dangerous, begging for black swans to destroy its assumptions.

Back to B2C fintech. These mobile-first solutions were able to use a platform shift technology, i.e., cloud services and mobile devices, to attach to demand for financial services products. Now that demand manifests not in the need for some feature, like “an asset allocation” or a “digital loan”. No, demand manifests as a problem, like “I want to retire in 10 years” or “I can’t afford this home improvement, but I need it to live”.

If you want to look at B2B fintech, use the same framing. It is not “We need a CRM that integrates portfolio management and performance reporting data” but “Our teams need to convert more of our prospects into paying users”. The product feature are the “solution” to the business problem equation. Don’t fall in love with the solution. Rather, find a business problem you can love and pivot around — however that business problem must be appropriately sized.

The Models of Business

In the examples above, we talk about large and existing demand that is somewhat obvious. The nice thing about financial services is that we generally know what people need, because they have been needing it for millennia without much change. People pay, save, borrow, lend, trade, invest, and insure against risk.

Those are repeatable financial services patterns. You can segment each need by the customer asset size, psychographics, and so on.