Gm Fintech Architects —

Today we are diving into the following topics:

Summary: There are cycles to it all — in market prices, in economic performance and personal debt, and in the innovation dialectic between applications and infrastructure. We look at the Union Square Ventures thesis from 2018 and apply it to current fintech valuations, Klarna’s results, and the upcoming Ethereum Merge. What’s the strategy for those of us in the fog?

Topics: strategy, markets, infrastructure, fintech, crypto

Tags: Klarna, Ethereum, Ray Dalio, Union Square Ventures, Morgan Stanley

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

Knowing the Not Knowing

We, finance people, are obsessed with market prices. The market is the truth machine, and so on. We think the market clears around some profound consensus about human creativity. Its waves and wiggly lines communicating the motions of economies and productivity.

Here is the mystical S&P 500, with its up and down …

… and is the abstraction explaining the market cycle from Ray Dalio …

… and here is a picture of your heartbeat …

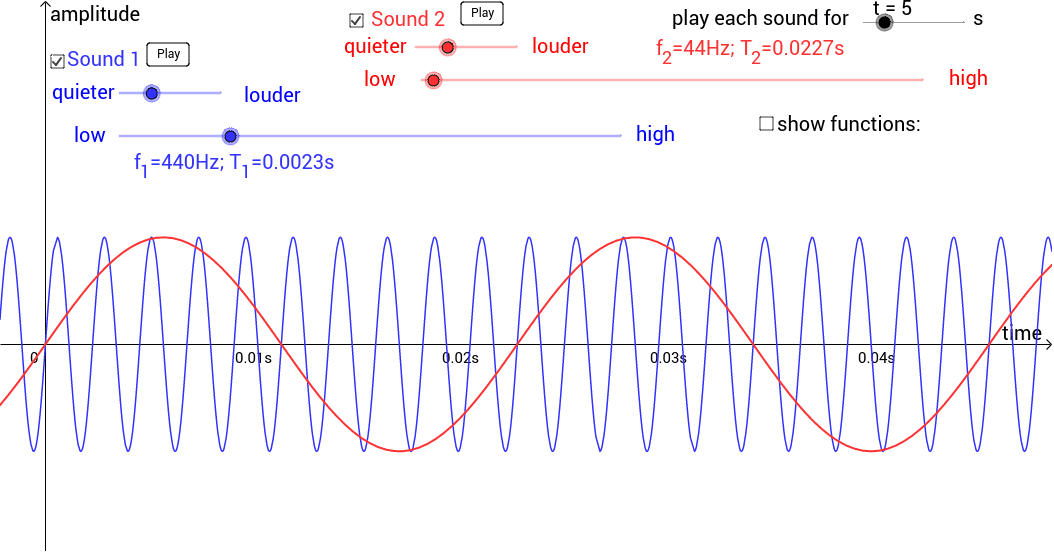

.. and some sound waves …

… and some ocean waves for good measure.

Isn’t it calming to see the self-similarity between natural phenomena? Aren’t the social and political structures of Homo Sapiens yet another version of the same?

It is alright to be at the bottom of the wave, and it is alright to be at the top of the wave. Alternately, how can the wave have a top if it had no bottom? The world would be flat, and there is no fun or adventure in that.

One of the more lasting explanations of similar cycles applied to innovation comes from Union Square Ventures, which pointed to a dialectic between *infrastructure* and *applications*. The two evolve in a symbiotic manner, and unlock successive stages of further economic development. Here are a few visuals from this key post written in 2018, at the bottoms of the last cycle.

The infrastructure of Internet tooling led to the creation of web applications. The infrastructure of banking-as-a-service tooling led to the creation of B2C fintech applications. The infrastructure of crypto tooling has led to the unlocking of DeFi and Web3 applications.

Yes, it is great hopium to say that a market collapse is a building phase for the great next frontier. But there is evidence for this true. It is in the nature of things.

We see it as a dialectic between identifying a market, a pantheon, an ecosystem of competition, and then competing directly in that arena. It is the difference between preparation of others for exploring the unknown, and the singular act of exploring it. There is a loop in this. An explorer will move through the wilderness until she meets an unpassable barrier. The fog becomes too thick to see beyond it.

Pausing in the Infrastructure Valley

Let’s look at a single example of B2C fintech winning the area and losing the way.