Long Take: MasterCard's biometric payments, Web3 soulbound NFTs, and the construction of digital identity

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this analysis, we review the concept of identity through the lens of the news of MasterCard’s facial recognition powered checkout pilot, and Vitalik’s paper describing non-transferable NFTs. Built well, decentralized identity can be composed of actual digital artifacts, and thereby enables new types of provenance, underwriting, airdrops, and social connection. Biometric identity, through machine vision and NLP, can connect a human being to their digital avatar in ways that are both cheaper and more intuitive to users. Whether this is a utopia or dystopia we leave to you as value judgment.

Topics: identity, payments, blockchain, Web3, NFTs, society and economy, property rights

Tags: MasterCard, Ethereum, Plaid, Apple, Lens protocol

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

Anchoring in Identity

We are going to talk about payments facial recognition in the physical world, and soulbound tokens in Web3. But before we get there, let’s establish why it matters — or rather, why this topic is exciting and worth looking at as causal to a number of industry features downstream.

Identity is an unlock. But it can also be a barrier. The truth is that very few identity companies get people actually riled up from a venture capital or investment point of view. While they are required for financial and economic flows to move — since every line needs to have a point of origin and a destination — identity itself is not a participation within transaction volume, and therefore isn’t as commercially attractive. There are no spreads, market makers, AUM fees, or underwriting within identity. And in fact, the history of startups is littered with dead identity attempts, including within the space of self-sovereign individuals. The more exciting it was, the less likely it was to work.

Some things that work around the topic are KYC/AML or other compliance software platforms, which are used to authenticate people into accounts or monitor payments fraud.

There are some great companies built around these themes, but people think of them as “infrastructure” at best or regulatory cost / rents at worst. Even if there’s $3B+ of annual revenue at stake and $18B+ in venture funding.

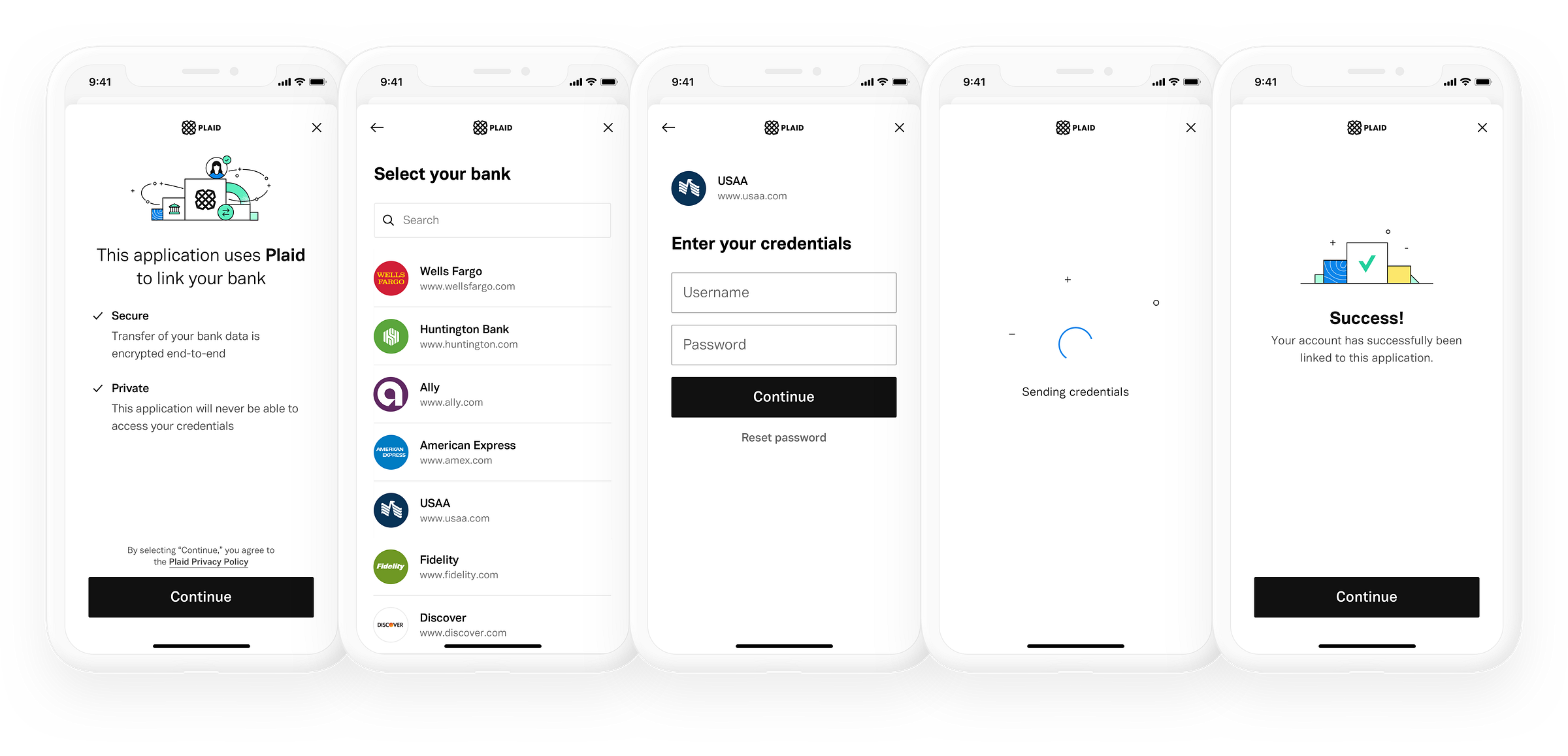

But this is a very narrow way of looking at identity, because it is framed as a financial problem to be solved. We can broaden the question instead to something that includes Plaid. How can one wrap around verified financial data in order to approximate an individual, and trust their credentials? How can we use streams of financial data to authenticate and underwrite?

Plaid is an identity company!

Or maybe, we think about logging into accounts — an extension of yourself, an avatar in the digital world.

Is Google an identity company, using your email to authenticate into third party services? Your email is composed of your private stream of communication, on which a machine learning bot could easily prove authenticity. Is Facebook an identity company, using your social network profile to connect into other software? Your social profile is connected into your friends group, which has validated the reality of your physical self by sharing photos with facial recognition, and records of conversational activity.

Wait. Is Apple an identity company?