Long Take: Revolut's $100MM opportunity cost and faltering profitability without a UK banking license

Interested in net interest

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: The banking system has been under our spotlight a fair amount recently, from the deposit runs on Silvergate and SVB to the collapse of Credit Suisse. This week we leave the incumbents to focus on challenger bank Revolut, which — despite growing compliance concerns and a looming rejection for a UK banking license — crossed the 30 million user mark last week. In particular, we discuss Revolut’s position among European competitors, the value of banking licenses in the neobank strategy, and the cost of being rejected from its primary UK banking market.

Topics: Revolut, N26, Monzo, Starling, neobanks, interest rates

Special thanks to Michiel for this fantastic analysis

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

The Neobank Wave

Consumer-led financial technology emerged in full in the wake of the 2008 financial crisis. In the United States, personal financial management like Mint and investment platforms like Betterment came first. In Europe, customers were particularly dissatisfied with their banking experience, leading to the rise of neobanks.

A 2010 investigation by the UK Treasury found that 47% of customers across the 5 largest banks were dissatisfied with their current/checking accounts. Among key issues were a lack of transparency on rates and charges, a frustrating mobile and online experience, and poor customer service.

Rapid advancements in mobile and digital platforms created an opportunity for challengers to address the shortcomings of the traditional financial sector. Globally, the number of live neobanks increased from 10 to nearly 400 in the period between 2014 and 2022. These firms leveraged changing customer expectations and a new regulatory environment (Open Banking in the UK and PSD2 in the EU) to build out their business models.

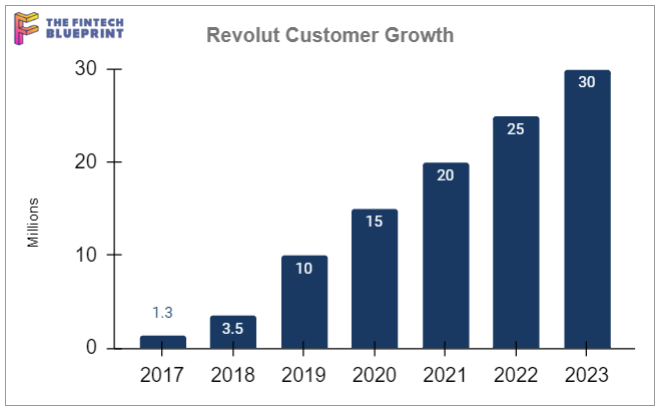

Among them is UK-based Revolut, which positions itself as a financial super-app — a term borrowed from the wildly successful Ant Financial — offering a suite of products spanning FX payments, trading, banking, and more recently insurance and travel booking. Revolut is not a super-app in the sense of being a platform aggregating third party functionality, but something more akin to a fully integrated financial services digital bundle. In 2021, the firm raised $800M from Softbank at a peak valuation of $33B valuation, most recently reporting 30 million customers in over 35 countries.

Standing out from the Pack, on users

Having just recently released their (much-delayed) financials for FY21, we lack a complete picture of how the company has fared since its fundraise — but 2023 appears rough so far: (1) auditor BDO recently expressed concerns about material misstatements in the company’s latest financials, (2) several board members left the firm including the CFO, and (3) the UK may reject its application for a banking license. Those are all not-so-great things for a company, but the last one might be particularly problematic.

Upon launch, challenger banks typically faced a decision on whether (1) to become a fully licensed bank or (2) operate as an e-Money Institution (EMI). The difference is important. Obtaining a banking license is a costly and time-consuming process, but ultimately enables companies to offer a wider scope of services and increased customer protection. In particular, it enables them to re-invest deposits and earn revenue on interest-bearing assets like loans and securities.

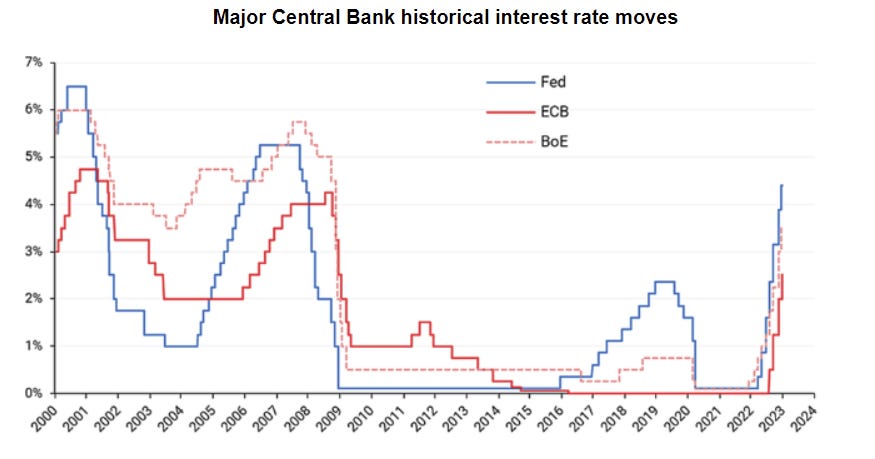

With interest rates currently at their highest level in 15 years, licensed banks — at least those that are not experiencing a deposit run — have been generating record profits from doing exactly that. Bank profitability reached a 14-year high in 2022 with revenue globally growing by $345B.

Most challenger banks launched in the past decade of historically low interest rates. For them, the decision to get a banking license often represented a trade-off between their ability to participate in interest income, which was negligible at the time, and the speed with which they could go to market and acquire customers. A license is also no sure thing, with the potential to be held up by regulators, and your venture-backed business killed by a semi-political process.