Long Take: Should Robinhood, Voyager, and BlockFi sell to FTX -- a view on the industrial logic

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: This week we look at how FTX and Alameda are spending their balance sheet, supporting crypto broker Voyager with a $500MM revolver and crypto lender BlockFi with a $250MM loan. We examine potential strategic rationales for this loans in the context of FTX strategy, as well as the underlying cause of distress for those companies, such as the Terra and 3AC fallout. We also think about Robinhood, and what it would add to the FTX equation.

Topics: capital markets, digital investing, mergers & acquisitions

Tags: Coinbase, FTX, Robinhood, Voyager, BlockFi, Luna/Terra, 3AC

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

Preamble

Put aside for a moment the market environment, and think about digital adoption. It is easy to mistake down rounds and lowered valuations as reflecting some underlying reality. Bears come out of the woodwork, beating the drum of the Luddite, claiming that nothing has happened in the last ten years of fintech. Let them celebrate a respite from the decay of traditionalist institutionalism. Change and progress will march on regardless. And to fail to see the change already happening, as pointed out by Ron Shevlin, is a failure of observation, not imagination.

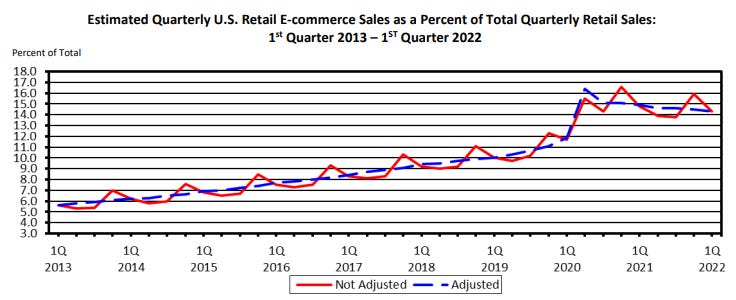

The “floor price” on digital adoption is the pace of technological change. Let’s look at this graph showing eCommerce adoption.

The trend is down quarter over quarter. Certainly some companies are worth less than during the Covid rush. Should we conclude that eCommerce market penetration is stalled out forever and fintech companies targeting BNPL and paytech are forever dead? Super obviously not.

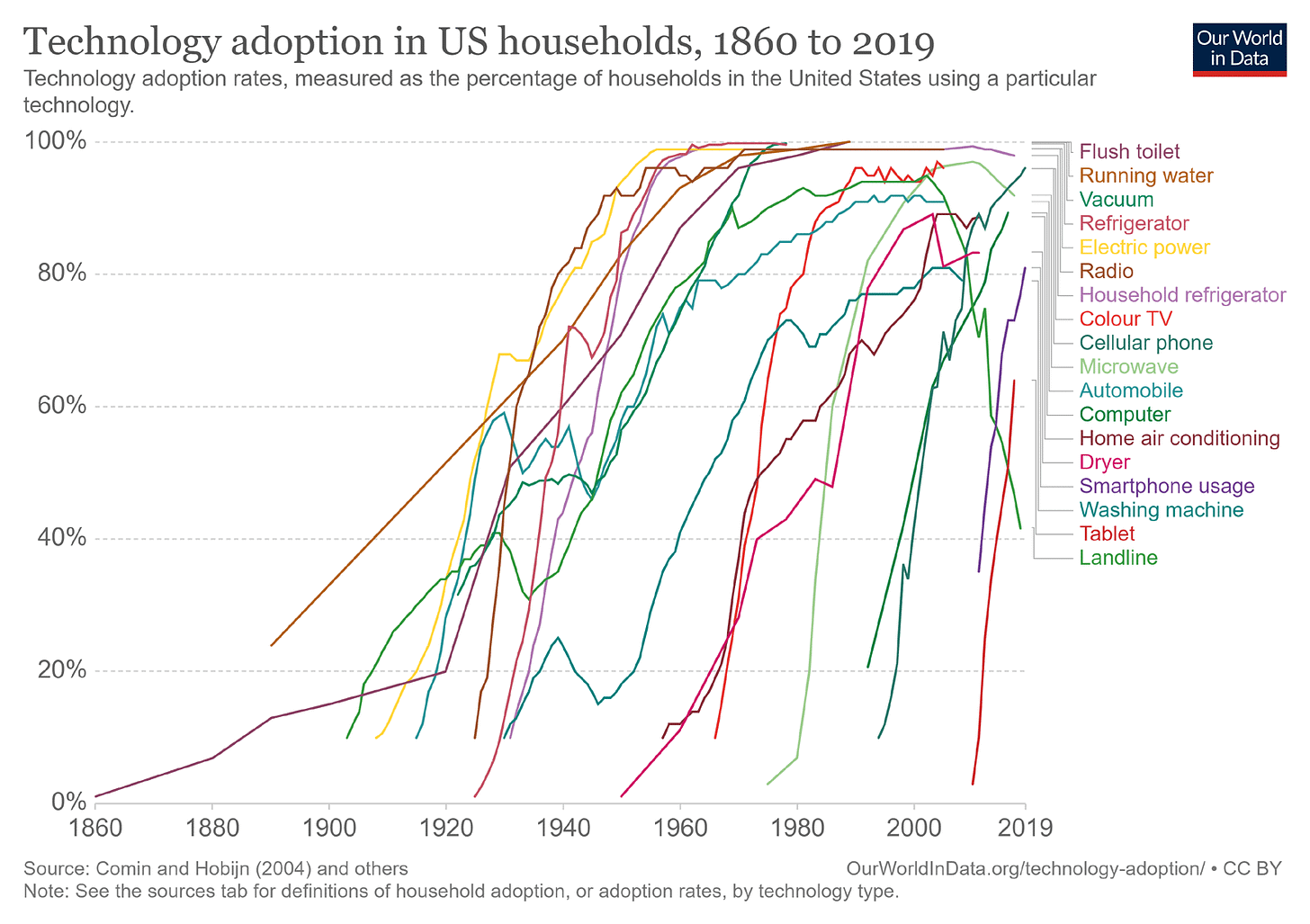

These curves are transitions from one platform to another. Their wiggles, including their early downward wiggles, are irrelevant. Who wants to listen to an electricity skeptic in the 1920s, or an automobile skeptic in the 1930s? Probably nobody. We believe in the same pattern for digital assets and blockchain based computation.

But again, this is the “floor price” and even that can be breached and stressed for decades as wars, financial crises, and low quality product outcomes ravage consumer trust and spending. And accelerations, like Covid or quantitative easing, are similarly unreliable — they can mask the operating problems in all sorts of companies and make degens look like geniuses. But here we all are together, swimming in the ocean and trying to figure out the direction of the waves.

The hungry hungry hippo

Forgive us for oversight of lumping together all Sam Bankman-Fried (SBF) interests into one. We will paint with a single brush Alameda, FTX, Solana and the rest, in the way that writers have always painted industrialists. Joe Lubin of ConsenSys, Marc Andreessen of a16z, SBF, all these personalities are being cut and molded in the popular culture as an avatar or J.P. Morgan — a man who created financial America, the railroads, and backed Thomas Edison.

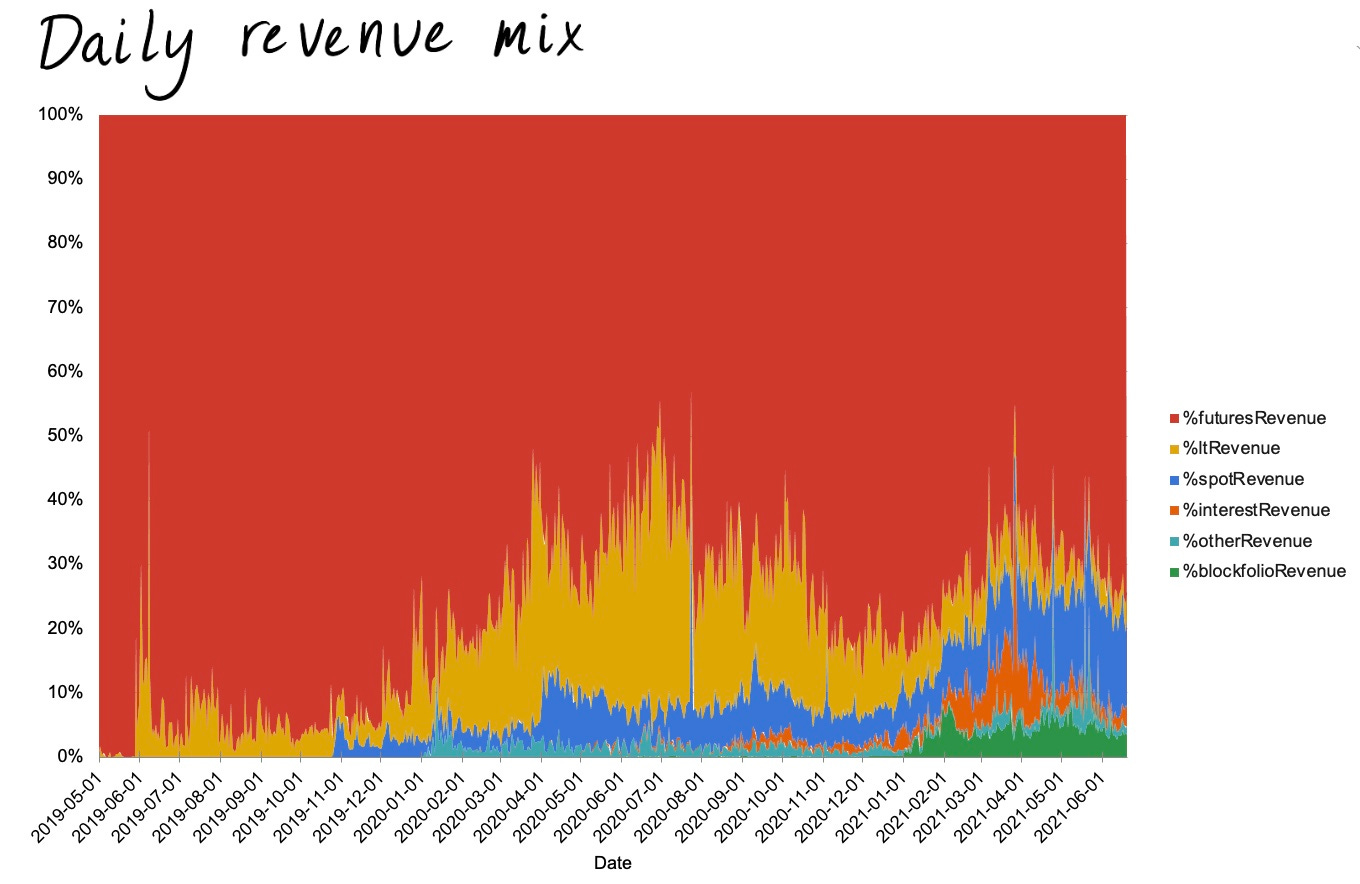

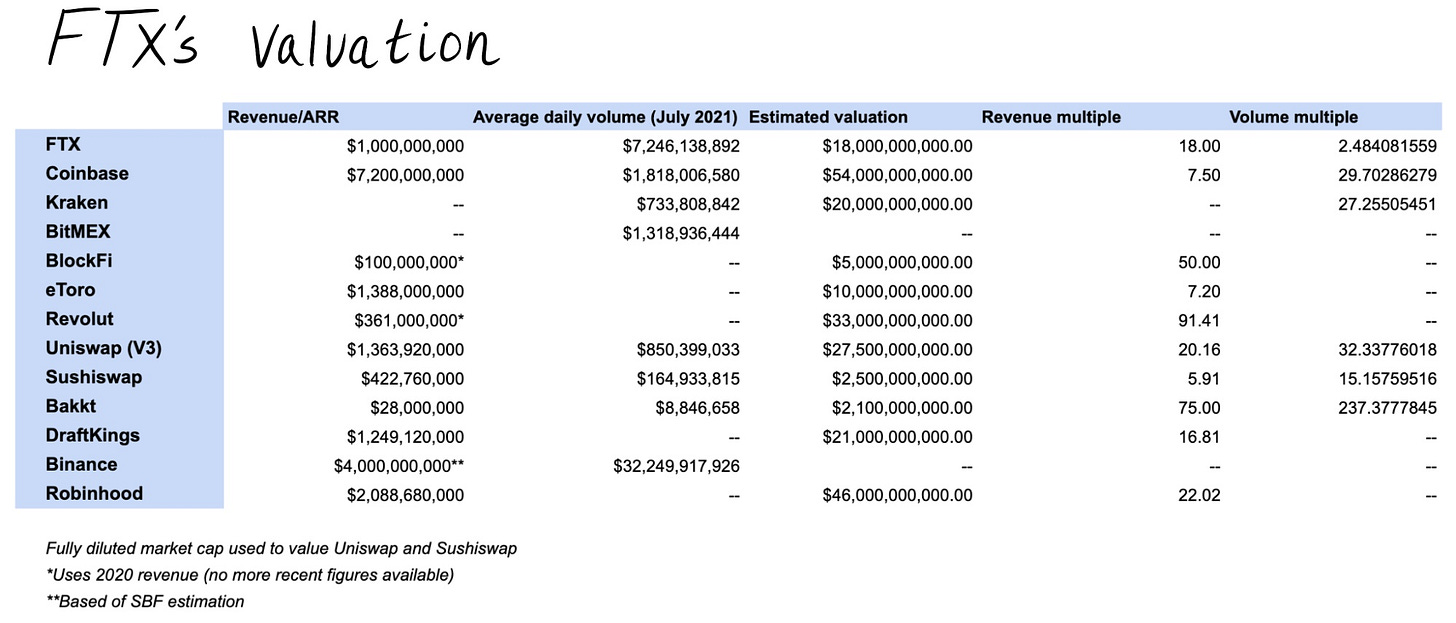

There is only so much room for nuance in the mind. But if you do want nuance, check out the fantastic profile by Mario from the Generalist on SBF and FTX. Here are a two key charts from a year ago on revenue mix (largely futures), and valuation (18x $1B ARR).

All of this very likely changed drastically in the last 12 months. But we can see the levers of the business for FTX — a need to expand the retail footprint, finding ways to drive interest income, and driving volume across products. The 18x revenue multiple was fair for the rapid growth the company exhibited, but likely should be in the 5x range today. Declining volumes in the down market are of course also at issue, as is a much lower appetite for leverage. You could lever up 20x on the FTX exchange, which likely meant that the last 6 months have seen a *lot* of user liquidations.

And let’s also flag our exploration of what it means to be a market maker, with a focus on Alameda and Cumberland here. This is the key chart about market share for USDT distribution, i.e., market making support by the key players.

A market maker is like the casino owner in our mental model. Or perhaps owning a market maker and an exchange is the equivalent of the casino owner. You provide the venue for the game, i.e., trading, and then you provide liquidity, which is what the game is made from. If you want to be a buyer, you can buy! If you want to be a seller, you can sell! That’s the product feature orchestrated by the capital of the market maker (Alameda), within the technological and human network construct of the exchange (FTX).

Therefore, you want more players, more capital, and more financial games.

Firesale on BlockFi

Every single company on the FTX competitor list has been crushed in valuation.

Relatively healthy businesses, like Coinbase, are worth 85% less since their IPO listing. Operating metrics like MTUs are very likely 30%+ lower since the peak of 11 million in Q4 2021, and we’d expect volumes to be down 50%+ from the peak of $550 million. That’s not permanent, but does create pretty significant pressure, with Coinbase burning $430 million last quarter on $1.1 billion in revenue. Good thing the company has cash.

But not all companies have cash.

For example, BlockFi doesn’t have the cash.