Long Take: Starbucks and Nike NFT strategy, with potential for $1B in additional revenue

A peek under the hood of Starbucks Odyssey and Nike's .swoosh

Hi Fintech Architects —

Today we are diving into the following topics:

Summary: Traditional brands are entering the Web 3 ecosystem through an NFT gateway. Among the leading innovators are Starbucks, teasing the public rollout of its Odyssey program, and Nike with its .swoosh community. This week we dissect the NFT strategies in the context of an increasingly digital customer base and the growing virtual environments built by the likes of Fortnite and Roblox. We also briefly touch on the underlying enablers and advancements in user experience and transaction speed.

Topics: payments, media, NFT, metaverse, Nike, Starbucks

Special thanks to Michiel for this fantastic analysis

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Brand NFT Market Context

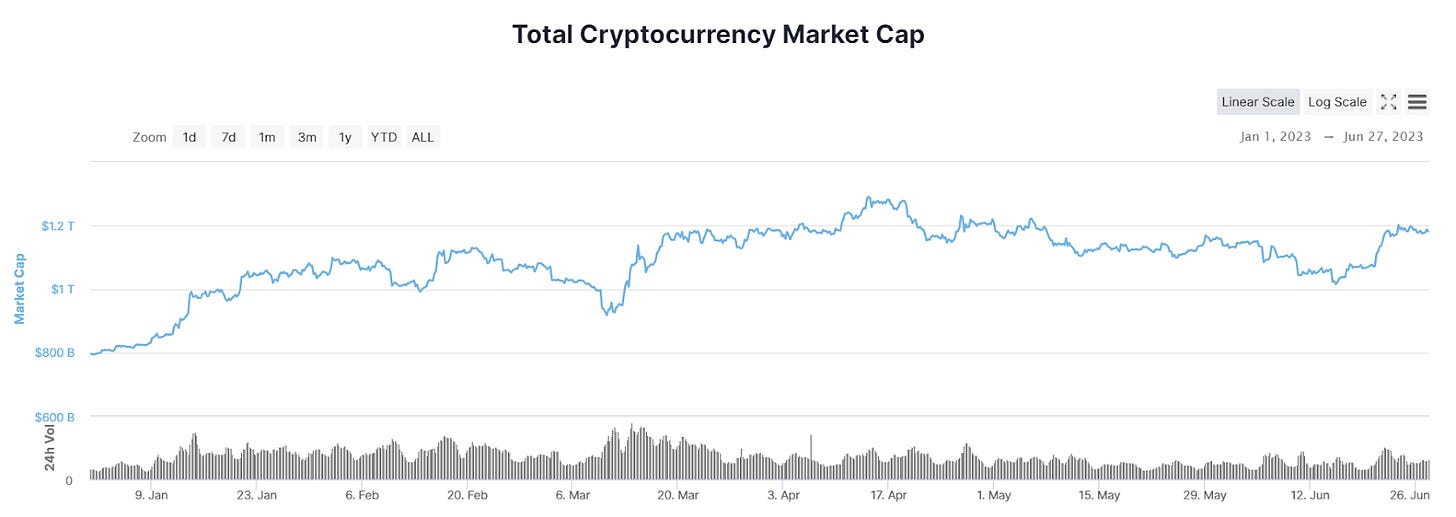

The regulatory crackdown on crypto is fully underway, in the United States at least. But things are not as dire as they are made out to be. Investor interest in Bitcoin and Ethereum, for example, appears to be fairly resilient. Global crypto markets are up +50% since the start of the year and are comfortably outperforming the broader market (S&P500 +15%) as retail and institutions continue to deploy capital to the sector.

The parallel ecosystem of NFTs, meanwhile, seems to be adrift. Mainstream interest in the sector was at its peak at the end of 2021, before diving headlong into its first prolonged bear market. 2023 has not been forgiving, with trading volumes down approximately 50% from the start of the year, despite a slight rebound as an apparent result of the launch of Bitcoin ordinals.

The core Web3 NFT markets seem to have experienced the type of pop-culture surge similar to that of 2017 ICOs, structured to attract FOMO interest with promises of future riches. Despite innovating on a real trend — fungible token capital raising for ICOs, luxury digital objects signalling status and commerce for NFTs — the particular shape of the market has become damaging to regular holders. Acute interest has been followed by a negative reputation. Some committed traders continue to move the assets around on marketplaces like Blur, but largely to generate yield farming rewards and manufacture trading volume.

However, an important underlying trend is the growing number of traditional brands launching NFT campaigns. This trend represents more organic economic activity that looks like digital commerce and loyalty rewards. The lack of meaningful speculation around corporate NFTs is a bug for crypto traders, but a feature for enterprises working to use Web3 as part of digital transformation.

New Brand Revenue and Nike Leadership

In 2022, 150+ companies launched ~250 NFT collections, with nearly half of these being first-time entrants. The top 10 brands generated a cumulative ~$265MM in revenue from primary sales and royalties from subsequent secondary market trades.

Nike accounts for ~70% of sales from RTFKT’s collections — a metaverse fashion studio it acquired for a speculated $1B+ in December 2021, a 30x increase in RTFKT’s valuation from 6 months prior to the sale. But in contrast to many crypto-native NFT projects, Nike already has a long-standing brand and an established community of loyal customers. And indeed, by the end of 2022,