Long Take: Stripe's $1 Trillion volume, and the promise of Internet GDP

A benchmarking to Adyen and PayPal, and a discussion of strategic opportunity

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In today's discussion, we dive into the impressive growth of Stripe, a key player in the fintech sector, which processed over $1 trillion in payments volume in 2023, reflecting its pivotal role in powering the internet's GDP. We compare Stripe's performance with peers like PayPal and Adyen, highlighting their roles in the evolving landscape of online commerce and the shift from physical to digital transaction methods. Despite the competitive space, Stripe's remarkable growth, along with its strategic positioning and potential public offering, positions it as a key winner of Web2 fintech. Moreover, we explore the future of payments, speculating on Stripe's ability to adapt to the advances in AI and Web3, and the potential for new transactional frameworks beyond traditional APIs and banking networks.

Topics: Stripe, PayPal, Adyen, Generative Ventures, Apple Pay, Square, Block, ApplePay, Cash App, Venmo, Zelle, Worldpay, Fiserv, payments

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

In Partnership

Generative Ventures invests in the machine economy — the financial activity settled on blockchain protocols and accelerated by the machine labor of generative AI.

Long Take

Stripe’s Trillion

There's fintech catnip out there, and we can't ignore it.

Stripe, still famously private, has just released a headline number that the company processed over $1 trillion in payment volume in 2023. Being private, they do not report detailed financial statements, so the annual letters and the various marketing PR figures are the main data we have to try and benchmark how Stripe is doing. Combined with an absolutely legendary product, amazing founder story, and potential IPO windfalls that could fund other fintechs for a decade to come, Stripe is one of the most important companies for all of us to follow.

Their mission to power the GDP of the Internet is deeply aligned with our thesis of the machine economy, as more and more automation and productive economic activity shift online. Targeting economic growth is far more healthy than chasing capital markets speculation or arbitraging one market against another. A key question is whether the payment processor of Web2 will be able to keep up with the transition to AI and Web3.

For example, PayPal, the eCommerce payment processor of Web1, has grown well but left plenty of strategic room for companies like Stripe and Adyen, who have defeated it on developer user experience, as well as for mobile and proximity wallets like Apple and Google, who have defeated it on vertical integration and distribution.

But we get ahead of ourselves. Let's canvas the Stripe numbers first.

The Numbers

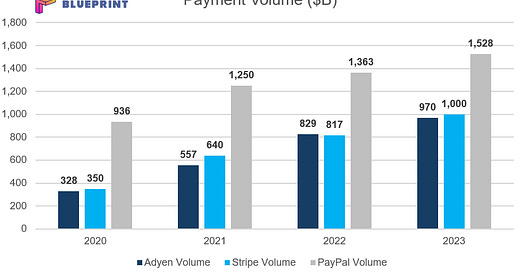

For context, we benchmark Stripe against PayPal and Adyen, two public companies with somewhat similar narratives. The main beta of this market is eCommerce -- the transition from physical to online purchasing experiences. This is a money-in-motion story (see below for an explanation), such that the main growth lever for all of these companies is to increase the payments volume, which they power.

These companies sit on the side of the merchant, i.e., the entity that sells goods to the consumer. We could also look at things like Square / Block or ApplePay, which capture the terrestrial proximity payments, or Cash App and Venmo, which target consumer money transfers between each other, or Zelle, which the banks use to have customers send money. But we leave the comp set narrow, focusing on companies aligned with Internet commerce.

First, the volumes.

Stripe claims that $1 trillion is 1% of all global GDP. This percentage sounds great, but is largely meaningless as a metric since those flows are counted multiple times. We could start looking at Visa and Mastercard, the rails on top of which all this stuff sits, or the Federal Reserve payments infrastructure with its $40 trillion of volume (see below), which eclipses any private rail, or AliPay, and try to tie things into how GDP comes together. One could ask a question about how much of global GDP is online, and assuming the answer is something like 20%, then Stripe is 5% done with their mission.

The numbers get big fast, and it is more important to understand how each company converts its go-to-market tactic to volumes, then those volumes to gross and net revenues, then those revenues into profits. We’ve looked through a number of online sources — investor relations reports, industry estimates — to come up with the following charts. Likely a few of the data points are off, so we advise you to treat them as directional rather than precise information.

All of these companies have grown materially since 2023, regardless of the Covid acceleration and the following dip. Adyen and Stripe perform nearly identically — growing from $320-350B of volume in 2020 to about $970B-$1T in 2023. Each is a champion in their local geographic market.

To be fair, this is absolutely shocking, extremely high growth. The companies tripled in size the four year time period, achieving as much growth as had been accomplished since their founding. PayPal, by comparison, has added $600B of volume as well, from $930B to $1.5T.