Long Take: Temenos launches AI and FIS does Banking-as-a-Service, acquiring innovation

Choose Operational Excellence Over Raw Innovation

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: In this article, we discuss the current state of the fintech industry, highlighting the contrast between the decline of new innovations and the rise of operational excellence. We examine the strategic moves by incumbents like Temenos and FIS, who are leveraging acquisitions and to enhance their offerings with Generative AI and Banking-as-a-Service. Despite the challenges for new entrants, vertical integration and strong user experiences remain viable paths to success. The ongoing competition raises questions about the future of B2B fintech and the potential dominance of established players.

Topics: Synapse, Tabapay, Nubank, Monzo, FIS, Temenos, Altruist, Uber, Bond, Evolve, Alloy, Plaid, Envestnet, Yodlee, Logical Glue.

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

In Partnership

Generative Ventures invests in the machine economy — the financial activity settled on blockchain protocols and accelerated by the machine labor of generative AI.

Long Take

Diving Deeper

This is a frustrating market. There is a cloud of noise.

Fintech is dead. Nothing new is happening. Only consolidation, layoffs, and destruction. Synapse is in tatters, Tabapay is out from the acquisition, the regulators are eating everyone alive.

Fintech is roaring. Nubank is making $1B in profit on nearly 100 million customers. Monzo raises another $190MM, following its $400MM round, with 10 million users.

Both things are true. Much of the raw innovation has been eaten away, which in turn has left execution and operational excellence, including the ability to navigate regulation, as the true driver of performance.

The time for sparkly ideas — in Fintech at least — was in the 2010s. Now, you have either been able to convert your good idea into a market arbitrage, thereby securing some advantage in users or revenue, or the incumbents are here buying up the remains and packaging things up in new clothes.

And it is this squeezing out of new players by incumbents that we want to focus on. If you missed your arbitrage window and got bought by FIS or Temenos, is that still *disruption* when they launch your software as a feature to their core banking clients?

Or put another way, by the time this happens, how much of a market is really left? A meaningful portion of B2B fintech is sitting on top of banks or investment managers, integrating into the legacy software providers underneath those companies, and then re-packaging their features and the bank capital into products that B2C fintechs can use.

In some cases, the neobanks become vertically integrated and have built out a modern core, lending or investment portfolio management software, and the full front-end. This is risky and expensive, and if it happens, it will usually happen at the scale of Nubank or Revolut, not before.

As a result, there is an adverse selection problem for B2B fintech platforms — the majority of their early customers will be small companies with poor distribution footprints themselves.

This is not always true. If your first customer was an early-stage Uber, it was a good bet for the payment processor.

Incumbents Strike Back

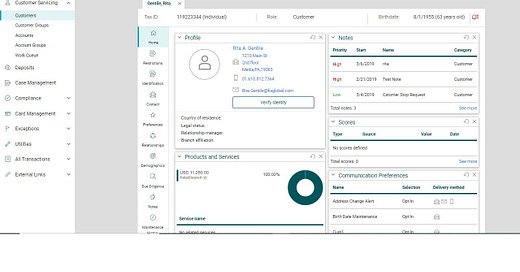

The two news items we are using to anchor today’s note are that (1) Temenos is launching a Generative AI product for core banking, (2) FIS has launched an embedded finance offering called Atelio. We will pull these apart in due course. The strategic lens is to ask whether B2B fintech captures sufficient value as the software providers down the stack expand upwards into process management and user experience.