Long Take: The 2020 guide to Fintech SPACs, and how to get them to like you

Hi Fintech futurists --

This week, we look at:

An overdue analysis of the SPAC structure, reflecting on the $75 billion size and stage of the market

Economics and regulatory paths of going public via investment bankers, SPACs, and direct listings

The marquee teams in Fintech looking to do deals, and what criteria for target selection look like

Holiday Sale

Until the end of the year, we are running a holiday sale. If you decide to sign up for 12 months before end of the year, please use this discount of 35%. In addition to the regular weekly email, you get 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays.

Long Take

The holidays are here, and we all deserve some gifts. Right? The best kind of gift is a one that you didn't expect, but wanted for a long time.

SPACs are like that, but for Fintech companies. You are just minding your own business being a start-up, thinking "how many more months of capital do I have until we are bankrupt." Or, "this COVID thing is really getting people to download our app and trade a lot of stocks." And out of nowhere you get a call from a friendly corporate entity trying to take you public, offering a cool $250 million.

Tis the season. The SPAC season. This year, there have been nearly 250 IPOs (vs. about 60 last year), with an average size of $300 million. That's about $75 billion in hopium.

A lot of people have written about SPACs already, so we will try to get the basics out of the way to get to the poetry. The acronym stands for a Special Purpose Acquisition Company, where the company is formed as a vehicle to (1) raise money from investors, i.e., sponsors, (2) which then goes public through an initial public offering, which then (3) finds a stake in a private company and purchases it. It is usually priced at $10 per share, and has 2 years to complete the necessary chain of events. This series of transactions achieves the outcome of a company going public, but without the traditional investment banking process. The private company negotiates only with the sponsor counterparty. Would you rather fight David Solomon (DJ Goldman Sachs) or Bill Ackman (Tennis Pershing AS?

In the past, SPACs were seen as opportunistic and lower quality paths to liquidity. In 2020, they are launched by celebrity billionaire investors, and none of that status stuff matters anyway. We can always get on Twitter and troll each other instead.

Here's an arcane entity structure diagram from Harvard Law School. You're welcome, readers of the newsletters who used to be lawyers. More meat and potatoes in this TechCrunch article too.

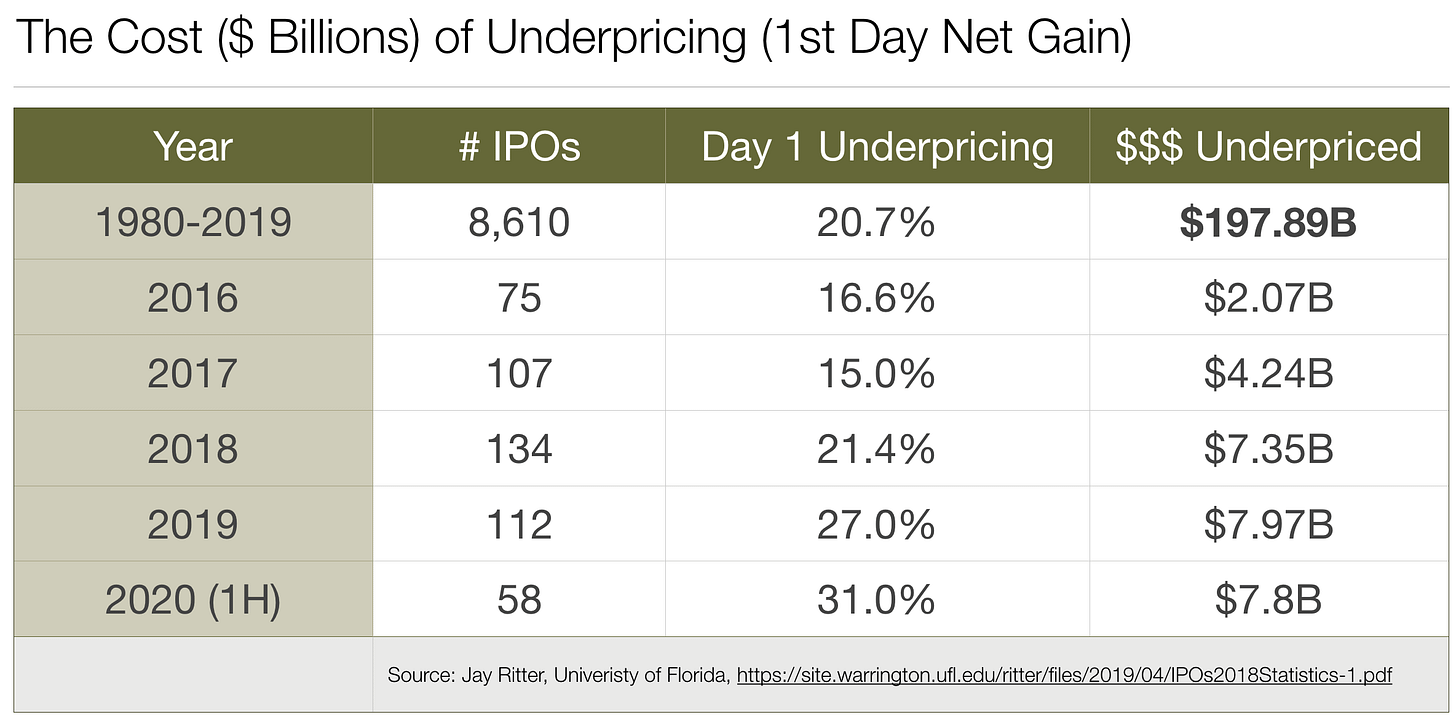

The overall transaction process is fairly straightforward, and can be benchmarked to the book-building and underwriting that an investment banker does. That service costs anywhere between 5% to 10%. Notably, bankers price the round to be a little cheap, so that the price "pops" on the day of the offering. This creates a value transfer to early holders, like large institutional and high-net-worth investors in multi-billion dollar wealth management practices. That increase is another 10% to 20% of enterprise value, suggesting an all in cost of about 15% to 30% for being in a public structure.

You, as the founder of the startup, want to be in a public structure for a number of reasons. First, you'd like to be rich. Second, you'd like your investors to be happy, so that they don't sue you and also subsidize any future adventures that you'd like to undertake. Third, you want your employees to have financial security and a positive take on their experience. But you probably don't want to give away enterprise value to Wall Street, because you've slogged for a decade all by yourself, so why should they get paid billions for a month of work!

As a result of this Silicon-Valley-Ayn-Randian logic tree, a bunch of tech unicorns started doing direct listings. Think Slack, Spotify, Palantir. Both the NYSE and NASDAQ have proposed certain rule changes to the SEC that would allow direct listings to be more easily accessible by companies, bypassing brokers all together. If you are a hot tech company, why give away nearly 30% of your value to financiers? Certainly there is demand -- maybe on Robinhood -- to eat up these shares and create exits for employees and founders.

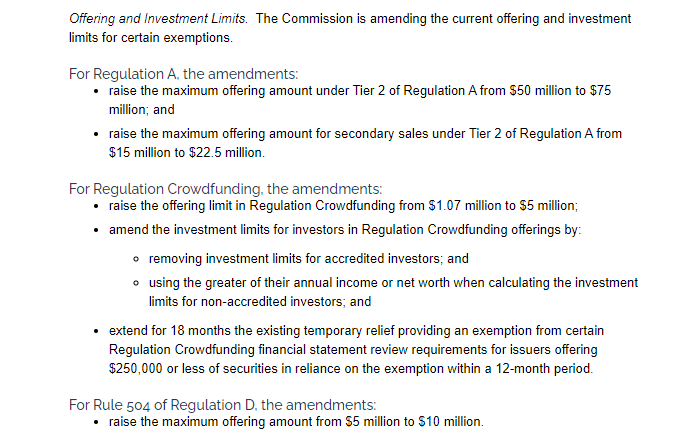

Our corollary from direct listings and the increasing privatization of enterprise value -- where companies don't go public until all the blitz-scaling is done -- was that private markets will see more liquid infrastructure. In human words, the private markets will become a lot more accessible. Democratic. Fintech-like. Digital assets and security tokens will make it easier to hold arcane private equity instruments. You can get venture exposure from all sorts of DeFi governance token protocols (INDEX, CVP).

At least that's part of the thesis. It turns out that it is pretty hard to get people to care about hard-to-understand investments, and it is hard to get regulators to change their minds about consumer protection around the world all at once. It will happen. But it's hard. The SEC has been quite forward-thinking on cleaning up its crowdfunding and private investment / accredited investor frameworks, but this takes time. There is further complexity in how the fundraising exemptions below overlap with digital and crypto asset classifications globally.

All this to say, having Bill Ackman show up with a SPAC is a pretty good present.

Nothing is Free in Finance

What motivated us to dig deeper on this topic this week is that SPACs are hitting Fintech in hurry, and SoFi is one such example. The digital lender / neobank / roboadvisor has raised about $3 billion in capital, which is on all accounts an absurd amount of money. It deployed that into a lending business, an investments business, a mortgage business, a wealth management business, and every single category you can possible imagine. In the mean-time, Chime hit a $14 billion valuation and Robinhood is in the deca-billions as well.

With COVID-catalyzed adoption boosting usage numbers this year, it is a great time for a B2C fintech to cash in. SoFi is one of the best names on the list from a cash-flow generation perspective, which means that a private equity sponsor will understand how to model it in a spreadsheet. And if SoFi is getting solicited, we are sure that the rest of the crew below is fielding calls as well. We would hate to be Stripe's CFO, in a "we would love to be Stripe's CFO" kind of way.

The price of saying "Yes" is embedded dilution. While you are not paying Goldman, you are making room in your cap table for financial investors, who have spent a meaningful amount cost trying to identify you, and engineer a return on investment for initial holders. The previously cited Harvard study suggests an almost 50% median cost of the cash raised, amounting to 15% of post-merger market capitalization.

It is hard to do the apples-to-apples math on this, honestly. Bankers take home a percentage of the funds raised. But the IPO pop relates to the trading equity of the company, which can also translate a price to privately held shares. In the SPAC analysis above, that 15% is a drag on the company's future performance for sure. But we also see sponsors negotiating lower fees, or as in the case of Pershing Square, terms that relate only to future upside. As the quality of sponsors increases due to competition, the cost to companies is also likely to fall -- or settle at the equilibrium, which should largely be equivalent to the total all-in cost from a bank.

Are returns any good?

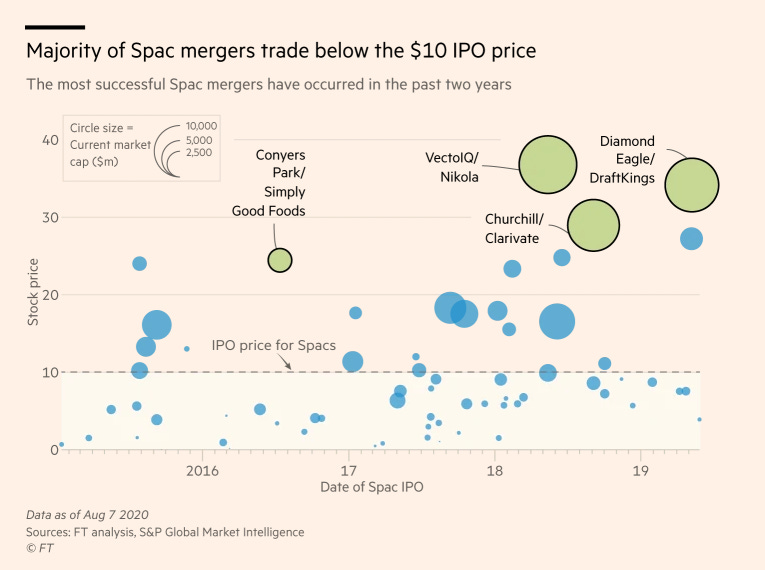

Performance is mixed. Barry Ritholtz rightly points out that most products suck -- something also true for the mutual fund, venture, hedge fund, and private equity asset classes. Below we collate performance data from Bloomberg and the Financial Times.

That's a lot of charts with dots and lines on them. The first one suggests that SPACs lag IPO performance. But we are just in the beginning of this trend of converting late stage private companies into public shares, so it is hard to rely on such a short time series. The second chart shows that most SPAC mergers are trading far below their $10 IPO price. There are only a few large successful outliers, like Draft Kings. Some of the large stories, like Nikola, are now engaged in securities fraud controversy. But none of that is news either. When you look at any venture portfolio, your upside returns are strongly distributed to a few large winners and many, many losers. Such is the black-swan probability curve.

In the Andreesen Horowitz data above, you can see that 60% of the total returns in the venture industry come from about 6% of the deals. If you look at the distribution of venture funds themselves, it looks similar. The top cream of funds is responsible for the majority of value creation. This is a network effect, and is both fundamental and engineered. Successful funds shepherd along companies, particularly their winners, to follow-on investment and exit. A brand-name investor isn't just there for prestige. They literally force positive outcomes for portfolio companies.

It is then super interesting to see a comparable slice of the SPAC data. When Harvard segments SPAC returns by "high quality", defined as sponsors with $1B+ in assets under management or led by CXOs of public companies, investment returns begin to look a lot better than the rest of the chaff.

Take a look above at the black dots (high quality), as compared to the empty triangles. Certainly there are a lot of correlation vs. causation problems in the data, but let's do the best we can in a world of imperfect information.

All About The Teams

There are too many vehicles for us to track rigorously, but we can do a light Fintech pass at the question. Insurtech Clover Health is going public via SPAC at around $4 billion, sponsored by Social Capital. Chamath Palihapitiya has been extremely active, and already put money to work in Virgin Galactic (joining the Bezos/Musk space club), OpenDoor and many others. This is as close to a Silicon Valley party as you can find. We already mentioned Ackman. Another Wall Street type is Alec Gores, buying his way into United Wholesale Mortgage at $425 million.

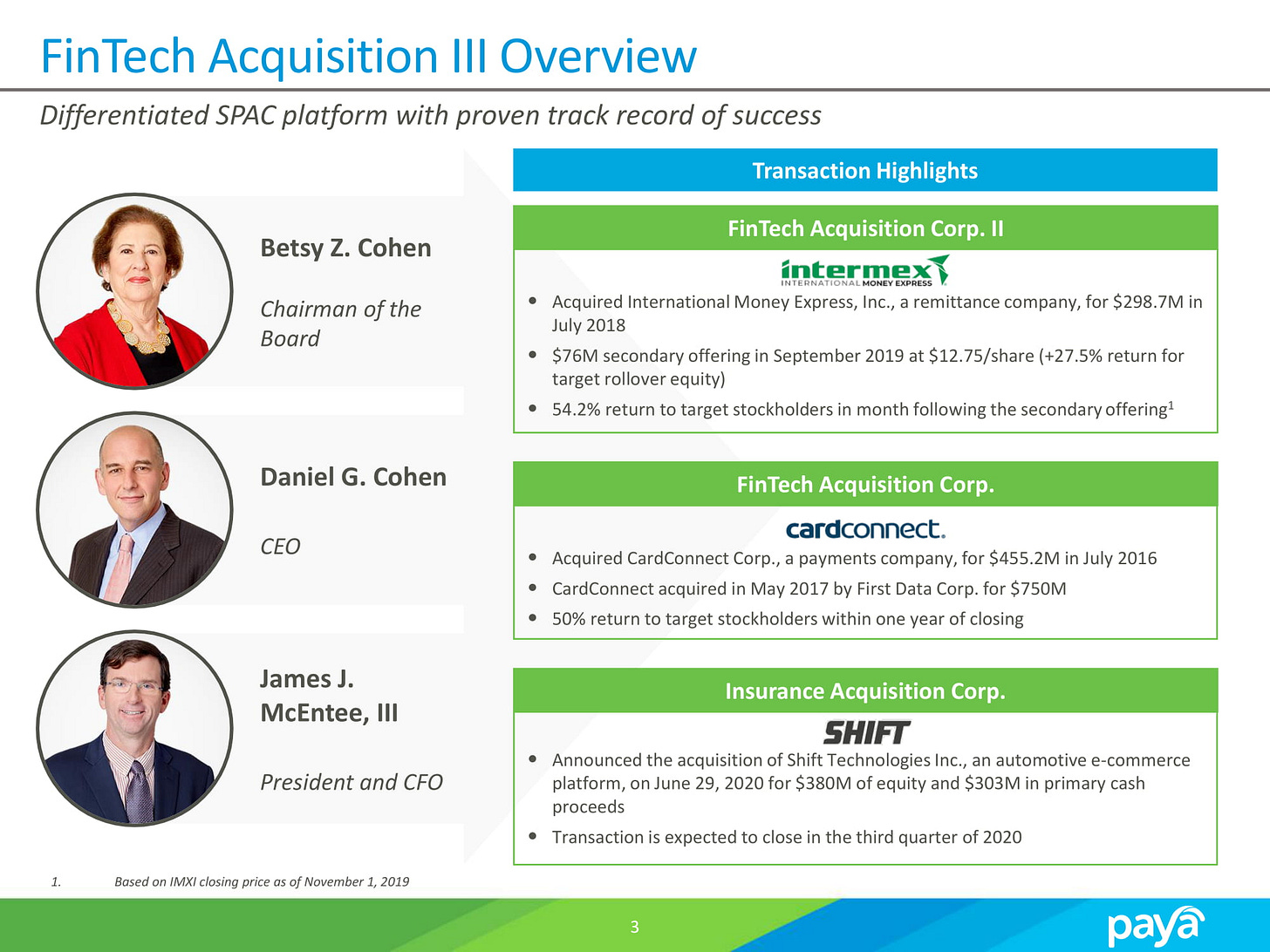

Then there is Betsy Cohen, the founder of The Bancorp, who has been the name behind a series of Fintech Acquisition Corp. vehicles. We continue to think that The Bancorp is an undervalued fintech pioneer, trading at around $800 million in market cap, while the services it powers are worth billions. Think Green Dot, but underneath Galileo (MoneyLion) / SoFi and the rest. Anyhow, there are now 5 of these launched, with the last one closing $250 million. They've picked up CardConnect (sold to First Data for $750 million), Intermex (remittances), and Paya (payments processor) with revenues of about $200 to 400 million in each case.

But there are others. The $200 million vehicle backed by wealth tech super group of Mark Casady (former LPL CEO), Chip Roame, and April Rudin called Lefteris comes to mind. Or the $350 million Fusion Acquisition Corp., led by asset management veterans John James (founded Singapore based BetaSmartz) and Jim Ross (formerly chairman of the global SPDR exchange-traded fund). All they need to find is a $1 to $5 billion private company, generating $100 to $500 million in revenue, ready to monetize some shares and deal with public market scrutiny.

Those used to be hard to find. But with the spate of neobanks hitting profitability, the financial API companies hitting their stride, embedded credit companies integrating into more commerce, crypto assets custody becoming mainstream, and digital payments volumes rising, we think the path here is more clear than ever.

Until the end of the year, we are running a holiday sale. If you decide to sign up for 12 months before end of the year, please use this discount of 35%. In addition to the regular weekly email, you get 12 frontier technology developments every week, a podcast conversation on operating fintechs, and novel food-for-thought essays.