Long Take: The $5 trillion of GDP that McKinsey, Goldman, and Galaxy say will be built in the Metaverse

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We take a tour through three insightful reports sizing the metaverse opportunity, in particular parsing out descriptions of potential economic activity. We see estimates ranging from $4 trillion to $8 trillion of revenue pool in the long run, and current investment in the hundreds of billions, of which about $10B per year is private. We also highlight some potential errors in pursuing strategy in the space, and offer hypothesis for the future.

Topics: metaverse, NFTs, eCommerce, DeFi, GameFi, gaming

Tags: McKinsey, Goldman Sachs, Galaxy Digital, ARK Invest

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

Open Sesame

In our ongoing quest to define the Web3 economy, we turn to some of the high end analyst names — McKinsey, Goldman, Galaxy — and their recent research reports. Industry reports are notoriously vague, and often late to the party. By the time a consulting firm spends 6 months writing an economic treatise on a market, the market moves. Maybe Terra collapses. Maybe 80% of the value evaporates. Maybe NFT volumes dry up.

But look, a map is better than no map.

And we are plagued by an infernal question — what is the GDP of the Metaverse?

What economy does Web3 support? And we don’t want to fall for the ICO illusion, imagining a science fiction future that never comes to fruition. Just because projects are working on things doesn’t mean that those are the things that will be valuable. Look at how many types of things there were in the 2018 ICO market! Look how diverse and real they felt! Remember the following crypto winter, with ETH at $80, and despair, anon.

Nor do we want the other categorical mistake, the one we suspect Mark Zuckerberg is making (👑 link here). Choosing a particular direction in the current fog of technological uncertainty as it relates to the definition and adoption of the “Metaverse” and then betting everything on some particular execution of that uncertain definition. Going so far on maximizing today’s best version of the vision that you end up building RealPlayer, but not YouTube. You might also know this mistake as “Google Glass”.

The mistake is to bet on a particular combination of low probability events — 20% chance current AR/VR tech is good enough, 20% chance current economic Web3 structure is good enough, 20% chance AI is sufficiently functional, 20% chance hardware infrastructure is already fast enough — and therefore bet on a <1% probability outcome. This is an opportunity for the Bayesian thinkers out there to correct our math.

And certainly there are magicians, like Steve Jobs was, who could see the narrow string of the future unfurling forwards in time. We reserve this exception as a black swan footnote.

Market Size

Let’s start with the question about whether the economic pie matters. Our last look at this question was in parsing the ARK Invest exponential adoption thesis, right around the time its fund imploded. We kicked the tires on whether the assumptions made any sense, and look, some of them surely still do.

Above is the core chart from that analysis, courtesy of ARK Invest. The thing it is saying is that NFTs are digital products, and digital products are consumption — that means you should think of them as commerce, not as financial assets.

And thereafter, eCommerce grows to include Web3 commerce, which looks to be around $2 trillion per year in 2026, and $8 trillion per year in 2030. How do the other reports look at this question?

McKinsey sees a $4 trillion potential across consumer and enterprise by 2030, growing from about $200 billion in 2022. That’s certainly more conservative than ARK, but who isn’t? The largest consumer use-cases are e-commerce, gaming, and entertainment, with education and advertising meaningful as well.

In enterprise, there’s value in the economic infrastructure, i.e., banking. But they also appear to bundle in enterprise VR and city-scale digital twin projects, meaning the rendering of digital worlds mirroring physical objects, like factories or jet engines. We are skeptical that those technologies will sit on the same chassis as the decentralized public economy of the next version of the Internet. Can retail innovation be driven by virtual environments for healthcare, or augmented reality staff training for electricians, or 3D walk-throughs by real estate brokers? Maybe, maybe not.

The chart above highlights where industries have focused to date, and you can see the difference between things like consumer and media progress in Web3, and initiatives by more traditional sectors to integrate virtual reality technology. It’s the difference between the Hololens and NFT trading.

If we ask Goldman Sachs, we get another cut at the same question below. The core categories they highlight are media, retail commerce, education, and advertising. Their starting point for the 2021 digital economy is about $70B in revenue for music, $16 trillion for commerce, $5.5 trillion for education, and $1.1 trillion for advertising. The gaming market doesn’t look that big in context either, with about $200 billion in revenue.

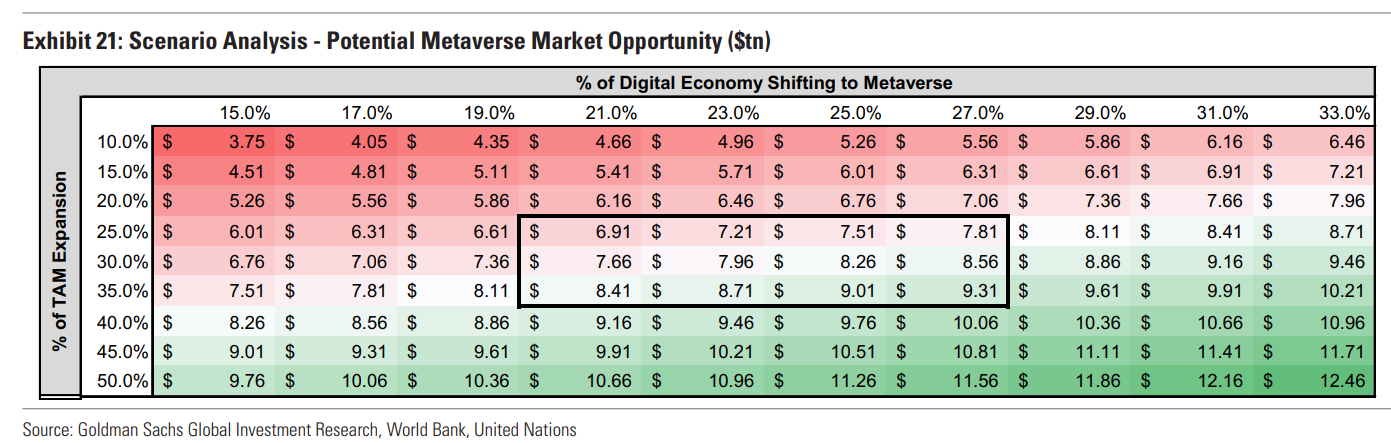

All this is prior to incorporating the Metaverse magic sauce. Taking those numbers, however, and applying some Excel sensitivity analysis on top, we start getting to destination market sizes. Assuming something like 25% of the digital economy shifts to Web3, and the market expands by 30%, the addressable opportunity looks like $7 trillion per year.

Goldman’s $7 trillion (or $4-12 trillion), McKinsey’s $4 trillion, and ARK Invest’s $8 trillion start looking somewhat similar, in terms of the order of magnitude. It is no wonder that investment is flowing to the space, and Zuck has tunnel vision chasing the dream.

Investing Already

There is capital flowing into this space, obviously. The mega trends of artificial intelligence, augemented and virtual reality, and crypto protocols have all converged into a cocktail of hype. When you add up all of the investment into each of those sectors, the numbers will tend to get large.

In 2021, there has been about $13B invested in Metaverse venture capital, and about $44B in M&A.