Long Take: The craft of scaling fintechs beyond their niche -- analyzing Twitter, Bunq, and Goldman Sachs

Bottoms-up or top-down?

Hi Fintech Architects —

It’s August and I am traveling with family across the US. It’s lovely to come back to NYC and remember the vibe for its bagels and subway stops. While London is storied and beautiful, there’s something in that New York industrial grime that lubricates the imagination.

We continue our publication schedule during the summer, with an awesome team supporting research and podcasts. Things are a little looser though, more fun, more weird, more sunny.

Today we are diving into the following topics:

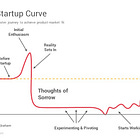

Summary: We want to riff on the underlying drivers behind successful growth and unsuccessful attempts at growth in fintech. This is in response to seeing the recent raise from Bunq, a profitable European neobank, watching Goldman shut down its consumer ambitions, as well as an interview we had done a few weeks back with Public. The custodian Altruist and lender SoFi also come to mind. Last, we’ll frame the transition of Twitter to X, and why that feels bad to everyone involved.

Topics: Bunq, Goldman, Twitter, neobanks, payments, startup strategy

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Feeling the Craft

Our world thrives on hyper-specialization.

Each of us is driven to get really good at something, and we specialize and specialize in its intricacy. This is an inexorable force of capitalism. People abstract themselves into a gear, fitting as a part into the great machine of productivity and economy. By being good at different things, we are stronger together as a whole.

The price, however, is the loss of holistic craft. A manufacturer of electric car batteries at scale cannot recreate a full electric car, nor understand the physical infrastructure or political process required to bootstrap that electric car company. Nor should they. Fewer and fewer people — those at the level of industry titans — are able to put together the pieces of the entire jigsaw puzzle.

Few people have learned a true craft, able to whittle the wood from the beginning to end, and create the final product.

The same is true for business building. Massive banks and corporations are disconnected from the hands-on craft of jump starting demand. They are often unable to touch it or teach it. The creative spark is irrelevant to operating the scaled machinery of mature markets. This gets packaged also as the innovator’s dilemma —

We note that it is not *just* disruptive technology that matters, but targeting those technologies at the right market and growing into the demand available there. People always say that disruptive offerings bring a 10x improvement. The key question is — a 10x improvement for what kind of user? Demand is kindling and oxygen for the fire of new technologies. If you miss it, you die.

Pockets of Demand

We want to aggregate a couple of different data points together into a broader view. For context, our foundational coverage of the core mental model is here:

On the one hand, Goldman Sachs is largely exiting the B2C consumer business. Loans are falling apart, Greensky is marked down and up for sale, and the entire division is repackaged as software infrastructure. On the other hand, neobanks like Bunq have reached profitability and raised $49MM in the current market at a $1.6B valuation and continue to grow in their “niche” to 9 million users.