Long Take: The Law of Unintended Consequences via Wells Fargo, Divergence Ventures, DeFi designs, and the Federal Reserve

Gm Fintech Architects —

Today we are diving into the following topics:

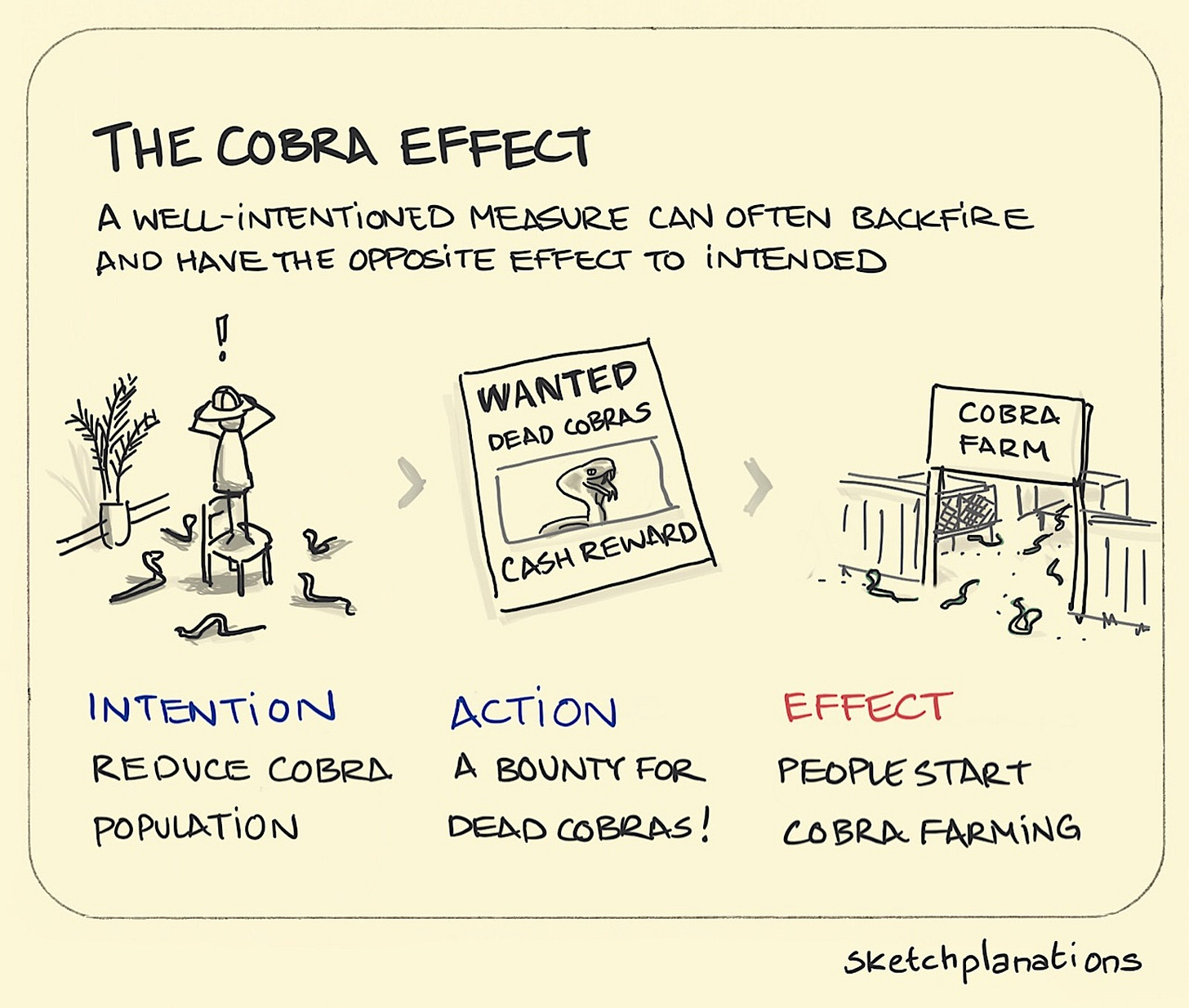

Summary: We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

Topics: Microeconomics, token design, fraud, compliance, banking, decentralized finance, venture capital, insider trading

Tags: Wells Fargo, dYdX, Divergence Ventures, Sybil Attack, Federal Reserve, SoFi, MoneyLion, Compound

If you got value from this article, please share it. Long Takes are now premium only, and we need your help to spread the word about how awesome they are!

Long Take

The Law of Unintended Consequences

Economists enjoy a simple, clearly defined model. A model where people are rational actors, and where the system in which they interact is reduced to clear deterministic functions. A model where everything makes sense!

This is why economists are pretty much always wrong.

The law of unintended consequences comes into play when a rule or policy generates an impact that is quite contrary to the initial goal, and often is in contradiction with it. Here’s a fun example from Wikipedia:

The British government, concerned about the number of venomous cobra snakes in Delhi, offered a bounty for every dead cobra. This was a successful strategy as large numbers of snakes were killed for the reward. Eventually, enterprising people began breeding cobras for the income. When the government became aware of this, they scrapped the reward program, causing the cobra breeders to set the now-worthless snakes free. As a result, the wild cobra population further increased. The apparent solution for the problem made the situation even worse, becoming known as the Cobra effect.

There are countless other examples. They reveal a disconnect between (1) the rules people make in order to accomplish some goal, and (2) the actual causal patterns from that rule, and the many ways that different actors attempt to game and manipulate the system, as well as the various externalities that loop back on each other and amplify completely unexpected outcomes.

In economics, we often say “all else being equal” when proposing an explanation or trying to run a regression.

But all else is neither equal nor static. Rather, systems are “dynamical”, implying an progression over time between states, and “complex”, suggesting that there are many interdependent causal components creating random-seeming outcomes. Imagine a jungle and its plants and animals as an example. Change just one small thing, and the equilibrium of the whole thing is thrown off balance.

Just Trying to Run a Business

Imagine you are working at Wells Fargo in 2010, and have the fantastic idea that selling more products to existing customers is easier than selling single products to new customers. So you start thinking about incentives, and thinking yourself very smart. After a while, you design a compensation plan that “aligns” bonuses to the number of products that a customer uses. The customers are sticker and more loyal, revenue per customer is higher, and all the McKinsey industry metrics look better.