Long Take: The novel political challenges in Solend and MakerDAO from market pressure

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: This week we look at political issues emerging within DAOs, and highlight the difference between mechanistic protocols and digital human organizations. In particular, we discuss Solend and the attempt to seize a large position to prevent a particular market outcome, despite that position having sufficient margin. We also look at the attempt to restructure MakerDAO by its founder into voter parties and functional component DAOs, using delegation of a large economic stake. Both cases provide interest views into voter behavior and governance design issues.

Topics: DAOs, DeFi, governance, cryptoeconomics, politics

Tags: MakerDAO, Solend, Solana

Thanks for your time and attention. If you have ideas for companies or topics to cover next week, let us know by clicking the button below.

Long Take

Protocols, Politics, and People

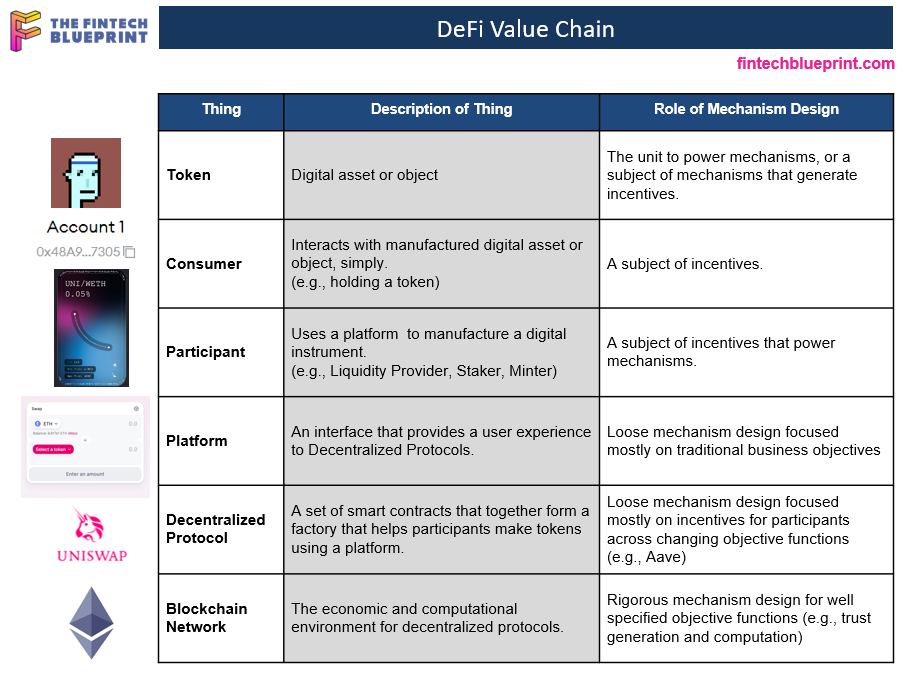

A quick reminder to set the topic. There are big differences between the mechanistic tokens generated by protocols and the qualitative tokens used by DAOs for tribe affiliation and collective governance.

The mechanistic token requires some real math to be produced by the function of a deterministic protocol. The whole thing is defined from start to finish. We might say that there is no “governance surface area”. An example would be Bitcoin or ETH, which are generated entirely from math. A primer on why this is good is here. When talking about decentralization, we talk about the technical architecture of nodes that processes information or capital that supports the mathematical, impartial token creation and distribution.

The DAO governance token is far more like a right to participate in democracy, corporation, or dictatorship. It entitles you to exercise a voice in order to impact some particular group of people. Often that group of people may be using blockchain-anchored tools to collaborate and coordinate. They may pool their labor or capital into onchain software, and then manufacture new goods and services for use in the crypto economy. The alignment and decision making around social structure, and in particular relating to those resources, is intermediated by governance tokens, which size up voice and influence by anchoring voting onchain.

People are a very messy kind of organism. Our ability to coordinate across very large groups, in part through the use of narratives and creation of super-organisms in the concept space, is why the Homo sapiens species rules supreme across this blue rock in space. This statement is best substantiated in Yuval Harari’s Sapiens.

Let us not be confused about the decentralization of technical hardware, the decentralization of capital, the decentralization of voting power, and the decentralization of outcomes. The euphemisms are painful, and end of the day, point to the main thesis we had about 2022 — Marxist collectivism thriving on Hobbesian libertarian software networks.

The Politics of Solend

Imagine that you build a network called Solana, meant to be a better and faster Ethereum, enabling a Web3 fit for Chicago’s market makers and high frequency trading firms. Imagine that this is funded by large, top tier, hyper capitalist venture investors who made lots of money on Internet and capital markets.

Imagine you develop an ecosystem of marquee names, like Alexis Ohanian and others, launching $100MM+ funds to finance the creation of various applications on your network, and that it generally works. It is another go for Silicon Valley to take on computational blockchains and carve out market share.

Imagine that an applicaton called Solend grows up to challenge the incumbent money market protocols, competing with Compound and Aave to create leverage on your chain. The model is proven well enough, and Solend is custom built for your code and user base. It accrues $1 billion in collateralized value and Solend’s native token SLND becomes the basis of governance for the protocol. Just like everywhere else.

Now, let’s add some price collapse to the equation. We drop the value of Solana from $180 to $40, a mere 80%. What happens to leverage markets? They liquidate.