Long Take: Understanding the Fintech user growth behind the $10.4 billion eToro SPAC and coming Chime IPO vs. the melting Megabanks

Hi Fintech futurists --

This week, we look at:

Chime, eToro, and Wise targeting the public markets through IPO and SPACs, and their operating performance

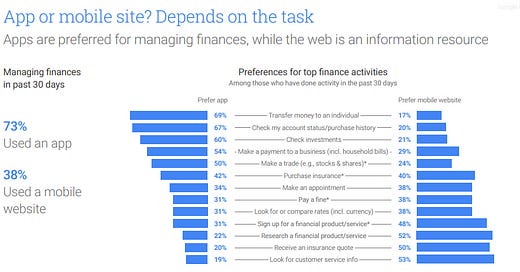

The overall growth in fintech mobile apps, their install rates and market penetration (from 2.5 to 3.5 per person), and whether that growth is sustainable

The implications for incumbents from this competi…