Long Take: What will Goldman Sachs do with Marcus, and Why?

We reflect on the news that the Goldman Sachs consumer banking strategy, represented by Marcus, is facing headwinds — with potential $1.2B losses for the digital bank and a restructuring

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: We reflect on the news that the Goldman Sachs consumer banking strategy, represented by Marcus, is facing headwinds — with potential $1.2B losses for the digital bank and a restructuring into wealth management. We trace the history of the digital bank efforts and dive into the economics of the effort, comparing it to some recent numbers from N26, the german neobank. Last, we suggest a narrative shift that is responsible for this stumbling block.

Topics: neobanks, digital lending, roboadvisors, capital markets, asset management, big tech

Tags: Goldman Sachs, N26, Marcus

If you got value from this article, please share it. Long Takes are premium only, and we need your help to spread the word about how awesome they are!

Long Take

The Goldman Stumble

Years back, we wondered at Goldman Sachs and how it was able to transcend its own DNA.

The Goldman of the year 2000 would never touch retail accounts, instead leaning into its brand of high-end investment banking, capital markets, and wealth management. And here we were, in the mid 2010s, with GS pushing at all of the fintech trends — from roboadvice, to neobanking, to artificial intelligence (remember Kensho?).

Their partnership with Apple and continued investment in Marcus put the firm apart from the pack — working with the high end of the tech industry instead of playing around in the fintech kiddie pool. Meanwhile, UBS waffled on buying and not buying Wealthfront. JP Morgan launched and killed one digital bank after another. Morgan Stanley went hunting for e-brokers.

And yet.

The headlines are that Marcus, despite its consumer base in both US and UK, and despite the positive interest rate environment (for banks), is expected to lose over $1.2 billion for Goldman this year.

Since the unit’s founding in 2016, some suggest that over a quarter of the engineering team on the project have quit the business due to burnout. We remind you that Google’s attempt to build a neobank met a similar end. As a result, Marcus is in internal strategic review, with proposals for the effort to be more cleanly integrated into wealth and asset management (i.e., to the high-net-worth market), and the consumer lending business curtailed.

That’s a WeWork level hopium chart, likely made prior to the current economic destruction.

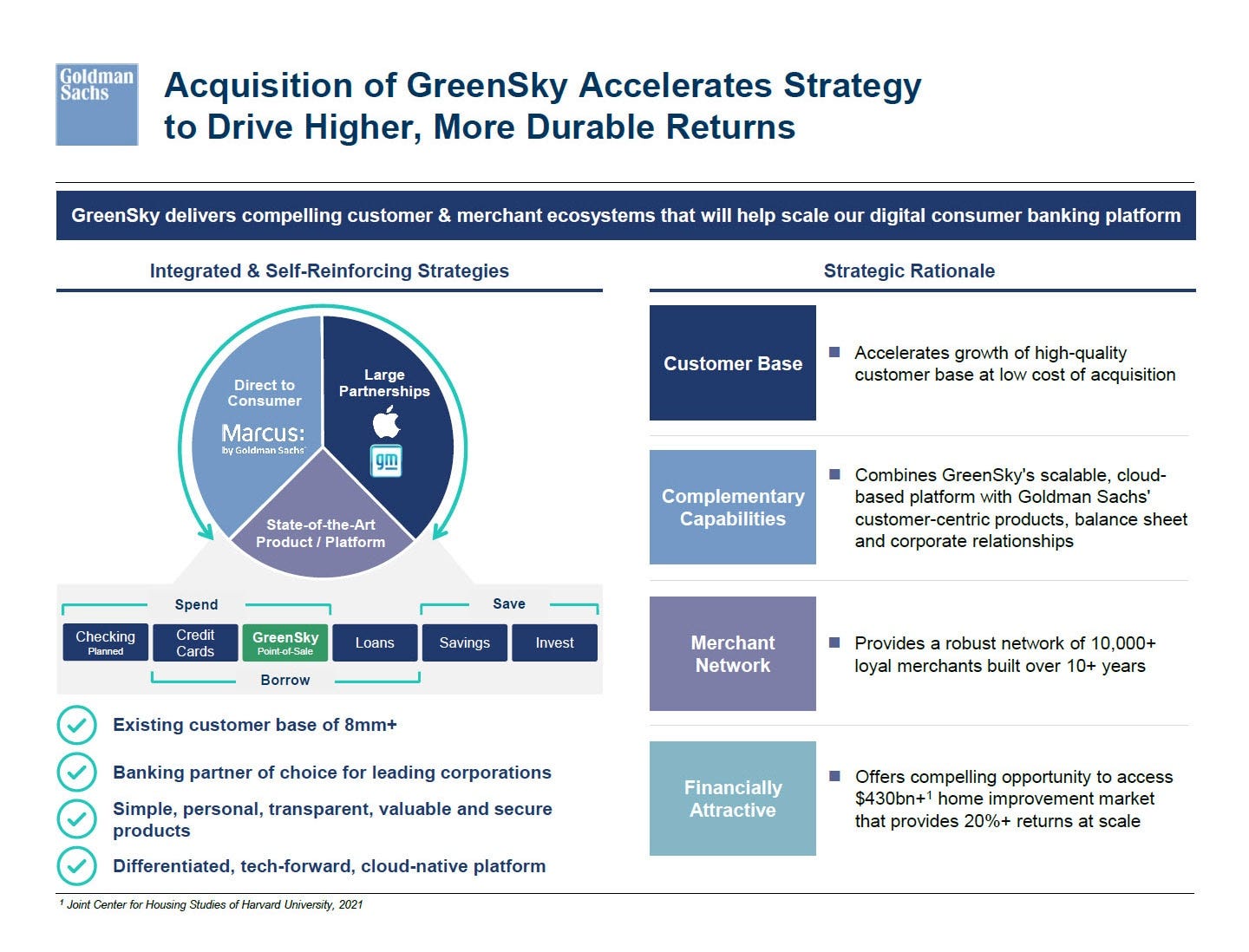

Let’s also remember the $2.2B acquisition of Greensky, the digital lending platform at point of sale for home improvement. The slide below gives some more context as to what Goldman was building —

Actually, quite a bit of the Goldman strategy has been to buy assets, technology, and growth. Some of the early acquisitions include GE Capital, parts of Bond Street’s team, the Final team, and the personal financial management website Clarity Money, which it later shut down.

We’ve always admired the purpose with which the bank was trying to enter the space. It wasn’t choosing between “Buy”, “Build” or “Rent” strategy relative to a particular fintech. Rather, it was substantially invested in a strategic vector, buying up and owning various pieces of the value chain, and continued to spend to put things together. This happened because of executive commitment from the very top.

And the strategy did work for the firm, in the sense that it literally created a leading digital consumer bank, which was batting away demand when it launched in the UK. Deposits went from $12 billion in 2016, to $60 billion in 2019, to $110B in 2021. But that doesn’t mean the thing was profitable, and unlike YOLO SoftBank bets, Goldman Sachs is a public company covered by FIG equity research analysts (i.e., the accountants for the accountants).

The story looked great going into 2020, and looked even better during the days of the pandemic. Fintech companies were trading at 10-50x revenues, and you could defend losses in the short term with the enterprise value created in the long turn. A $60B digital bank with 5 million customers generating $900MM in revenue suggests $180 per year per customer (which is high relative to Revolut’s numbers at the time), and about 1.5% of spread on deposits.

Anyway, one could make the argument that this thing would be worth $25 billion ($900MM x 30) and be taken seriously. Therefore, chucking a few billion here and there for acquisitions and losses is just fine. And that brings us to today.