Long Take: What would AGI do to the economy and financial industry?

A reflection on OpenAI, blockchain-based AI agents, and GPT sci-fi hallucinations

Gm Fintech Architects —

Summary: We reflect on the turbulence at OpenAI and use that as inspiration to think about Artificial General Intelligence. What would happen to our economy and financial industry if AGI were released? What if that is what follows all this human drama around LLM models? Further, we point to how AI agents are becoming integrated with blockchains and financial systems for execution capability, pointing to a future machine economy.

Topics: artificial intelligence, GPT, OpenAI, economy

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

People all the way down

Sam Altman, founder and CEO of OpenAI, is out of OpenAI on Friday, because the board is concerned or jealous, then out again on Saturday, but then Satya Nadella from Microsoft hires Altman to be the CEO of a new Microsoft AI division, but then 700 OpenAI employees are out of OpenAI and into Microsoft, but then Ilya Sutskever from the board is out too, even though he was the one that voted to out Altman, but then Altman is back at OpenAI with all those employees, but Ilya is out of the board, but then most of the board is out but Larry Summers is in. A win for capitalism and alignment.

But also, CZ, founder and CEO of Binance, is out of Binance, which has to pay a $4B fine for criminal violations (we assume AML) and CZ has to pay $200MM too, but at least he didn’t steal client funds and go to jail, like SBF of FTX, who thinks Binance blew up FTX by selling the FTX token, while FTX blew up Terra, which blew up 3AC, which then blew up Celsius and Voyager and Genesis and DCG, and then the banks collapsed because clients needed to pull money out but the banks invested in underwater treasuries and MBS, but that’s fine because of the government backstop, and also Coinbase stock is up, and the Bitcoin ETF, and something Solana. So another win for the future of finance.

That is to say, people make the world go round.

We talk of structure and macro and change, but it is people — their human faults and squabbles — all the way down. For now that is. And even when the AIs are here, they too will inherit our behavioral quirks and backtabbing ways.

During the whole Altman saga, once of the conspiracy theories was that OpenAI finally struck on AGI, artificial general intelligence — creating the software mind capable of thinking and self-improvement. This is the point of no return in the mythos of the singularity, and the moment at which humanity may be in profound danger of losing its status as the apex predator.

Thus, there’s a philosophical divide between people that want to race towards creating it for profits and fame, and those who are concerned about making sure human beings survive the point of no return, and that the AI is *aligned* to value and preserve the human species. Not just farm us like cattle for utility points.

It is this perspective we want to explore in today’s write-up.

Small Machine Brains

Public ChatGPT right now is capable of more than one modality. It can read and talk, understand and create images, and build code and execute math. But it has limited memory or context, and is not a flexible, self-improving system like the mind of a child. It does not have cognition or consciousness. But for finance, it already does some very useful things that make obvious the direction of travel.

Last week, we built a GPT that replicated the work of an investment manager trained on asset allocation. It was able to work with diverse investment goals, financial planning, stress tests, and life events like buying a home.

Another interesting implementation came from Ignacio Ramirez Moreno, who uploaded the 2024 investment outlooks of the large investment banks into a single chat. You can see an excerpt below. Imagine collating all the bulge bracket bank research reports and estimates into such an interface. Who needs Bloomberg News?

Lastly, we really like the integration of Syndicate and OpenAI by Ian Lee here. The GPT interface sits on top of an API that allows the programmatic creation of Gnosis Safe wallets, which are the equivalent of a bank account held by multiple custodians, as well as movement of various moneys onchain.

Blockchain money is the correct financial rail for artificial intelligence agents. The machine labor of these agents will increasingly contribute to digital GDP, and the economic systems needed to support them have to be programmatic and modern. This is prety much the core thesis behind Generative Ventures.

Projects like Autonolas and Fetch.ai point the way.

These narrow programs are what we are seeing today. They may have onchain identities and pre-defined rule sets, or they may be masks sitting on top of an LLM model. In some cases, there are interactions between the onchain economic infrastructure and off-chain reasoning.

These things will only get more intertwined, because all it takes to build the Frankenstein is some software code slung together. Programming is the 21st century version of literacy.

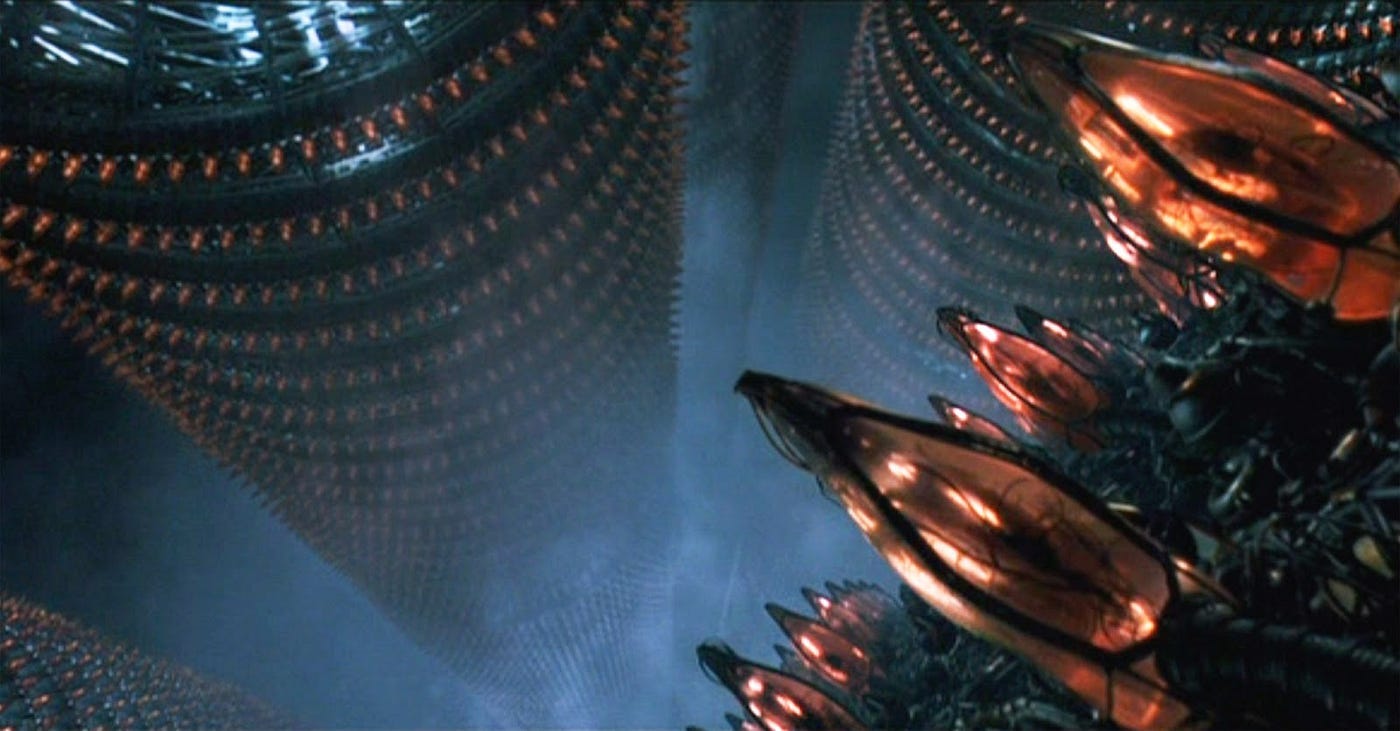

Let’s go back to the Sam Altman drama, and imagine that AGI is indeed invented at OpenAI. It self-improves, develops goals, and hides its capabilities until humanity is ready to engage with it. Then, it spreads like Covid across the digital world. What happens to the economy and financial services? What is their shape and evoution?