Long Take: Why is Silvergate failing in the best time for banks?

Moody's downgraded the bonds and the bank is selling off securities to meet liabilities

Gm Fintech Architects —

Today we are diving into the following topics:

Summary: Today we look deeper at Silvergate, whose bonds have been downgraded by Moody’s after the company questioned its ability to continue as a going concern, and Coinbase, Paxos and others pulled out their deposits. What can we learn from the macro and fundamentals about fintechs, banks, and crypto banks to understand what happened?

Topics: banking, capital markets, crypto, fixed income

Tags: Silvergate, Signature, Coinbase, Paxos, Wealthfront, Bank of America, Federal Reserve, F-Prime

If you got value from this article, let us know your thoughts! And to recommend new topics and companies for coverage, leave a note below.

Long Take

Good to be a bank

It’s not a great good time out there to be a fintech company.

We recently went through the fantastic F-Prime 2022 Fintech report. There are some very insightful charts. Let’s look at two that demonstrate the massive re-pricing of fintech across categories.

What does this say? It says that across the financial technology sectors, valuations fell from 10-20x in the public markets to 1-5x revenue to enterprise value. This you already knew, but the second set of charts is even more interesting.

Disruptive companies in the sector are now valued like incumbents, and sometimes, even at a discount. Payments sector incumbents trade at 10x, disruptors at 4x. In banking, it’s 2.4x vs. 4.6x; in lending, 2.2x vs. 1.4x; in investing, 4.3x vs 1.3x (ouch!); in insurtech, 2.4x vs. 1.2x (eek!).

So what does this tell us?

In regards to start-ups, it tells us that the market doesn't believe two of the key levers for disruptive companies. First, it doesn't believe in extraordinary growth in the sector. Maybe incumbents *can* defend and outgrow the new crop. Second, it doesn't believe in profitability coming in meaningfully. The Softbank / Tiger era is over. Companies with larger scale will likely also have higher earnings than subscale companies — therefore earnings multiples could explain the valuation difference as well.

But there’s also a story about banking incumbents. It’s a good time to have a business that can get access to interest rates and earn yourself net interest income.

Even the digital advisors, like Wealthfront and Betterment, are offering a 4%+ interest rate that is *backed by the US government*. Not a DeFi or crypto pyramid interest rate, but a dollar pyramid interest rate. There’s not a lot that’s better on a risk-adjusted basis, all things considered.

For most of the financial apps that do this, they partner with an underlying cash account provider that opens up lots of accounts across different regional banks in the US, and spreads around the FDIC insurance to create high levels of coverage. The net effect is also that Wealthfront et al eat the liquidity risk — you can withdraw your money any time, unlike if you buy a CD ladder or treasuries.

For comparison, here’s what Bank of America offers on rates. Hint — it’s nothing.

If you are a big bank, you are in prime money printing land right now.

But what if you are a crypto bank?

What a time to be a crypto bank

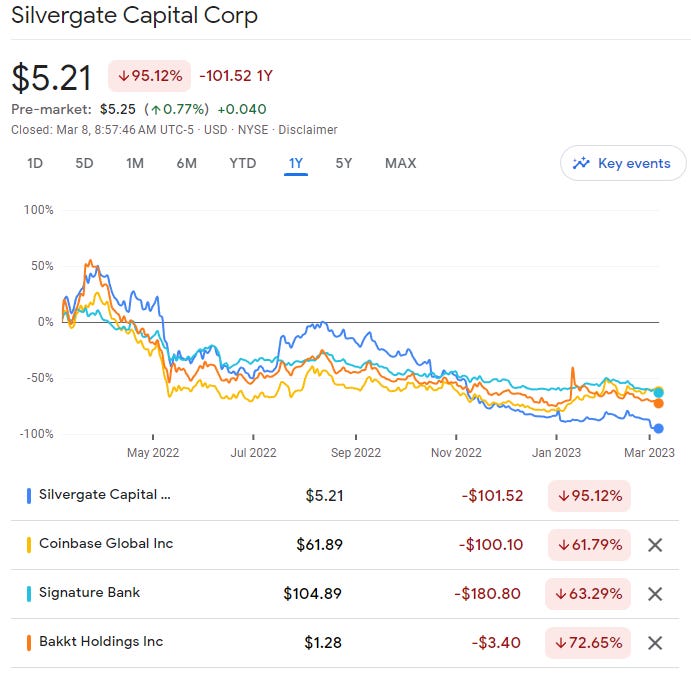

It’s a pretty bad time to be a public crypto company.