Neobank Chime valued at $6 billion with 7 million users, Goldman to launch roboadvisor with $5,000 minimum; plus 12 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

I am "out of office" this week, taking in the sun and waters of the Cayman Islands. In just the last three days, my wife and I got to hold a starfish, kiss a stingray, and take out a sail boat for the very first time. Being here, next to a roaring ocean and hot sand, is a good reminder of the tangible physical world in which we travel. So much of our days now is spent staring at a screen and navigating each other's mental models and cultural viruses. So much is pausing to think about thinking, and then thinking some more.

Just two hundred years ago in 1820, the Homo Sapien had a very different existence. I imagine the arduous interaction with wooden sail boats, or some terrifying encounter with the stingray. I imagine the saltwater and the sun biting into the laboring skin -- no sunscreen or showers in the hotel to make life comfortable. Over these centuries, the explosion of intelligence and technology is truly spectacular. See Kevin Kelly's concept of the Technium. But it makes us feel like self-referential computing brains balancing on stilts, rather than living animals doing the physical work of moving through the world.

Anyway, I spent a lot of time on the links this week, and each of the sections really comes together. So forgive me for just sharing some general thoughts, and then giving you a whole set of interesting pictures. Read the links below!

In Fintech bundling, we have a lot of absolutely insane news. Chime, a US neobank that has 6.5 million users, is now valued at about $6 billion in enterprise value on allegedly $300 million in revenue. Paying $1,000 per user seems pretty intense, especially since only 150,000 of them are signed up via direct deposit. Similarly, the barely year-old Figure has raised another $60 million, for a total of $125 million, after issuing $700 million in home equity loans. Unlike Europe, where the main value proposition of a neobank is FX arbitrage, in the US that value proposition is credit. Giving money away is a much better customer acquisition model than, let's say, taking it. I also think these valuations are an exceptional bidding war between SoftBank and DST Global -- valuations that will not stand the scrutiny of public markets.

In equally fantastic news, Goldman Sachs is launching a roboadvisor with a $5,000 minimum. While Goldman portfolios did previously reside in Betterment, this market entry follows the acquisition of United Capital, its mass affluent advisors, and the underlying technology powering digital wealth. I had a fairly extensive discussion on Twitter with Michael Kitces about what constitutes roboadvice and whether it is true that 12% of all ETFs are managed by roboadvisors (Efi Pylarinou used my prior estimate that digital wealth comprises half a trillion in assets, divided into $4.7 trillion in AUM, with a recent $266 billion of flows).

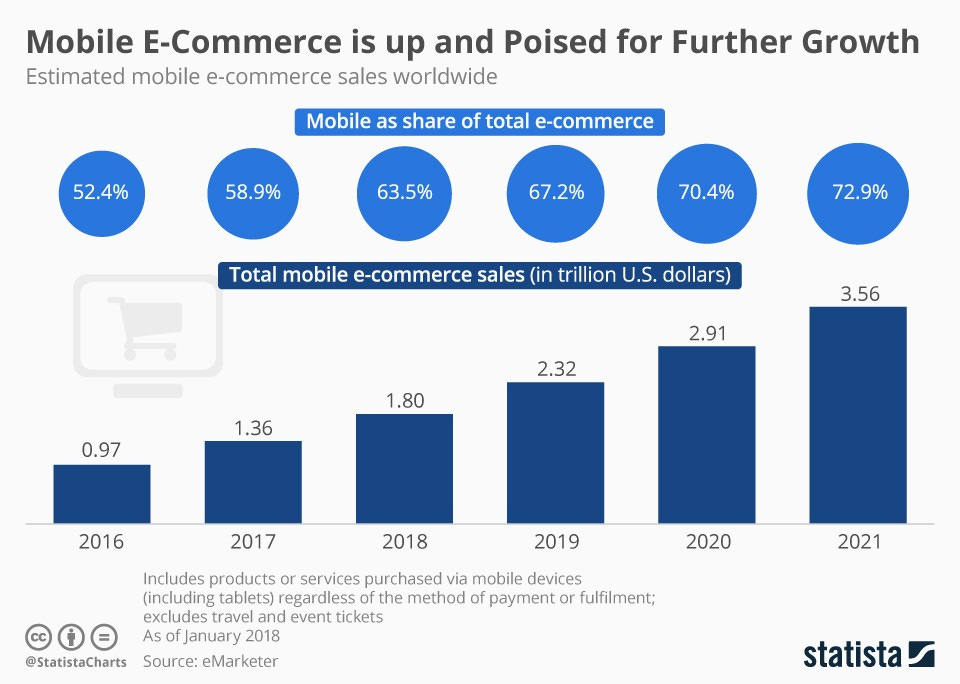

Michael thinks it is really important that we are precise about these offerings being technology-only asset allocators, and that CFPs enabled by technology are a different breed. I think it's truly bizarre to nitpick definitions in a world where Revolut is offering pensions and Wealthfront is offering mortgages. Your phone is your roboadvisor. It gives you all financial product, most likely powered by Apple or Google as the distributor (i.e., who permissions you to open up those banking apps, and authenticates you via your face). We live in a world where the Chinese "Black Friday"-like event Singles Day generates $38 billion in commerce, sold in large part by social media influencers on streaming sites, with much of the purchases happening on mobile phones.

And our next step is crypto-exchange enabled phones that come with a global, decentralized financial system. That financial system is built on real-time aggregated data across all asset classes -- from lending, to banking, to payments, to investments. No overnight batch processing of CSV files, no account opening breaks, no wet signatures on legal documents. It comes with open source programmable rails to build new, customer-centric financial products that people can choose regardless of their jurisdiction. So you can see why I'm no longer compelled by financial planning software for advisors.

Anyway, the real cool stuff this week is the artificial intelligence and augmented reality columns, all linked in their respective sections. First, below is a picture of a person using facial recognition to pay for a subway ride! There is now regulation in China that forces telecom companies to collect selfies of customers for machine vision before selling them a phone. Like some sort of technology version of Arya from Game of Thrones.

And here's a picture of a biometric key fob that uses your thumb to authenticate a payment transaction, from NatWest. It is decidedly less cool.

Here is an augmented reality shopping experience that is launched by interacting with a physical advertisement. This category will see $1.5 billion in spending next year.

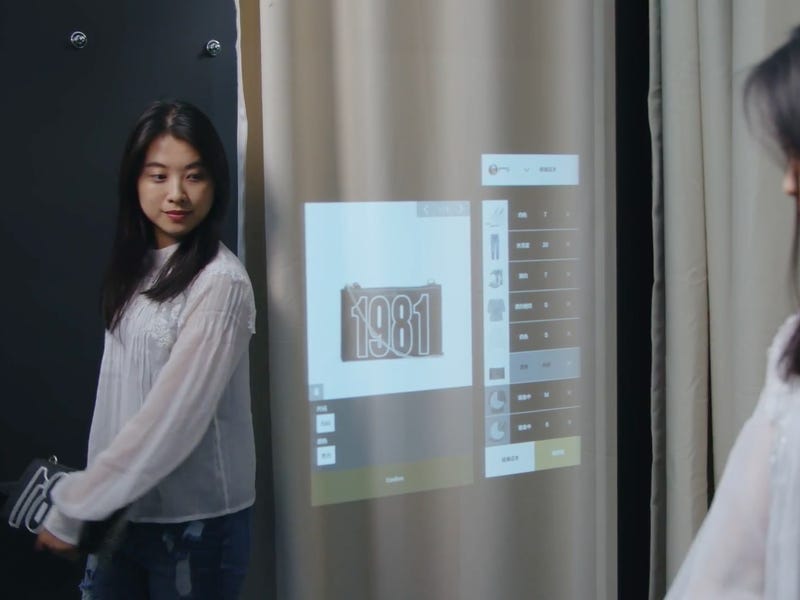

... and a smart mirror for shopping ...

... and one for scanning your body into an accurately sized rendered avatar ...

The digitization of the physical world, and similarly the instantiation of digital objects in the physical world, is an important frontier for the economy. I track it for a number of reasons. First, like many I believe that the economic behaviors 14 year-olds in a video game will end up defining consumer interfaces, business models, and financial products in the decade to come. Free advice -- look at how teenagers buy things in virtual environments, and translate that into your fledgling fintech startup (Fortnite below).

But second, and perhaps more immediately, we see financial services products move from the factory where they are manufactured closer to the stores where they are distributed. Trading is moving away from portfolio managers at hedge funds, and into the hands of the masses with a Robinhood app on their phone. Banking is leaving the Central Bank behind, and finding home in peer-to-peer software. Credit underwriting is abandoning the physical branch, and integrating through APIs into eCommerce shopping carts, points of sale, and search intent. Your voice assistant becomes your financial advisor, confidant, and investment manager.

While some of these vectors are overpriced today from a venture perspective, the integrated APIs and technology artifacts that they will leave behind can be used to create a fully contextual, human financial economy. Finance then will be like a second skin, maybe a coat you put on or take off -- changing depending on where you are today, and where you go tomorrow.

Featured Interviews, Podcasts, and Conferences

Xtiva WEALTHTECH TRENDS 2020. Check out this deep report across wealth tech about what the next year can look like -- my contribution was to discuss how digital assets will start making their way into more traditional portfolois.

Venture Bingo & Cryptomaximalists on the 11:FS Blockchain Insider podcast. Simon Taylor and Lex Sokolin talk about the latest news in blockchain, Bitcoin and Crypto, including JP Morgan's autoloan provenance.

Fintech used to be a back-office support function, now it's defining an industry. Check out my Op-Ed in Investopedia about the history and future of financial technology.

Short Takes

Figure Technologies, a home equity loan startup founded by former SoFi CEO Mike Cagney, has raised another ~$60MM in a new funding round. This is a pretty big raise, especially coming after a $65 million raise earlier in the year. That's a billion of enterprise value in about a year. Good to see a company solve problems for an older demographic, but I have mixed feelings about both the valuation and the pace of growth in a post-WeWork world.

Chime Raises $500M On $5.8B Valuation. Speaking of incredible valuations, here's Chime at 6.5 million users and $300 million in revenue getting funded by DST Global, the Russian SoftBank. 150,000 users are set up on direct deposit, which is what would make Chime the primary bank rather than the side account.

Crypto trading platform eToro has confirmed that it is looking at launching a debit card. Convergence! Here wecome. Fun fact is that eToro has 12 million users, which suggests it is about the size of semi-comparable Robinhood. Start-up Robinhood tops 10 million accounts even as industry follows in free-trading footsteps. Though of course the revenue generation potential is quite in favor of eToro.

Smart Pension partners with Revolut to offer a pan-European pension solution. Another example of integrated services, with retirement solutions being pushed through mobile first banks. Oh, and Wealthfront the roboadvisor is going to be offering mortgages.

HSBC will swap out the paper and pen for blockchain to track $20 billion of assets. This is a private blockchain solution to keep track of private equity assets. Also Deutsche Börse and HQLAX Launch Sec Lending DLT Platform, but in opposite news State Street Slashes DLT Developer Team as Bank Rethinks Blockchain Strategy. Not sure how to read these together, other than the use-case is moving forward to production level software for some, but it is very hard to pull this off in large companies given other pressures.

WisdomTree launches its first bitcoin exchange-traded product. The $60 billion asset manager is launching a Bitcoin ETP on the Swiss Exchange.

Decentralized finance adoption has jumped up, largely due to crypto exchange Coinbase eating its own dog food. Total debt in the system is $900 million and total collateral is $1.7 billion, generating an estimated $3.8 million in interest. The article links a meaty report from Graychain which you can grab here. Also, user aggregator Zerion raises $2M from investors including Placeholder.

HTC’s Binance edition smartphone going on sale tomorrow; supports bitcoin, BNB payments. Let's see if it makes a difference to have a crypto exchange directly embedded into hardware. I am skeptical about a for-profit trading company being the front end married to a phone, rather than an open source Bitcoin or Ethereum node.

Adyen CEO on AI for payments: ‘I was surprised how effective it was’. Sounds like the company took a deliberate and customer-cetric approach to building machine learning based risk management and fraud detection tools, and it paid off with 30% efficiency gains.

China’s subways embrace facial recognition payment systems despite rising privacy concerns. China is actively bootstrapping a facial recognition national database that can be used across public and private services. Nearly 120 million people have been cumulatively signed up, which will be further accelerated ba regulation that forces Telecom companies to scan faces of phone purchasers. In a local proof of concept, 200,000 people have been using their face to pay for the local train. Very much related: Deepfakes’ Next Stop: Banking. Fun fact is there are now 14,000 deep fake videos online. Also related, New swarm of pro-China Twitter bots spreads disinformation about Xinjiang.

NatWest to test biometric fobs that offer contactless payments using fingerprint verification. Instead of a card, this fob can be attached to a key ring and has a built-in finger print scanner. It's a cool technology, but I have trouble seeing a bank like NatWest leading the adoption of a new consumer behavior (vs. ApplePay for example).

How 5G Will Power The Industrial Commerce Revolution. The premise of the article, and the paper on which it is based, is that 5G infrastructure will create a larger machine-to-machine economy, which requries a modern M2M payments infastructure.

12 kinds of shopping tech that didn't exist 10 years ago but have changed retail as we know it. Great overview of technoloy like body scanning, QR code payments, augmented reality shopping, and other frontier developments. Comes with pictures.

Retailers to spend $1.5B on AR/VR in 2020. IDC is projecting a $1.5 billion revenue market on AR/VR. To quote directly -- "The consumer segment will make up 37% of spending on AR/VR next year, followed by 23% for distribution and services, 19% for manufacturing and resources and 14% for the public sector. China next year will be the biggest market for AR/VR technologies with spending of $5.8 billion, followed by the U.S. at $5.1 billion, Western Europe at $3.3 billion and Japan at $1.8 billion, per IDC."

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.