Ok, Boomer -- a meme for the broken political economy; plus 12 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at the merits of Generation Z's memetic dismissal -- Ok, Boomer. Is it justified and backed by data, or is the world getting better while the young get softer? We dig one step further to think about the political economy of when Baby Boomers were growing up, and whether it is fair to generalize their experience to others at all. The answer comes down to a failure to negotiate -- with each other and the world we live in -- which may leave everyone worse off as a result.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

Chlöe Swarbrick, a 25-year old climate MP was presenting her climate change case to the New Zealand parliament, and was heckled by an older audience member. Without missing a beat, she acknowledged and dismissed the challenger with a pithy “Ok, Boomer.”

The recording has since gone viral, inspiring everything from merchandise to Vogue articles. While the incident isn’t the source of the phrase “Ok, Boomer”, today it is the most well known manifestation. So what does the phrase mean? If you are inclined to more colorful language, see Urban Dictionary. But the meaning is obvious on its face — Gen Z is dismissing utterly and without consideration the judgment and protestations of society's elders on multi generational issues like economics, climate change, and social norms.

For example — If you hear Warren Buffet call Bitcoin rat-poison-squared, “Ok, Boomer” may be the proper response. I don't think Warren is running any nodes.

The interesting thing to me about this isn’t necessarily that teenagers are disrespectful — isn’t that what teenagers always do? Rather, it is that the term has struck a nerve in America’s consciousness, offending and deeply bothering some Baby Boomers as an ageist slur. Of all the things that have been said of the younger generations (e.g., snowflake, spoiled, lazy, etc.), this little memetic bite is barely a counter attack!

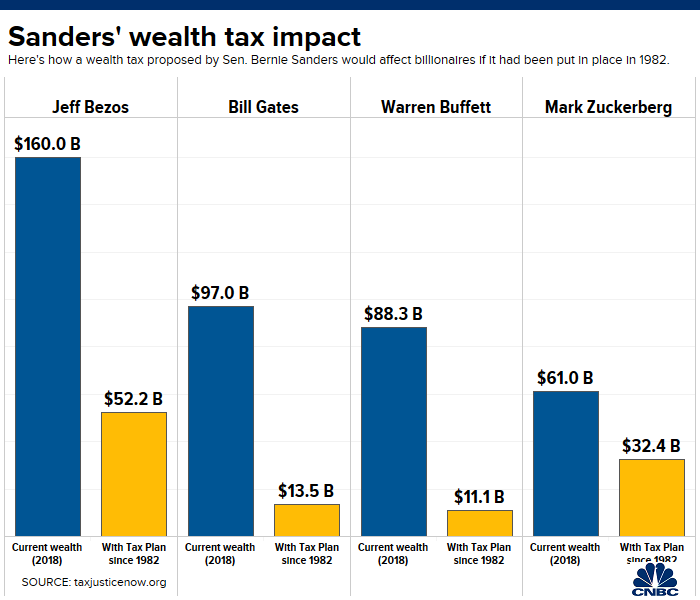

It is sort of like Elizabeth Warren’s or Bernie Sanders' proposed Billionaire tax. The tax is so politically impractical that it should be seen as a rallying cry rather than policy — except that multi billionaire Bloomberg nearly jumped into the race, purportedly backed by America's top dog Jeff Bezos, days after the tax entered the public debate. The overreaction is valuable information. It betrays a fragility and defensiveness of some unspoken current in our society. This is too sacred! This is too precious! We can push, but you cannot push back.

I want to bring this closer to Fintech and economics, but let’s first talk about negotiation. When you are trying to change someone’s mind and persuade them to give you a slice of their economic pie, the best approach is not to yell your position most loudly until one party collapses from exhaustion. Rather, the best tactic is to find the point of belief within your counterparty’s current belief system or negotiating range to which they can still say *Yes*. Even if you disagree, proposing some position beyond the scope of your opponents capacity simply won’t work. Instead, it will provoke them into dismissal and disengagement.

What’s happening with “Ok, Boomer” is that for Gen Z, the world view of a certain type of person — whether fairly or unfairly stereotyped as white, old, male, conservative is debatable — is simply outside the bounds of engagement. They know it is pointless to negotiate with some people, because there is no fruitful overlap. This implies that from a macro view, we would rather see a young generation full of anger or argument, rather than nihilism and depression. But the data tells a different story, supercharged by the coils of the Internet. In recent history, young people have never been this depressed.

What are they unhappy about? Below is the quantitative core of the argument and the complaint is well known, since Millennials have been squeaking about it for a while. First, there is massive involuntary student debt of $1.4 trillion, up from "merely" $300 billion fifteen years ago. This burden has resulted in delayed adulthood and a shrinking set of opportunities. Growth in income inequality is also well documented, but it helps to see that for many in the bottom income quintiles, the inflation-adjusted economic pie has effectively shrunk 10% since the late 1990s, while top incomes have seen extreme gains. Analyzed on a relative basis, the emotional story for the bottom quintiles becomes even worse.

Home ownership opportunity is the lowest it has been for 40 years for both 35-44 year olds and those under 35, while those over 65 have experienced a relative increase. Families have delayed having children too, for many well into their 30s. Baby Boomers simply did not face this type of economy, nor this particular depressing frame about the future. A single-income family in the post-War years in the US could afford a house and a child, something many twenty year olds today do not think possible.

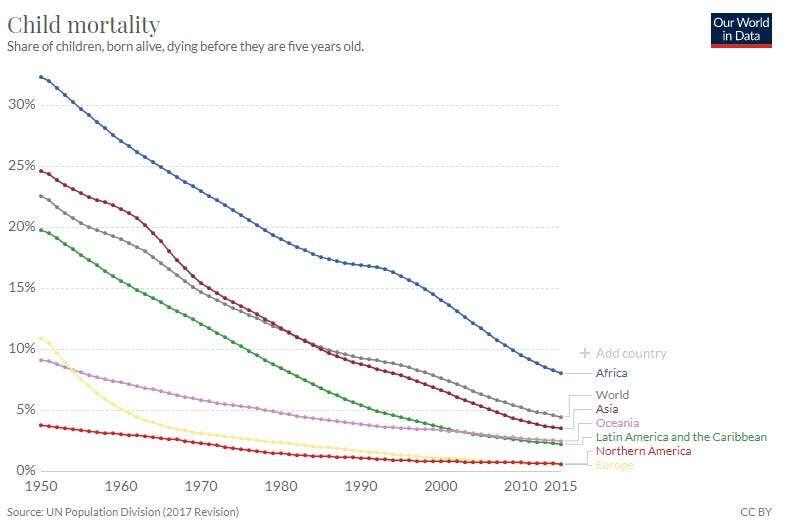

But that’s not the full meat of it. Surely many qualities of life today are preferable to that of fifty years ago! From a general increase in life expectancy, a decline in war and violence, greater human rights, fantastic technology and nutrition — there are many individual issues to which the older generations can point, and claim that Gen Z and Millennials are soft, spoiled brats to complain about life in 2020. It is certainly true that my parents had a harder set of issues to deal with than I do, and that their parents survived two World Wars and a nuclear threat. On the global macro metrics, life is better.

And yet! I talked to Aaron Hall, a legal and political historian, to find a more intuitive answer as to why younger generations have the right to complain, beyond simply the cycle of life. It's not that Gen Z is jealous of previous opportunities, but rather that it is rejecting the libertarian austerity lecturing of people who had received a unique gift from history and do not display the self-awareness about its benefits.

The “political economy” between the Great Depression and the early 1970s saw a massive rise in demand-side economics, from the New Deal social safety net, to wartime spending, to post war construction. Aaron pointed me to a book called The Great Exception, which suggests that economic growth came not from some divine American progress, but an artificial moment in history fueled by social choice -- one which created a lasting impression that children should have a better economic future than their parents. For a data-backed argument, see below for how inequality falls in the 1930s, and slowly boils up to historic levels in the United States just recently.

The growth default has been hollowed out and transformed into the divided political mess we see today. I am trying hard not to suggest distributional outcomes or political regimes; but it is safe to say that today's social unrest is correlated with neoliberal economics and the various synthetic economic policies under which we operate our systems today. That over 20% of global debt is bearing negative interest rates, inflating both real estate and stock market prices, is the tip of the iceberg.

One loose comparison to this is the slow deflation of the SoftBank-led venture capital bubble. Having made billions from Japan's Internet growth and an early investment into China's Alibaba, SoftBank became price-insensitive to building industry leaders. As a result, it put transient capital into transient companies, like OYO, Uber, WeWork and others. These companies in turn have persuaded people to join based on the over-promise of a sunny future. This was often economically motivated, guaranteeing some particular payments over time or simply advertising entrepreneurial freedom. A hotel owner may get pre-payments from OYO, or an Uber driver may rely on some unrealistic, subsidized payout rate.

Now, as blitz scaled companies are shedding valuations, or being refinanced into nothingness, the same workers that were pulled into these ecosystems are losing employment en masse. The political economy of SoftBank — endless venture money if you are showing growth — is ending just like the Great Exception. So would you be willing to taking moralizing career advice from Adam Neumann, who pulled over $1 billion out of WeWork as it ate its own tail in slow motion?

Whatever version of “Ok, Boomer” is applicable to Neumann, or Zuck’s Libra, we should say it without hesitation. Similarly, this is the same utterance every Fintech entrepreneur has had to say under their breath to venture capitalists that have never started a financial services business and look for eye-balls, not assets. Or to large bank executives that asked startups to present their software, only to have internal teams copy the feature-set and call it innovative. It is what that entrepreneur has had to say to the world when they had bad market timing — too early, too late, not enough, too much. It is, end of the day, a failure to negotiate. A failure to make it work. It is the lack of human connection, on both sides of the story, on how to build the future together.

If someone stereotypes you with an ageist disregard in response to a “reality check” you provide — perhaps you’re not sharing the same reality. What is the context in which Gen Z is looking at the world? Will they keep buying gold, mutual funds, pay bank fees and trading commissions, and come to your office for meetings? Or will they stream financial advice on Twitch and pay for it in DAI or Bitcoin? Will they want you to sue the fiduciary rule into oblivion or cancel the OCC Fintech charter? Or will they build global tech networks to flow around the barriers we have put in place?

They will learn their own lessons in time. And if we are lucky, we will learn those lessons together.

Featured Interviews, Podcasts, and Conferences

Fintech used to be a back-office support function, now it's defining an industry. Check out my Op-Ed in Investopedia about the history and future of financial technology.

Interview with Blocks99. In this discussion, we focus on the financial crisis, entrepreneneurship, and why decentralized finance infrastructure is needed in the industry.

Are banks losing the brand war to tech firms? Great podcast with American Banker's Penny Crossman. We don't buy Tylenol from the Tylenol store. Why do we buy Wells Fargo bank accounts from Wells Fargo?

Short Takes

Next in Google’s Quest for Consumer Dominance: Banking. The plan is to package up the bank accounts of other banks (e.g., Citi), which may seem like it won't be that revolutionary. But remember that for tech companies, owning customer attention is the important and valuable bit. See also, JPMC Opens eWallet So Tech Firms Can Offer Virtual Bank Accounts and Every Tech Company Wants to Be a Bank.

WeInvest launches wealth tech platform and Plum Fintech , the UK-based money management and investing app, has raised $3 million and Japanese robo-advisor WealthNavi banks $37.6m in series D round. This suggests to me there is room for digital wealth to grow -- but probably not in the United States.

Lemonade will delay its plans due to “concerns about how fast-growing tech firms are being viewed by the market.” after raising $480 million, while Blockchain analytics firm with SEC as a client eyes US IPO to raise ‘up to several hundred million’. It is nice to see that WeWork's failure to launch has had a chillin effect on the private tech market, and injected just a tiny bit of rationality into exposing horrible economics to public investors. There's nothing wrong with horrible economics, but don't expect to cash out on them!

Balance Sheet as a Business Model for DeFi Platforms. Great write up from the Defiant on how both Maker and Synthetix are decentralized finance models of creating various assets. Wish we dropped lingo like "minting" or "staking" and replaced it with "issuing" or "lending". Also questionable is the self-referential nature of these financial instruments. But love the pioneering.

Coke One North America (CONA) — the tech firm that manages IT operations for the soda giant’s bottlers — is using a blockchain solution developed by German software firm SAP to manage its supply chain. This tells me that blockchain could be a technology feature deployed by most enterprise tech providers, rather than a company defining one.

CFTC Chairman Heath Tarbert said last month that ether is a commodity, and he expects to see regulated ether futures in the U.S. in the next six months. Ethereum continues to be grandfathered into a more favorable status -- new programmable blockchains hoping to bootstrap a token in the West are not likely to be so lucky. This is a competitive advantage.

Blockchain Publicly Unveils Lending Desk, Already In The Top 5 Crypto Lenders With $1.6 Billion Of Transactions. People still really like to trade cryptocurrencies and to do so on margin. At $10 billion of total annual lending -- a wild guesstimate -- $300 billion of market cap is not all that levered up.

Special Report: AI Policy and China – Realities of State-Led Development. If you want to understand the reality of what's possible in China today, grab this 46 page report about China's challenges in building an AI superpower. Not owning NVIDIA or Google (i.e., the fundamental infrastructure) is one.

Instagram is now testing hiding likes worldwide. The company is testing hiding the total likes and interaction counts on other people's posts -- you would still see your own engagement, and the alorithms would continue to reward popular content. But maybe we will all have a litte less FOMO.

When Algorithms Decide Whose Voices Will Be Heard. Justice and distributional outcomes will be decided by those who own our data, many time unintentionally. See of example DataCubes uses machine learning and artificial intelligence to analyze a broad array of information sources, including semi-structured insurance submissions and over four billion objects in its data lake, which just raised $15 million.

See the new Star Wars–like display that could ‘revolutionize’ virtual reality. Cool display technology that combines ultrasound which manipulates a tiny bead, and a set of RGB lasers that color the pixel in physical space.

Magic Leap Patents Signed Over to JPMorgan Chase as Collateral Just Months After Major Funding Push. Wow. So first off, the AR unicorn is having trouble raising real capital. And second, JPM is taking a VR patent portfolio as a legitimate piece of collateral for financing. JPM will be competing with Apple on augmented reality in not time! That is a joke, good people.

Report: Apple In Development Of VR/AR Headset & AR Glasses, First Device Launches 2022. Apple is playing the long game, but keeping information tightly controlled is harder than ever and details are leaking. The tech firm believes glasses to be the post-iPhone computing form factor. I am sceptical given the slow-ish adoption of the Apple watch (20mm per year), and a lack of any breakthrough innovations post-Steve-Jobs. But still holding my breath!

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.