Hi Fintech Futurists,

Welcome back to our podcast series! For those that want to subscribe in your app of choice, you can now find us at Apple, Spotify, or on RSS. If you enjoy it, throw us a rating here — it helps spread the word!

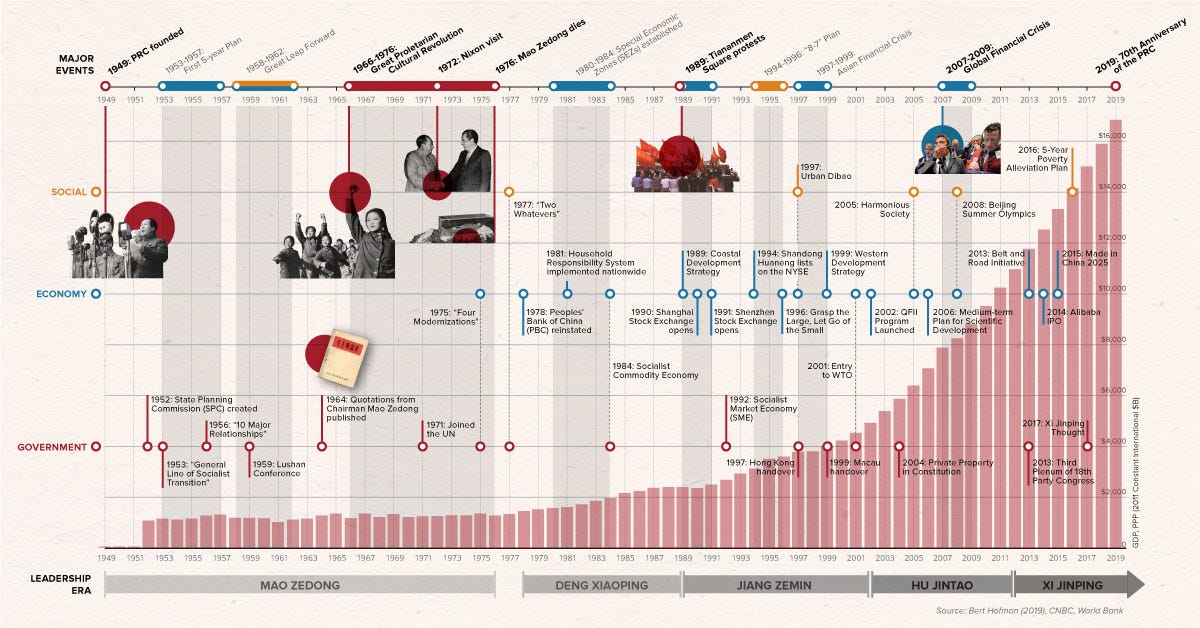

In this conversation, we chat with Richard Turrin – an award-winning executive, previously heading FinTech teams at IBM, following a twenty-year career, heading trading teams at global investment banks. He’s also the author of the number one international bestseller, Innovation Lab Excellence. One of his books is Cashless: China’s Digital Currency Revolution, which brings the story of China’s incredible new central bank digital currency to the west. He lives in Shanghai, China, where he’s had the privilege of living in China’s cashless revolution firsthand.

More specifically, we touch on where China has gotten to in terms of FinTech and blockchain, and dispel some of the myths and assumptions that people bring to the conversation. Additionally we touch on the CBDC and how that's becoming really important, and how Richard got to China in the first place and began to build a career there, and so so much more!

Help others get deeper in Fintech & DeFi by sharing this newsletter via the botton below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

In Partnership With:

Join 30,000+ online meetings! Fintech Meetup focuses on what you really want from an event--meetings with new partners and customers. Join 3,000+ other participants to meet fintechs, banks, neobanks, investors, networks, tech cos, credit unions and more! Online, March 22-24, startup rate available for qualifying co’s. Get Ticket

M1 is the Finance Super App that puts you in control of your wealth. Invest, borrow, and spend your money how you want with sophisticated, automated tools to help you reach your financial goals more easily. Investing in securities involves risks, including the risk of loss. Borrowing on margin can add to these risks. M1 Finance LLC, Member FINRA/SIPC. Click here to get started.

Sneak Peek:

Richard Turrin:

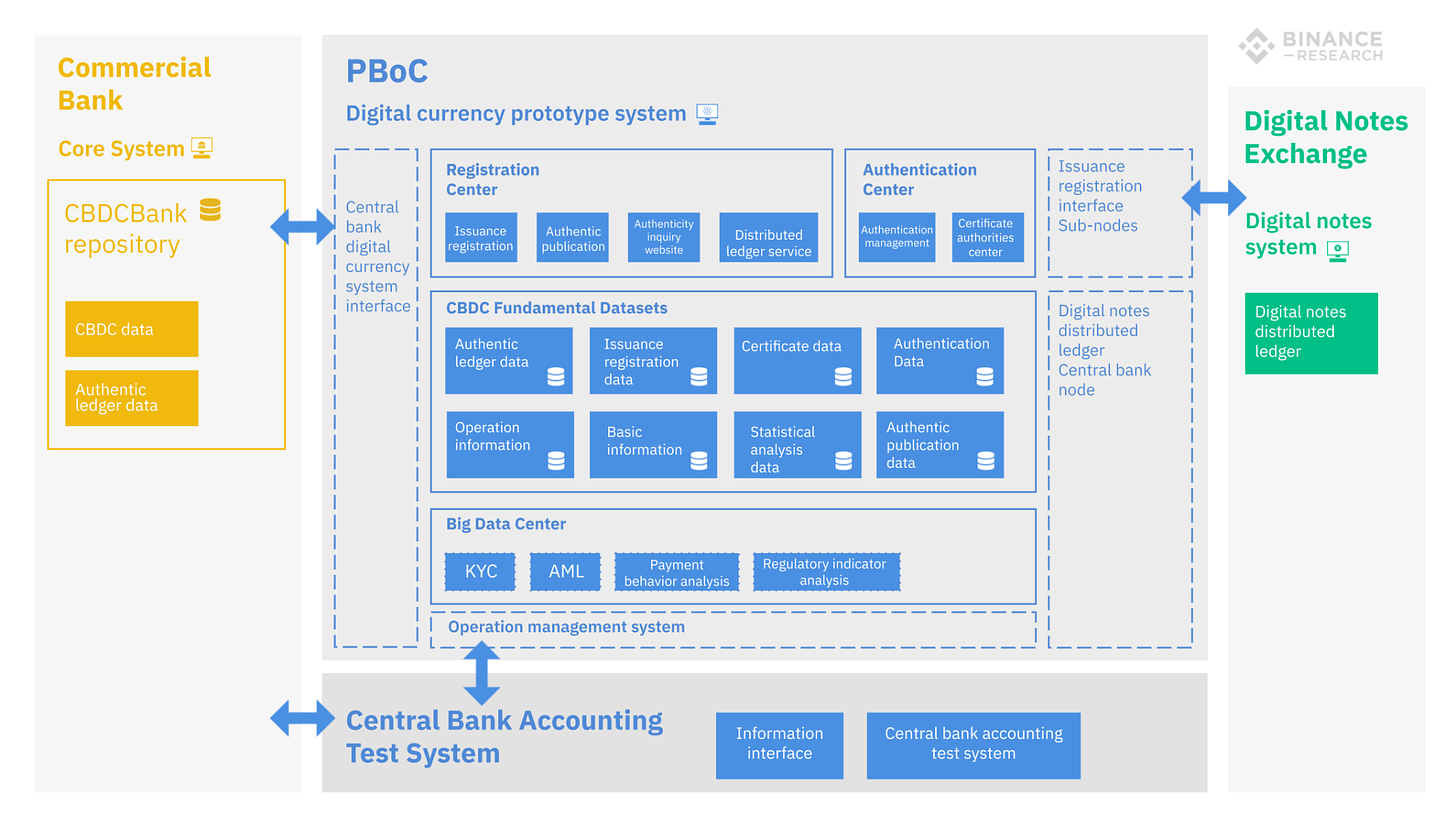

let's kill two misperceptions. Ready? Misperception number one: People's Bank of China is launching its central bank digital currency in order to kill Alipay and WeChat Pay. Demonstrably untrue. It is important to understand that the PBOC started its digital currency project back in 2014, and WeChat launched. Neither one of these payment services was a smash hit in 2014. Yes, they were successful when they launched. The companies, WeChat and Alipay and the PBOC, no one really thought when they launched in 2014 that they were going to make China go cashless in about four years, that they were smash hits. But the point is the CBDC has been underway since the formation of the Digital Currency Research Institute, which is part of the PBOC, and that goes all the way back to 2014.

So, people's view is that, "Oh, WeChat and Alipay were too successful, so they then made the digital currency to put them out of their misery in spite." No, digital currency was already in the cards back in 2014 for the PBOC. They see, saw, and continue to see digital as the solution to many problems that you have when you have 1.4 billion inhabitants. Digital is the only solution that's viable for many things. So that's number one. Now, the second one that I'm going to handle is... Ready?……

More? So much more!

Subscribe to our podcast on Apple Podcasts or Spotify

What did we miss? Reach out here anytime.

Stop by our Discord!

Like it? Share it!