Real Estate Tech brokerage Compass earns its $6.4 billion valuation from smart arbitrage; plus 14 short takes on top developments

Hi Fintech futurists --

In the long take this week, I examine how $6.4 billion real estate brokerage Compass stacks up against the digital wealth and lending companies with a similar go-to-market strategy, and provide some ideas as to why it is successful. Compelling questions also emerge when looking on how technologies like AR/VR are commoditizing the property brokerage experience -- what is the equivalent in Fintech?

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

Imagine an industry. In this industry, professional sales people with a technical background try to sell some intangible asset to other people. The asset has a lot of regulation and legalese associated with it -- mountains of paper, contracts, and arcane instruments. Everyone wears a suit, and things feel *important*. Transactions don't happen very frequently, but when they do, it is a life event, and a difficult moment for the customer making a purchase.

Now imagine a technology start-up coming along and saying that they will use software to make this process more efficient. Accounts will be opened online or on mobile phones, using automated KYC/AML. Money will be moved seamlessly, reducing the time of the traditional approach from several weeks down to a few minutes. CRM will be deployed across the sales force, to function like a workflow automation tool that integrates into all of the legal and financial features that make this industry complex. Pricing will go down, customer numbers will go up, and the technology will be deployed directly to the consumer, and then to other traditional incumbents who will rent the software.

I could, of course, be talking about any number of financial services industries. When you look at wealth management, this is the Personal Capital or AdvisorEngine story -- taking financial advisors and plugging them into modern technology. A few billion dollars of wealth tech investment per year over the last 5 years have funded a whole set of competitors that know how to make a human/software advisor hybrid -- whether at a startup or at Bank of America Merrill. Goldman Sachs just paid a hefty $750 million for one of these things as well!

Or maybe you want to focus on digital lending, noting how OnDeck and Kabbage did the same thing for business loans. Instead of going to a human underwriter that processes paperwork manually before your firm can get financing, instead fire up a clean web interface supported by human staff (or a chatbot). If you are a global bank, you can free-ride on the $3 billion of annual venture capital in digital lending by renting a private label version of the startup software.

But in this particular case, I am talking about someone else. I am talking about Compass, a residential real estate startup that built out a platform for brokers -- proprietary and external -- and has recently raised $370 million at a $6.4 billion valuation. I found the language and positioning sort of eery, in how similar it was to the story in industries I closely follow. It even bought a CRM earlier this year, not unlike AdvisorEngine buying Junxure, or Salesforce getting into financial verticals. What I did find unusual, was the absolutely massive valuation.

What makes this type of company any more valuable than a similarly positioned company in Wealthtech or Digital Lending or Insurance or Trading? A couple of things come to mind. First, those other industries do have their vertical unicorns, like SoFi or Robinhood. But such B2C players are not really about an augmented advisor helping individuals make large individual purchases -- rather they are about democratizing access to previously unaffordable financial product. This makes Compass a less transformative company by comparison, since it *merely* improves the user experience. That should make it less valuable.

Second, Compass did heavy financial recruiting of brokers from top competitors -- essentially buying revenue or what in financial-advisor-land you would call a "book of business". If I give a large sign-on bonus to a Douglas Elliman broker, I will inevitably bring over some portion of their revenue generation. This is a short term trade, where you are betting that your platform will have superior operating performance based on the technology-enabled model. Traditionally, you would never get a venture capital type multiple on buying real estate commission revenue; you would similarly never pay more than 1-3x revenue for a financial advisory business. But in the case of venture capital, which funds Fintech companies at 20-100x revenue these days (thanks Softbank!), there is a clear M&A arbitrage. Get cheap financing, acquire top producers.

Third, the market timing in the case of Compass was very positive. You can see in the charts above that the core financial verticals have seen Fintech venture inflows over the last decade, until equilibriating and leveling off at GDP percentages between 2014 and 2016. Real estate technology investment has lagged behind -- until the pop to $5 billion per year in each of the last two years. This means that investors were looking to put money into this thesis, with many simply trying to find "the Lemonade" or "the Revolut" of Real Rstate. Enter Compass, and its valuation. Same can be said of course for WeWork -- the best timed $700 million market arbitrage of them all. A less critical venture investor makes for a better entrepreneurial experience. That's not to say these guys don't deserve the success -- it is certainly a great story powered by beautifully designed software. But at the same time, it is important to understand the underlying drivers for differing performance in similar fact patterns.

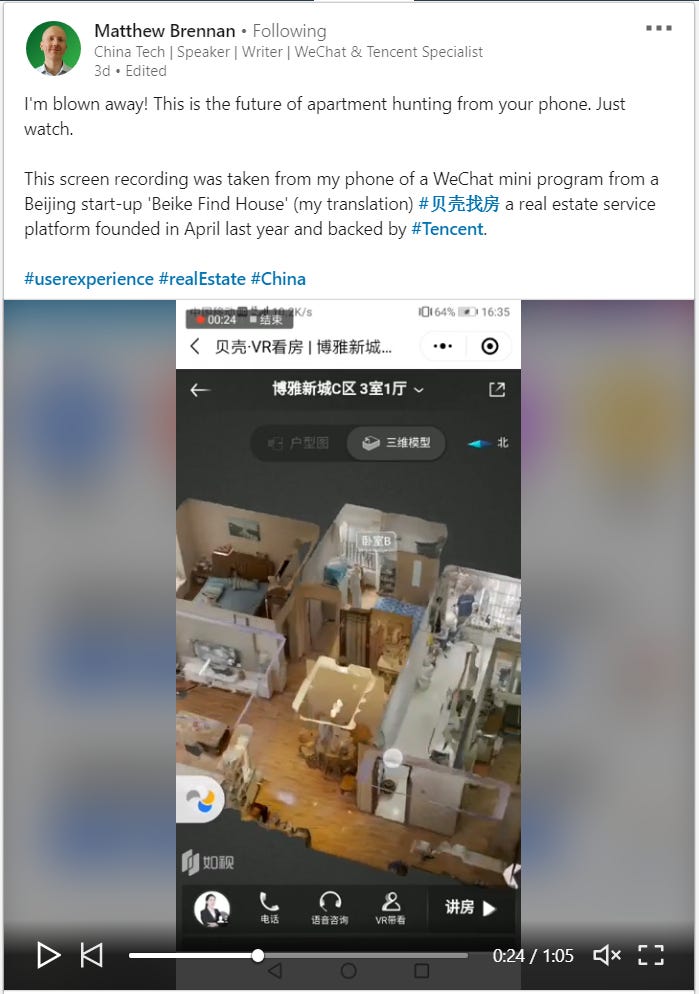

Another thing, however, that I want to show you is a version of the same use-case (house hunting) solved in China by a WeChat mini-program backed by Tencent, shared in video form by Matt Brennan here. A user can search a map on their device, find a listing, click into a 3D rendering of the apartment, and walk around looking at lighting and detail in a realistic environment. That's more powerful than a broker CRM.

In the West, Matterport is the key company working on this vector -- digitizing physical spaces and mapping them into an AR/VR rendering that can then be inserted into mobile and web applications. Now Matterport is "only" valued at around $325 million, most recently raising $48 million. If I were Compass, I would acquire this company yesterday to lock in real technology innovation into my model. Revenue multiple arbitrage doesn't hold a candle to taking the very asset you are working on transacting, and digitizing it such that the need for human-hand holding trends to zero.

I wonder how the same can be done for non-property financial product. How do you tangibly communicate investing, or banking, or lending using frontier technology? End of the day, those products are nothing more than some abstracted rates of return from one entity to another. Charts can be rendered in more dynamic or simple ways, and stories can be told in more emotional media. But until someone really figures out a way to convey those products as impactfully as these 3D renderings of homes and the associated feeling of presence, such financial services will continue to be intermediated by expensive people.

The closest thing today, I would wager, is the abstraction of financial products into features within other types of commerce. As finance moves to point of sale, its detail becomes less relevant (and likely more commoditized by API-based banking-as-a-service competition). We make decisions not on the best loan or the best ETF, but on the product we are actually buying. Thus Greensky wins by financing home improvements in the process of home improvement contractors physically evaluating your home. Or, Affirm wins by being tied to your eCommerce shopping experience at checkout. Doubtless, there is still great distance to cover.

Short Takes

The Apple Card starts rolling out today. What I love about this is that (1) on the one hand it is just a boring old credit card, but on the other hand (2) haha, you are all out of business now. In related news, Mastercard acquires Nets account-to-account payments business and Mastercard Is Building a Team to Develop Crypto, Wallet Projects. The key distinction to keep in mind is whether the payments are flowing from consumers to businesses, or from businesses to busineses, or some other permutation.

Curve raises $55m for mobile payment app that combines multiple bank cards. I am late to this, but have heard a few other things through the grapevine that confirm the value of this strategic direction. Being the nexus for a bunch of payments rails is the new version of data aggregation. So watch the data aggregators in Europe and the US.

UK Digital Bank Starling Updates on User Growth: Expects One Million Accounts Before Year End. This discussion of the missive from one of Europe's leading neobanks is interesting -- in particular revealing how small the balances are on the SME side. Average balances are around £10,000 for LLCs, and total assets £600 million. I still think pushing this stuff into the US is suicide (hey there N26 and Revolut!)

LendingClub Unveils Select Plus for Sophisticated Investors. Whatever LendingClub's banking partner doesn't underwrite, someone else can underwrite. Can the marketplace model scale up? Feels more like junk bond territory to me, but hey, I like DeFi lending, which isn't much safer.

IEOs are unsustainable, but for now Binance is outperforming the competition. The top-line alone is interesting: legitimate exchanges have had 28 IEOs combined, out of which 18 (~64%) have had a positive return in terms of USD; less than half of the projects have outperformed bitcoin. I would also recommend understanding what Binance wants to do in the US here.

tZERO to Open Security Token Market to Retail Traders Next Week. So Overstock's blockchain subsidiary has wanted for a while to do security tokens, and led the way conceptually. But it has not led from an execution perspective -- perhaps this will be the turn of events. Given the lack of info on its roboadvisor performance, I am skeptical. And you know, they don't have a lot of time -- Coinbase acquires Keystone Capital in bid to become a regulated broker-dealer.

Shenzhen Issued 6 Million Blockchain Invoices in 12 Months. So I don't really understand what it means for a Chinese region to have a blockchain, but even if it is not decentralized, it is important. You don't see, let's say, California doing this yet.

Here’s when analyst reports matter, according to Morgan Stanley’s AI. So supposedly analyst reports are still valuable -- but only when you get an AI to scrape out the human emotion from the language, and ignore all the voodoo mathematics. Then you can beat the S&P 500 index.

As China turns towards facial recognition payments, are QR codes on their way out? This would be a great turn of events -- well at least in terms of convenience, not necessarily security. My immediate thought goes to being able to use your face as the biometric password to your digital identity and net worth (i.e., crypto wallet).

CFPB gives boost to use of alternative data and machine learning. No action letter for AI-based lending underwriter, Upstart. Go ahead and multiply, AI lenders!

App developer Lightricks raises $135 million at a $1 billion valuation. Interesting one -- Goldman Sachs was the latest investor in this team, which has 3 million users for its app FaceTune, which uses neural networks to make you look better. Goldman Sachs helping teens fix up their blemishes for Tinder, everyone. I am going to download the app right now.

Snapchat to Raise $1 Billion to Further Build Content, Gaming, and AR. Spectacles were a bust, but this company is still the best bet for the US to compete against TikTok. I don't expect to see anything poppy and fresh from Facebook. Maybe it will be Apple, along with Goldman and their new credit card: Flurry of New Apple ‘AR/VR’ Job Listings Point to New Products on the Horizon.

HTC’s 6DoF Lite Video Mode Now Available On All Vive Headsets. This is neat. Imagine taking a video shot, and the data within the video itself allows for it to be rendered into 3D. If you have the latest iPhone, you know about Portrait mode and the various depth of field settings that come from having multiple camera lenses. Same thing here, but more advanced. Will future video just record a 3D rendering?

Consumer Watchdog: Mass cyberattack could result in control of connected cars. If you can hack Capital One for credit card data, will you be able to hack a fleet of self-driving Teslas? It all depends on the cryptography, but many insider "whistle blowers" are concerned.

Looking for more?

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.