Shifting from Institutions to Retail Clients -- NYSE direct listings and Central Bank digital currencies; plus 12 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at the similarities between the NYSE building out direct listing products to augment or replace IPOs, and Central Banks considering launching consumer-facing digital currencies. In each case, the value chain of the respective financial sector is compressing, as the underlying manufacturers of financial product move closer to the consumer. I also highlight how a few blockchain-native alternatives to trading and rebalancing software are developing, and the reasons to get excited about things like Set, Uniswap, and Aragon.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

A core thesis I've held for a decade now is that personal finance -- what many in the industry call "end clients" -- is the tail wagging the dog. If you are a multi-billion dollar portfolio manager at KKR, or a multi-million dollar trader at Morgan Stanley, this might not be super obvious yet. The machinations of the high finance factory, with its blinking lights and massive bonuses, still feel like the primary activity in the industry. Once upon a time, so did the whirring of a newspaper printing press. But the examples keep piling up, and there is a way to draw a line that ends in an arrow, which points the way.

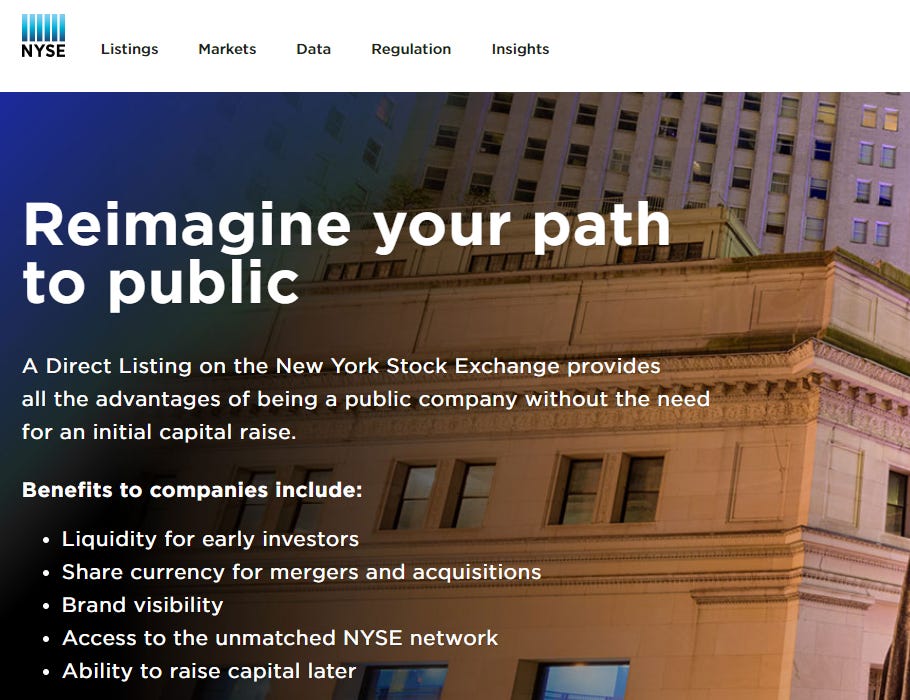

Take for example, the offering of shares to investors. The New York Stock Exchange is working on making direct listings more easily available to companies that want to go public. In short, more venture backed companies have been staying private longer, the average IPO size and cost of issuance have been going up, and the public/private market off-ramp is broken. Traditionally, investment banks intermediate private companies going public by building "liquidity" in the form of a willing book of public investors. Investor types include mutual funds, hedge funds, other banks and asset managers, and ultra high net worth investors. Maybe even some single-digit millionaires, grudgingly for the bankers of course.

It's a type of permitted market manipulation, where investment bankers often price the IPO at a discount, and the IPO purchasers often get to experience a "pop" in the price. Often -- but increasingly not at all. The breakdown of this carrot is causing private companies to re-think how they go to market. And by private companies, I mean venture investors at the top of the equity captable, like SoftBank. The failures of WeWork and Uber in the public market are key data points for this mental model.

Anyway, the large stock exchanges including NYSE and NASDAQ are exploring direct listings, which both Spotify and Slack recently used. What's a direct listing? To quote the Bloomberg article -- "Under a direct listing, a company makes its shares available for trading on a stock exchange without the formalities of a traditional IPO. That means no road show, no underwriter and no offering price". This implies that there is such built-in brand-demand that the stock starts trading without needing the guarantee of an underwriter. Popular companies are willing to take the jump and freefall into the market.

Remember Initial Coin Offerings, or its 2019 cousin Initial Exchange Offerings? Put aside your presumptions about regulation and desireability of the underlying asset. A direct listing is an Initial Exchange Offering. Or perhaps, an Initial Exchange Offering is a direct listing. You package up the investment asset, find an exchange with the largest network effect (in the crypto case, most certainly Binance; in the STO case, maybe CoinList or ConsenSys Digital Securities/Codefi), and lob it over into the ecosystem. Investors should be careful not to confuse the method of offering with the quality of the underlying investment. If all the good IPOs suddenly decided to list directly, direct listings would garner premier status. If all the good IPOs decided to tokenize and list on Coinbase (properly regulated), tokenized securities would garner premier status. This lemons problem is solvable, and direct listings are potentially the first step.

Let's look now at Central Banks. I like having to capitalize "Central Banks", because it makes them seem Official.

What does a Central Bank do? There are some differences between the Federal Reserve, the Bank of England, and the People's Bank of China. But the primary function of such institutions is to control monetary policy to accomplish economic outcomes for the government. You control policy by issuing or redeeming debt, thereby increasing or decreasing the supply of money, thereby equilibrating the interest rate at which the market clears, thereby setting the risk-free rate for your local region, thereby driving the pricing of all capital assets in the economy, thereby controlling both wealth creation and wealth accumulation through borrowing.

Another thing you do is let banks hold accounts with you as a lender of last resort. Perhaps you ask the banks to hold some sort of reserve to support systemic stability. Perhaps you also route the payments and print the money, though such functions often sit in other parts of the government (e.g., Treasury, ACH). What you do not generally do is let "end clients" open Central Bank accounts, provide credit to consumers, or generally hold their money. That's generally, of course! More recently, the Swiss and Swedish Central Banks have considered getting into the consumer game. And now Denis Beau, the First Deputy Governor of the Banque de France, has come out to suggest that there is appetite to experiment with a Central Bank Digital Currency ("CBDC"). With the Euro under pressure in a Brexit world, perhaps this can become a mainstream European opinion.

By implication, if a Central Bank designs and implements a collateralized stablecoin that is at least loosely based on cryptocurrencies, then it has gone into the business of standing up a digital money for consumers. Since blockchain-based assets don't really need custody or bank accounts (blah blah key custody blah), as the blockchain is the system of record, this puts government entities into the business of providing digital banking as a public utility to the individual. It is what China seems to be doing already, with a focus on retail payments and cross-border money flows. The nodes don't have to be decentralized to cut banks out of the value chain.

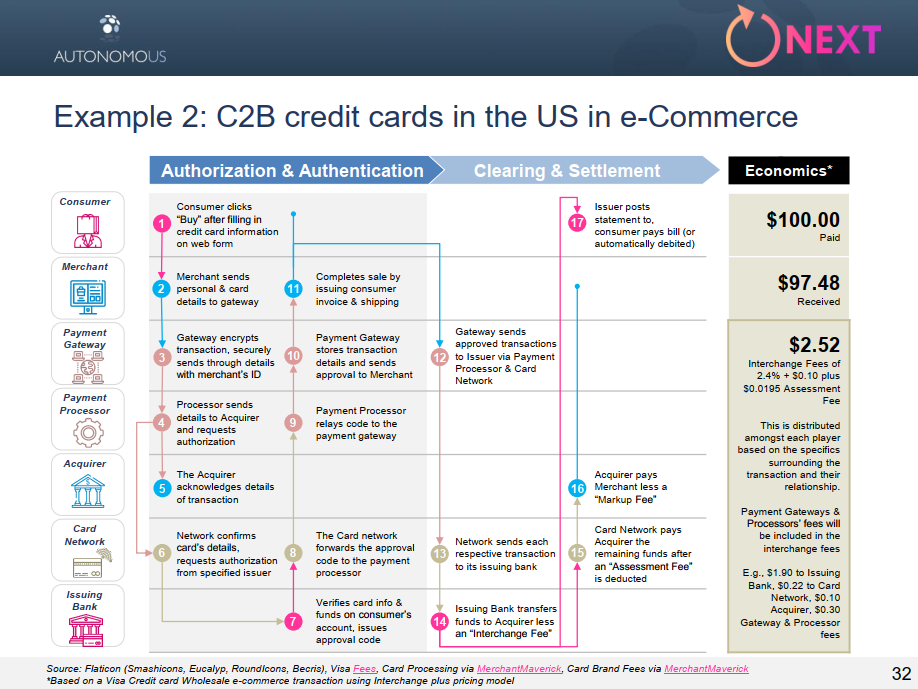

So we end up in this interesting, weird place. The institutional finance value chains -- whether investment banking functions leading to exchange offerngs, or retail banking functions leading to consumer financial accounts -- is shortening as technology removes various gears from the provision of services. For payments, this is pretty straightforward. We know that Bitcoin and other crypto monetary instruments are simultaneously the money-like commodity, the payments network, and the payments processor. See the operating flow for making a credit card transaction on a website using the VISA rails below. The user experience sitting on top of that mess has been polished to shiny bits.

For investments, it's a bit more complicated. But I hear often, for example, that it is the capital markets exchanges that are interested in tokenizing various financial instruments, rather than the broker/dealers that rely on exchange services. Why? Because exchanges and broker/dealers in the blockchain space are collapsing into the same thing. The function of trading and exchange is being built into the software itself, and the human work boils up to a layer of financial instrument structuring and client aggregation.

What do I mean in saying that trading and exchange is being built into the software itself? Let's compare what it means to have trading and rebalancing for a financial advisor vs. a blockchain-native asset. In the case of a financial advisor, there is a human being who has a contractual relationship with a custodian, like Fidelity, Schwab/TD, or BNY Mellon. They use a software on their computer to look at a set of assets. From Envestnet Tamarac, to AdvisorEngine, Oranj, iRebal, there are many such solutions. Maybe this is a roboadvisor like Betterment or Wealthfront, and the software is home-grown. Regardless, it looks something like this:

This software is plugged into the custodian, and has an interface in the form of a CSV file that is uploaded to the custodian's FTP, likely once a day and processed overnight. The CSV file makes its way to a bigger bundled set of trades that the custodian/broker does for all of its advisors, which gets sent through a trading system via FIX to a set of exchanges (e.g., NYSE, Nasdaq) for execution. Does the exchange really hold the assets? Sort of. Underneath the exchange, there is something like Euroclear, which provides clearing and settlement, and sometimes the function of a Central Securities Depository ("CSD"). So you know, this is a lot of abstraction layers to do a stock trade! And at every stage of information interfaces, things break down.

For blockchain-based assets, the blockchain stores the asset's current location and its transaction history. The trading software, as well as the rebalancing software, are open source pieces of software that are written as "smart contracts". In other words, it's not a computer on the advisor's desktop that does math and sends instructions to the custodian. It's not the server in the custodian's closet that does math and sends instructions to the exchange. It's not the exchange's cloud instance that does math and sends instructions to the CSD. Rather, it is the network itself that computes the math, and propagates the transaction throughout the network.

All I can do to illustrate further is show pictures of what I am talking about. See Set for investment management, which uses smart contracts to create self-rebalancing portfolios. See Uniswap for a decentralized exchange, which has created $30 million of liquidity across over a dozen trading pairs and is now being considered for real estate-backed security tokens. See the payments bridge Wyre is creating to attach bank accounts to blockchain addresses via what looks like a Plaid integration, such that any cryptocurrency hitting these addresses is liquidated and placed in the fiat bank account. See Aragon, the software-based arbitration court!

I know that for many of you, at this point it appears that I am just hand-waving and saying magic words. There is a definitely a non-zero chance that I am a wizard, and all of this is nonsense. But there is also a non-zero chance that when you see Central Banks and massive capital markets venues like the NYSE looking to deal directly with a consumer, something in the air is changing. There is a hard, pioneering path ahead for those of us that can find and follow the yellow brick road. I can only point at it with my heart.

Featured Interviews, Podcasts, and Conferences

Venture Bingo & Cryptomaximalists on the 11:FS Blockchain Insider podcast. Simon Taylor and Lex Sokolin talk about the latest news in blockchain, Bitcoin and Crypto, including JP Morgan's autoloan provenance.

Fintech used to be a back-office support function, now it's defining an industry. Check out my Op-Ed in Investopedia about the history and future of financial technology.

Interview with Blocks99. In this discussion, we focus on the financial crisis, entrepreneneurship, and why decentralized finance infrastructure is needed in the industry.

Short Takes

Indian e-commerce and payments firm Paytm is to expand into insurance, lending, stockbroking and investments after receiving a whopping $1 billion round of funding. Good luck fighting this behemoth in India! Facebook, Google, and the rest of the West interested in Southeast Asia is probably in over their head. Watch again how the lines have blurred -- it's not JP Morgan or Wells Fargo making these moves.

Goldman Sachs may be acquiring E-trade or merging with US Bank. But there are things that Goldman is doing, on top of spending $2 billion on Marcus, United Capital, Honest Dollar, and other lego pieces. One of those things may be just buying the retail presence that's hard to build. One of the core problems is that it's hard to generate the $1B+ revenue line items that GS needs for this stuff to make sense.

Robinhood withdraws bank charter application and Britain's RBS launches digital bank Bó to take on start-ups. Just the regular ebb and flow of Fintech non-sense. It doesn't matter who builds the neobank -- the neobank will be built. In China, roboadvisors are also starting to get spun up: China CITI Bank International launches its robo-advisory offering in Hong Kong which was co-developed with fintech firm Quantifeed.

HSBC aims to shift $20 billion worth of assets to a new blockchain-based custody platform by March. This is a proprietary solution for moving paper-based records of private placements to a distributed ledger. I mean, many distributed and definitely not decentralized. But it's a start! Ans also because I have to -- MoneyGram Expands Blockchain Services as Ripple Invests Another $20 Million.

Commodities firm Mercuria plans $100 million enterprise blockchain, AI fund and China’s big 3 blockchain trade finance projects hit $63 billion in volume. We are starting to see some real chunky capital moving through blockchain-enabled workflow systems. These aren't digital assets yet either, but could be one day.

Poloniex acquires TRON-based DEX to offer decentralized trading. There's something to be said for paying your way to the top, and somehow TRON has acquired Bittorrent and co-opted Poloniex through its machinations. Why not just fork an open source code base on Ethereum? In related news, Fireblocks Is Moving $2.5 Billion In Crypto Assets Monthly. Their Crypto Transfer Infrastructure Could Challenge Future Payment Technology. This is for trading between exchanges.

Meet Safe-esteem , “the world’s first personal risk & safety digital assistant.”. Interesting concept to take the chatbot vector and re-focus it on location-aware risk management. You can spin financial products off the underlying data.

Are You Preparing to Fail on AI? Here’s A Handy Checklist for Companies. Here's what Broadridge thinks you need to know about putting AI into large financial services companies. Forget the content. What is Broadridge trying to get done by positioning itself as a company that knows about this subject matter? It's no IBM or Google.

China issues new rules to clamp down on deepfake technologies used to create and broadcast fake news, but also China’s top fintech adviser sees ‘bright prospects’ for facial recognition payment systems. So we have a technology whose primary use-case is to swap celebrity faces onto adult content, and whose secondary use-case is facial recognition payments. Fantastic. No problem regulating that one!

The Hartford expands IoT capabilities. Massive insurance company proclaiming it will use data from smart homes to power its insurance undewriting and claims process. Has dedicated Innovation Internet of Things Lab.

Russian Farmers Using VR To Calm Their Cows And Increase Milk Production. This horrible truth-meme has been making the rounds on Twitter. Cows wear VR headsets, see blue skies and green pastures instead of their reality prison, make more milk. In other dystopian robot news -- The Boston Dynamics Robot Dog Has Joined a Bomb Squad. If you thought we weren't living through Robocop, time to revise your assumptions.

Investigators conclude self-driving Uber in fatal crash had multiple software issues. I'd say this is about the state of the world more broadly: "The system design did not include a consideration for jaywalking pedestrians," the investigators said.

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.