Short Takes: $30B+& 5MM users for Bank of America via Life Plan; Direct Indexing acquisitions by Vanguard & BEN; FTX LedgerX buy powers crypto futures

Gm Fintech Futurists — our agenda for today is:

CONSUMER: Bank of America’s financial planning tool proves a $30B+ hit (link here)

ASSET MANAGEMENT: Vanguard Completes Acquisition of Just Invest (link here) and Franklin Templeton to Acquire O’Shaughnessy Asset Management, a Leading Custom Indexing Provider through its Canvas® Platform (link here)

CRYPTO-DERIVATIVES: FTX’s acquisition of LedgerX (link here)

RESEARCH: User-Generated Finance and Cultural Financial Instruments, via Snoop Dogg, Dapper Labs, and $1.5B Decentralized Social (link here)

PODCAST: CEO of Yield App, Tim Frost, on integrating DeFi Yield products into a regulated Fintech company (link here)

If you want to go deeper in Fintech & DeFi, check out premium subscriptions below.

Visit our curated Partners:

M1 is the Finance Super App that puts you in control of your wealth. Invest, borrow, and spend your money how you want with sophisticated, automated tools to help you reach your financial goals more easily. Investing in securities involves risks, including the risk of loss. Borrowing on margin can add to these risks. M1 Finance LLC, Member FINRA/SIPC. Click here to get started.

Fintech Meetup is the easiest way to find partners, create opportunities and fill your pipeline! We don’t have any content so we can focus on getting you the 1-1 meetings you need with fintechs, banks, credit unions and others. That’s why we’re facilitating 30,000+ 1-1 meetings for 3,000+ industry professionals. Online, March 8-10, startup rate available for qualifying cos. Get Ticket

Short Takes

CONSUMER: Bank of America’s financial planning tool proves a $30B+ hit (link here)

Interesting stats on digital transformation. Life Plan, Bank of America’s digital financial planning tool, has gotten to 5 million users in a year since its launch. The tool helps customers prioritise goals across finances, family, health, home, work, leisure, and giving. Life Plan users have increased account balances to $34 billion. Of these customers, 62% are Millenials and Gen Z, 35% are Boombers and Gen X, and 20% are students. The software will soon be integrated with Erica, their AI-driven virtual /chat assistant.

We are reminded of a few things. This isn’t necessarily a roboadvisor effort, like Schwab’s Intelligent Portfolios and its $60 billion of assets. Rather, it is an onboarding questionnaire that establishes customer needs upfront, and then ties those needs to bank products through deterministic logic. By clarifying that demand, the bank is able to funnel assets into lots of different financial instruments, and therefore benefit across the board. Financial planning and data aggregation are top of funnel for the sale (or purchase) of product, and in essence this app reduces friction for selection.

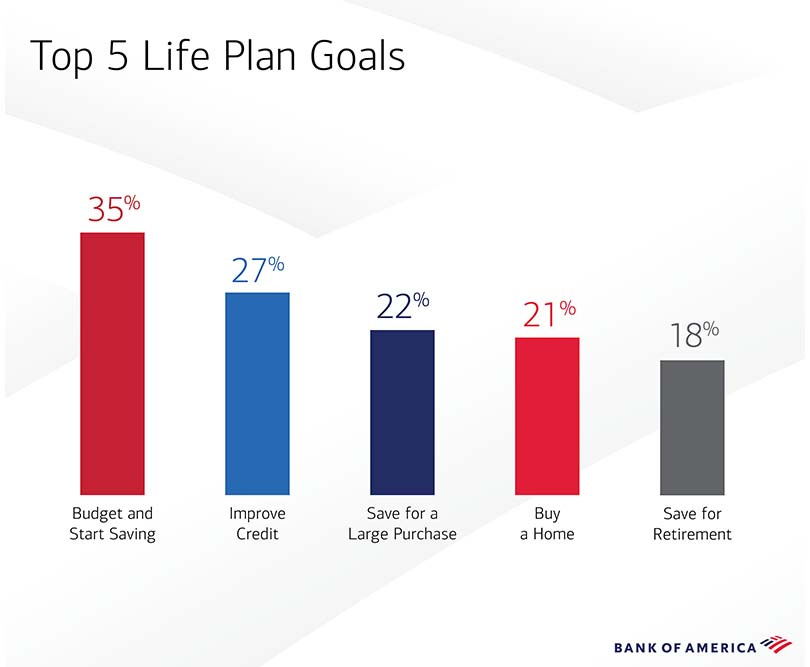

The other sort of interesting thing is penetration. There are 250 million adults, give or take in the US, and 20 million of them are using BAML’s chatbot Erica. 5 million, or about 2% of the population or 25% of Erica users, are using Life Plan for onboarding. This is essentially a population-level demand assessor. The fact that 35% need to start budgeting and 27% need to improve credit is a depressing reality of American financial health. On a related topic, check out our podcast with Altruist CEO Jason Wenk on financial planning and improving financial health here.

ASSET MGMT: Vanguard Completes Acquisition of Just Invest (link here) and Franklin Templeton to Acquire O’Shaughnessy Asset Management, a Leading Custom Indexing Provider through its Canvas® Platform (link here)

Fractional investing and customised index building are having a moment. Vanguard completed its acquisition of Just Invest and Franklin Templeton acquired O’Shaughnessy Asset Management (OSAM). Just Invest manages about $1 billion in AUM and offers direct indexing — a service that allows users to create bespoke portfolios by modifying existing indices to focus on factors like ESG or growth. Conversely, Franklin Templeton’s acquisition of OSAM and their custom indexing platform Canvas, will operate primarily on the advisor side, enabling advisors to tailor indices to specific customer needs. Canvas itself now has $1.8 billion in AUM (out of OSAM’s total $6.4 billion AUM) since founding in 2019.

Other asset managers are also taking interest in direct index solutions — BlackRock acquired Aperio Group for $1+ billion in November, at a valuation of about 50 times earnings. Morgan Stanley also bought Eaton Vance for $7 billion, which included their customised client portfolio unit. Why now? Customers are becoming increasingly financially engaged, and companies are betting that investors will invest in areas driven with their beliefs and interests.

The downstream implications and precedent conditions are worth noting. First, you need zero commission capital markets to build so many mass-customized portfolios. For example, for Canvas, 70% of accounts have unique characteristics around taxes and tax treatment, desired returns, income, risk exposures, and ESG. This would be very expensive to rebalance without free trading. Further, the software stack downstream, like trading, rebalancing, and performance reporting, also gets very complicated quickly. All in we think this is driven both by consumer preferences, as well as market structure and the availability of cloud-based modern software.

CRYPTO-DERIVATIVES: Thread - FTX’s acquisition of LedgerX (link here)

FTX raised $900 million at an $18 billion valuation. They have also acquired LedgerX, which allows users to trade bitcoin and Ethereum derivatives 24/7 on a single US licensed platform. We wanted to share the above thread about what this means for FTX and crypto derivatives for retail in the US.

LedgerX is a CFTC-regulated crypto derivative exchange with licenses from DCM, DCO, and SEF (check out the full thread for details on what each licenses enables). Given these licenses and following guidance and approval from CFTC, FTX US will be able to begin offering licensed crypto futures and options to US retail customers and institutions, provide clearing services for other crypto exchanges looking to offer crypto derivatives trading to retail, and to even move into traditional asset classes like equity index futures.

Regulation is a competitive moat for incumbents, and FTX is spending its war chest to get behind the wall and be protected, rather than be exposed to regulatory lashback. We know that Robinhood makes a very large portion of its revenue from options, and we expect FTX to move swiftly into this area and become a threat to retail fintechs.

Rest of the Best

Here are the rest of the updates hitting our radar:

ASSET MGMT: UK Fintech 10x Banking Is Working with Chase to Create a Modern Technology Platform (link here)

PAYMENTS: Why WhatsApp payments failed to click in India (link here)

CRYPTO: Andreessen Horowitz Births Crypto Unicorn With First India Bet (link here)

DEFI: Sienna Network Launches Privacy-Centric DeFi Crypto Exchange (link here)

DEFI: Cross-Chain DeFi Exchange THORSwap Raises $3.75M in Private Token Sale (link here)

DEFI: DeFi security project 'Lossless' helps recover $16.7M from Cream Finance hack (link here)

DEFI: Red Deer Launches Information Management Platform (link here)

METAVERSE: Sky Mavis Series B: Fueling the Play-to-Earn Revolution with Axie Infinity parent company raising $152MM (link here)

METAVERSE: Facebook Offers up $10 Million to Draw Creators to ‘Horizon’ (link here)

EMBEDDED INSURANCE: Sure raises $100 million (link here)

Blueprint Updates

Analysis: User-Generated Finance and Cultural Financial Instruments, via Snoop Dogg, Dapper Labs, and $1.5B Decentralized Social (link here)

How is cultural shaping the financial instruments of the future?

The structure of capital markets precedes the innovations that come from it. High frequency trading, passive ETF investing, SPACs, and crypto assets all telegraphed their value proposition before becoming large and meaningful in scale. We are now seeing a new market shape emerge, one that starts with community and builds up into financial instruments that are cultural and social. This analysis looks at the most recent developments in the overlap between decentralized social and cultural work and related financial features.

Podcast Conversation: CEO of Yield App, Tim Frost, on integrating DeFi Yield products into a regulated Fintech company (link here)

In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

“There are financial institutions all over the world that are actively exploring how can they implement decentralized finance to their business model. Particularly those in jurisdictions that are, I guess, almost the forgotten jurisdictions of the world that need access to better financial services and gateways and payment rails. And so, it's not going to play out, I think, as anyone has envisioned, but it has been very powerful of what is actually people have been able to tap into today.

And so, I think financial institutions, I mean every week, we have calls that are set up from people that are actively exploring, how can they actually move in and take advantage and build around what is happening? I'd say in my optimistic point of view is, yes, we're going to go on a bridge and just continue to impact the lives around the world.”

More? More!

If you want to go deeper in Fintech & DeFi, upgrade to a premium Blueprint subscription below. Our value prop is simple: experienced judgment, accurate vision. If you knew the shape of the tomorrow, what would you do today?

Want to chat? Stop by our (pretty empty right now until you join) Discord!

What did we miss? Reach out here anytime.