Square's Robinhood competitor and Robinhood's Square competitor are rented from API providers, delegating billions; plus 13 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at two mental models explaining why and how financial APIs have led to the creation of billions in enterprise value. The driving news is that Square Cash is competing with Robinhood in free trading, powered by trading API company DriveWealth. Last week, we saw that Chime, Robinhood, and Monzo were powered by payments API company Galileo. Should these enablers be worth the billion-dollar valuations of their clients? Are APIs inevitable technology progress? Or are we just seeing venture financing spilling desperately into a rebundling play to find profitability?

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

More and more news is supporting the Fintech rebundling thesis, demonstrating how vertical champions are enabling the cross-sell of adjacent financial products. The latest ones to really stand out are (1) DriveWealth turning on stock trading for Square, and previously Revolut and MoneyLion, and (2) Galileo turning on payments and banking for Chime, Robinhood, and Monzo. But I got to thinking, and you know, there is more than one mental model that can create an explanation of what is happening with these companies. A little bit of WeWork disaster juice (i.e., the collapse of the thesis that private companies should be blitz-scaled) has also challenged how I think about the secular story.

The original financial API thesis goes something like this: Data and functionality is trapped in large financial incumbents. Legacy mainframes from the 1980s, on which they run, are highly functional but cannot be adapted to modern software. Further, customer information is not allowed to travel between banks, which leads to duplicative workflows and anti-competitive pressures. The broader macro technology environment is leading to the digitization of all financial services, and as a result, products are being atomized and made digital. They will be melted down into application programming interfaces, which will create a web of information exchange, lower barriers, and increase competition. Start-ups will be built on these new APIs and deliver more customer-centric solutions, making users happier and better off.

Venture investors have been beating the drum about "banking-as-a-service" since 2013, imagining a world of commodity capital and depository product providers dominated by technology companies and lean entrepreneurial projects. In Europe, regulators have taken this thesis to heart, and forced the issue by forcing the API concept into a regulation called Payment Service Directive (PSD2). European banks have to open up their technology gates by law. The "secular digitization" thesis has become a self-fulfilling prophecy that we mutually believe. This has led to the proliferation of PSD2 aggregators like Tinc, Bud, and others.

The next step in the development of this primary story is that all infrastructure switches onto blockchain, which by default is programmable. This is the bet with ConsenSys Codefi, and others folks like Hydrogen Platform. If you can do any financial function in similarly architected and secured code from the start, why layer on top of outdated, existing infrastructure? The answer has been -- to get customers where they live today. But what if the Fintechs have moved customers off their current providers (hi there Deutsche Bank) and into apps (hi there N26)? What if the Fintechs are just a stepping stone to fully programmable finance?

Anyway, that's the neat linear story that we deduce by looking at venture financing and reading the news. Surely, people succeed because they have logically made a smart macro bet and executed well?

Surely, it's not just random capitalist chaos in the hurricane of absurd flailing experiments running out of other people's money! Or the forces of creative destruction and ego-centric insanity battling against rigid regulatory structure and hopeless conservatism.

For this second *chaos-first* mental model, we can start by looking at American regulation. The OCC has just been handed a defeat by a New York court in trying to stand up a "fintech charter", which would allow fintech companies to more easily create and license banks. The NY regulator sued the federal regulator (OCC) for overreach, and won. It somehow doesn't matter that for a similar investment advisor entity regulated by the SEC, you could create and license an "internet exemption" advisor since the early 2000s! Or you can look at the CFTC with its innovation lab, defending and facilitating Bitcoin trading and development, while the same theme is assaulted by Congressional bodies and central bankers as irrelevant and dangerous. That is, until China declares it a national priority to move billions of transactions through blockchain platforms. Technology squeezes between these various flailing human inputs to create any outcome that it can -- like water flowing around rocks. The shape of the outcomes is lumpy and arbitrary, not linear and divine.

So when we look at the companies that are succeeding in the space -- like Plaid, DriveWealth, Galileo -- it is very possible they are succeeding for the "wrong reasons". Or rather, they are succeeding for reasons that are not the macro logic people use to talk about themes, but because of idiosyncratic, one-off human situations created by adjacent markets or other happenstance.

As a starting point, remember when early Facebook employee and now-billionaire Chamath Palihapitiya explained that venture capital's biggest beneficiaries are Google and Facebook advertising platforms? Any company that needs to blitz-scale will pump its user acquisition budget into online ads. This is why, when you divide the amount of money most Fintech vertical champions have raised by the number of users they collected, you get a pretty average financial services user acquisition cost. To keep on with Revolut -- they've raised around $350 million and have about 5 million users, which is about $80 per account. If I gave you $1 billion, how many ads would you buy? Likely all of them.

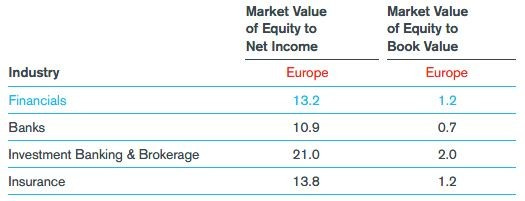

We can extend this logic, and say that the $80 in acquisition cost needs to justify about $400 in enterprise value. I am going to very roughly use the above chart for a back of the envelope, which is precisely wrong, but directionally correct. To generate $400 value in the public markets, you need (1) $400 / 13.2 = $30 of profit margin per user, which requires you to generate (2) $30 / 25% = $120 of revenue per user per year. If you are making 3% in credit spread per customer, that is a $4,000 account. If you are making 1% in credit spread, that's a $12,000 account. We know that today's neobanks have somewhere between £500 and £1,000 in deposits, and most of them not in the lending business (i.e., 0% spread).

Similar math plays out of the other verticals, whether you talk about free trading or digital wealth. This means that there is an overwhelming imperative to cross-sell and rebundle into adjacent verticals. Therefore, it is the crazy venture capital pressure created by unicorn expectations that is driving our favorite Fintech apps to go horizontal. And to go horizontal fastest in a world where US financial regulation should at best described as schizophrenic, they need to rent infrastructure into which they can quickly integrate. Thus comes the value of the financial APIs -- a saving grace for the venture story around independent, stand-alone Fintech consumer aggregators.

So when you think you are getting this ...

... what you are really getting is this:

And when you think you are investing in this ...

... you are really investing in a tiny part of this:

I can give you another dozen examples, from Green Dot behind ApplePay, to Metropolitan Commercial Bank behind Current. The great job that BBVA and Santander have done packaging their bank-as-a-service products as technology-first is an exception, not the rule. Most providers in this space are financial product-first, benefitting from being early risk seekers in their move to power over-funded consumer aggregators.

You could paint similar pictures around the growth of $25+ billion Stripe, attached to the unrivaled and unique multi-billion venture spending spree of Uber's growth (i.e., how you pay automatically for the cab). Similarly, $2 billion Plaid had its authentication data aggregator functionality tethered into the user journeys of the payments industry bet Venmo. The growth is not coming from some exogenous, aesthetic, systemic change. It is coming from venture capital flows into adjacent parts of the economy, creating urgency and demand by its recipients, and then spilling over API-first financial products for a hail-mary to profitability.

So those are your two stories about Financial APIs. Which one do you believe?

Featured Interviews, Podcasts, and Conferences

Are banks losing the brand war to tech firms? Check out my podcast with American Banker's Penny Crossman. We don't buy Tylenol from the Tylenol store. Why do we buy Wells Fargo bank accounts from Wells Fargo?

From Crypto to Decentralized Finance. Another great podcast with Will Beeson at Rebank: Banking the Future. Check out our conversation and subscribe here.

Blockchain Insider. Had a great time with Todd McDonald of R3, Thomas Zeeb of SIX exchanges, and Simon Taylor of 11FS discussing the latest blockchain developments.

Short Takes

Citigroup appoints Jane Fraser its new president, putting her in line to be first woman CEO of a major bank. I learned a lot from the book Invisible Women: Exposing Data Bias in a World Designed for Men (link), which used data to highlight the type of negative experiences women go through when the average study (or design process) uses male subjects as a default -- from airbag failure to freezing office temperatures. Having female leaders focus our systemically important finance companies to better serve the economy is powerful, more powerful than building companies only focused on women (e.g., Ellevest).

Mobile banking app Current raises $20M Series B, tops half a million users, and Starling Bank Raises £30 Million to Fund its Expansion as it Approaches its Millionth Account. How many neobanks do you need? Rough math is that raising $50 million gets you 500,000 users -- so $100 per user. Current's key channel is 15 year olds, and it uses Metropolitan Commercial Bank as its banking provider. I am having trouble getting excited about a re-skin of old tech.

OCC Cannot Grant Special Bank Charters to Fintech Companies. This is pretty awful news for Fintechs that wanted to take advantage of potential flexibility from the bank chartering regulator at the federal level. The New York state sued the federal regulator in the SDNY court for over-reach (thanks NY!) and won. The strategic answer will continue to be renting charters from banks.

Square launches stock trading on its popular Cash App. The trading functionality is powered by DriveWealth, a broker/dealer-as-a-service company that also powers trading with Revolut. They are becoming the Stripe of trading rebundling.

Xi Jinping Tells World that Blockchain is an Important Development and China Will Take the Lead Globally. The Western industry blockchain leaders are Bitcoin (little government support), Enterpise Ethereum (ConsenSys, JPM, many others), Corda by R3, and Fabric by IBM. They are competing for early adoption across corporates, or definining new but small markets. In China, it is the massive Ant, Tencent, and Ping An that deploy blockchains at large scale (each the size of Libra), and they have support from the government. It will be a challenging decade for the West. See also, Chinese internet court adopts blockchain smart contracts, processes 1.9 bn transactions.

G20 kicks off debate to regulate 'stablecoins' in hit to Facebook's Libra. While the stated purpose by leadership is to limit risks like illicit money laundering, realistically this is about trying to maintain a sense of sovereign currency control. Lots of contradictions happening at the same time, such as the CFTC launching a lab to help digital assets and crypto currencies along.

HTC’s Latest Blockchain Phone Can Run a Full Bitcoin Node. While I would be much more interested in a similar statement relating to an Ethereum node, this is still very cool -- let's start with payments and savings. Hopefully it doesn't mean that phone batteries now have to support proof-of-work mining.

Liquid Warping GAN: A Unified Framework for Human Motion Imitation, Appearance Transfer and Novel View Synthesis. Just look at the link. A combination of various generative neural networks and style transfer algorithms allow motion, clothing, and body swapping between a source photo and a video. Perhaps one day rendering things from models will be fully replaced by GANs.

FCA and Bank of England on the State of Machine learning in UK financial services. Based on a survey of 100+ financial institutional, AI implementations are set to double. This confirms also my my anecdotal hypothesis about financial AI from news coverage -- most of it is finding practical implementations in insurance.

State Auto launching AI-guided self-service inspections. You guessed it -- computer vision used to power self-service on boarding for an insurance policy.

Snapchat now powers billions of daily AR experiences, with each of our daily active users interacting with augmented reality nearly 30 times every day on average. That's a quote from the Snap earnings call. The company is caught between Apple, Facebook, Google, Microsoft, and Magic Leap -- but has the strongest creative community to support its AR efforts. If I were to think about AR and Finance, I would do it on their platform.

Should We Be Concerned About the Security and Privacy Risks of VR and AR? The interaction history within mixed reality devices is highly revealing of its users personality. Since these devices are a "simplified" version of regular computers, they are good targets for botnets and other hacking attempts. Are there ways to build engagement with virtual worlds with privacy as a starting point? (yes, see the point on HTC phones running a blockchain node).

Smart Home Appliances Continue to Grow Market Share. You thought "smart" talking fridges and microwaves were a joke punchline! Well, there may be 30 million of them by 2020.

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.