The Ethics of $2B Lemonade, $100B Softbank Visions, and $500MM of Binance IEOs, plus 13 short takes on top developments

Hi Fintech futurists --

Today the long take focuses on recent news that seem totally bonkers -- from overpriced IPOs, to opaque IEOs -- and on why they seem unfair. The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below.

Thanks for reading and let me know your thoughts by email or in the comments!

Long Take

I've been seeing a lot of Fintech headlines recently that make me raise my hands in the air, and go "Come on, are you for real!?". I imagine a lot of people feel similarly frustrated by Lemonade looking to go public at a $2 billion valuation on $50 million of revenue, Initial Exchange Offerings on crypto exchanges raising over $500 million this year, Facebook's tone deaf Silicon Valley club crypto money, or SoftBank talking about selling its overpriced $100 billion Fintech unicorn fund in an IPO. So other than getting crankier with age (Happy Father's day everyone!), I want to dig a little bit into the concept of fairness, asymmetric information, economic rents, and how this can help disentangle feelings from thoughts on these news items.

Debating the distribution of wealth, income inequality, and the equity of social outcomes is a dangerous game. Many people think of these issues as philosophically or politically determined -- your point of view on these things, supposedly, stems from your culture, upbringing and vantage point in society. But I am going to sidestep all that, as this is just a humble Fintech newsletter after all. Instead I am going to link to a video about two monkeys.

For the same task, one is paid in grapes, and the other in cucumbers. Within moments, the primate receiving the "worse" payment displays some very human emotions about its predicament. It feels the unfairness. It gets angry. It throws the cucumber at the experimenter playing the role of a Central Bank. In other words, *our own* feelings about who gets what are animal feelings, not intellectual derivations, and how we feel about the headlines I mentioned are these monkey reactions.

There are a couple of different frames we can take for thinking about the difference between value earned, and value co-opted. Bear with me, as I am going to describe points of view that are not necessarily mine. First, there is a difference between (1) real underlying economic activity, and (2) financialization and speculation. People may think that running a factory or opening a store is honest work, while day trading cryptocurrencies is abstract, non-productive, and zero-sum. Another way to think about this is that there is a difference between (1) building a business that creates products and jobs, and (2) taking economic rents from control over property, capital, or data. There is something physical about the sense of hard work, and something feudal about living off capital gains grown off wealth (especially the wealth of others). A similar split applies to the philosophy of Bitcoin, (1) with early communities backing cheap payments and the growth of digital commerce, and (2) more recent investor entrants being content with a "store of value" thesis, which accrues capital gains.

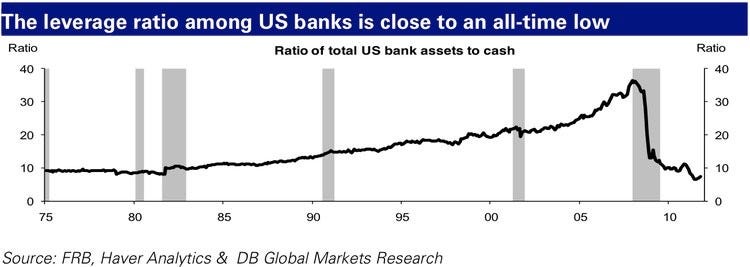

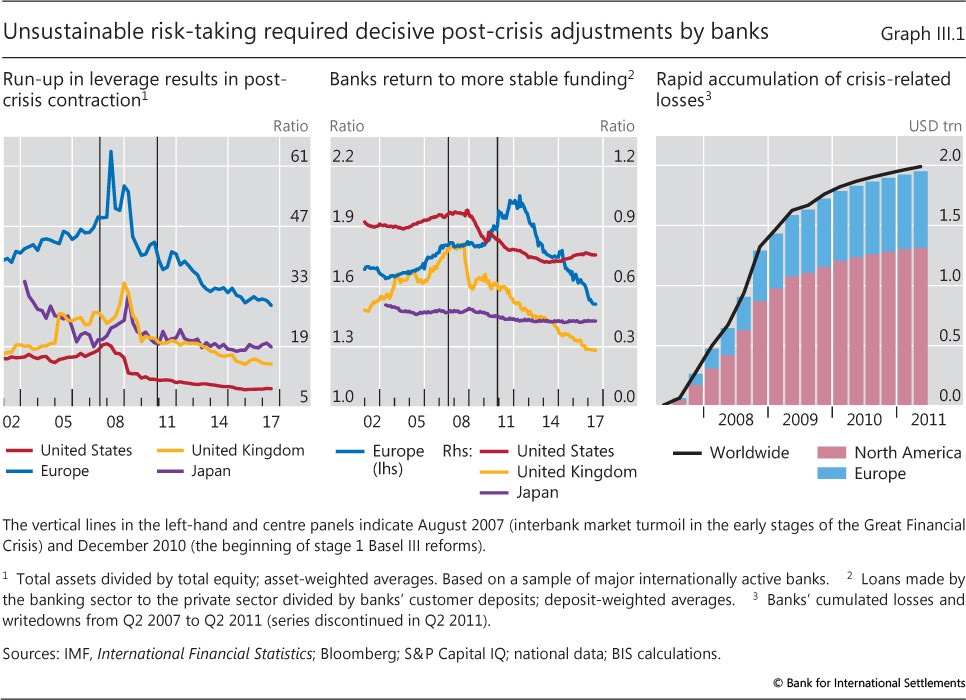

Now I don't fully agree with this bifurcation, because a healthy financial sector and associated strong property rights are a required pillar for a country to develop a modern economy. Credit is the oil lubricating intertemporal utility maximization. Put simply, without credit and the banks lend it, there is no entrepreneurship. Without entrepreneurship, we wouldn't have the joys of Netflix and cat pictures on the Internet. However, financial sectors are derivatives of the economy. When divorced from non-financial activities, Finance stops being a catalyst, and becomes circular and self-referential. It levers up its own instruments 35x, slices them up a million times, re-packages and re-distributes them throughout social strata -- all using other people's money. You can see why the monkey would be mad at this cucumber.

The success of Initial Exchange Offerings on Binance triggers this line of thinking, especially as Americans become excluded from the core offering. As a reminder, Initial Coin Offerings raised about $20 billion last year, but have been widely derided as unregistered securities offerings that lost many investors 80%+ of their holdings. Unlike ICOs, which rely on companies to self-market the offering, IEOs come with a pre-built investor audience using an exchange. Compared to the traditional investment banking model, we can say that Binance in this world behaves as both the investment banker, the broker/dealer, and the exchange -- a profound set of conflicts of interest. Still, projects that launch an IEO have a much greater chance of actually hitting their fundraising target. The same cannot be conclusively said of the project's ability to deliver on its promises.

If we assume IEOs will hit $2 billion this year, and that 50% will flow through Binance at a 1-5% fee, listing revenues would be somewhere in the $10-50 million range. The reason something feels wrong about this is twofold. First, there is some sense that these projects are still lemons. Since they are not fully public and are not required to provide real disclosure, the likelihood they will achieve their aim is low. And second, it moves the entire ecosystem towards financialization rather than economic activity. Offering these instruments on a trading platform immediately (at least ICOs had to apply to be listed after they raised money and the exchange didn't take capital raising fees) leads to speculation and price manipulation, which in turn is a wealth transfer from people who think the project is an investment, to people who understand that the project is a trade. It becomes better to cash in the idea now, than to build it into a business later.

Similar logic applies to the news about Lemonade, which was founded in 2015 and has raised $480 million to date. With its revenue in the $50-100 million range, and a target of $2 billion as an IPO valuation, we could be looking at a 40x revenue multiple for a mobile app insurance company. I am a huge advocate of B2C fintech companies with a smart distribution edge, but this too feels like a trade on a trend. To extrapolate the below quarterly chart from Matteo Carbone into a multi-billion dollar value business, you have to maintain the out-sized growth rate for several years while re-architecting the P&L, getting closer to the industry multiple of 12x on profits. Margin in the insurance industry fall between 3 to 10% of revenue, which roughly translated into 0.5x to 1.2x revenue multiples ... not 40x.

A very similar phenomenon happened with digital lenders, like Lending Club and OnDeck (see below), which came to the market and presented themselves as tech companies. The story told was that these fintech startups will be massive marketplaces that aggregate consumers across geographies, types, and product -- the Amazons of the financial world. As a result, their IPOs valued the companies as if they were tech players with organic consumer-acquisition virality, which unfortunately led to massive value destruction for retail investors that bought those IPOs. The businesses themselves are great platforms for borrowers, with lower costs and more nimble products. But from a financial perspective, the price was too high, and sellers in the transaction had more information about the business than the buyers. It's not that we don't want the businesses to succeed and its management get paid for success. Rather, we don't want financial players to profit from underwriting and transacting in an asset which is not fairly priced.

Could the shares have been more fairly priced? Sure, but that would have created a mark down for the venture capital owners of these companies -- something the investment bank trying to get their business would never allow. And on the retail side, investor protection falls under the jurisdiction of the SEC. Recently, there has been a struggle between the SEC and the Department of Labor about what duty of care a financial advisor has to a client. While the DOL pushed for a fiduciary standard, thereby making it harder for intermediaries to self-deal and sell proprietary product, the SEC has now clarified their position as the "best interest" standard. This is a lower level of protection, which commission-paid trading-oriented broker/dealers prefer and have lobbied for aggressively. Seems that in the US, investors must practice caveat emptor, unless of course you are looking at cryptocurrencies, which can only be sold and packaged by Facebook and JP Morgan.

The final gripe comes in the form of SoftBank's potential $100 billion Vision Fund IPO. Now, the Vision Fund is awesome -- it generates large bets across Fintech and other emerging technology sectors. It allows entrepreneurs to go long on moonshots, like Uber and WeWork and Alibaba, with big war chests. This is the only way you can wrangle control from existing oligopolies. However, more recently the private valuations of venture-backed companies have ballooned beyond reasonable expectations. When you have $26 billion raised across 35 companies with valuations higher than $1 billion in Fintech alone -- and no real exits to show for it -- the market is imbalanced. Private deal making has replaced public investment research. Shifting $100 billion (or a portion thereof) of this embedded mark-down into the public market is a trade, not an investment.

Short Takes

Step Raises $22.5M Led by Stripe. Payments heavyweight invests into a mobile banking app for teens in order to move closer to consumers when they are most impressionable. Always sell into life events, people!

A Chinese-style payment network to challenge Visa and Mastercard is taking shape in Europe. This is very powerful news. European mobile wallet providers, with a 190,000 merchant footprint, are partnering with Alipay on a QR code standard. This would be a rail outside of Visa and Mastercard, and help the Chinese fintech gain strength in the West.

N26 and Monzo prep US launches. This will cost a large amount of money, and generate many learning opportunities for the Europeans, I expect. Venmo, Wealthfront, Acorns, MoneyLion, Chime, and everyone else is unlikely to be welcoming.

Amazon launches a credit card for the ‘underbanked’ with bad credit. Such moves are part and parcel of the Ant Financial and Tencent playbooks. A great way to compete in a market is to open up an entirely new channel, and finance consumption.

Facebook’s cryptocurrency partners revealed—we obtained the entire list of inaugural backers. Another massive news item, but how much can I write about Facebook. The key takeaway is that traditional banks are in for a world of pain. The Silicon Valley best-in-class, including PayPal and Uber, are partnering together to make their own crypto money. Crypto natives don't trust it, but that won't matter in the mainstream channels.

IBM, Hyperledger Blockchain ID System for Banks Launches in Brazil. Enterprise blockchain is about workflow, not value transfer. These are fruitful moves in the right direction.

Coinbase Earn Now Supports Ethereum-Based Dai Stablecoin and Iceland’s Currency Will Be First in Europe to Be Traded as E-Money point to further interest of cryptocurrencies to be used as a unit of account and method of payment. Between the stablecoins and Facebook, we might be at the tip of a usage avalanche.

Mary Meeker’s most important trends on the internet. Surely you have already seen the definitely Internet trends analysis from the world's best research analyst? The cliff notes: more users, video content, and games than ever; marketing costs going up; eCommerce growing relative to terrestrial commerce; the US is no longer the only game in town.

AI auditing startup MindBridge gets $14.5 million from Ottawa’s Strategic Innovation Fund. The company is focused on auditing financial data -- a routine but powerful case for machine analysis.

Breaking neural networks with adversarial attacks. Want to protect yourself against machine vision and Big Brother? Here is a how-to guide on tricking neural networks with stickers and rainbow-colored glasses.

Apple is reportedly buying self-driving startup Drive.ai. There is a lot of turn-over in Apple's efforts around autonomous vehicles. But the opportunity for a car-based operating, payments, and insurance system is still out there.

Amazon Adding Virtual Try-On from L'Oréal's ModiFace to Its Beauty Products and Fashion Startup Kollectin Lets You Try on Earrings & Necklaces from Indie Designers in AR, with Just a Swipe to Buy. This gives you a flavor of how AR commerce can be different from traditional eCommerce.

Here's How Augmented Reality in Google Search Works. Interesting example as to how intent from a search engine query can be instantiated as a real object in the environment. One line of thinking is to ask how this can be monetized in a different way than a display ad.

Looking for more?

Fully updated website here, and LinkedIn over here.

Find me on Twitter here for Fintech and here for Digital Art.

Want to send me a note? Reach out here anytime.