The political limits of commerce -- Telegram's $1.7B US offering and NBA's $1.5B China deal; plus 13 short takes on top developments

Hi Fintech futurists --

In the long take this week, I look at the boundaries that Telegram and EOS have crashed into in the US with recent SEC actions and lawsuits, and the melting of Facebook Libra. There have been a number of interesting regulatory moves recently, and the positive headlines of 2017 have become the negative headlines of 2019. How does SEC jurisdiction reach foreign institutional investors? We also touch on the $1.5 billion NBA distribution deal now on the fence in China, and how US companies are under the speech jurisdiction of a foreign nation. How does China reach American protected speech? Through pressure, boycott, and economics.

The latest short takes on the Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

There are 7.5 billion of us. That's at least two Facebooks worth of people -- a lot of online trolling and flame wars. And more importantly, it is a wide range of political and social constructs in which we participate. Being a single unit of a human being myself (at least I am told) allows for a pretty limited view of the systemic web in which we live. We can strive for knowledge and clarity, trying to research and understand the broader containers to which we belong. What is your tribe? What is your corporate animal? What is your regional hub? What is your nation? What is your country? How do these machines click together, and at the level of the superorganism, what do they want? What tools do they have to effectuate their desires?

From my seat here, all I can see are the signalling flags of different colors and stories. Sometimes these are logos of start-ups or investment banks. Sometimes they are political parties, or nation states. In the chart above (showing political regime across the last two centuries under which our species has lived), I used to be in the red bucket, and now I am in the green one. It is easier to write disobedient Fintech newsletters on capitalist social networks from this side, and I like that. But let's not forget that the webs of power and constraint are embedded into the fabric of reality all around us, and that these webs are legion.

You don't have to go deeply into politics or philosophy to understand our animal conflicts. Most individuals want to pursue their wishes freely, without much regard for others. In some political narratives, abilities and rights are endemic to nature (i.e., top down). For example, you deserve freedom from bodily harm, because that is a right bestowed on all. In other narratives, these rights are constructed by social agreement and joint contract (i.e., bottom up). For example, people shouldn't die from the flu, and therefore have a right to healthcare. Check out Wait but Why for a deeper treatment on these overlapping rights bundles.

The rub is that there are 7.5 billion vectors of countless imagined freedoms, each bumping into each other. Just trying to calculate the factorial of 7.5 billion, which is the number of potential interactions between us humans, breaks the calculator. Add into this all of our groupings, allegiances, corporate rights, and other legal baskets -- and everyone is always stepping on everyone else's foot. Collective agreement, cooperation, and governance is the only path out of the mathematical quandary. Thus we delegate our rights and obligations to systems and their regulators, and enshrine past decisions into law under the principles of stare decisis (adhering to past court decisions). It's generally OK. We all agree that selling fraudulent securities Bernie-Madoff style is bad for business.

In Fintech and Crypto, the 2017 disruption happened faster than our regulators could respond. Using blockchain platforms, about 6,000 different companies across the world launched $10 billion of financing issuances on the open Internet. They generally did not go to investment banks, or get registered with the national authorities, or fold into the growing crowdfunding sector under the JOBS Act. Nope. They just put up a website, made some broad representations, and listed their tokens. Many did not know they were lacking the rights to do so, while some were advised to seek novel structures (e.g., the SAFT) or jurisdictions where cowboy behavior was more condoned (e.g., Malta). But boy, are the regulators responding now!

Let's also be clear about who matters in the world of capital markets, whose feet have been stepped on by this activity. America, China, Japan, Europe. China had an advanced warning from its Bitcoin mining industry, numerous crypto exchanges, and 5,000 peer-to-peer digital lender scandals. Like an immune system on hyperdrive, it responded by shutting down non-condoned activity. But it also liked the technology -- as an example today, China Construction Bank has over $50 billion flowing through its non-public blockchain. Japan and Europe saw a growth opportunity, squeezed as they are between the Dollar and the Yuan. But the United States turned on its stubborn machinery, and the results are starting to trickle it.

One of the first firms in the cross-hairs of SEC action was Kik, a Canadian messaging app that saw the promise of micro payments and chat combined. It raised $100 million by selling a token, of which $55 million was bought by US investors. The SEC alleged that this was a sale of unregistered securities, and despite initially planning to fight the SEC in court, the tech company is planning to shut down its messenger, fire 80% of its people, and focus on the crypto currency. I can't help but be reminded of the music industry trying to jail teenagers that were using Napster in college dorms.

Next up is ICO Box, which is an online investment bank that helped ICOs package up their investment materials, create promotional packages and prices, and launch websites that collected payments for tokens. The site was never registered with American regulators as a broker/dealer or Registed Investment Advisor, and has roots in Eastern Europe. ICO Box also ran its own $14 million ICO, which was distributed to 2,000 investors. The SEC is pursuing a lawsuit against this company -- so there is still legal determination to come from the courts. But it is notable that the American regulator has reach to target this company through its exposure and sale to US investors.

Arguably the biggest and most absurd ICO ever was EOS, which lasted a full year and collected over $4 billion in proceeds to build an Ethereum competitor. Of course, it used Ethereum to do the raise -- imagine if Microsoft fundraised $4 billion worth of Google stock to launch a competitive search engine, and then shorted Google stock for the trouble. The company behind the offering, Block.one, has just settled with the SEC over the purported sale of unregistered securities for $24 million.

This is a pittance relative to the overall amount, less than 1% of the total raise. Under other punitive regimes like GDPR, fines are closer to 4% of the relevant metric (annual revenue in that case). But, we can make the math work out a bit better by assuming that only 20% of the raise went to American investors, and that the market value of the raised amount (i.e., ETH) fell in the markets by 90%, which would mean the $24 million fine was 30% of the current remaining total -- a bit more harsh. My favorite bit is that EOS actually (1) blocked American IP addresses from the raise, and (2) put in the legal documents a clause from the signatory representating that they were not US investors. But you know, they also bought an advertising billboard in Times Square.

Lastly, the SEC has just gone after Telegram and its TON blockchain. Telegram is like Kik, just bigger, more privacy focused, and run by Russians. The project raised $1.7 billion in two tranches, most if not all of which (I thought) went to large, institutional investors (like venture capital firms Benchmark, Sequoia, and Lightspeed) or foreign exempt persons. The SEC is preventing Telegram from launching its product and distributing tokens to investors, who, in theory, can then sell them into the unsuspecting public markets in the US using crypto exchanges.

The GRAM token is functional, like ETH within the Ethereum ecosystem. Preston Byrne, one of the deeper legal thinkers in the space, thinks that if launched today the Ethereum ICO would be categorized unfavorably too. But the SEC has already indicated that ETH is not a security, and the CFTC has just declared it a commodity. Does the regulator think that TON was using the private placement as a mere instrument to then sell unregisted securities to the public? Let's see what the courts think -- but the supply chart below now seems unlikely.

Last, but not least is Facebook's Libra. Given the recent public response, and private pressure from the American regulators, Libra has seen a number of high profile defectors including PayPal, Mastercard, Visa, eBay and Stripe. You can read a more detailed take over at TechCrunch, from whom I have borrowed the graphic below. What is worth noting is that the *financial* companies are leaving -- the ones that are already regulated as money transmitters and have a real business to lose. What's left is the attention economy footprint of Uber, Spotify, and Facebook, sponsored by future finance VCs like USV, Ribbit, and Andreessen. Staking (i.e., putting capital at stake to back a currency and generate interest) may be a developing business on Ethereum. But it is not likely to be allowed by the US regulator in US dollars, without a banking license and traditional oversight, no matter how idyllic and noble your mission to save the unbanked!

I've listed a number of projects and companies that thought they had a right to pursue their particular economic freedom, but actually didn't. They didn't because they were trying to do business with the residents of a particular jurisdiction, which had already congealed a set of laws and practices out of the interactions of the various people and organizations in its sovereign territory. What Kik or Telegram want to build is cool, and I like it (some of it at least). But their circle of rights bumped against those of the American state, uninformed consumers, and financial professionals who had chosen to comply with the regime for decades. That's not to say the line can't or won't change -- I have a strong belief that the line is always shifting. But the friction is there, because we do not float in a vacuum. Our space is littered with other people.

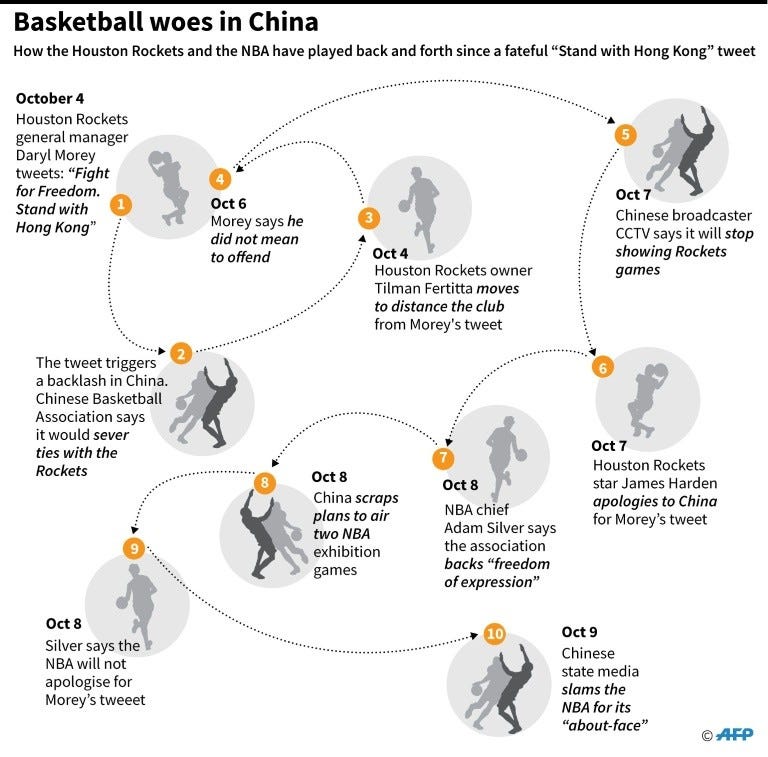

Take an example that is maybe more difficult for Americans, where Western values cut in the opposite direction. The NBA has gotten into trouble after Daryl Morey, the general manager of the Houston Rockets, tweeted support for the Hong Kong protestors. After immediate pressure from the Chinese, Morey apologized and deleted the tweet. The NBA at first also condemnded the tweet, as broadcasters like Tencent blacklisted NBA content from being played to the Chinese audience. The $1.5 billion dollar commercial relationship matters, after all! But American politicians then accused the organization of "retreating" and failing to protect the freedom of speech of a its employee. So the NBA swung the other way, and came out defending Morey and American values. Now, if you search Alibaba or JD.com for Houston Rockets merchandise, the sites will come up empty as it has all been purged.

Such treatment of third rail issues is not an isolated incident. The video game company Blizzard just punished a Taiwanese gamer participating in its tournament when he showed pro-Hong Kong support by banning him and taking away the prize money, then re-instating the prize money, but continuing to critisize his speech at the event. Blizzard's parent company is 40% owned by Tencent. Joe Tsai of Alibaba penned a post I found helpful in relating to the reasons why sovereign integrity is so important to the political discourse in China -- from colonial history, to military action, to national pride. Yet aren't these commercial boycotts and public pressure on corporations analogous to SEC actions and lawsuits against foreign companies?

You would think private speech on Twitter wouldn't fall under Chinese jurisdiction. But speech anywhere and everywhere that China can hear has come under its domain. The more connected we all become through the veins of technology, the more difficult these issues are to navigate. Maybe the crypto world feels the same way about their money! Doesn't Citizens United v. FEC tells us that money is speech, anyway?

Featured Interviews, Podcasts, and Conferences

Are banks losing the brand war to tech firms? Check out my podcast with American Banker's Penny Crossman. We don't buy Tylenol from the Tylenol store. Why do we buy Wells Fargo bank accounts from Wells Fargo?

From Crypto to Decentralized Finance. Another great podcast with Will Beeson at Rebank: Banking the Future. Check out our conversation and subscribe here.

Digital Asset Strategy Summit, I've joined the speaking faculty at this great event for asset allocation and financial advisors docused on blockchain based assets, October 20-21st in Dallas. If you are interested in attending, let me know by email as I have limited passes. Only asset managers, pension funds, registered investment advisors, and family offices please.

Blockchain Insider. Had a great time with Todd McDonald of R3, Thomas Zeeb of SIX exchanges, and Simon Taylor of 11FS discussing the latest blockchain developments.

#ItzOnWealthTech Ep 25: How Software is Eating Banking with Lex Sokolin, ConsenSys. A fun conversation with Craig Iskowitz, covering everything from digital wealth, to artificial intelligence, to blockchain based assets and the evolution of banking. Highly recommended!

Short Takes

Broadridge to Expand Fiduciary and Reg BI Solutions for Wealth and Retirement Industry With Acquisition of Fi360, and Refinitiv is in the robo game. Now what? Two very large market data and infrastructure companies (Refinitiv, Broadridge) have both moved closer to the digital wealth space. For Refinitiv, the deal was inked by Joe Mrak (former CEO Foliodynamix, sold eventually to Envestnet) integrating SigFig. One takeaways is that the executives that know digital wealth are cross-pollinating it into the public industry incumbents.

ETF Firms Hit by E-Broker Price War. Arrangements that ETF providers have signed with brokerages like Schwab, TD Ameritrade now in flux. This is worth a full write up, maybe next week. I covered already what happens when price goes to zero in trading, but this is an unexpected side effect. Not only do commissions go away, but "free" ETF trading is also effected because the revenue share has evaporated. BlackRock's asset management business suffers without the kick back.

Coverager on the $3 billion Assurance acquisition by Prudential. This news had been a scratcher for me, and the only thing I found to explain the transaction was a WeFox comp and mysterious very high direct traffic number. Well, Coverager digs in and finds that Assurance is primarily a call center with 1.4 million in traffic coming from Publishers Clearing House. Yes, sweepstakes marketing that's getting people into a call center queue for insurance from a single carrier.

Mastercard, Visa, eBay and Stripe quit Facebook’s Libra. This news is worth re-iterating from above, in case you jumped to the Short Takes. PayPal has already exited, so the main remainder is Silicon Valley disruptors (e.g., Uber) and their stalwart funders (e.g., Andreessen, Ribbit). I don't think SV will outmaneuver Wall Street or the SEC on this.

Hdac Technology, the blockchain arm of South Korea’s largest car manufacturer Hyundai Motor Group, plans to set up a $10 million blockchain investment fund in 2019. The Internet of Things use case is strong -- though I imagine without a 5G networks and scalable next generation blockchainchains, we are not going to see much use.

IKEA just allowed an invoice to be paid via the Ethereum blockchain. Invoice management, payment, and other activity related to workflows in commerce is happening all over the place. Having tokenized equivalents of national currencies is a pre-requisite.

Microsoft, Intel Back Ethereum-Based Token to Reward Consortium Efforts. The Enterprise Ethereum Alliance settled on a standard to create tokenized rewards for contributing to consortia activity. The concept of Tokenomics had a heart attack in 2018, with the melting of most token-gated networks, so it is good to see its continued evolution.

Chinese citizens will soon need to scan their face before they can access internet services or get a new phone number. Using machine vision to scan people's faces to activate payments is a pretty good idea -- you can avoid carrying a wallet. Forcing machine vision to scan people's faces so you can track their finances -- priceless.

California has banned political deepfakes during election season. Pretty easy to create misinformation using generative neural networks, whether in politics, financial promotions, or social media. California is banning such impersonation -- which has legal ground in intellectual property around personal representation (e.g., you can't pretend Arnold is endorsing you). Not all geographies will follow.

Gradient AI Secures $6 Million in Series A Financing, Led by Forte Ventures and Sandbox Insurtech Ventures; Includes participation from Gradient’s existing investor, MassMutual Ventures. The most progress I am seeing for artificial intelligence in the manufacturing of financial products continues to the in the insurtech space. This is about machine learning in claims assessment and underwriting.

Apple Glasses Set for Early 2020 Launch (Report). Without Steve Jobs, Apple has had trouble doing new platforms. Hard to say that Apple Watch is a smash success. I for one am pretty interested in trying out their AR glasses, and am optimistic about the use case.

How IoT insurance is helping Groupama reduce claims and accidents. Interesting IBM article about adoption of telematics for car insurance in Italy. Is a 20% insurance discount enough to subsidize people putting a tracking device in their car? I am still not clear on which form factor will win -- a dedicated telematics device, an iPhone, or the smart car itself.

Holoride Officially Launches Immersive In-Car VR Experience. Cute. The headset can be connected to data about your car, like speed, and then change the rendered experience to match (e.g., speeding up your VR car in response to your real car). This is also an interesting two screen problem -- you may be in a smart car, which has its own operating system, but then your VR headset wraps around your head with yet another operating system.

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.