Top 5 Decentralized Finance predictions for 2020 and beyond; plus 20 key Fintech developments

Hi Fintech futurists --

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

The latest key updates on Fintech bundles, Crypto and Blockchain, Artificial Intelligence, and Augmented and Virtual Reality are below. Thanks for reading and let me know your thoughts by email or in the comments! Last but not least, these opinions are personal (or maybe made by a robot) and do not reflect any views of ConsenSys or other parties.

Long Take

Decentralized Finance Overview

Happy holidays, good people! As 2020 sneaks up on us, 'tis the season for predictions and prognostications. Which makes me realize how much I miss being able to get into a meaty, quantitative analysis in a well formatted PowerPoint document. I realize this because several blockchain industry analysts have put out absolutely fantastic work that should be your reference for the coming year. If you read anything but this newsletter, you've got to read:

So let's narrow our entire lens to decentralized finance. There's a lot to say about the overlap of Fintech and blockchain, but let's find the very edge of the frontier and focus right there. I am talking about financial manufacturing engines that sit on large, distributed, open source, programmable infrastructure. I am talking about global cyborg money, flying around between regulatory frameworks, finding the weak spots, and building cathedrals of complexity before anyone can notice. I am talking about systemic risk, and the promise of what is most likely the future of financial services after Google, Facebook, Ant Financial, and Apple dismember the banks.

To catch you up, here are the basics. If you already know the basics (you anarchist devil!) scroll down for the predictions below.

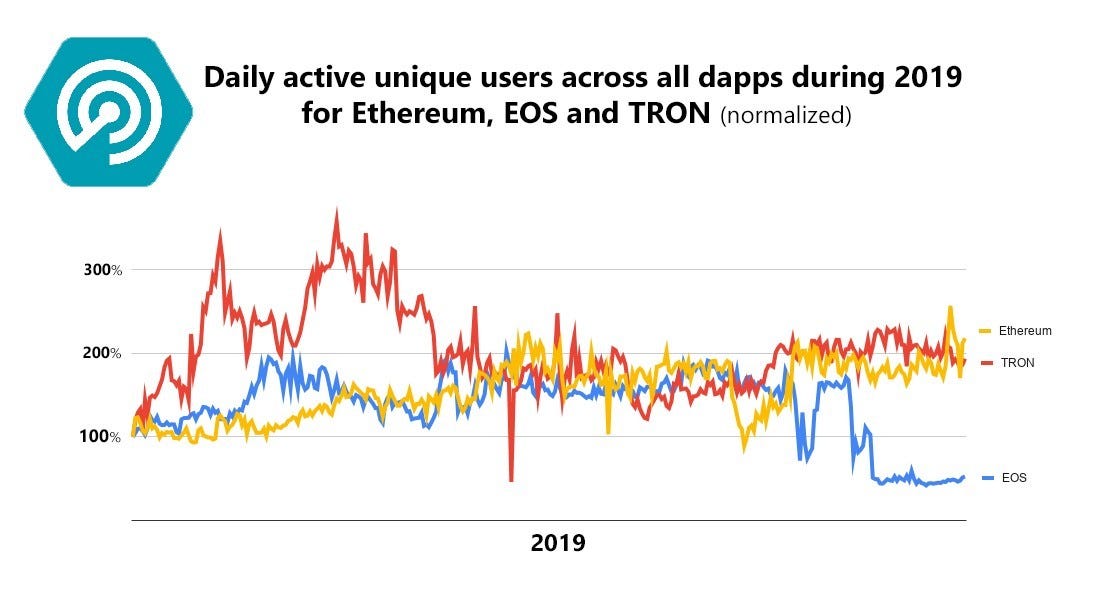

Ethereum is the leading platform for decentralized financial software, full stop. EOS and TRON (two massively funded competitors) are the Windows phone of this segment. If given the benefit of the doubt, those platforms have a much better shot at the gaming and gambling sector than to cross the bridge to real financial infrastructure. But being a leader doesn't yet mean celebrating industry victory -- Ethereum's decentralized lending and trading are floating around 2,500 daily users. On the other hand, there are only 8,000 Registered Financial Advisors in the United States and even fewer hedge funds, private equity firms, and family offices. So 2,500 users isn't necessarily small, and it just happens those users are moving real money in terms of volume (see the vertical axis in the apps above). You can tell I am of two minds on the topic. Here's a good Messari quote to sum it up:

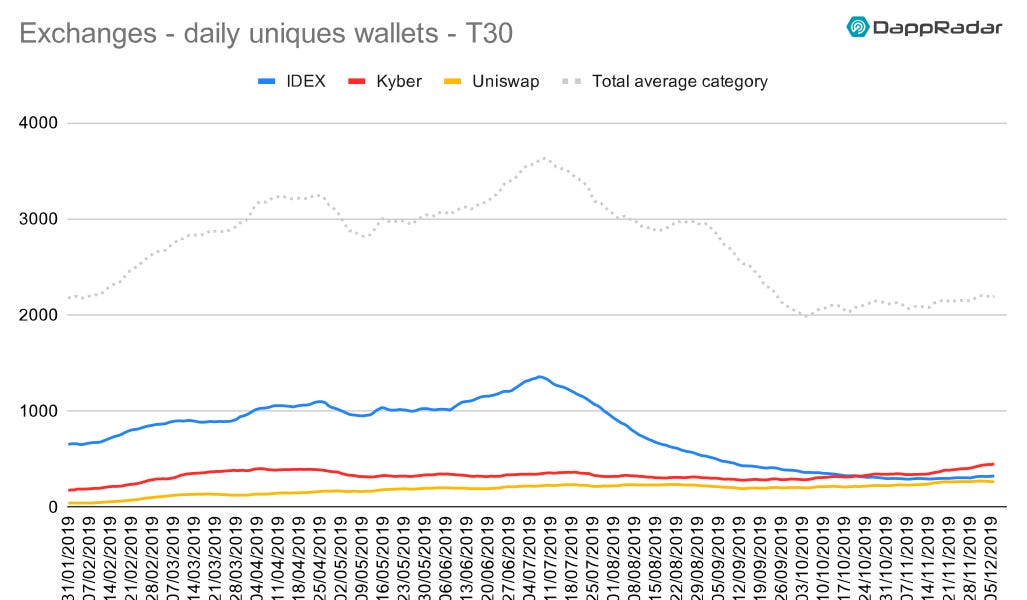

What are these application categories that make up the primitives of DeFi referenced above? Below I walk through the major financial protocols by daily unique wallets, a proxy for popularity. The first use case is decentralized exchanges -- some straight-forward peer-to-peer trading. API integration into other apps is starting to become the killer feature for adoption. For example, if you have a payments app and need to trade in and out of an asset, integrating Uniswap is a quick solution. Notably, the exchanges do differ by where they store data and if/how they form order books.

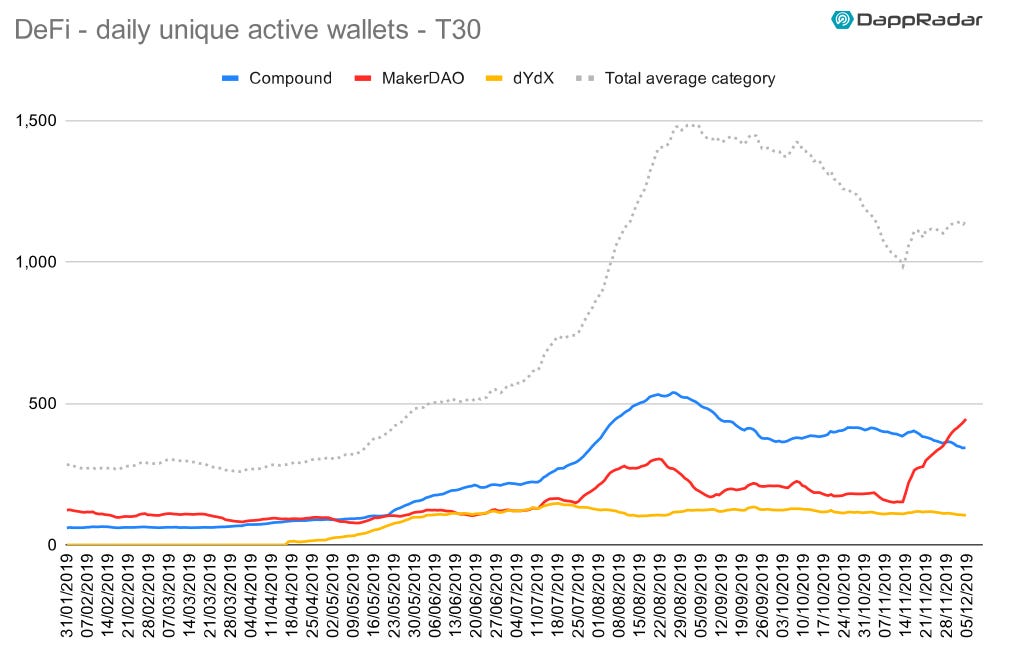

The lending product above is a bit more complicated. In the case of MakerDAO, you put some Ether into a black box as collateral, and get issued a loan pegged to the US dollar collateralized by that box. If you withdraw your Ether, you get charged an interest rate determined by an open governance community. Other things like Compound are essentially a securities lending marketplace -- you get paid some market-clearing interest rate to loan out assets like Bitcoin, which someone is borrowing for a trading or hedging purpose. Having interest rates native to the crypto economy is very helpful, but we are still shy of lending based on actual underwriting and off-chain risk.

Payments is also spreading to Ethereum, which you can see by the growth in USD-pegged stablecoins. The largest one, Tether (putting aside its dubious history for now), has recently shifted its technical infrastructure to Ethereum and has been responsbile for a meaningful amount of transactional value. According to Blockchain Capital below, nearly 40% of the stablecoin market is Ethereum-based Tether, accounting for 80% of transaction value overall. DAI, which is the native stablecoin of DeFi issued by MakerDAO, remains a small percentage. I would guess this is because DAI was originally only collateralized by Ether, while USDT was purportedly backed by ($ billions in) cash. Notably, DAI is now able to accept multiple types of collateral.

Outside of the core financial products, we have multiple services and exotic asset classes developing. First up is automated asset allocation with trading and rebalancing -- a wealth management service from Set Protocol.

Next, feel free to buy insurance mediated by software from Nexus Mutual.

Or if you want to get real complicated, here are a few projects that have been building synthetic assets and derivatives (see UMA and Synthetix). Nothing like some good old financial engineering to lever up a small market!

I'd be remiss not to mention the broader concept of "staking". This feature will be built into Ethereum over the next several years, but already exists in various other blockchain protocols. The main idea is that by taking some part of your money and putting it up as a "stake", you get a native interest rate and some amount of control over governance (i.e., something between equity voting and dividend yield). This financial commitment also performs the function of securing the historic accuracy of the data on the chain itself, like electricity-consuming mining does in Bitcoin. A number of staking blockchains have already launched, and also offer a junk-bond type of interest rate. See Staking Rewards and the chart below, and Coinbase for an example of a large Fintech providing the service.

Soon enough, you will be able to go from start to finish across your financial life using these various services. A year ago, they were disconnected and difficult to use, unless you like installing browser plugins and downloading strange Internet software. This is now much less true. Given that crypto native financial products have proliferated, user aggregator applications are starting to emerge. Whether the leader is Argent, Instadapp, Zerion or someone else, the blockchain-enabled Internet is about to get a whole lot more financial. It's like watching Mint.com emerge in 2007.

So what does the future to come look like?

Top 5 Predictions for DeFi in 2025

(1) Global Fintech champions like Robinhood, SoFi, Revolut, and Square will enter and win the crypto race as soon as the business model is established

There's no obvious way for crypto aggregators to make money. They could try to scale to millions of users, and then charge a subscription fee. But they are missing the revenue streams that traditional financial institutions use to subsidize free services. For example, you could get free financial advice from the Schwab roboadvisor, but you will pay the management fee pn the ETFs from which the portfolio is made. You will also cede some interest income to Schwab on the cash that you hold in their sweep account. The set of licenses and regulatory entities that Schwab holds allows it to bank, broker, and manage assets and charge these market fees.

In DeFi, the economics of financial manufacturing are extremely uncertain -- and because they are open sourced, I believe they will trend towards zero. Once you invent a software and launch it as an open source project, that automation is out in the world. It's a protocol, not a company. Thus the user aggregators can be quickly copied and co-opted by incumbents. Look for example at the early "staking" competition between Coinbase and Binance, leading to an immediate price war around these returns, eating away a potential revenue pool for new companies. Further, actually touching client funds immediately makes these apps into regulated custodians or money transmitters or financial advisors, which means a lot of compliance cost for little upside.

On the other hand, there are already a half dozen mobile apps -- all Fintech unicorns -- that have licenses and millions and millions of users. Today, Square, Robinhood, Revolut and a few others offer crypto trading. This is most likely enabled with an omnibus account at an institutional, centralized crypto exchange. If the alphabet soup of DeFi projects becomes compelling enough for the users of those mobile apps, they will aggressively feature-compete. I also think the consumer Fintechs will out-race even the financial incumbents experimenting with enterprise blockchain, such as Goldman Sachs, JP Morgan, and Santander. If you raised money from SoftBank, you have to take on large risk, while the banks will take another 5 years to touch real DeFi.

(2) Risk management and regulatory transparency is paramount in DeFi, as leverage and systemic correlation threatens the ecosystem

A lot of this space is self-referential and recursive. That's fine if it is anchored by some powerful set of fundamental activity. Imagine the cigarette economy of prison. Or less controversially, imagine going to the moon and establishing a colony that develops a new currency based on moon rocks. Creating synthetic derivatives based off the moon rocks is fine, as long as people are doing something to earn those moon rocks. If they are just creating markets for borrowing rocks, and then taking the interest from the lending, and using that as collateral for more borrowing -- well, we know what 2008 looks like. For a good take on this Russian Doll problem, check out the Defiant.

What if, for example, one of the core protocols like Maker (pick your favorite one) blows up. Is that likely? Crypto's 2016 attempt at venture investing (The DAO) blew up in a spectacular hack, leading to an existential crisis with a $500 million cost and an SEC warning. Crypto's 2017 financial attempt at investment banking (ICOs) led to a year and a half long bubble, followed by a 90% price drop across thousands of assets, erasing $500 billion of market capitalization as a result. Crypto's 2019 attempt at banking and lending will surely hit some wall, especially given the sofware integrations and user concentration across these protocols.

Overall, I find this destruction encouraging -- each time, the industry gets it a little more right. More tools are created. Scar tissue is formed. Lessons are learned. To that end, the only antidote to dumb mistakes is transparency and data. When looking at high-yield future tech investments, maybe think about risk and not just return! What form does that risk take when looking at decentralized software? Who is your counterparty? What does the system look like? We've been staring deeply at this question at ConsenSys -- see the DeFi Score initiative. Certainly, regulators will be asking the same question as the space grows more popular. Data and analytics services that deliver good answers will weather the storm.

(3) The software of Decentralized Finance will be replicated by central banks and governments and launched nationally

Either this is super obvious, or I am completely insane. Nearly every nation on the face of the Earth is trying to understand what it means to launch a Central Bank Digital Currency (CBDC). Two 2019 symptoms have caused this rush -- Facebook's Libra, and the Chinese digital yuan. Neither of those initiatives are a true cryptocurrency, in the sense that they are neither trustless nor permissionless. But both are inspired and motivated by Bitcoin. As a result, Sweden has hired Accenture to create the e-krona pilot, the European Central Bank is exploring a CBDC, and countless other meetings are taking place behind closed doors to formulate a response.

That said, when I think about government-backed financial infrastructure, I think about the Automated Clearing House in the US, the Faster Payments initiative in the UK, and the PSD2 regulation of open banking APIs throughout Europe. Similarly, national regulation often mandates student lending access through public-private entities, provides social security or pensions, and some form of medical insurance. That is to say -- governments are definitely in the business of running communal financial infrastructure across asset classes. And if Bitcoin gets transmuted into CBDCs, perhaps DeFi can take the place of public services.

Imagine Fannie Mae run as a smart contract -- operated, or maybe audited and controlled, by the US government. It can combine attributes of collateralization from Maker with the services of a third party underwriter. This may be an "oracle" underwriter external to the whole process, or an embedded machine learning algorithm trained to assess properties. Alternately, imagine a smart contract that distributes retirement income in a tax-advantaged way, similar to the Schwab roboadvisor for older generations. However, this software is built and audited by the Department of Labor. Such a version of the world presupposes mass crypto asset adoption. It also assumes that the philosophies of DeFi have overlap with national interest -- something I believe we will have to solve in order to help people most in need.

(4) Real world assets will be assimilated into the DeFi Borg cube through staking incentives, and would be a big win for the space

Look, I know you are bored hearing about enterprise blockchain and Security Token Offerings. Neither has had the short-term impact that many people hope, and there is an impression that institutions continue to sit on the sidelines. While it is true that Santander issued a bond on the Ethereum mainnet, supply chain consortia like komgo and Vakt are moving trade at scale, Chinese tech companies are installing blockchain invoicing across large geographies -- these developments have not excited the popular imagination. Similarly, STO and IEO volumes failed to match the hype of the ICO cycle. Yet this is a must-do step in the journey to economic adoption.

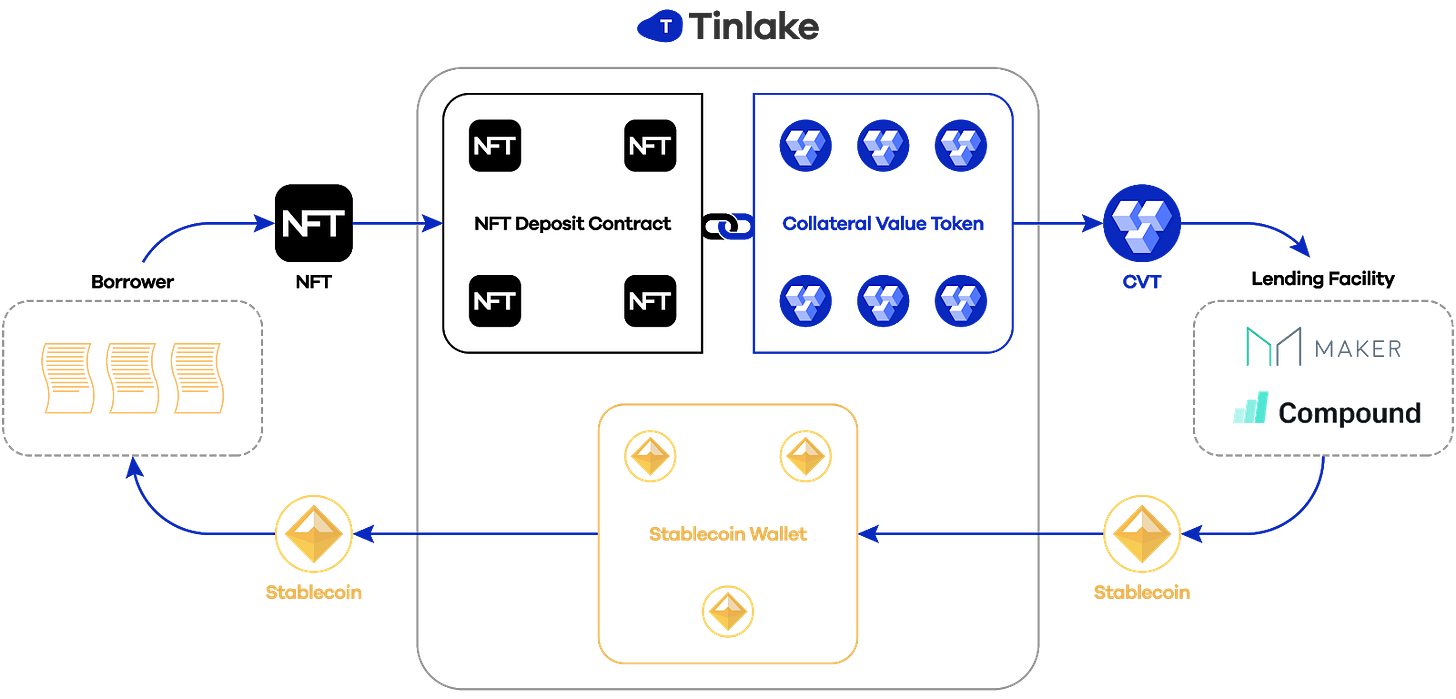

I will call out two projects. The first is Figure, a home equity loan platform that records and manages its loans on a proprietary blockchain. Figure has raised over $100 million, is run by the founder of SoFi, and has quickly turned blockchain into a feature, not the main course. The second is Tinlake from Centrifuge. Now that Maker accepts more than just Ether as collateral, Centrifuge is working on bringing other financial products as collateral for USD-pegged stablecoin issuance. Those could be anything from invoices to houses -- just put them into a crypto box.

I can imagine a world where staking is the primary source of interest rates on the decentralized web. When your money is sitting idle, you commit it to generate cybersecurity for everyone's financial infrastructure, and get paid interest. This could be a larger source of interest income, in the sense that it can absorb more funds for productive activity, than (1) a governance body setting an interest rate for issuing debt, or (2) a market interest rate for borrowing assets for trading. To reach that interest, you may want to commit traditional assets, from your brokerage portfolio, to your home equity, to even just a promise for repayment. This bridge may be built by the DeFi entrepreneurs. Or it may just be built by financial incumbents as they spin up institutional chains, analogous to Figure. The downside of a global, default risk-free rate is that it is a tax on those who are unaware it exists. When everyone else stakes, and you do not, it erodes your purchasing power through inflation. Sound familiar?

(5) Don't bet against Bitcoin, and try to pull its value into DeFi machines.

That chart says it all -- Bitcoin is still the most systemically relevant crypto asset. The more DeFi can figure out how to pull Bitcoin into the Ethereum fold, the higher the water rises for everyone.

Enough said! Happy holidays and thanks for reading.

Key Fintech Developments

Congress Passes Sweeping Overhaul of Retirement System, Bill encourages 401(k) plans to offer products with guaranteed income payment and Schwab set to launch 'shoe-that-dropped' subscription retirement income robot that acts like a virtual annuity and produces 'predictable' paycheck. (love it!)

Fintech lenders tighten standards, become more like banks and San Francisco’s Credit Karma Acquires Fintech Haven Money, a Savings App.

Lemonade and the Art of Spin -- a critical take on the economics of the Insurtech unicorn and Lemonade is now a GEICO Insurance Agency partner. The latter has referred approximately 5,000 visitors to Lemonade’s site in November.

Exploring DeFi trading strategies: Arbitrage in DeFi (was new to me!) and Nic Carter's On-Chain Data Story and Are DeFi's Money Legos Creating Systemic Risk?

Cardano Now Has Over $195 Million in Staked Digital Currency (ADA) on its Test Network

Swedish central bank taps Accenture for e-krona pilot but Switzerland Skeptical Of Central Bank Digital Currency

The Worldwide Web of Chinese and Russian Information Controls and Baidu vs Google: 2019’s searches inside and outside China’s Great Firewall

DreamQuark raises €14M for its AI software Brain and DataRobot to acquire data prep company Paxata

How Virtual and Augmented Reality Are Advancing Pediatric Care

Dior Returns to Instagram AR with Virtual Makeup Effect to Promote Holiday Collection

China’s car parking problem spawns start-ups with big money backers as AI dominance grows

Looking for more?

Get this writing directly in your Inbox by subscribing here.

Find me on Twitter here for Fintech and here for Digital Art.

Check out ConsenSys Codefi for software powering digital assets, financial enterprise blockchains, decentralized finance, and crypto payments.

Want to send me a note? Reach out here anytime.